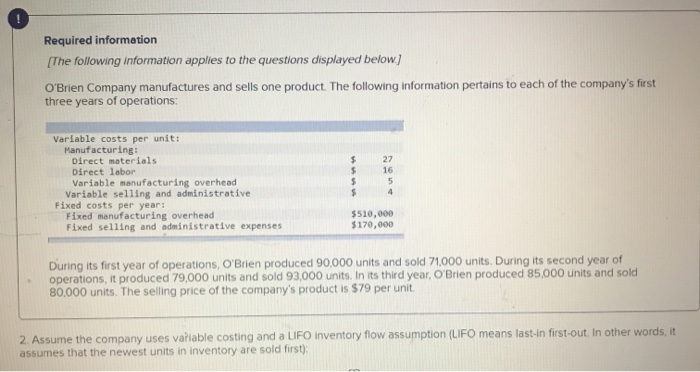

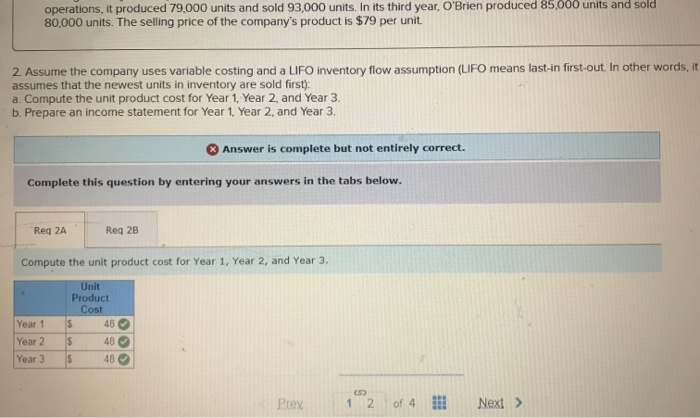

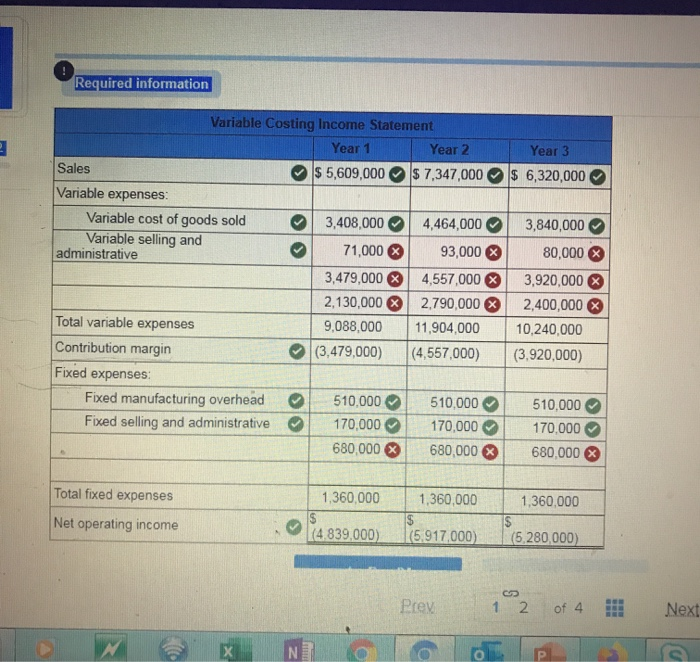

Required information [The following information applies to the questions displayed below) O'Brien Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations: Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year! Fixed manufacturing overhead Fixed selling and administrative expenses $ $ $ $ 27 16 5 4 $510,000 $170,000 During its first year of operations, O'Brien produced 90,000 units and sold 71,000 units. During its second year of operations, it produced 79,000 units and sold 93,000 units. In its third year, O'Brien produced 85,000 units and sold 80,000 units. The selling price of the company's product is $79 per unit. 2. Assume the company uses variable costing and a LIFO inventory flow assumption (LIFO means last-in first-out. In other words, it assumes that the newest units in inventory are sold first); operations, it produced 79.000 units and sold 93,000 units. In its third year, O'Brien produced 85,000 units and sold 80,000 units. The selling price of the company's product is $79 per unit. 2. Assume the company uses variable costing and a LIFO inventory flow assumption (LIFO means last-in first-out. In other words, it assumes that the newest units in inventory are sold first): a. Compute the unit product cost for Year 1 Year 2, and Year 3. b. Prepare an income statement for Year 1. Year 2, and Year 3. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req 2A Reg 2B Compute the unit product cost for Year 1, Year 2, and Year 3. Year 1 Year 2 Year 3 Unit Product Cost $ 48 $ 48 $ 48 Prex 1 2 of 4 Next > Required information 2 Year 3 $ 6,320,000 3,840,000 80,000 Variable Costing Income Statement Year 1 Year 2 Sales $ 5,609,000 $ 7,347,000 Variable expenses Variable cost of goods sold 3,408,000 4,464,000 Variable selling and administrative 71,000 X 93,000 X 3,479,000 4,557,000 2,130,000 2,790,000 Total variable expenses 9,088,000 11,904,000 Contribution margin (3,479,000) (4,557,000) Fixed expenses: Fixed manufacturing overhead 510,000 510,000 Fixed selling and administrative 170,000 170,000 680,000 680,000 3,920,000 2,400,000 10,240,000 (3.920,000) 510,000 170.000 680,000 Total fixed expenses 1,360,000 1,360.000 Net operating income 1,360,000 $ (4.839,000) (5.917,000) (5.280,000) Prey 1 2 of 4 Next M X NE