Answered step by step

Verified Expert Solution

Question

1 Approved Answer

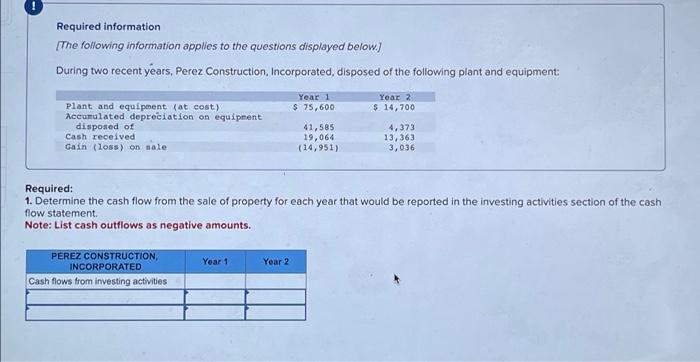

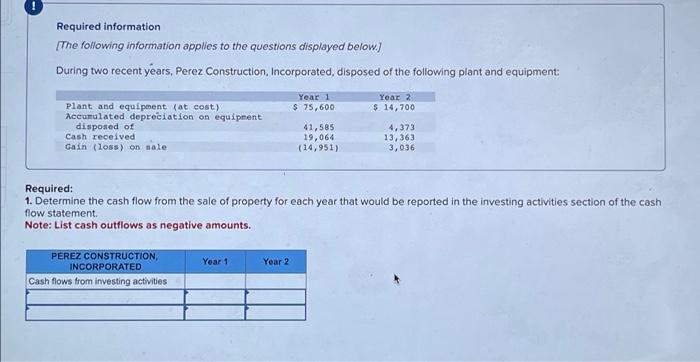

Required information [The following information applies to the questions displayed below.] During two recent years, Perez Construction, Incorporated, disposed of the following plant and equipment:

Required information [The following information applies to the questions displayed below.] During two recent years, Perez Construction, Incorporated, disposed of the following plant and equipment: Plant and equipment (at cost) Accumulated depreciation on equipment disposed of Cash received Gain (loss) on sale PEREZ CONSTRUCTION, INCORPORATED Cash flows from investing activities Year 1 Year 1 $ 75,600 Year 2 41,585 19,064 (14,951) Required: 1. Determine the cash flow from the sale of property for each year that would be reported in the investing activities section of the cash flow statement. Note: List cash outflows as negative amounts. Year 2 $ 14,700 4,373 13,363 3,036

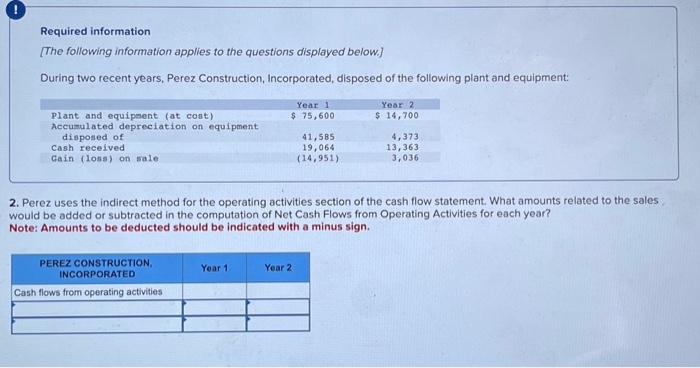

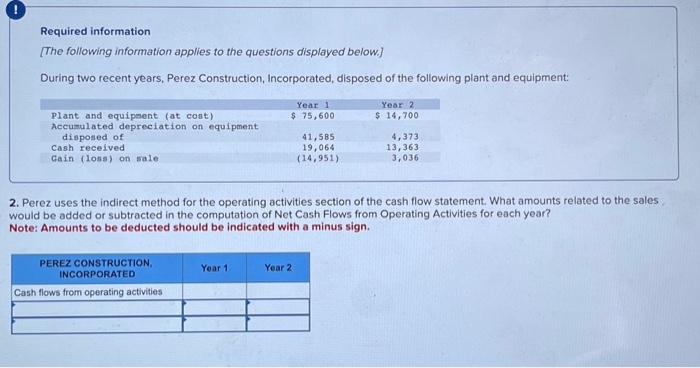

Required information [The following information applies to the questions displayed below.] During two recent years, Perez Construction, Incorporated, disposed of the following plant and equipment: Required: 1. Determine the cash flow from the sale of property for each year that would be reported in the investing activities section of the cash flow statement. Note: List cash outflows as negative amounts. Required information [The following information applies to the questions displayed below] During two recent years, Perez Construction, Incorporated, disposed of the following plant and equipment: 2. Perez uses the indirect method for the operating activities section of the cash flow statement. What amounts related to the sales would be added or subtracted in the computation of Net Cash Flows from Operating Activities for each year? Note: Amounts to be deducted should be indicated with a minus sign

Required information [The following information applies to the questions displayed below.] During two recent years, Perez Construction, Incorporated, disposed of the following plant and equipment: Required: 1. Determine the cash flow from the sale of property for each year that would be reported in the investing activities section of the cash flow statement. Note: List cash outflows as negative amounts. Required information [The following information applies to the questions displayed below] During two recent years, Perez Construction, Incorporated, disposed of the following plant and equipment: 2. Perez uses the indirect method for the operating activities section of the cash flow statement. What amounts related to the sales would be added or subtracted in the computation of Net Cash Flows from Operating Activities for each year? Note: Amounts to be deducted should be indicated with a minus sign

Required information [The following information applies to the questions displayed below.] During two recent years, Perez Construction, Incorporated, disposed of the following plant and equipment: Plant and equipment (at cost) Accumulated depreciation on equipment disposed of Cash received Gain (loss) on sale PEREZ CONSTRUCTION, INCORPORATED Cash flows from investing activities Year 1 Year 1 $ 75,600 Year 2 41,585 19,064 (14,951) Required: 1. Determine the cash flow from the sale of property for each year that would be reported in the investing activities section of the cash flow statement. Note: List cash outflows as negative amounts. Year 2 $ 14,700 4,373 13,363 3,036

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started