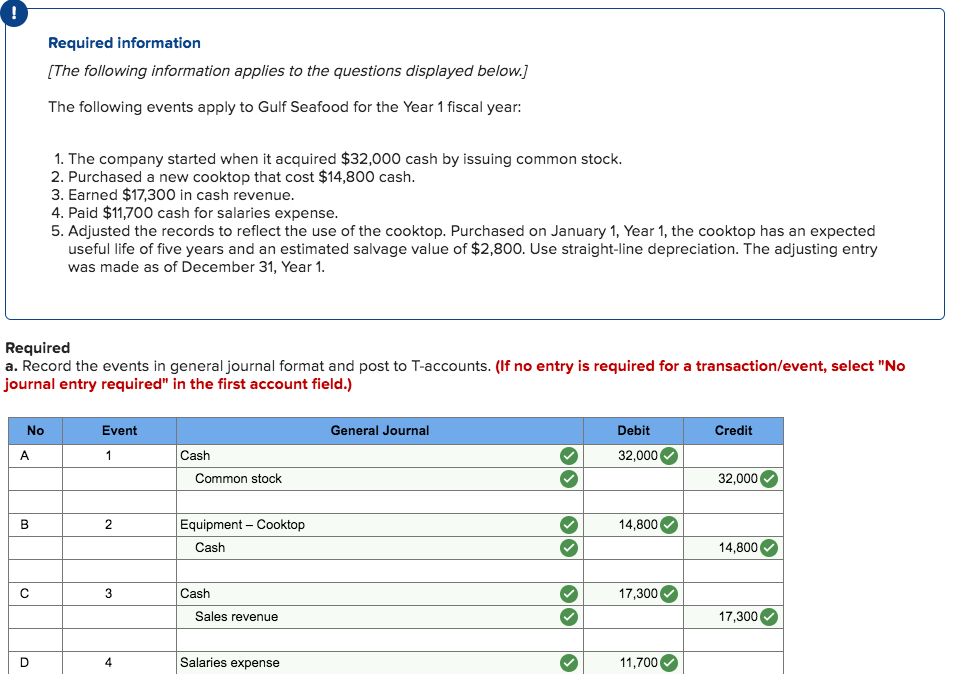

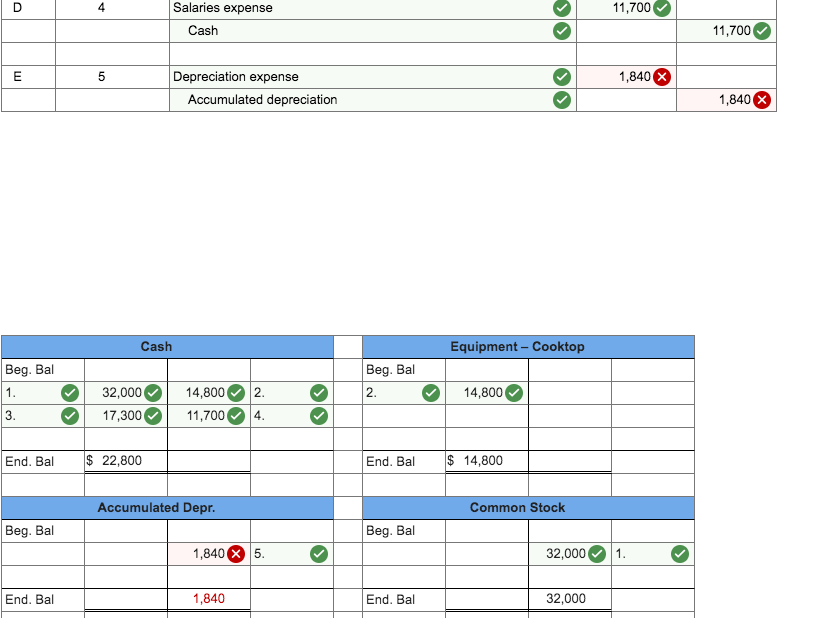

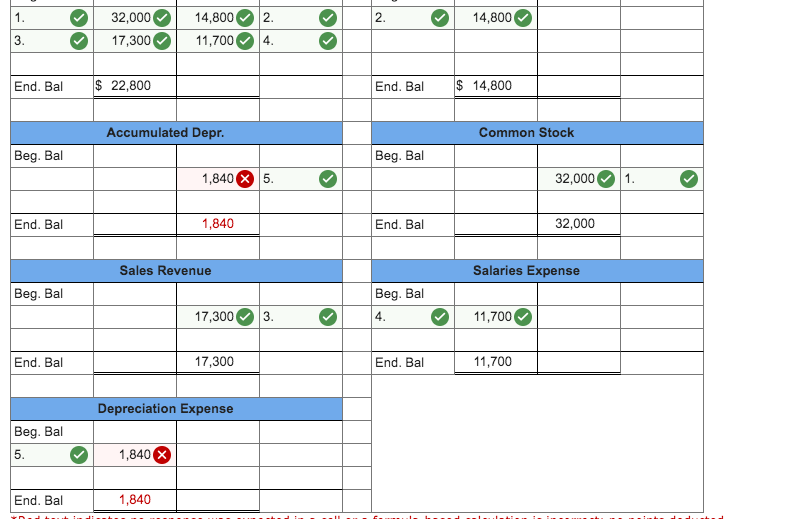

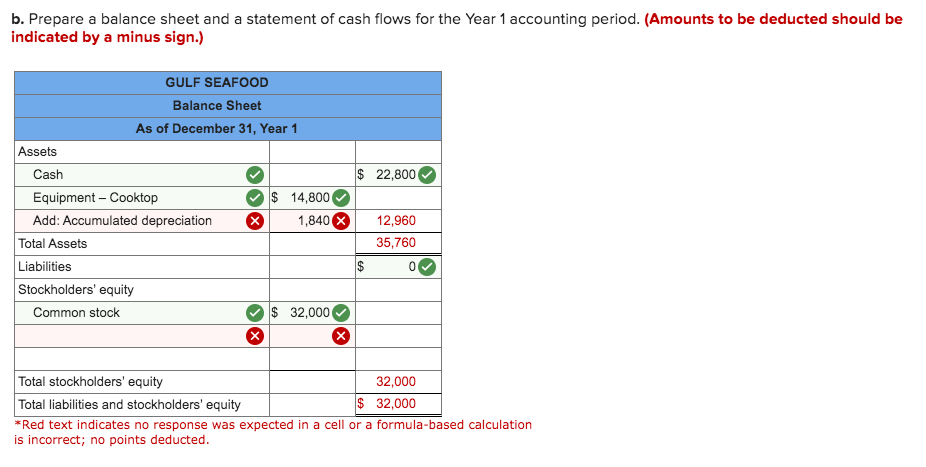

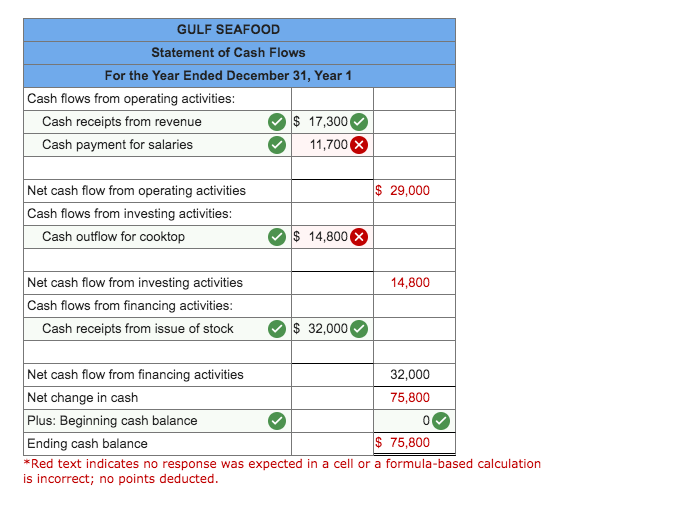

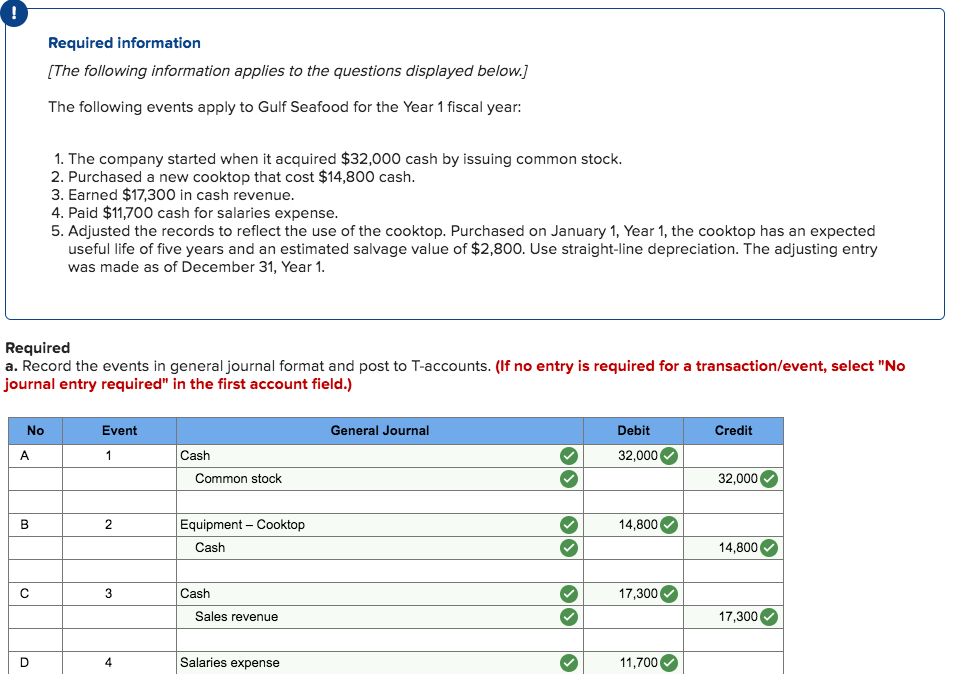

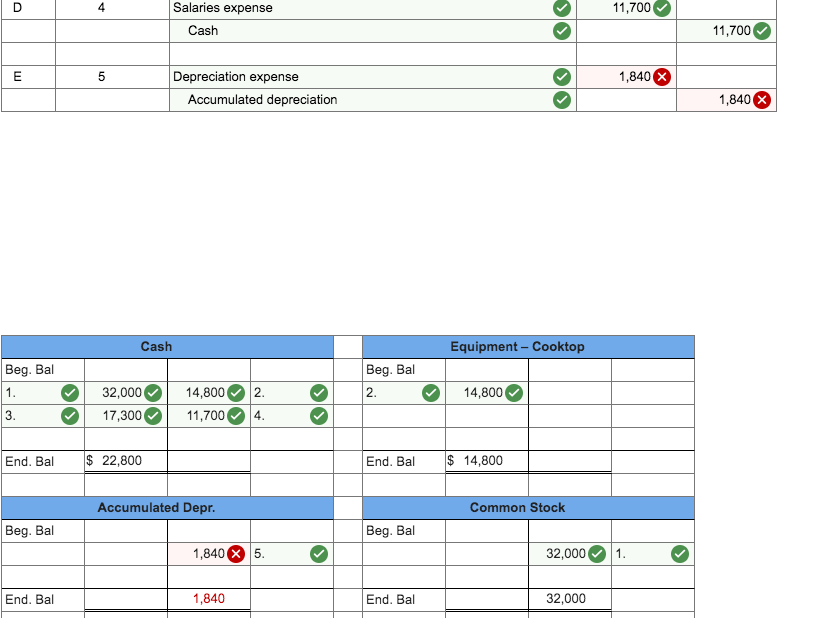

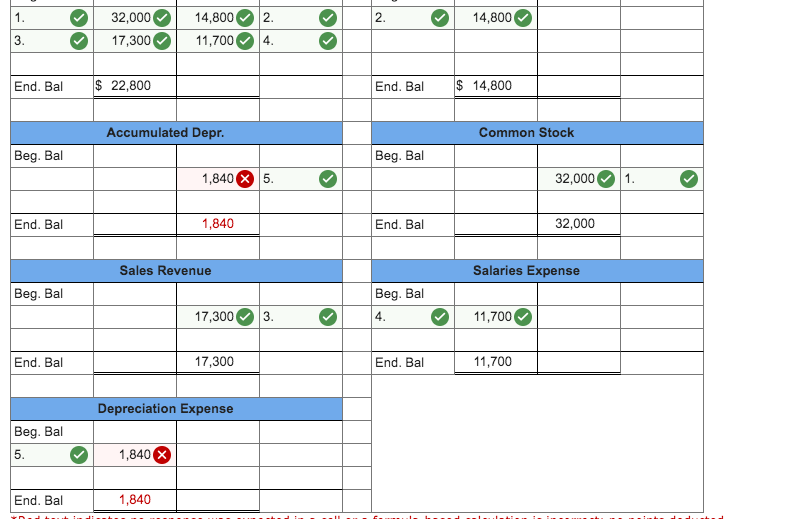

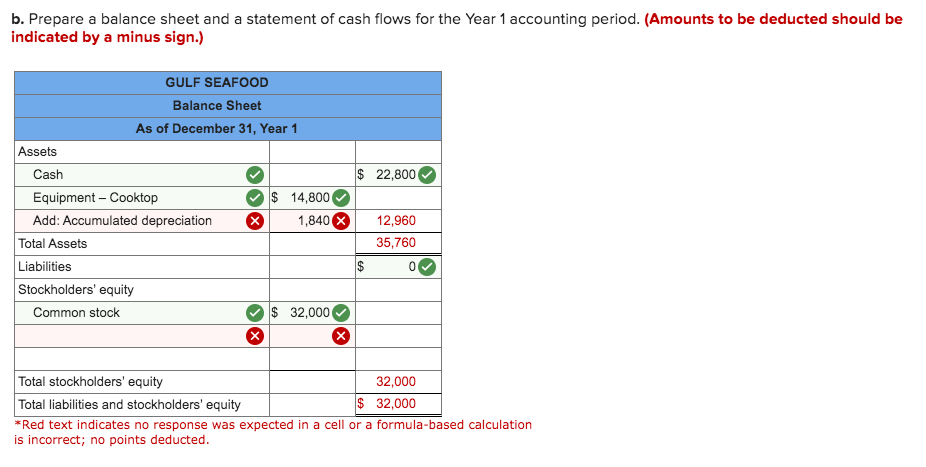

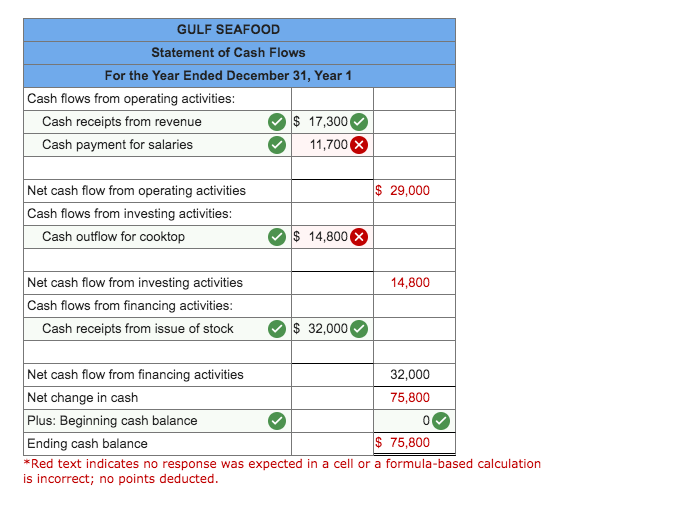

Required information [The following information applies to the questions displayed below.) The following events apply to Gulf Seafood for the Year 1 fiscal year: 1. The company started when it acquired $32,000 cash by issuing common stock. 2. Purchased a new cooktop that cost $14,800 cash. 3. Earned $17,300 in cash revenue. 4. Paid $11,700 cash for salaries expense. 