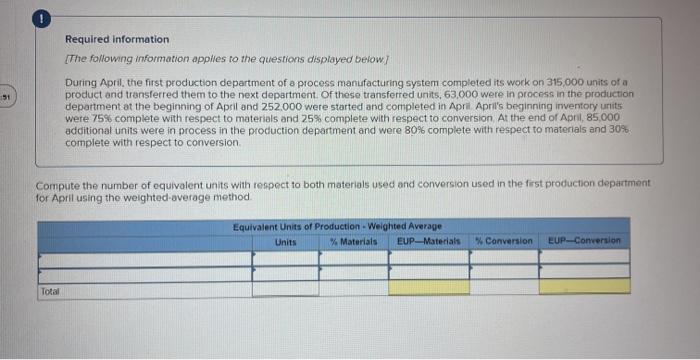

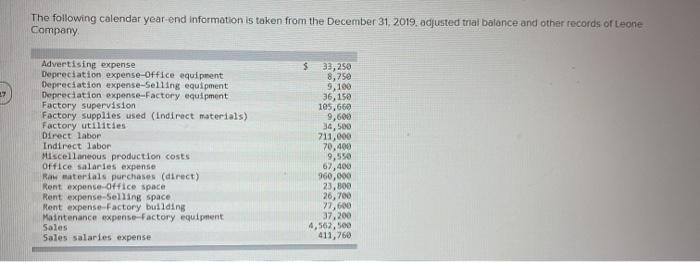

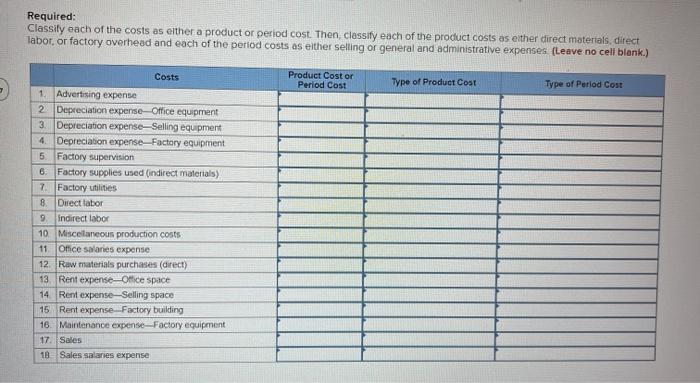

Required information The following information applies to the questions displayed below! During April the first production department of a process manufacturing system completed its work on 315,000 units of a product and transferred them to the next department of these transferred units, 63.000 were in process in the production department at the beginning of April and 252.000 were started and completed in April. April's beginning inventory units were 75% complete with respect to materials and 25% complete with respect to conversion At the end of April, 85,000 additional units were in process in the production department and were 80% complete with respect to materials and 30% complete with respect to conversion 151 Compute the number of equivalent units with respect to both materials used and conversion used in the first production department for April using the weighted average method Equivalent Units of Production - Weighted Average Units % Materials EUP-Materials % Conversion EUP-Conversion Total The following calendar year-end Information is taken from the December 31, 2019. adjusted trial balance and other records of Leone Company Advertising expense Depreciation expense-Office equipment Depreciation expense-Selling equipment Depreciation expense Factory equipment Factory supervision Factory supplies used (Indirect materials) Factory utilities Direct labor Indirect labor Miscellaneous production costs Office salaries expense Raw materials purchases (direct) Rent expense-Office space Rent expense-Selling space Rent expense Factory building Maintenance expense Factory equipment Sales Sales salaries expense s 33,250 8,750 9,100 36,150 105,660 9,600 34,500 711,000 70,400 9,550 62,400 960,000 23,800 26,700 27,600 37,200 4,562,500 411,760 Required: Classily each of the costs as either a product or period cost. Then, classify each of the product costs as either direct materials, direct labor or factory overhead and each of the period costs as either selling or general and administrative expenses (Leave no celi blank.) Costs Product Cost or Period Cost Type of Product Cost Type of Period Cost 1. Advertising expense 2 Depreciation expense-Office equipment 3. Depreciation expense-Selling equipment 4 Depreciation expense Factory equipment 5 Factory supervision 6. Factory supplies used (indirect materials) 7. Factory utilities 8. Direct labor 9 indirect labor 10 Miscellaneous production costs 11 Office salaries expense 12 Raw materials purchases (direct) 13 Rent expense Office space 14 Rent expense-Selling space 15 Rent expense Factory building 16. Maintenance expenseFactory equipment 17. Sales 18 Sales salaries expense