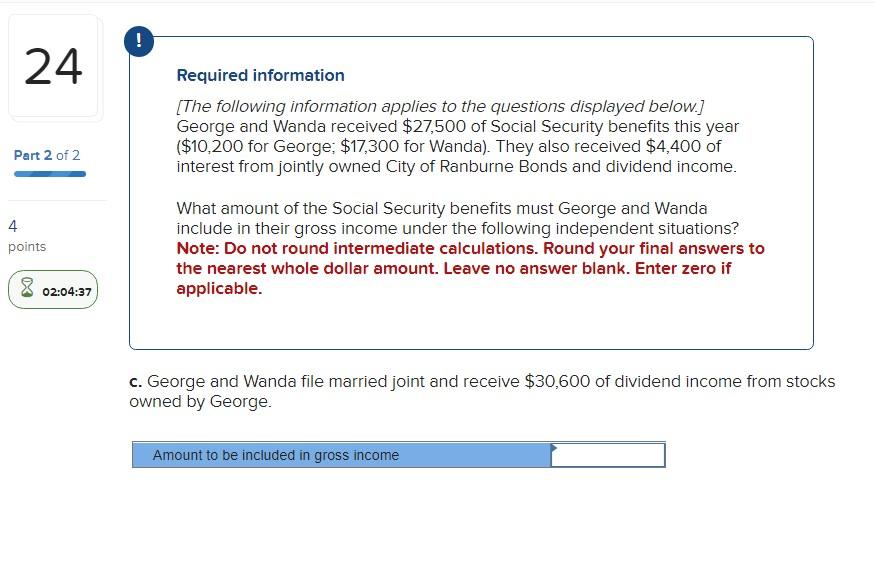

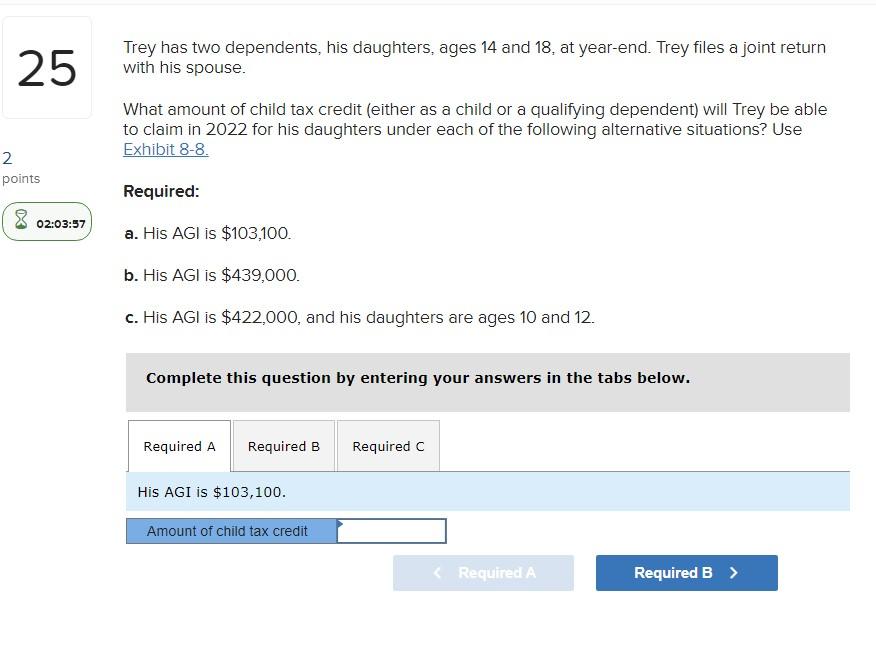

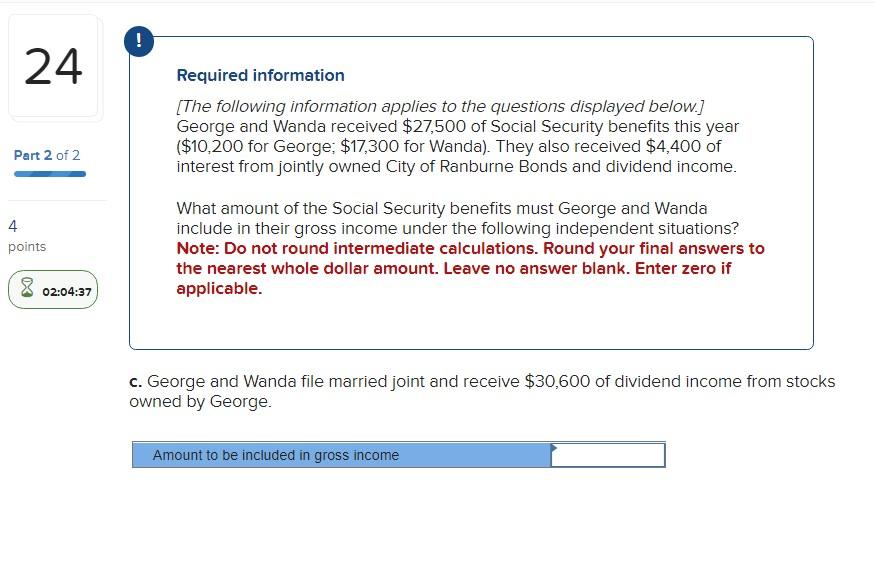

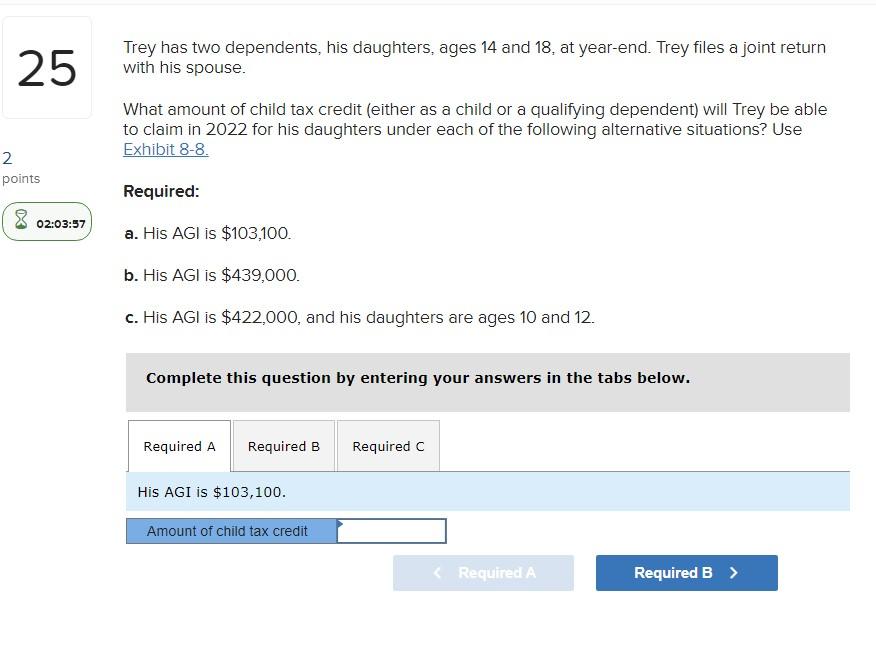

Required information [The following information applies to the questions displayed below.] George and Wanda received $27,500 of Social Security benefits this year ( $10,200 for George; $17,300 for Wanda). They also received $4,400 of interest from jointly owned City of Ranburne Bonds and dividend income. What amount of the Social Security benefits must George and Wanda include in their gross income under the following independent situations? Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable. c. George and Wanda file married joint and receive $30,600 of dividend income from stocks owned by George. Trey has two dependents, his daughters, ages 14 and 18 , at year-end. Trey files a joint return with his spouse. What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2022 for his daughters under each of the following alternative situations? Use Exhibit 8-8. Required: a. His AGl is $103,100. b. His AGl is $439,000. c. His AGI is $422,000, and his daughters are ages 10 and 12 . Complete this question by entering your answers in the tabs below. His AGI is $103,100. Required information [The following information applies to the questions displayed below.] George and Wanda received $27,500 of Social Security benefits this year ( $10,200 for George; $17,300 for Wanda). They also received $4,400 of interest from jointly owned City of Ranburne Bonds and dividend income. What amount of the Social Security benefits must George and Wanda include in their gross income under the following independent situations? Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable. c. George and Wanda file married joint and receive $30,600 of dividend income from stocks owned by George. Trey has two dependents, his daughters, ages 14 and 18 , at year-end. Trey files a joint return with his spouse. What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2022 for his daughters under each of the following alternative situations? Use Exhibit 8-8. Required: a. His AGl is $103,100. b. His AGl is $439,000. c. His AGI is $422,000, and his daughters are ages 10 and 12 . Complete this question by entering your answers in the tabs below. His AGI is $103,100