5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of five years and an estimated salvage value of $2,800. Use straight-line depreciation. The adjusting entry was made as of December 31, Year 1. Required a. Record the events in general journal format and post to T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Event General Journal Debit Credit A 1 32,000 Cash Common stock OO 32,000 B 2 14,800 Equipment - Cooktop Cash o 14,800 C 3 Cash 17,300 Sales revenue 17,300 D 4 Salaries expense 11,700 D 4 11,700 Salaries expense Cash 11,700 E 5 1,840 X Depreciation expense Accumulated depreciation 1,840 X Cash Equipment - Cooktop Beg. Bal Beg. Bal 2. 1. 14,800 32,000 17,300 14,800 11,700 2. 4. 3. End. Bal $ 22,800 End. Bal $ 14,800 Accumulated Depr. Common Stock Beg. Bal Beg. Bal 1,840 X 5. 32,000 1. End. Bal 1,840 End. Bal 32,000 1. 2. 2. 14,800 32,000 17,300 14,800 11,700 3. 4. End. Bal $ 22,800 End. Bal $ 14,800 Accumulated Depr. Common Stock Beg. Bal Beg. Bal 1,840 X 5. 32,000 1. End. Bal 1,840 End. Bal 32,000 Sales Revenue Salaries Expense Beg. Bal Beg. Bal 17,300 3. 4. 11,700 End. Bal 17,300 End. Bal 11,700 Depreciation Expense Beg. Bal 5. 1,840 X End. Bal 1,840 b. Prepare a balance sheet and a statement of cash flows for the Year 1 accounting period. (Amounts to be deducted should be indicated by a minus sign.) $ 22,800 GULF SEAFOOD Balance Sheet As of December 31, Year 1 Assets Cash Equipment - Cooktop $ 14,800 Add: Accumulated depreciation x 1,840 Total Assets Liabilities Stockholders' equity Common stock $ 32,000 12,960 35,760 $ 0 Total stockholders' equity 32,000 Total liabilities and stockholders' equity $ 32,000 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. GULF SEAFOOD Statement of Cash Flows For the Year Ended December 31, Year 1 Cash flows from operating activities: Cash receipts from revenue $ 17,300 Cash payment for salaries 11,700 $ 29,000 Net cash flow from operating activities Cash flows from investing activities: Cash outflow for cooktop $ 14,800 X 14,800 Net cash flow from investing activities Cash flows from financing activities: Cash receipts from issue of stock $ 32,000 Net cash flow from financing activities 32,000 Net change in cash 75,800 Plus: Beginning cash balance 0 Ending cash balance $ 75,800 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted