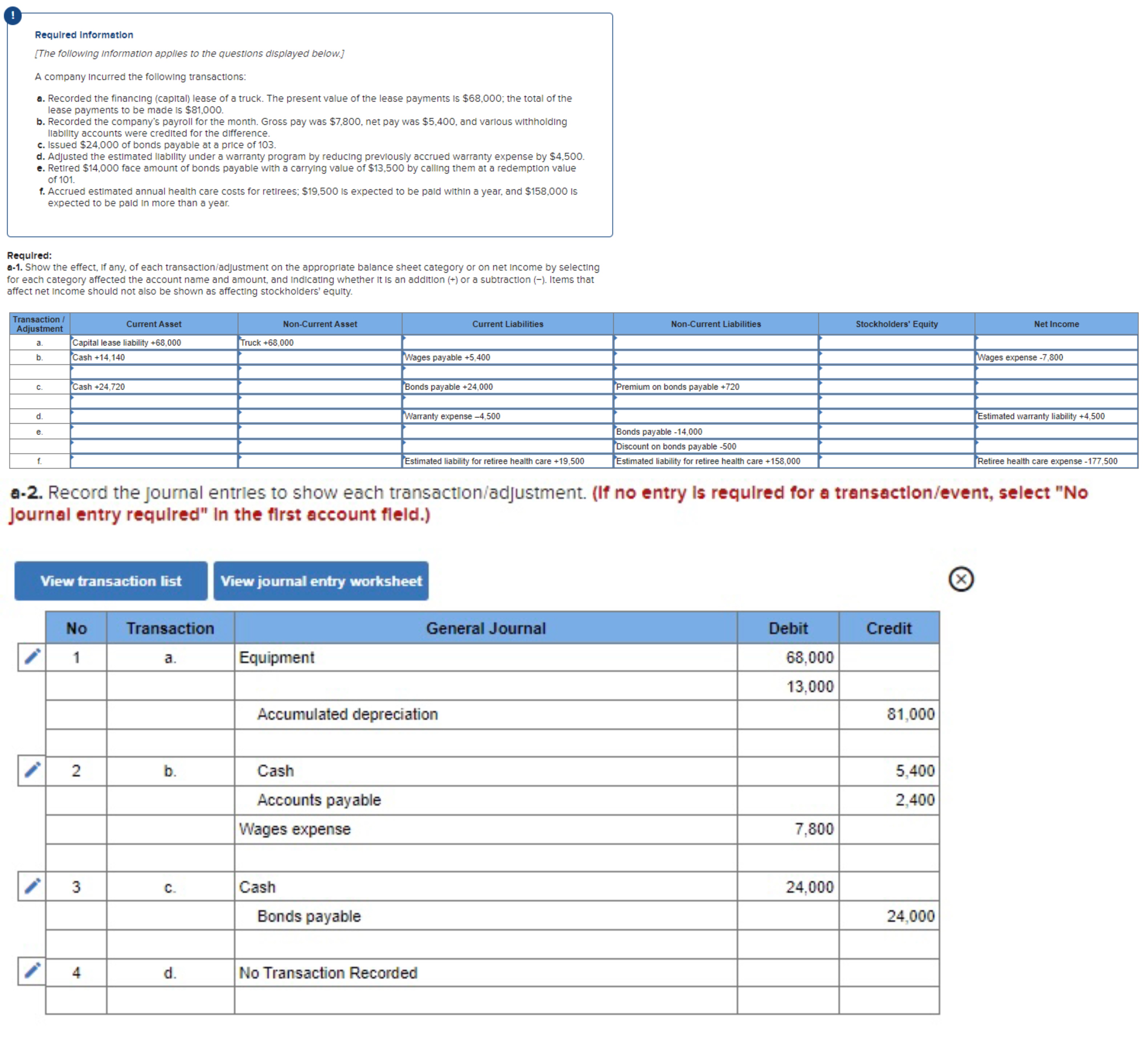

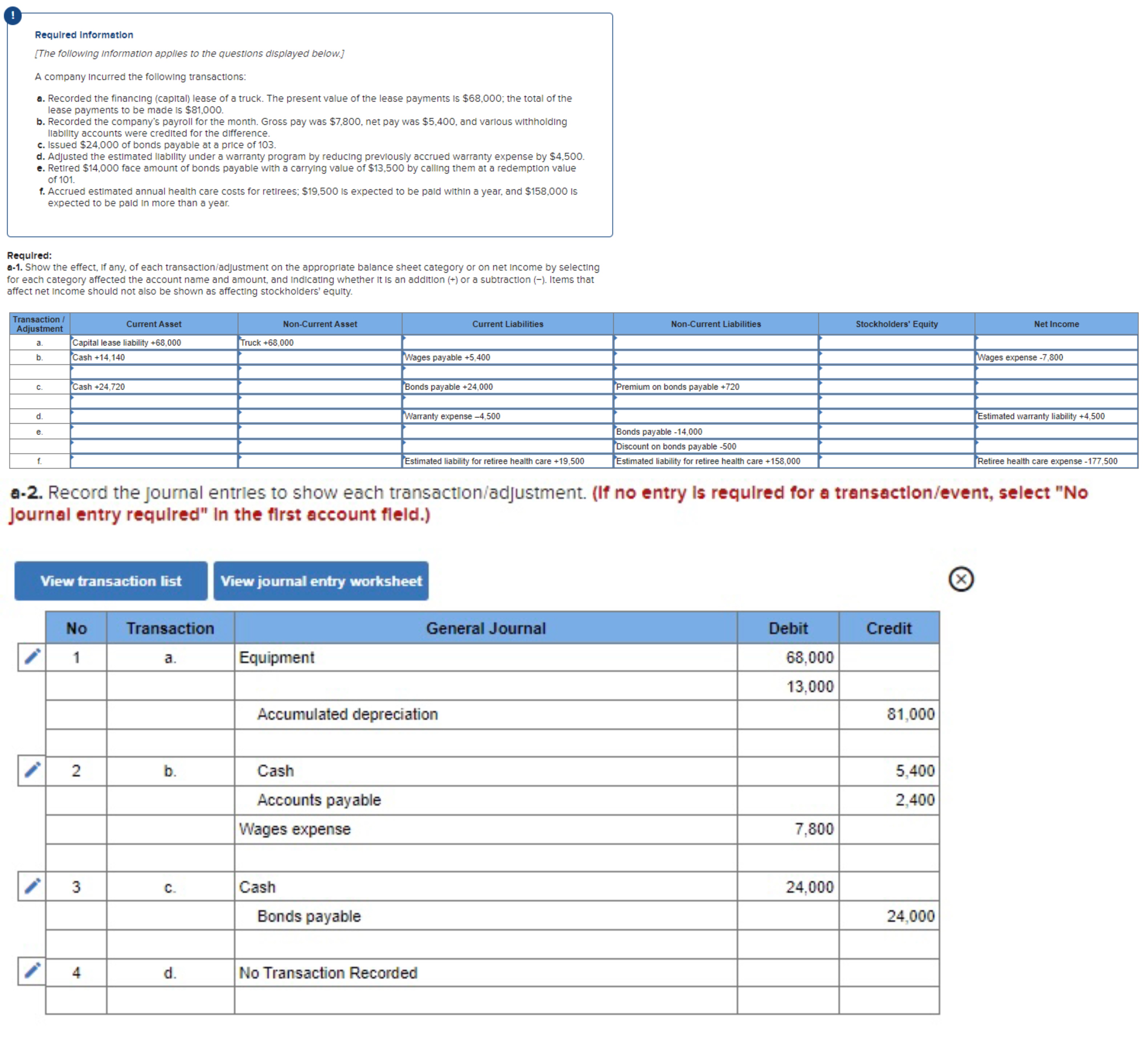

Required Information [The following Information applies to the questions displayed below.] A company Incurred the following transactions: a. Recorded the financing (capltal) lease of a truck. The present value of the lease payments is $68,000; the total of the lease payments to be made is $81,000. b. Recorded the company's payroll for the month. Gross pay was $7,800, net pay was $5,400, and varlous withholding llability accounts were credited for the difference. c. Issued $24,000 of bonds payable at a price of 103 . d. Adjusted the estimated llability under a warranty program by reducing previously accrued warranty expense by $4,500. e. Retired $14,000 face amount of bonds payable with a carrylng value of $13,500 by calling them at a redemption value of 101. f. Accrued estimated annual health care costs for retirees; $19,500 is expected to be paid within a year, and $158,000 is expected to be paid In more than a year. Required: a-1. Show the effect, If any, of each transaction/adjustment on the approprlate balance sheet category or on net Income by selecting for each category affected the account name and amount, and Indicating whether it is an addition (+) or a subtraction (-). Items that affect net Income should not also be shown as affecting stockholders' equity. a.2. Record the journal entrles to show each transaction/adjustment. (If no entry Is requlred for a transaction/event, select "No Journal entry requilred" In the flrst account fleld.) Required Information [The following Information applies to the questions displayed below.] A company Incurred the following transactions: a. Recorded the financing (capltal) lease of a truck. The present value of the lease payments is $68,000; the total of the lease payments to be made is $81,000. b. Recorded the company's payroll for the month. Gross pay was $7,800, net pay was $5,400, and varlous withholding llability accounts were credited for the difference. c. Issued $24,000 of bonds payable at a price of 103 . d. Adjusted the estimated llability under a warranty program by reducing previously accrued warranty expense by $4,500. e. Retired $14,000 face amount of bonds payable with a carrylng value of $13,500 by calling them at a redemption value of 101. f. Accrued estimated annual health care costs for retirees; $19,500 is expected to be paid within a year, and $158,000 is expected to be paid In more than a year. Required: a-1. Show the effect, If any, of each transaction/adjustment on the approprlate balance sheet category or on net Income by selecting for each category affected the account name and amount, and Indicating whether it is an addition (+) or a subtraction (-). Items that affect net Income should not also be shown as affecting stockholders' equity. a.2. Record the journal entrles to show each transaction/adjustment. (If no entry Is requlred for a transaction/event, select "No Journal entry requilred" In the flrst account fleld.)