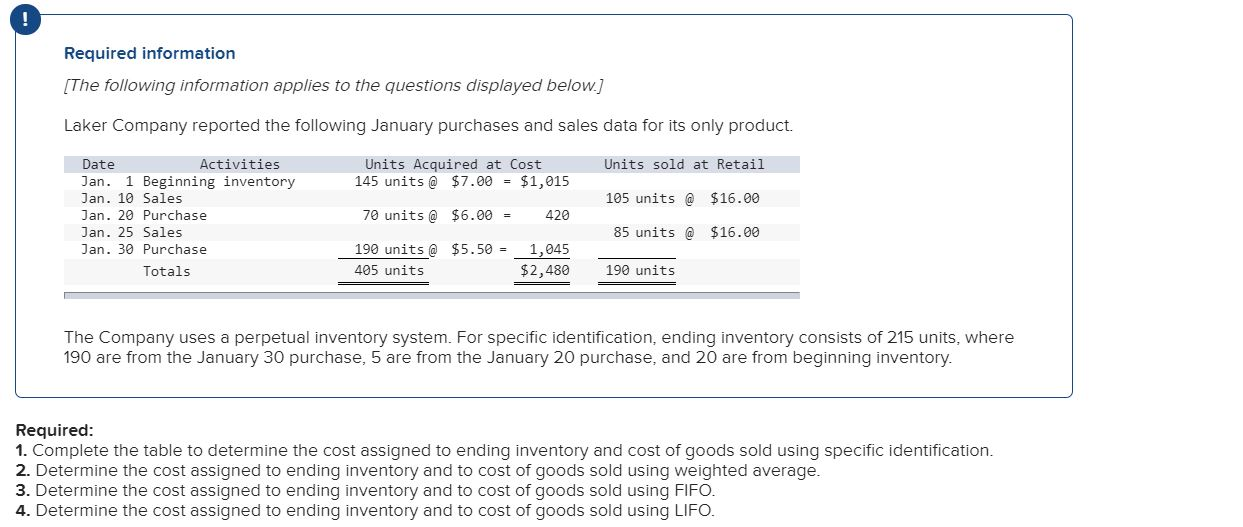

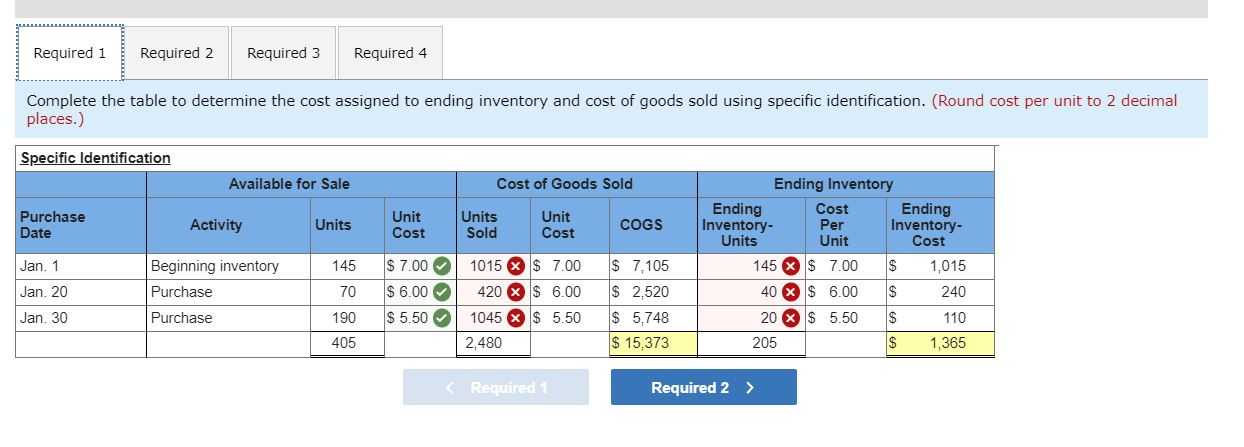

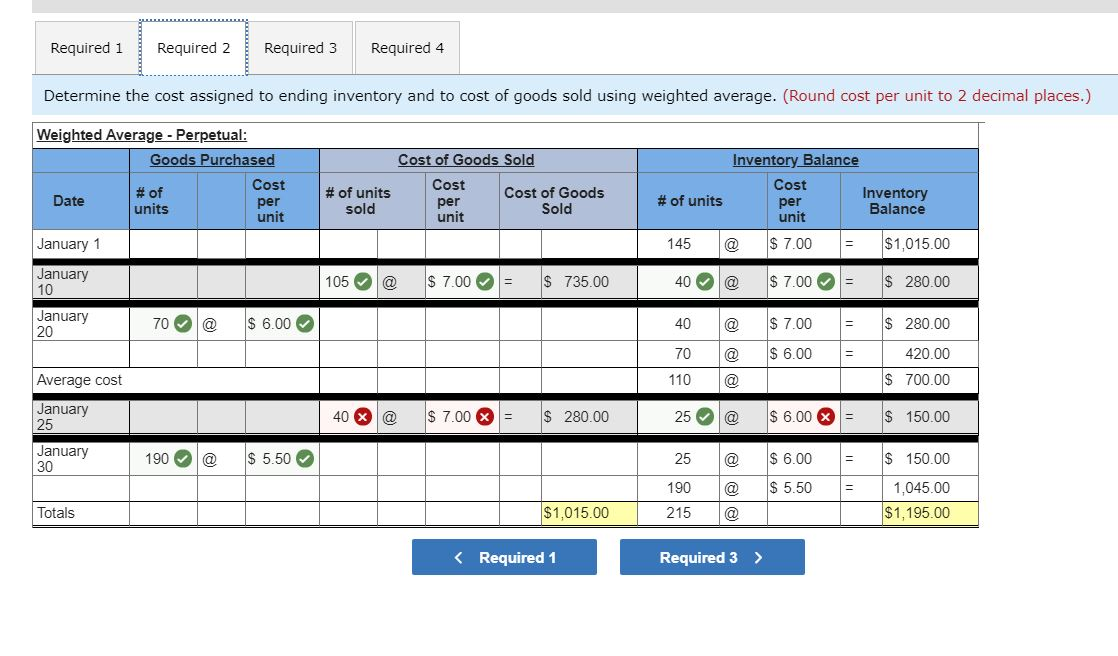

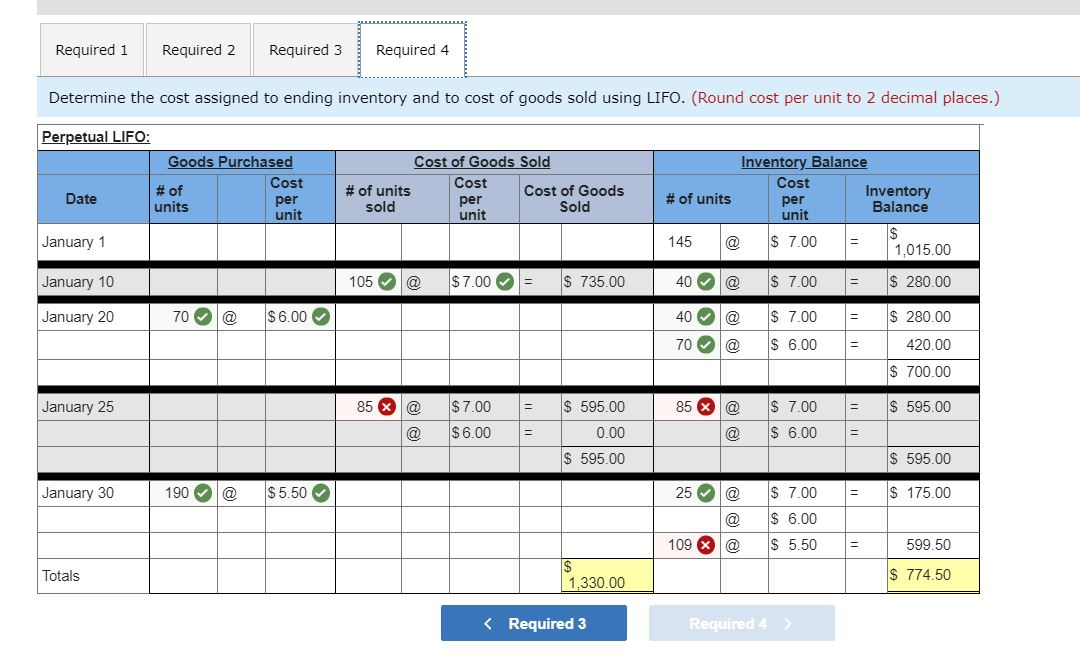

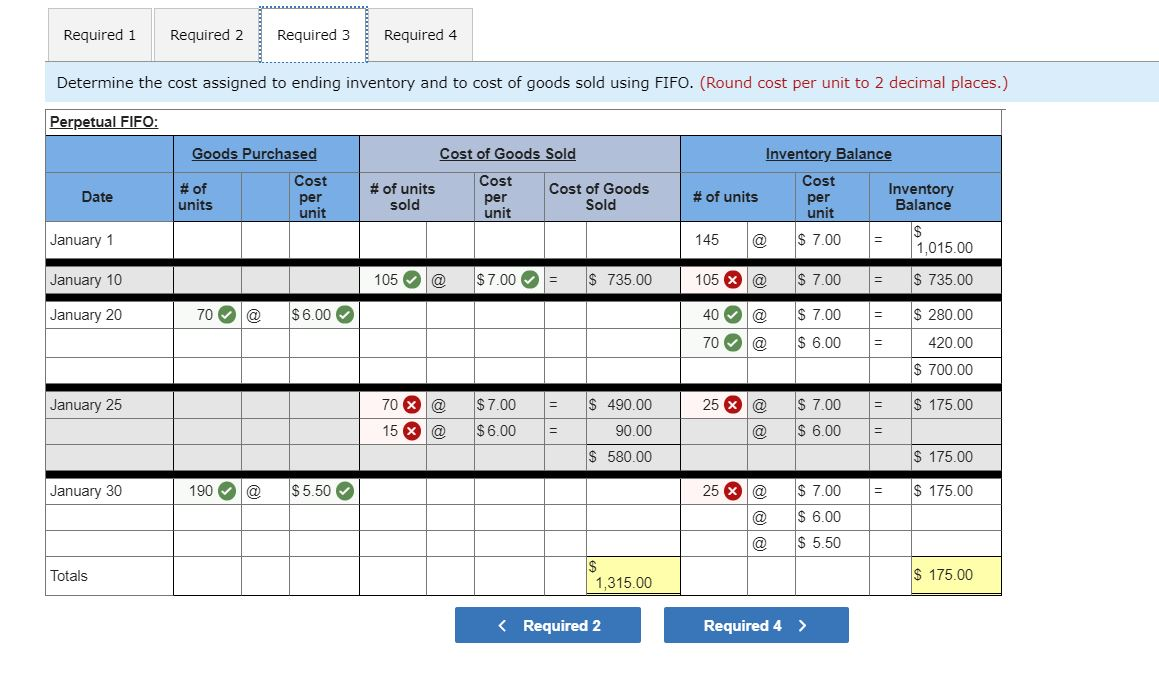

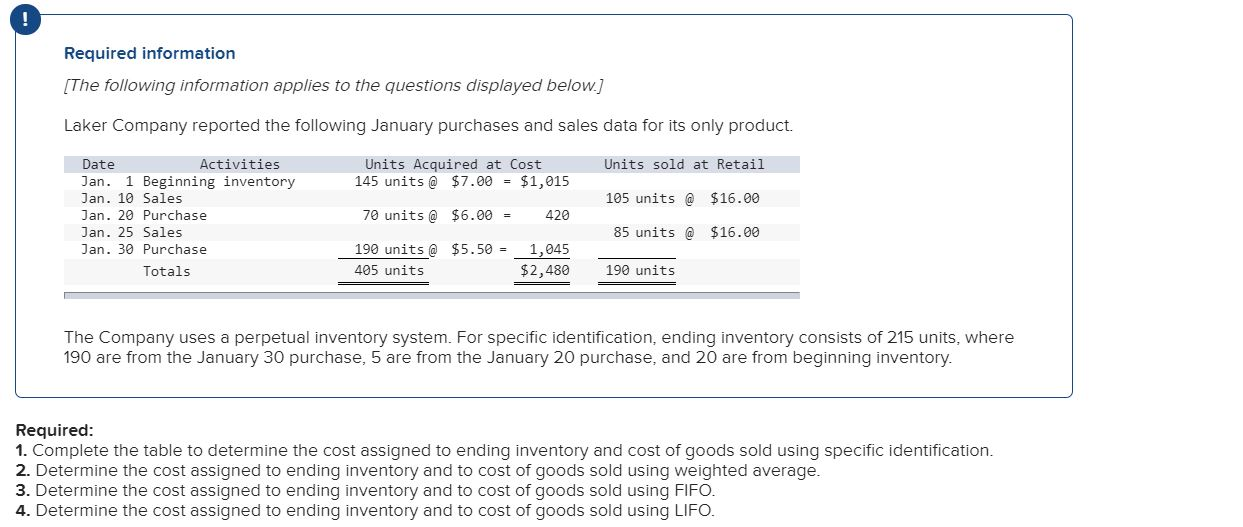

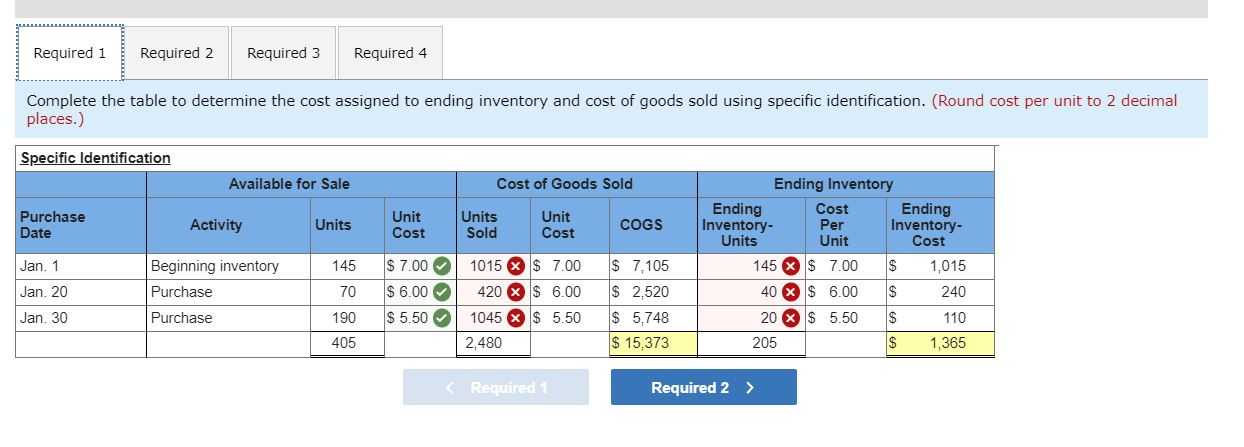

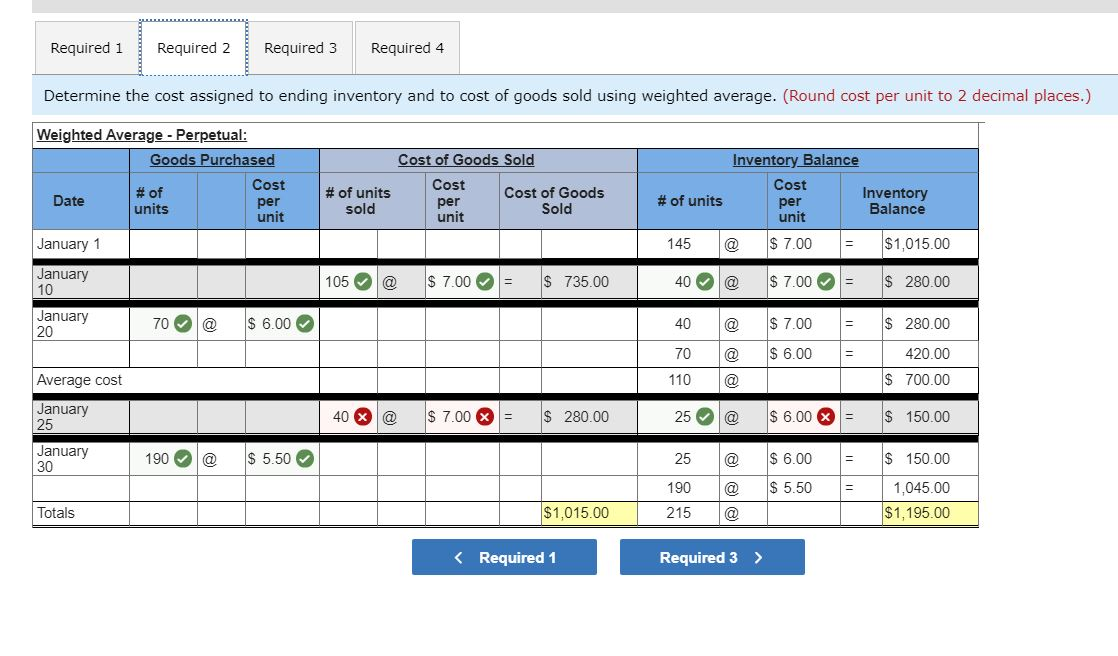

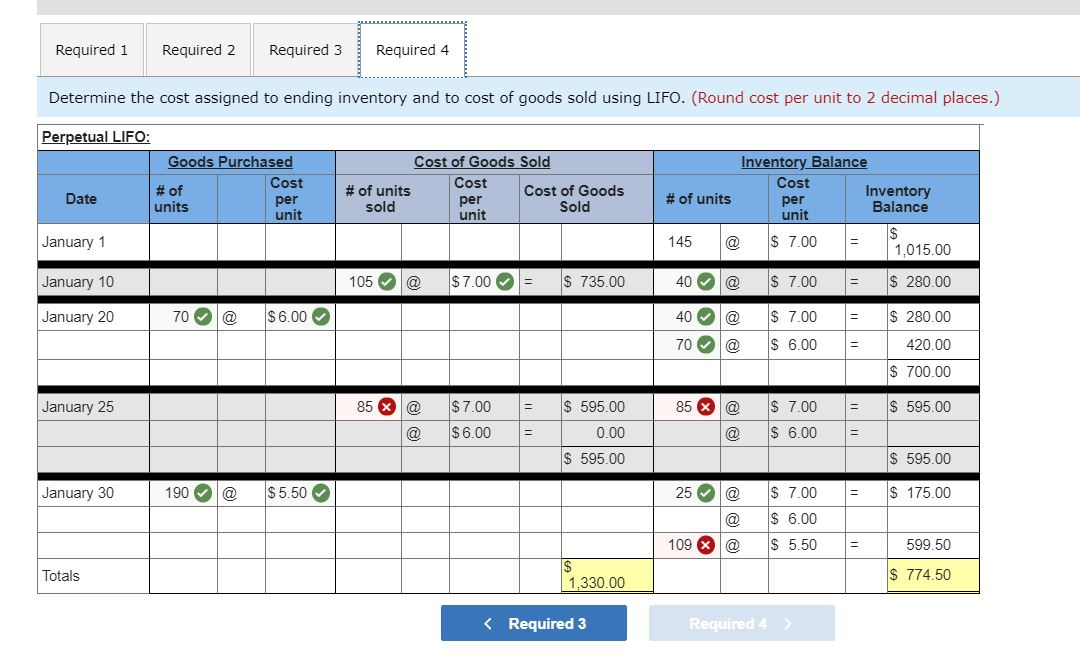

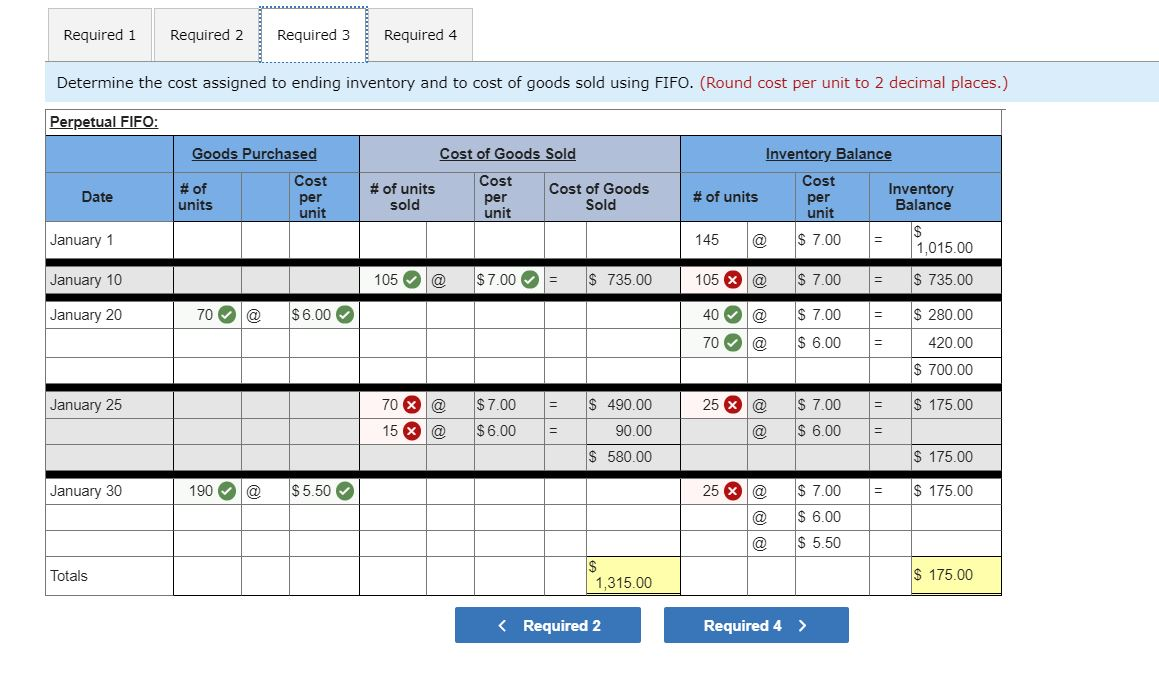

Required information [The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. Units sold at Retail Units Acquired at Cost 145 units @ $7.00 = $1,015 105 units @ $16.00 Date Activities Jan. 1 Beginning inventory Jan. 10 Sales Jan. 20 Purchase Jan. 25 Sales Jan. 30 Purchase Totals 70 units @ $6.00 = 420 85 units @ $16.00 190 units @ $5.50 = 405 units 1,045 $2,480 190 units The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 215 units, where 190 are from the January 30 purchase, 5 are from the January 20 purchase, and 20 are from beginning inventory. Required: 1. Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification. 2. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. 3. Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. 4. Determine the cost assigned to ending inventory and to cost of goods sold using LIFO. Required 1 Required 2 Required 3 Required 4 Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification. (Round cost per unit to 2 decimal places.) Specific Identification Available for Sale Cost of Goods Sold Purchase Date Activity Units Unit Cost Units Sold Unit Cost COGS Per Jan. 1 145 Beginning inventory Purchase 70 $ 7.00 $ 6.00 $ 5.50 Jan. 20 Jan. 30 1015 X $ 7.00 420 X $ 6.00 1045 X $ 5.50 2,480 Ending Inventory Ending Cost Ending Inventory- Inventory- Units Unit Cost 145 X $ 7.00 $ 1,015 40 X $ 6.00 $ 240 20 X $ 5.50 $ 110 205 1,365 $ 7,105 $ 2,520 $ 5,748 $ 15,373 Purchase 190 405 EA Required 1 Required 2 Required 3 Required 4 Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. (Round cost per unit to 2 decimal places.) Weighted Average - Perpetual: Goods Purchased Cost # of Date per units Cost of Goods Sold Cost Cost of Goods per # of units # of units Inventory Balance Cost Inventory per Balance unit $ 7.00 $1,015.00 sold Sold