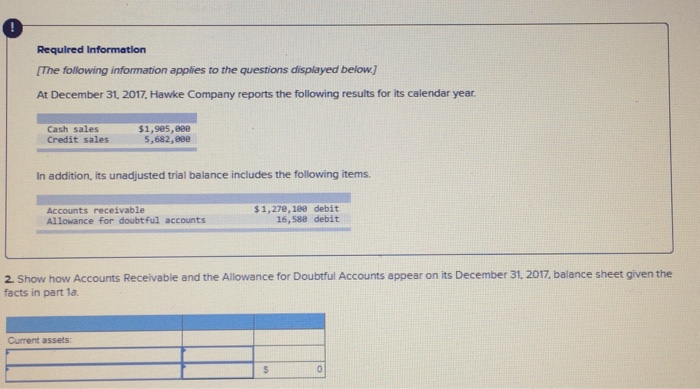

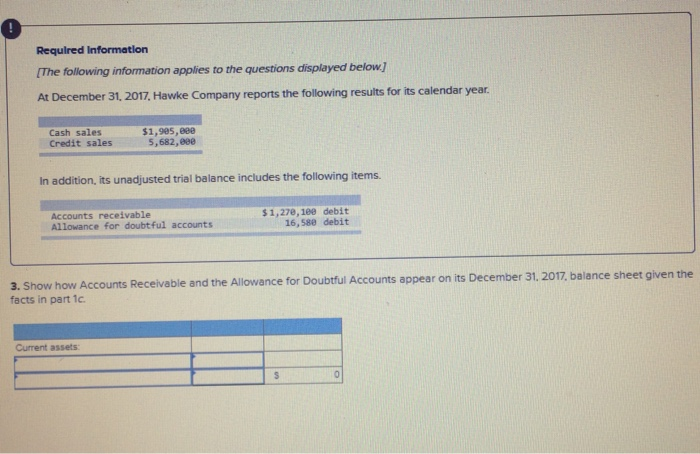

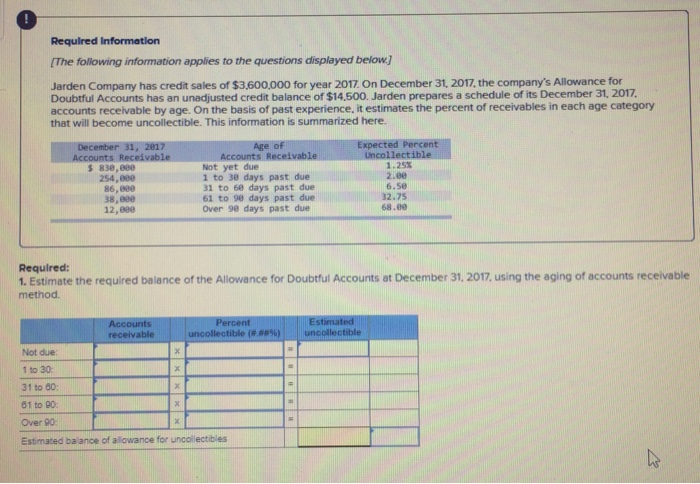

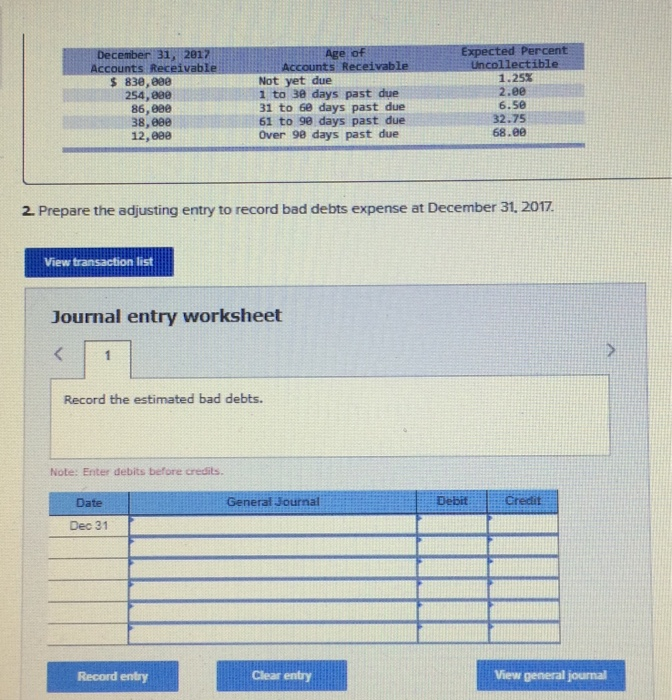

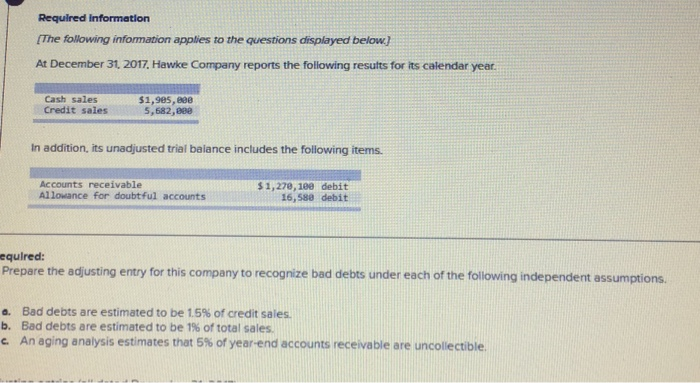

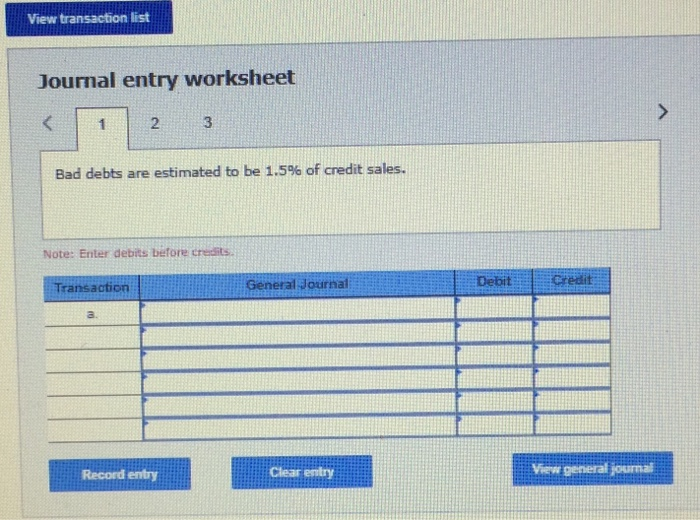

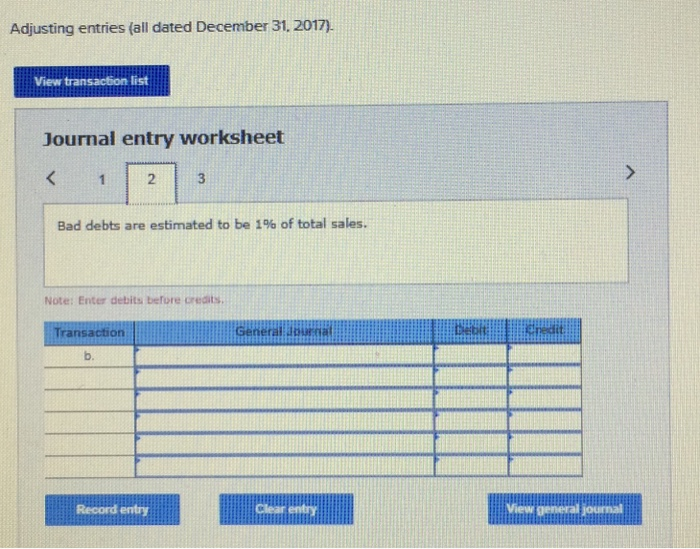

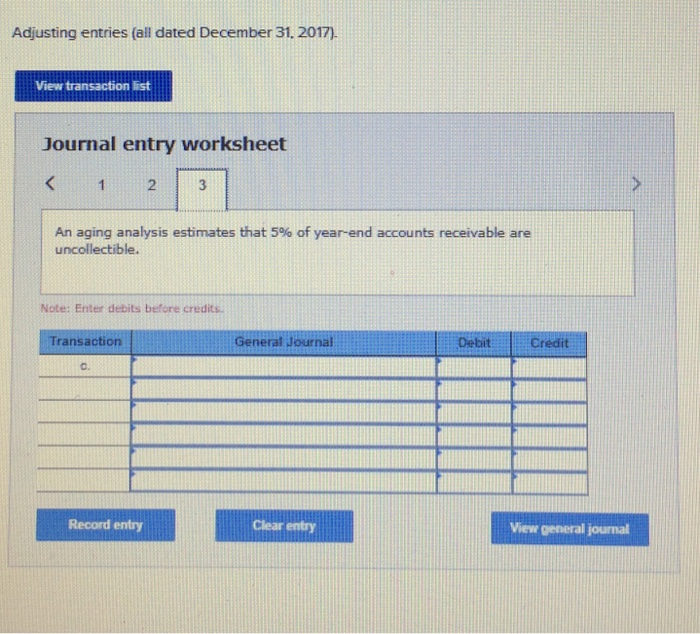

Required Information The following information applies to the questions displayed below At December 31, 2017. Hawke Company reports the following results for its calendar year Cash sales Credit sales $1,985,888 5,682,888 In addition, its unadjusted trial balance includes the following items. $1,27e, 18e debit 16,588 debit Accounts receivable Allowance for doubtful accounts 2. Show how Accounts Receivable and the Allowance for Doubtful Accounts appear on its December 31, 2017, balance sheet given the facts in part la Current assets: Required Information [The following At December 31, 2017, Hawke Company reports the following results for its calendar year information applies to the questions displayed below $1,9e5,888 5,682,086e Cash sales Credit sales In addition, its unadjusted trial balance includes the following items. $ 1,276, 180 debit 16,580 debit Accounts receivable Allowance for doubtful accounts and the Allowance for Doubtful Accounts appear on its December 31, 2017, balance sheet given the 3. Show how Accounts