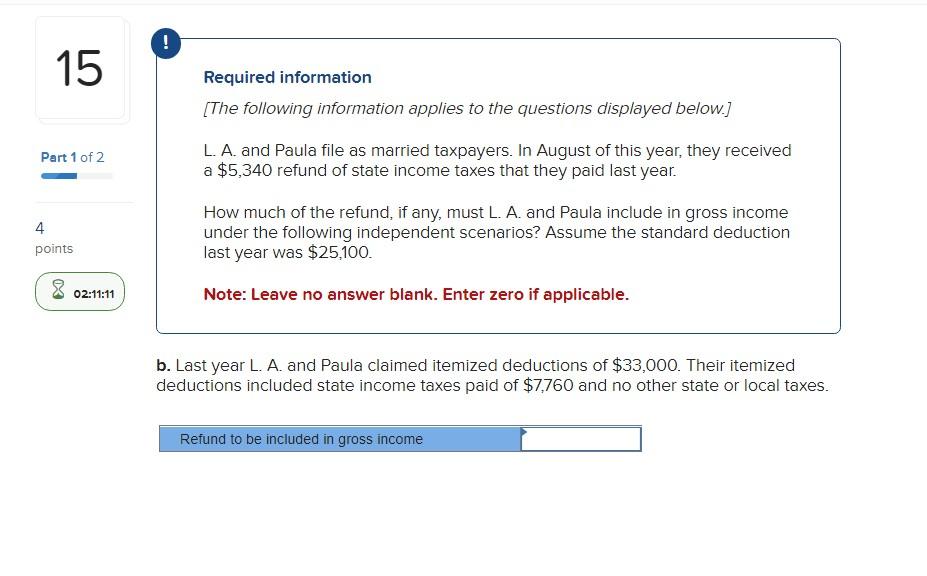

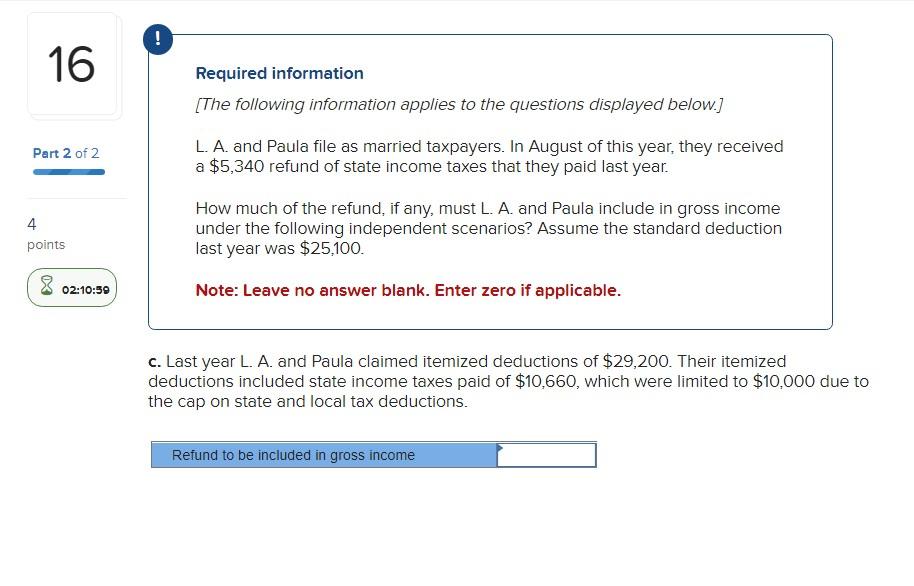

Required information [The following information applies to the questions displayed below.] Cecil cashed in a Series EE savings bond with a redemption value of $17,500 and an original cost of $12,250. For each of the following independent scenarios, calculate the amount of interest Cecil will include in his gross income assuming he files as a single taxpayer: Note: Leave no answer blank. Enter zero if applicable. b. Assume the same facts in part (a), except Cecil plans to spend $5,250 of the proceeds to pay his son's tuition at State University, and Cecil estimates his modified adjusted gross income at $66,800. Required information [The following information applies to the questions displayed below.] L. A. and Paula file as married taxpayers. In August of this year, they received a $5,340 refund of state income taxes that they paid last year. How much of the refund, if any, must L. A. and Paula include in gross income under the following independent scenarios? Assume the standard deduction last year was $25,100. Note: Leave no answer blank. Enter zero if applicable. b. Last year L. A. and Paula claimed itemized deductions of $33,000. Their itemized deductions included state income taxes paid of $7,760 and no other state or local taxes. Required information [The following information applies to the questions displayed below.] L. A. and Paula file as married taxpayers. In August of this year, they received a $5,340 refund of state income taxes that they paid last year. How much of the refund, if any, must L. A. and Paula include in gross income under the following independent scenarios? Assume the standard deduction last year was $25,100. Note: Leave no answer blank. Enter zero if applicable. c. Last year L. A. and Paula claimed itemized deductions of $29,200. Their itemized deductions included state income taxes paid of $10,660, which were limited to $10,000 due to the cap on state and local tax deductions. Required information [The following information applies to the questions displayed below.] Cecil cashed in a Series EE savings bond with a redemption value of $17,500 and an original cost of $12,250. For each of the following independent scenarios, calculate the amount of interest Cecil will include in his gross income assuming he files as a single taxpayer: Note: Leave no answer blank. Enter zero if applicable. b. Assume the same facts in part (a), except Cecil plans to spend $5,250 of the proceeds to pay his son's tuition at State University, and Cecil estimates his modified adjusted gross income at $66,800. Required information [The following information applies to the questions displayed below.] L. A. and Paula file as married taxpayers. In August of this year, they received a $5,340 refund of state income taxes that they paid last year. How much of the refund, if any, must L. A. and Paula include in gross income under the following independent scenarios? Assume the standard deduction last year was $25,100. Note: Leave no answer blank. Enter zero if applicable. b. Last year L. A. and Paula claimed itemized deductions of $33,000. Their itemized deductions included state income taxes paid of $7,760 and no other state or local taxes. Required information [The following information applies to the questions displayed below.] L. A. and Paula file as married taxpayers. In August of this year, they received a $5,340 refund of state income taxes that they paid last year. How much of the refund, if any, must L. A. and Paula include in gross income under the following independent scenarios? Assume the standard deduction last year was $25,100. Note: Leave no answer blank. Enter zero if applicable. c. Last year L. A. and Paula claimed itemized deductions of $29,200. Their itemized deductions included state income taxes paid of $10,660, which were limited to $10,000 due to the cap on state and local tax deductions