Answered step by step

Verified Expert Solution

Question

1 Approved Answer

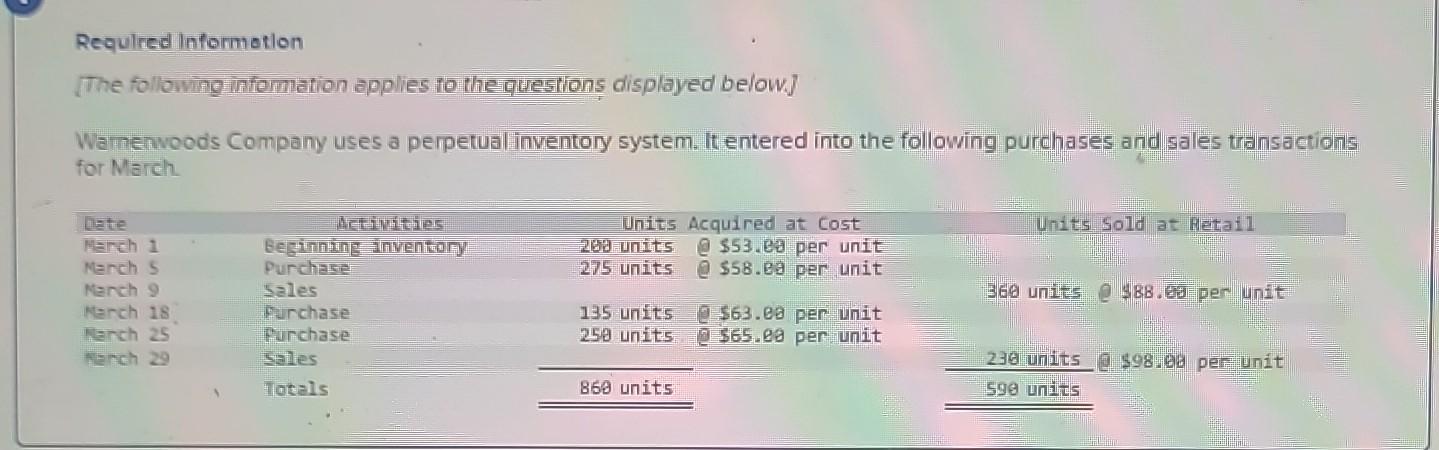

Required Information [The following information applies to the questions displayed below] Wamerwoods Company uses a perpetual inventory system. It entered into the following purchases and