unit unit January 1 145 January 10 105 @ $ 7.00 $ 735.00 40 la $ 7.00 - $ 280.00 January 20 70 @ $ 6.00 40 $ 7.00 - $ 280.00 70 @ $ 6.00 420.00 Average cost 110 @ $ 700.00 January 25 40 @ $ 7.00 280.00 25 @ $ 6.00 X = $ 150.00 January 30 190 @ $ 5.50 25 @ $ 6.00 - $ 150.00 190 $ 5.50 1.045.00 $1,195.00 Totals $1,015.00 215 Required 1 Required 2 Required 3 Required 4 Determine the cost assigned to ending inventory and to cost of goods sold using LIFO. (Round cost per unit to 2 decimal places.) Perpetual LIFO: Goods Purchased # of Cost units per unit Cost of Goods Sold Cost # of units Cost of Goods sold per Sold unit Date # of units Inventory Balance Cost Inventory per Balance unit $ 7.00 $ 1,015.00 January 1 145 @ January 10 105 @ $7.00 = $ 735.00 40 $ 7.00 $ 280.00 ON January 20 70 @ $6.00 40 @ $ 7.00 70 @ $ 6.00 $ 280.00 420.00 $ 700.00 January 25 85 @ 85 x @ $ 595.00 $ 7.00 $6.00 $ 595.00 0.00 $ 7.00 $ 6.00 @ $ 595.00 $ 595.00 January 30 190 @ $5.50 25 @ $ 175.00 $ 7.00 $ 6.00 @ 109 x @ $ 5.50 599.50 Totals $ 1,330.00 $ 774.50 25 @ - $ 175.00 @ $ 7.00 $ 6.00 $ 5.50 @ Totals $ 1,315.00 $ 175.00