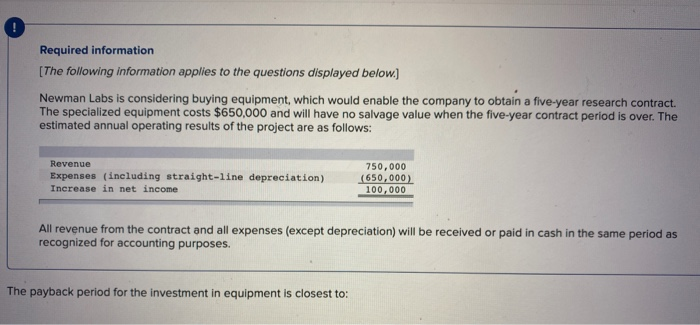

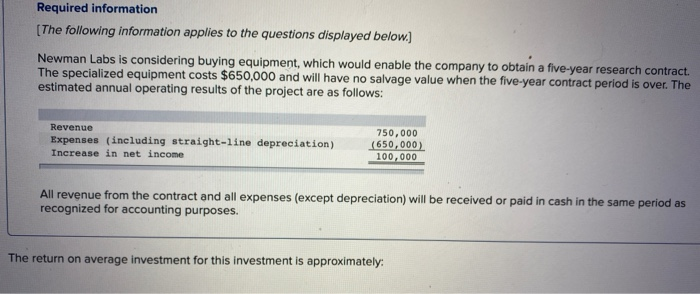

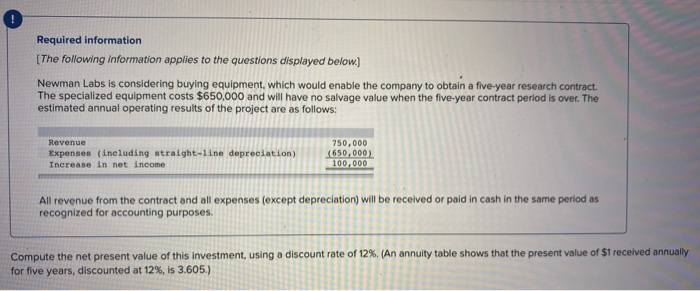

Required information [The following information applies to the questions displayed below) Newman Labs is considering buying equipment, which would enable the company to obtain a five-year research contract. The specialized equipment costs $650,000 and will have no salvage value when the five-year contract period is over. The estimated annual operating results of the project are as follows: Revenue Expenses (including straight-line depreciation) Increase in net income 750,000 (650,000) 100,000 All revenue from the contract and all expenses (except depreciation) will be received or paid in cash in the same period as recognized for accounting purposes. The payback period for the investment in equipment is closest to: Required information (The following information applies to the questions displayed below.) Newman Labs is considering buying equipment, which would enable the company to obtain a five-year research contract. The specialized equipment costs $650,000 and will have no salvage value when the five-year contract period is over. The estimated annual operating results of the project are as follows: Revenue Expenses (including straight-line depreciation) Increase in net income 750,000 (650,000) 100,000 All revenue from the contract and all expenses (except depreciation) will be received or paid in cash in the same period as recognized for accounting purposes. The return on average investment for this investment is approximately Required information [The following information applies to the questions displayed below.) Newman Labs is considering buying equipment, which would enable the company to obtain a five-year research contract. The specialized equipment costs $650,000 and will have no salvage value when the five-year contract period is over. The estimated annual operating results of the project are as follows: Revenue Expenses (including straight-line depreciation) Increase in net income 750,000 (650,000) 100.000 All revenue from the contract and all expenses (except depreciation) will be received or paid in cash in the same period as recognized for accounting purposes. annuity table shows that the present value of $1 received annually Compute the net present value of this Investment, using a discount rate for five years, discounted at 12%, is 3.605.)