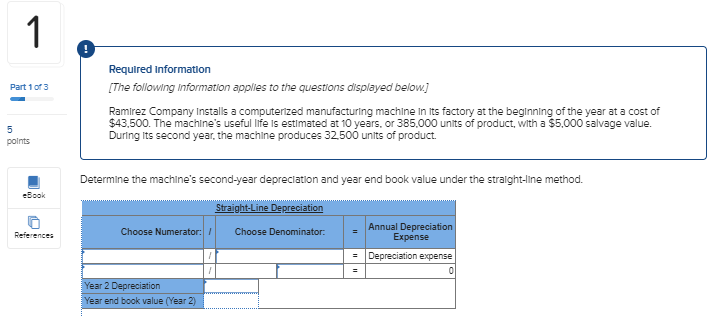

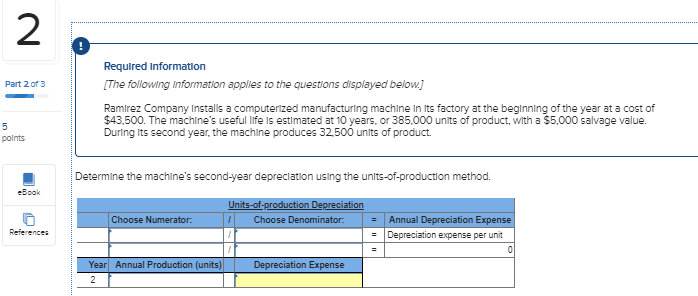

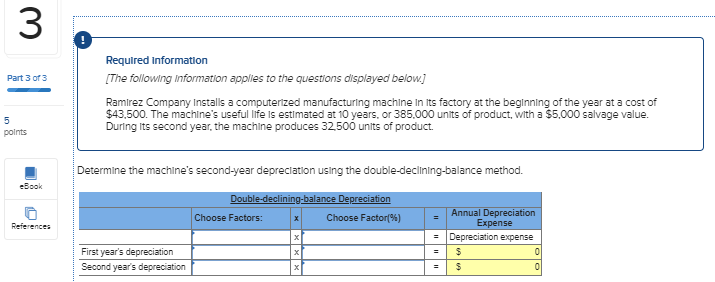

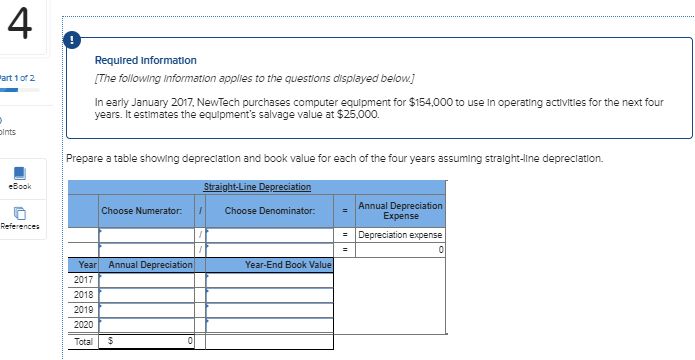

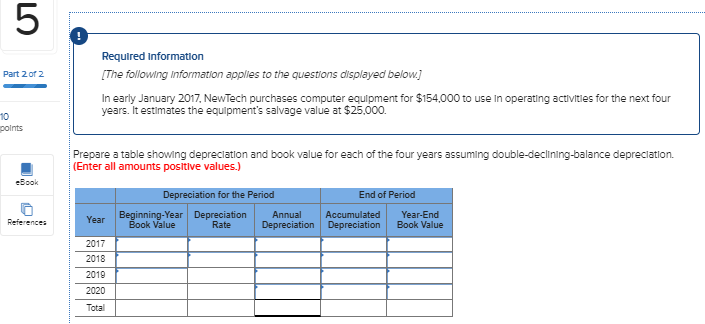

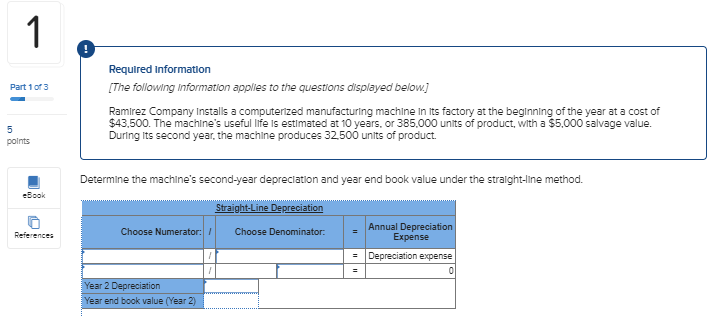

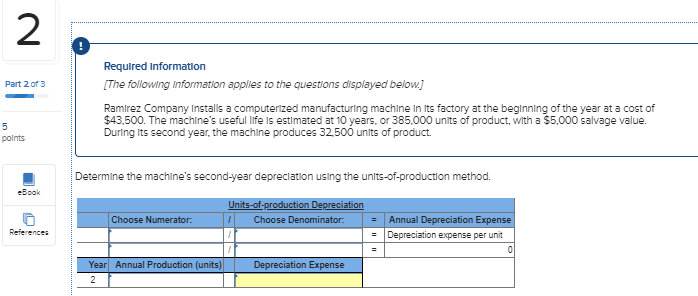

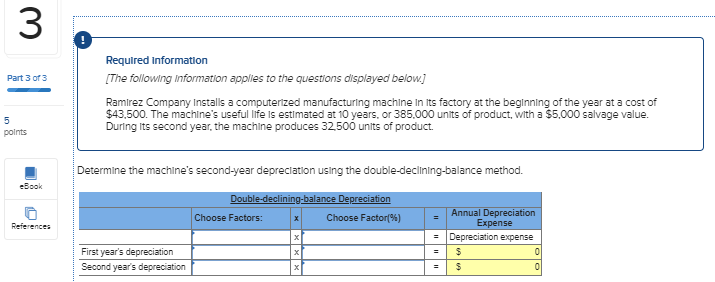

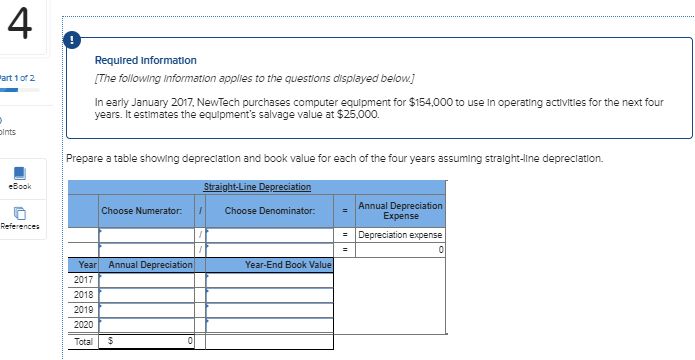

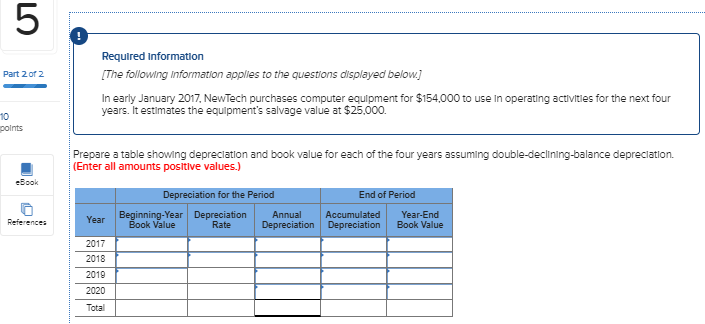

Required information The following information applies to the questions displayed below] Part 1 of 3 Ramirez Company Installs a computerized manufacturing machine In Its factory at the beginning of the year at a cost of $43.500. The machine's useful life is estimated at 10 years, or 385.000 units of product, with a $5,000 salvage value. During its second year, the machine produces 32.500 units of product. points Determine the machine's second-year depreciation and year end book value under the straight-line method. ebook Straight-Line Depreciation References Choose Numerator: Choose Denominator: Annual Depreciation Expense = Depreciation expense Year 2 Depreciation Year end book value (Year 2) Required information [The following information applies to the questions displayed below) Part 2 of 3 Ramirez Company Installs a computerized manufacturing machine In Its factory at the beginning of the year at a cost of $43,500. The machine's useful life is estimated at 10 years, or 385.000 units of product, with a $5,000 salvage value. During its second year, the machine produces 32.500 units of product. points Determine the machine's second-year depreciation using the units-of-production method. eBook Choose Numerator: Units-of-production Depreciation Choose Denominator: = = Annual Depreciation Expense Depreciation expense per unit References Year Annual Production (units) Depreciation Expense Required information [The following information