Receivable facts in part 1c. Current assets Required Information [The following information applies to the questions displayed below Jarden Company has credit sales of $3,600,000 for year 2017 On December 31, 2017, the company's Allowance for Doubtful Accounts has an unadjusted credit balance of $14,500. Jarden prepares a schedule of its December 31, 2017 accounts receivable by age. On the basis of past experience, it estimates the percent of receivables in each age category that will become uncollectible. This information is summarized here. Age of colle 1.25% Not yet due 1 to 38 days past due 31 to 68 days past due 61 to 98 days past due Over 98 days past due 2.00 6.56 32.75 68.80 254,000 86,809 38,80 12,880 Required: 1. Estimate the required balance of the Allowance for Doubtful Accounts at December 31, 2017, using the aging of accounts receivable method nt uncollectible uncollectible (#.es%) receivable : Not due 1 to 30 31 to 80: 81 to 90 Over 90 Estimated balance of allowance for uncollectibles December 31, 201Age of Receivable 1.25% 2.00 6.50 32.75 68.00 S 838,88e 254,880 86,880 38,880 12,eae Not yet due 1 to 38 days past due 3l to 68 days past due 61 to 90 days past due Over 98 days past due 2. Prepare the adjusting entry to record bad debts expense at December 31, 2017. View transaction list Journal entry worksheet Record the estimated bad debts. Note: Enter debits before credits. bebit Crecit General Journal Date Dec 31 View general journal Clear entry Record entry Required information [The following information applies to the questions displayed below) At December 31, 2017 Hawke Company reports the following results for its calendar year Cash sales Credit sales 51,9e5,8ee 5,682,880 In addition, its unadjusted trial baiance includes the following items. Accounts receivable Allowance for doubtful accounts $ 1,278, 100 debit 16,588 debit equired: Prepare the adjusting entry for this company to recognize bad debts under each of the following independent assumptions. a. Bad debts are estimated to be 1.5% of credit sales. b. Bad debts are estimated to be 1% of total sales. e An aging analysis estimates that 5% of year-end accounts receivable are uncollectible View transaction list Journal entry worksheet 2 3 Bad debts are estimated to be 1.5% of credit sales. Note: Enter debits before credits. Debit | Credit General Journal Transaction a. View general journal Clear entry Record entry Adjusting entries (all dated December 31. 2017). View transaction list Journal entry worksheet 2 An aging analysis estimates that 5% of year-end accounts receivable are uncollectible. Note: Enter debits before credits. Transaction General Journal Debit Credfit C. Record entry Clear entry View general journal