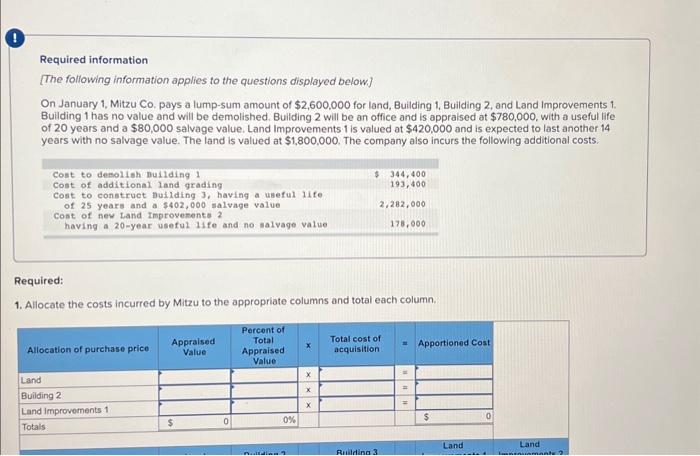

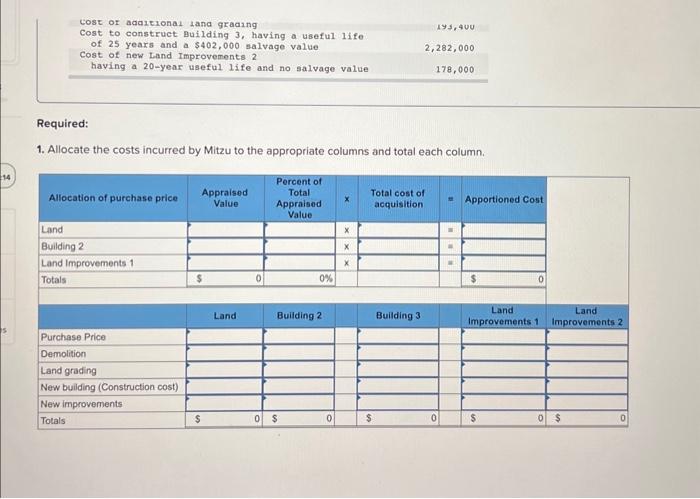

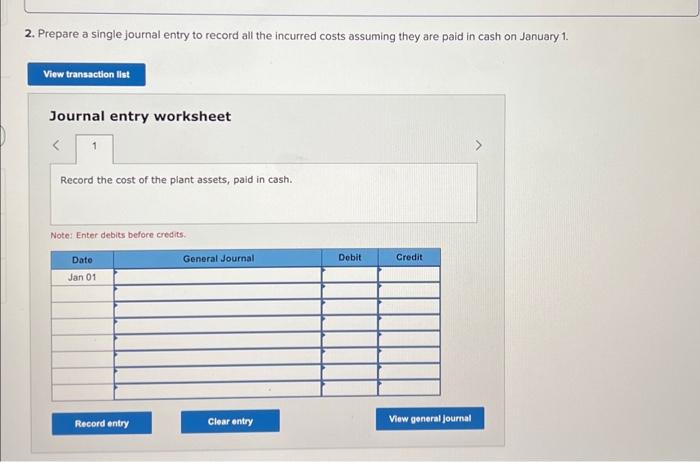

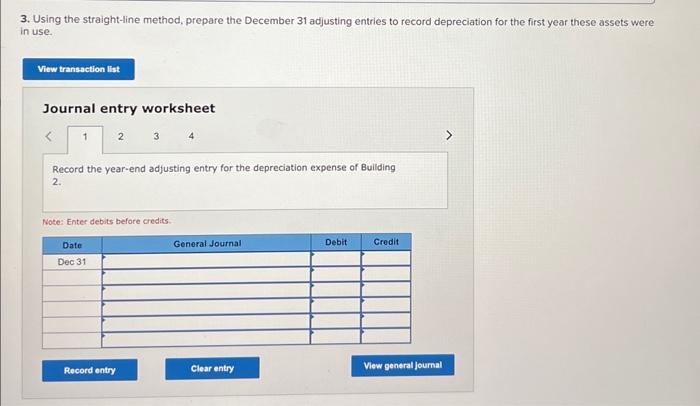

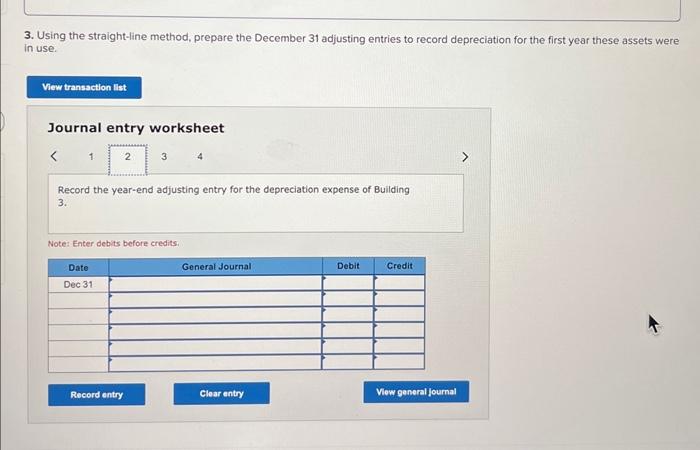

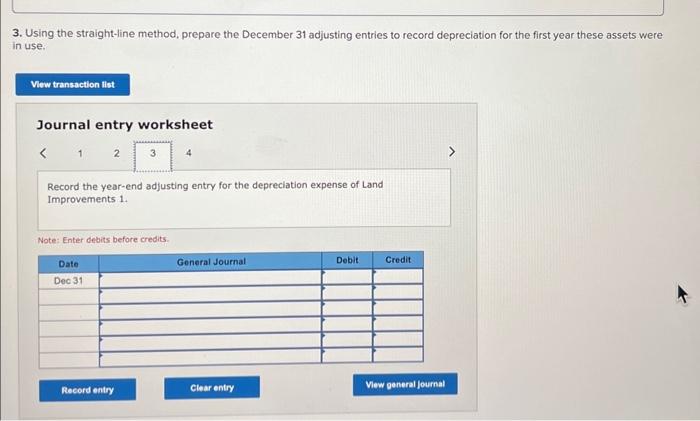

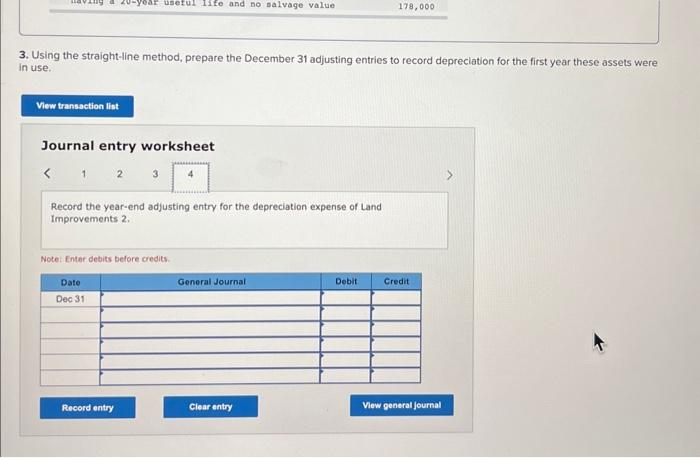

Required information [The following information applies to the questions displayed below] On January 1, Mitzu Co, pays a lump-sum amount of $2,600,000 for land, Building 1, Building 2, and Land Improvements 1 . Building 1 has no value and will be demolished. Buliding 2 will be an office and is appraised at $780,000, with a useful life of 20 years and a $80,000 salvage value. Land Improvements 1 is valued at $420,000 and is expected to last another 14 years with no salvage value. The land is valued at $1,800,000. The company also incurs the following additional costs. Required: 1. Allocate the costs incurred by Mitzu to the appropriate columns and total each column. Required: 1. Allocate the costs incurred by Mitzu to the appropriate columns and total each column. 2. Prepare a single journal entry to record all the incurred costs assuming they are paid in cash on January 1 . Journal entry worksheet Record the cost of the plant assets, paid in cash. Note: Enter debits before credits. 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use. Journal entry worksheet 4 Record the year-end adjusting entry for the depreciation expense of Bullding 2. Note: Enter debits before credits. 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use. Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of Building 3. Note: Enter debits before credits: 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were n use. Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of Land Improvements 1. Note: Enter detuits before credits. 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use. Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of Land Improvements 2 . Note: Enter debits before credits