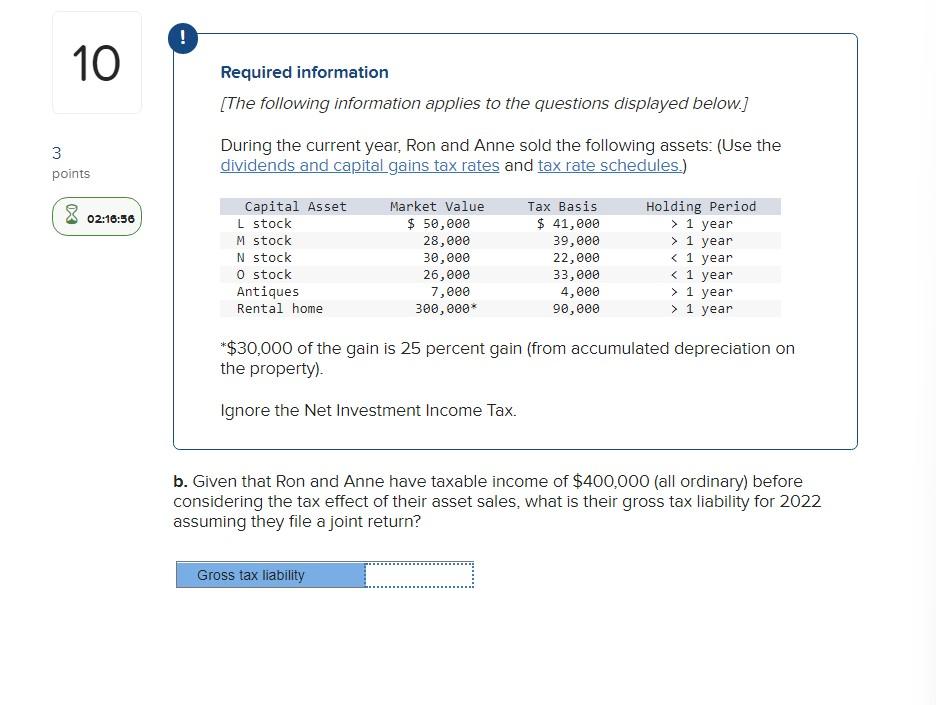

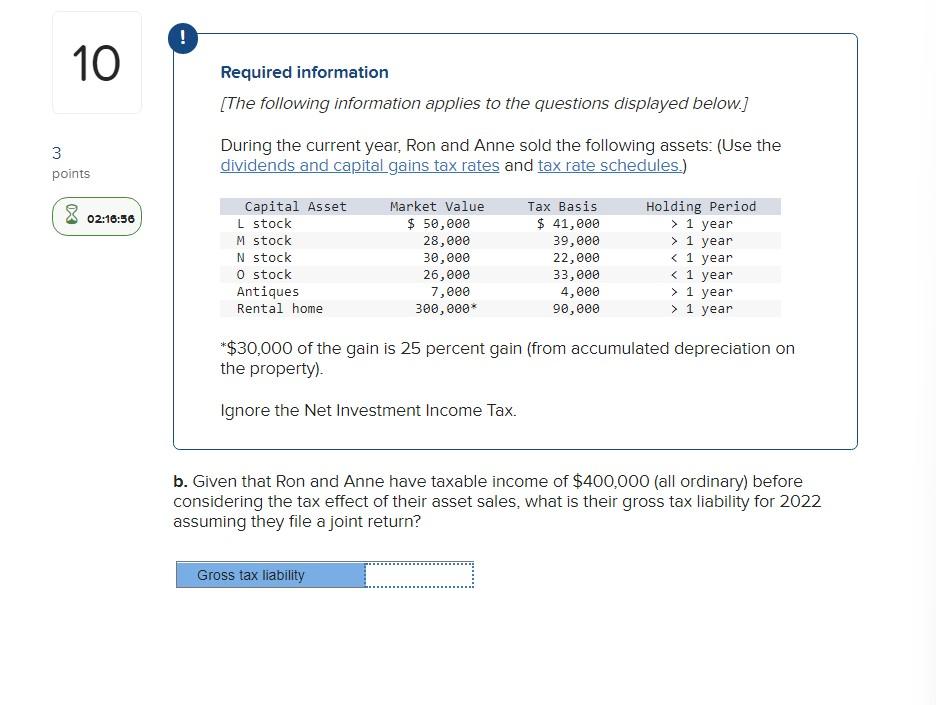

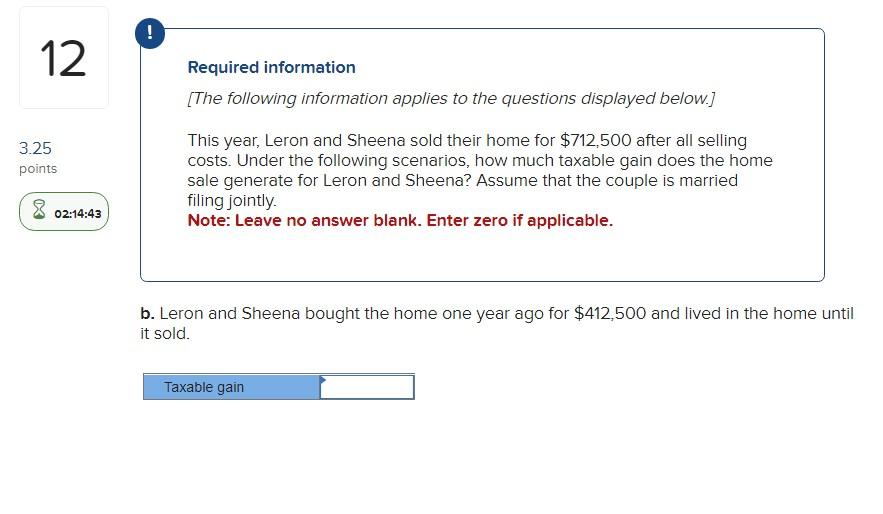

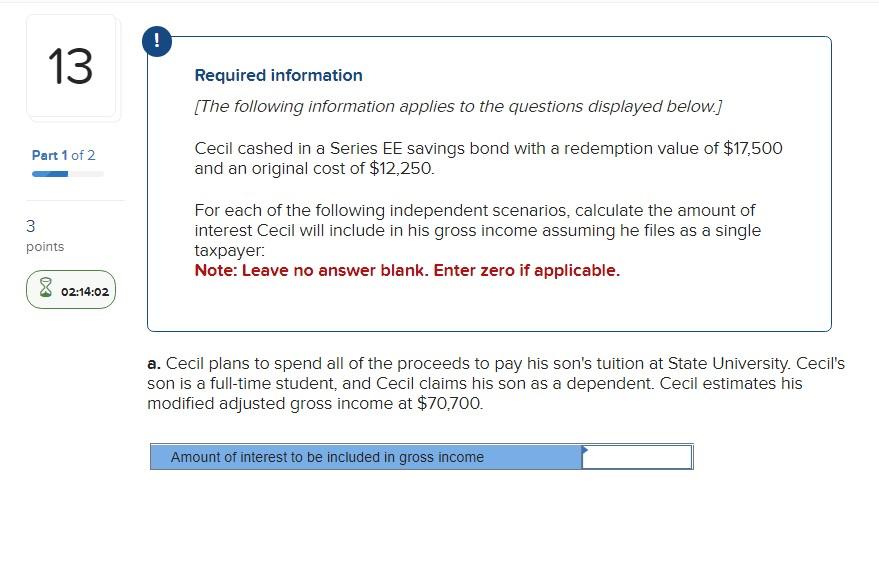

Required information [The following information applies to the questions displayed below.] During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.) * $30,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net Investment Income Tax. b. Given that Ron and Anne have taxable income of $400,000 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2022 assuming they file a joint return? Required information [The following information applies to the questions displayed below.] This year, Leron and Sheena sold their home for $712,500 after all selling costs. Under the following scenarios, how much taxable gain does the home sale generate for Leron and Sheena? Assume that the couple is married filing jointly. Note: Leave no answer blank. Enter zero if applicable. b. Leron and Sheena bought the home one year ago for $412,500 and lived in the home until it sold. Required information [The following information applies to the questions displayed below.] Cecil cashed in a Series EE savings bond with a redemption value of $17,500 and an original cost of $12,250. For each of the following independent scenarios, calculate the amount of interest Cecil will include in his gross income assuming he files as a single taxpayer: Note: Leave no answer blank. Enter zero if applicable. a. Cecil plans to spend all of the proceeds to pay his son's tuition at State University. Cecil's son is a full-time student, and Cecil claims his son as a dependent. Cecil estimates his modified adjusted gross income at $70,700. Required information [The following information applies to the questions displayed below.] During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.) * $30,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net Investment Income Tax. b. Given that Ron and Anne have taxable income of $400,000 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2022 assuming they file a joint return? Required information [The following information applies to the questions displayed below.] This year, Leron and Sheena sold their home for $712,500 after all selling costs. Under the following scenarios, how much taxable gain does the home sale generate for Leron and Sheena? Assume that the couple is married filing jointly. Note: Leave no answer blank. Enter zero if applicable. b. Leron and Sheena bought the home one year ago for $412,500 and lived in the home until it sold. Required information [The following information applies to the questions displayed below.] Cecil cashed in a Series EE savings bond with a redemption value of $17,500 and an original cost of $12,250. For each of the following independent scenarios, calculate the amount of interest Cecil will include in his gross income assuming he files as a single taxpayer: Note: Leave no answer blank. Enter zero if applicable. a. Cecil plans to spend all of the proceeds to pay his son's tuition at State University. Cecil's son is a full-time student, and Cecil claims his son as a dependent. Cecil estimates his modified adjusted gross income at $70,700