applies to the questions displayed below.] Part 3 of 3 Ramirez Company Installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $43.500. The machine's useful life is estimated at 10 years, or 385.000 units of product, with a $5,000 salvage value. During its second year, the machine produces 32.500 units of product. points Determine the machine's second-year depreciation using the double-declining-balance method. eBook Double-declining-balance Depreciation Choose Factors: X Choose Factor%) = References Annual Depreciation Expense Depreciation expense = First year's depreciation Second year's depreciation art 1 of 2 Required Information (The following information applies to the questions displayed below.] In early January 2017 NewTech purchases computer equipment for $154,000 to use in operating activities for the next four years. It estimates the equipment's salvage value at $25,000. gints Prepare a table showing depreciation and book value for each of the four years assuming straight-line depreciation eBook Straight-Line Depreciation Choose Numerator: Choose Denominator: Annual Depreciation Expense References = Depreciation expense Annual Depreciation Year-End Book Value Year 2017 2018 2019 Total $ 0 Required Information The following information applies to the questions displayed below.] Part 2 of 2 In early January 2017, NewTech purchases computer equipment for $154,000 to use in operating activities for the next four years. It estimates the equipment's salvage value at $25.000. points Prepare a table showing depreciation and book value for each of the four years assuming double-declining-balance depreciation. (Enter all amounts positive values.) eBook Depreciation for the Period End of Period References: Year Beginning-Year Depreciation Book Value Rate Annual Depreciation Accumulated Depreciation Year-End Book Value 2017 2018 2019 2020