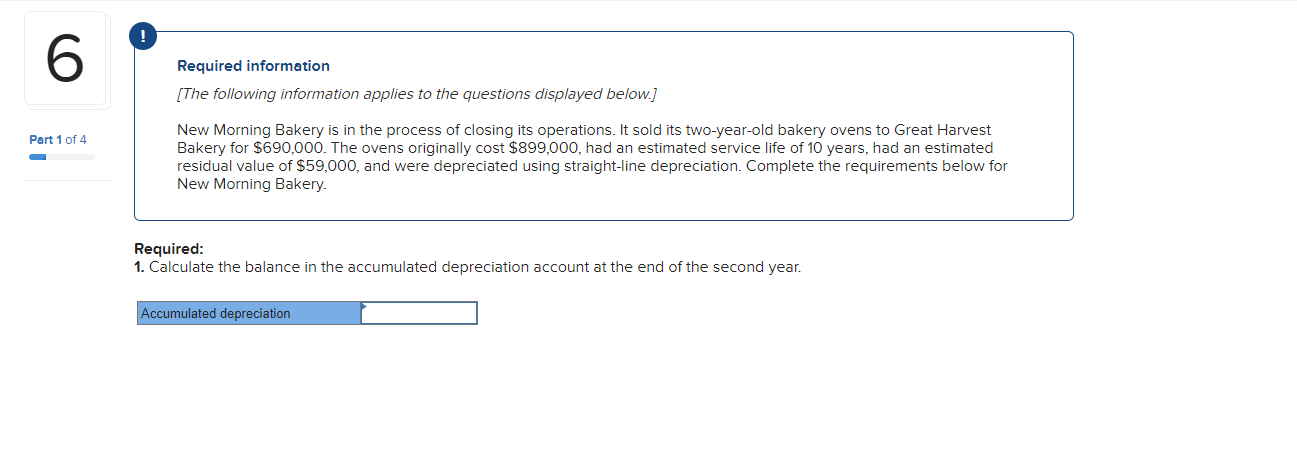

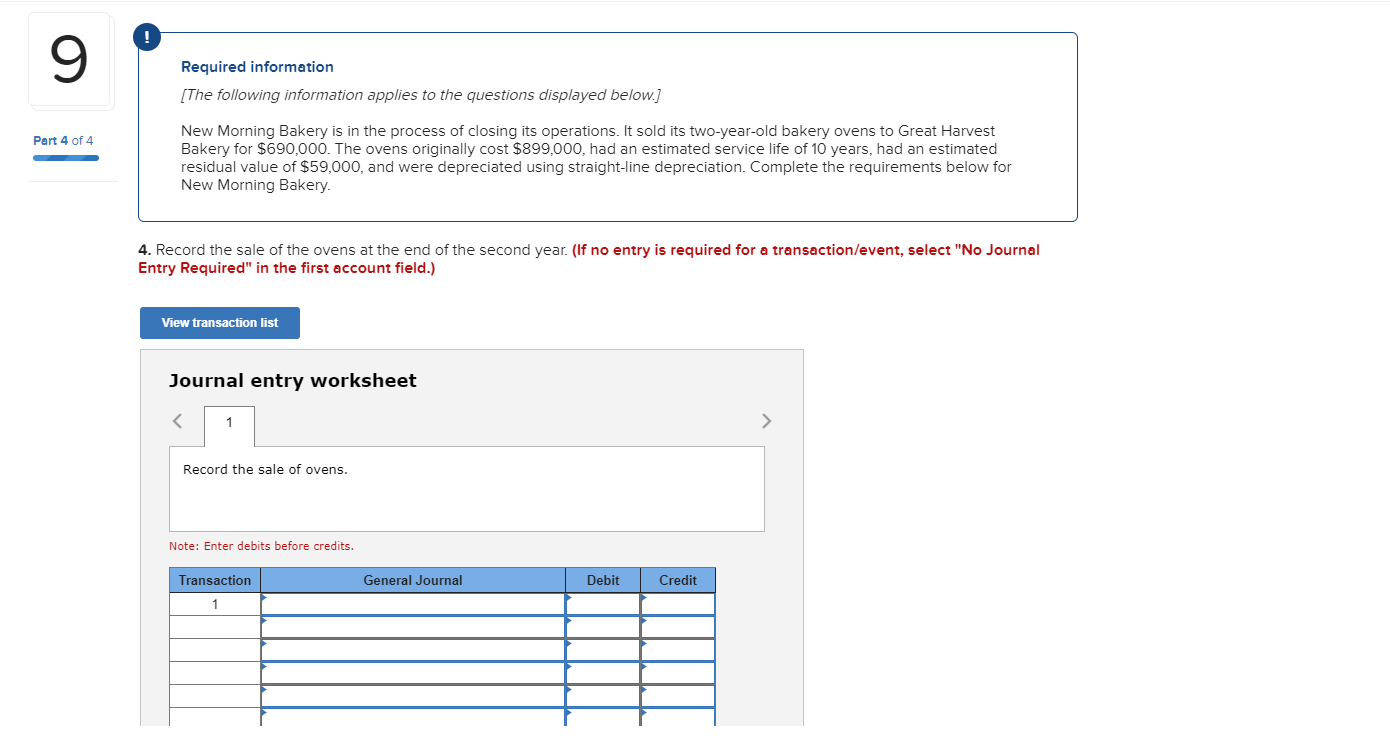

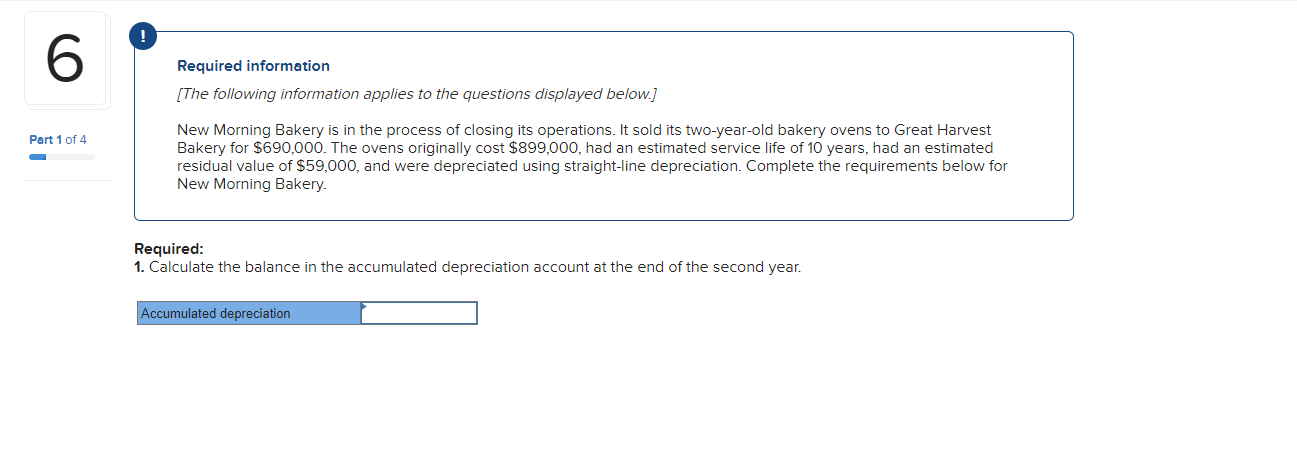

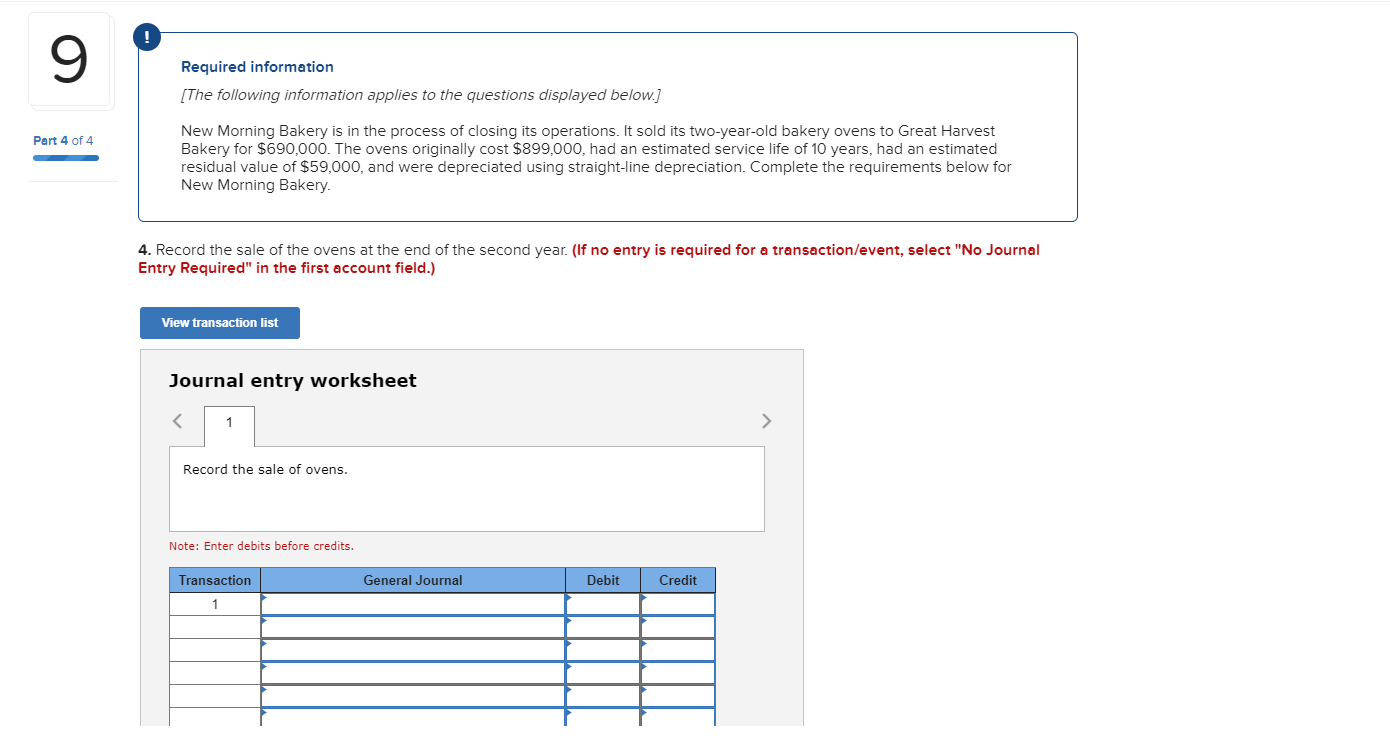

Required information [The following information applies to the questions displayed below.] New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $690,000. The ovens originally cost $899,000, had an estimated service life of 10 years, had an estimated residual value of $59,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. Required: 1. Calculate the balance in the accumulated depreciation account at the end of the second year. Required information [The following information applies to the questions displayed below.] New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $690,000. The ovens originally cost $899,000, had an estimated service life of 10 years, had an estimated residual value of $59,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. 2. Calculate the book value of the ovens at the end of the second year. Required information [The following information applies to the questions displayed below.] New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $690,000. The ovens originally cost $899,000, had an estimated service life of 10 years, had an estimated residual value of $59,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. 3. What is the gain or loss on the sale of the ovens at the end of the second year? Required information [The following information applies to the questions displayed below.] New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $690,000. The ovens originally cost $899,000, had an estimated service life of 10 years, had an estimated residual value of $59,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. Record the sale of the ovens at the end of the second year. (If no entry is required for a transaction/event, select "No Journal intry Required" in the first account field.)