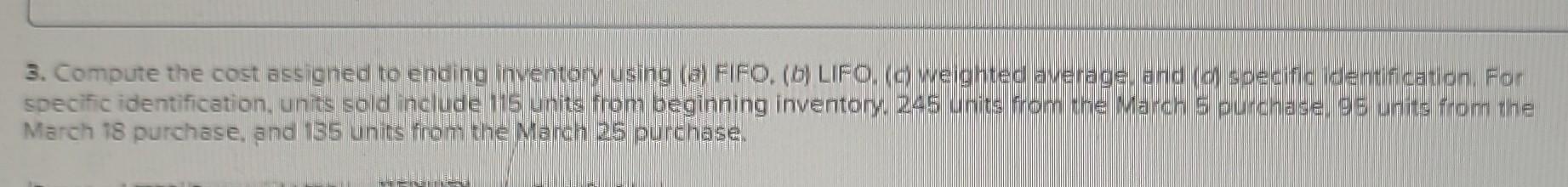

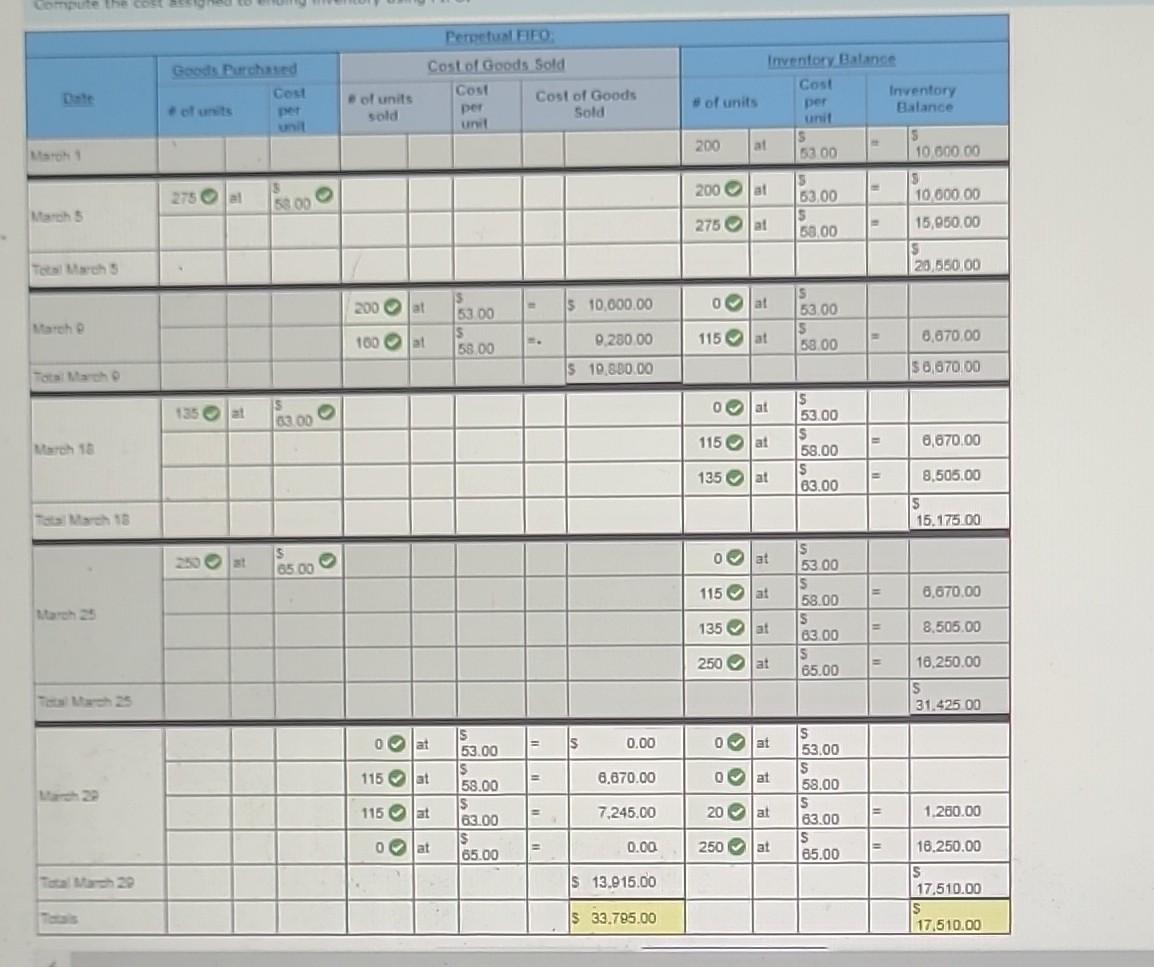

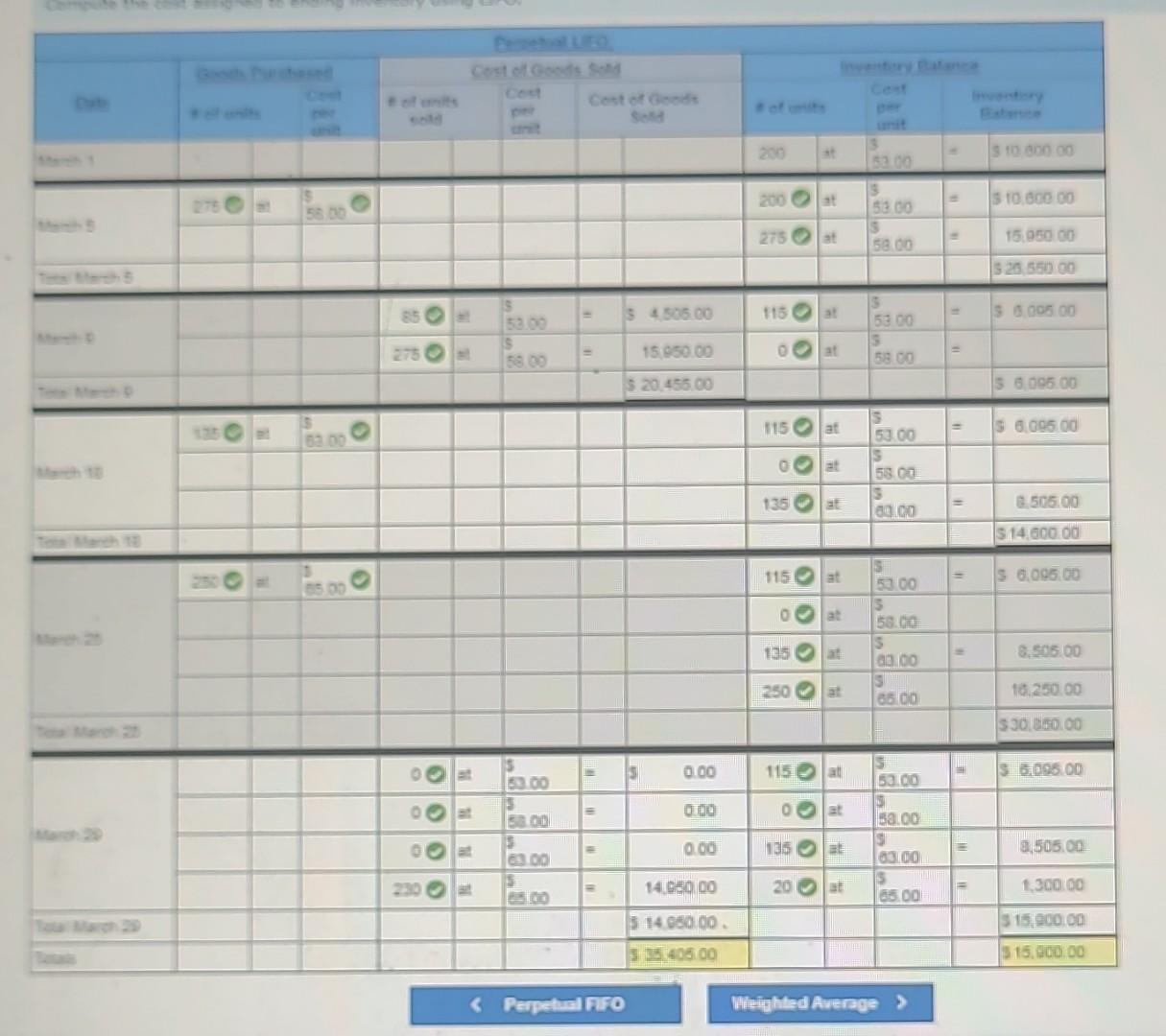

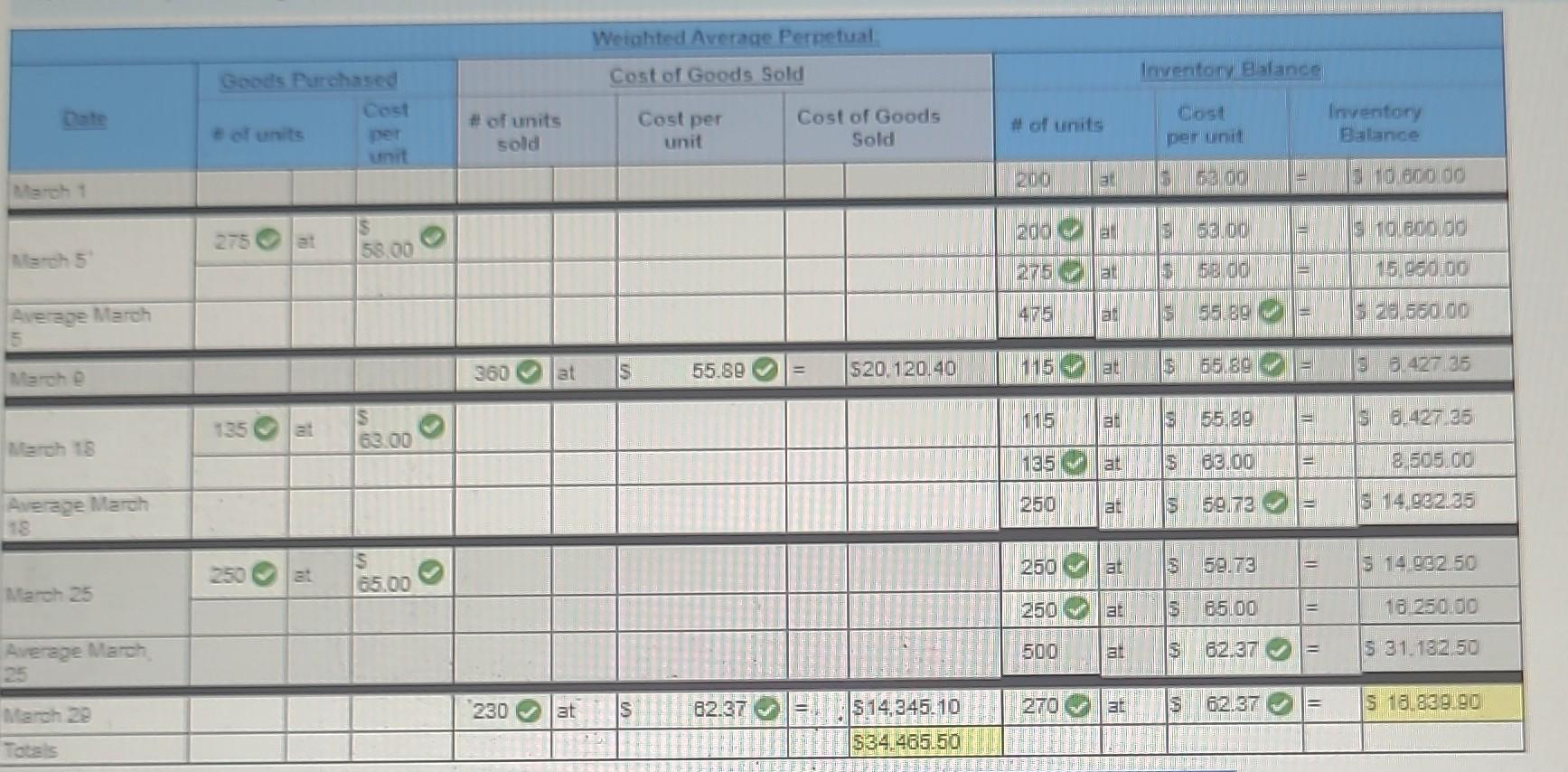

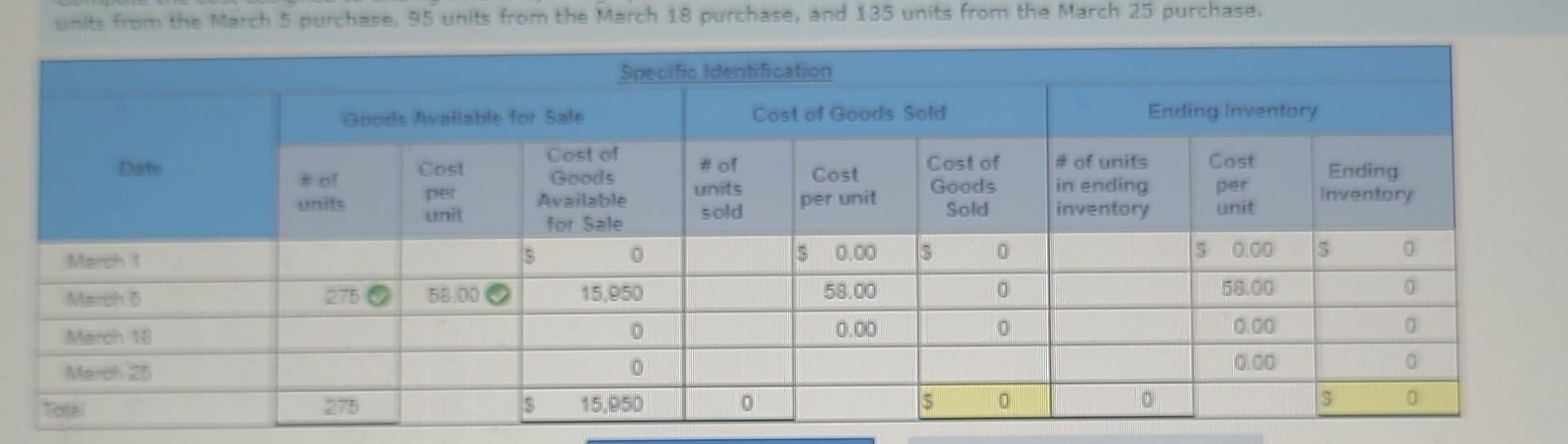

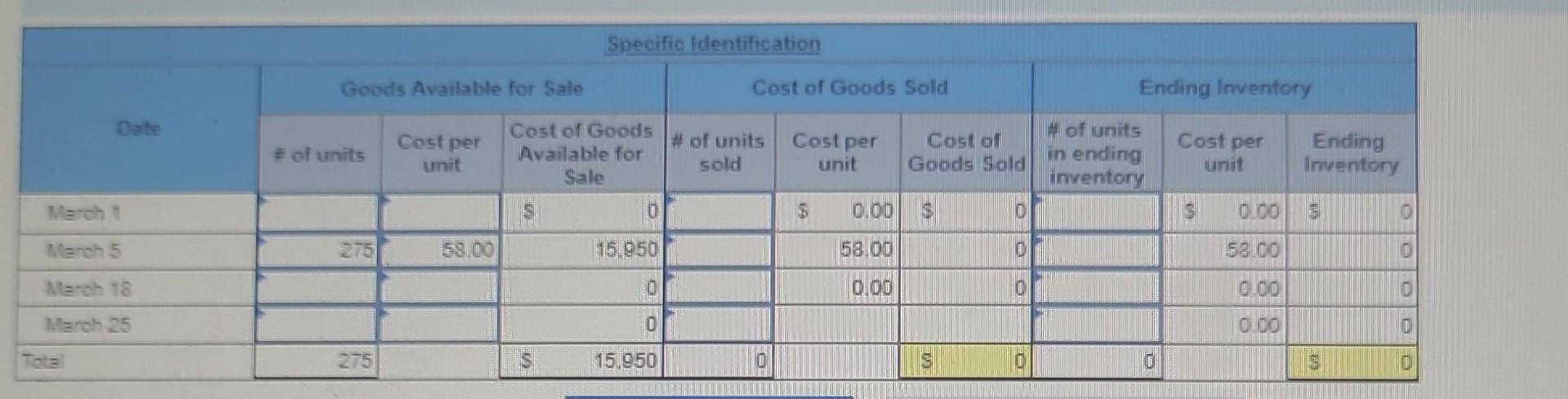

Required Information [The following information applies to the questions displayed below] Wamerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{14}{|c|}{ Specific Identification } \\ \hline \multirow[b]{2}{*}{ Date } & \multicolumn{3}{|c|}{ Goods Available for Sale } & \multicolumn{5}{|c|}{ Cost of Goods Sold } & \multicolumn{5}{|c|}{ Ending Inventory } \\ \hline & f of units & Costperunit & CostofGoodsAvailableforSale & #ofunitssold & Cos & tpernit & CGoc & & Aofunitsinendingimventory & Cos & perit & ErInv & \\ \hline March 1 & & & s. & & $ & 0.00 & \$ & 0 & & 3 & 0.00 & 5 & 0 \\ \hline March 5 & 275 & 58.00 & 15.950 & & & 58.00 & & 0 & & & 58.00 & & 0 \\ \hline March 18 & & & 0 & & & 0.00 & & 0 & & & 0.00 & & 0 \\ \hline March 25 & & & 0 & & & & & & & & 0.00 & & 0 \\ \hline Total & 275 & & 15,950 & 0 & & & S & 0 & 0 & & & s & 0 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{14}{|c|}{ Perpetuol HF. } \\ \hline \multirow{3}{*}{DoteWoron1} & \multicolumn{3}{|c|}{ Goosts Purchnes } & \multicolumn{5}{|c|}{ Cost of Goods Sotd } & \multicolumn{5}{|c|}{ Inventory Batance } \\ \hline & \multicolumn{2}{|c|}{ - of units } & \multirow[t]{2}{*}{Costperonit} & \multicolumn{2}{|l|}{eofunitssold} & \multirow[t]{2}{*}{Costpetunit} & \multicolumn{2}{|c|}{CostofGoodsSold} & \multicolumn{2}{|c|}{ \# of units } & \multirow{2}{*}{Costperunit55300} & \multicolumn{2}{|c|}{InventoryBalance} \\ \hline & 8 & & & & & & & & 200 & at & & = & 1000000 \\ \hline \multirow{2}{*}{ March 5} & 2750 & al & 500080 & & & & & & 2000 & at & 53.00 & = & 10,000,00 \\ \hline & & & & & & & & & 2750 & at & 58.00 & = & 15,950,00 \\ \hline Tedal Wreh 5 & . & & & & & & & & & & & & 50,550,00 \\ \hline \multirow{2}{*}{ Warche } & & & & 2000 & at & 5300 & = & 510,000.00 & 00 & at & 53.00 & & \\ \hline & & & & 1000 & at & 5800 & =. & 0.280 .00 & 1150 & at & 58.00 & = & 6,670,00 \\ \hline Total Wrach & & & & & & & & $10.880.00 & & & & & $6,070,00 \\ \hline \multirow{3}{*}{ March 18} & 1350 & at & 5log0000 & & & & & & 00 & at & 553.00 & & \\ \hline & & & * & & & & & & 1150 & at & 58.00 & = & 0,670,00 \\ \hline & & & & & & & & & 1350 & at & 63.00 & = & 8,505.00 \\ \hline fatal Narch 18 & & & & & & & & & & & & & 515,175,00 \\ \hline \multirow{4}{*}{ March 25} & 2500 & st & & & & & & & 00 & at & 53.00 & & \\ \hline & & & i & & & & & & 1150 & at & 58.00 & = & 0,670.00 \\ \hline & & & & & & & & & 135 & at & 83.00 & = & 8,505.00 \\ \hline & & & & & & & & & 2500 & at & 565.00 & = & 16.250 .00 \\ \hline Teal Mach 25 & & & & & & & & & & & & & 531.42500 \\ \hline \multirow{4}{*}{ Hach 29} & & & & 00 & at & 53.00 & = & 0.00 & 00 & at & 553.00 & & \\ \hline & & & & 115 & at & 58.00 & = & 0.670 .00 & 00 & at & 558.00 & & \\ \hline & & & & 1150 & at & $63.00 & = & 7,245.00 & 200 & at & 63.00 & = & 1.260 .00 \\ \hline & & & & 00 & at & $5.00 & = & 0.00 & 2500 & at & 565.00 & = & 16.250 .00 \\ \hline Fital March 22 & & & & & & & & \$ 13.915 .00 & & & & & 517.510.00 \\ \hline fasis & & & & & & & & \$ 33.785 .00 & & & & & 17.510 .00 \\ \hline \end{tabular} 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (C) weighted average, and ( C ) specific identif cation, For specific identification, units sold include 115 units from beginning inventory, 245 units from the March 5 purchase, 95 units from the March 18 purchase, and 135 units from the March 25 purchase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started