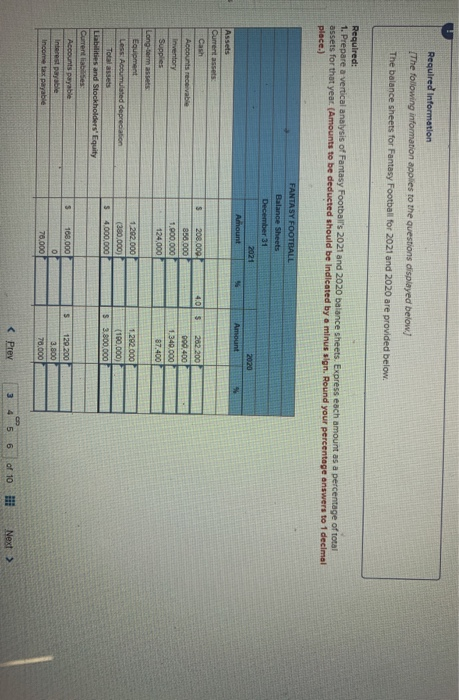

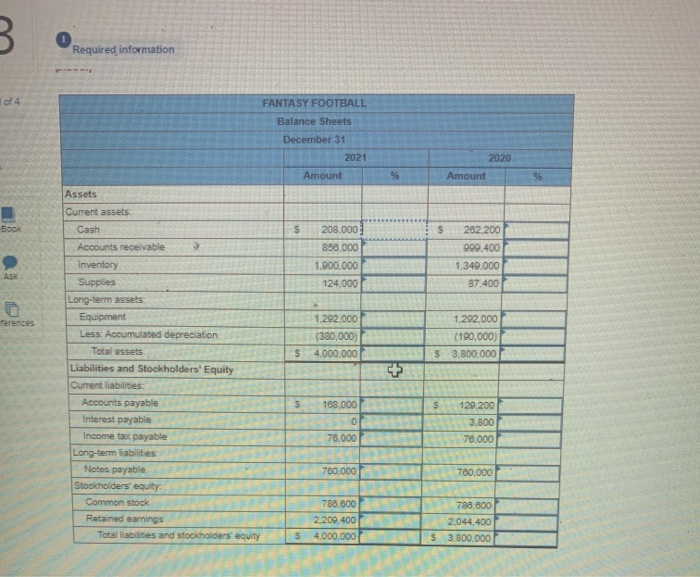

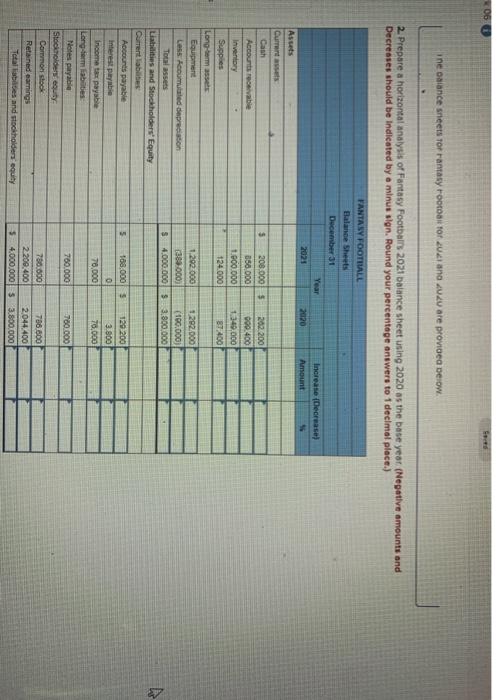

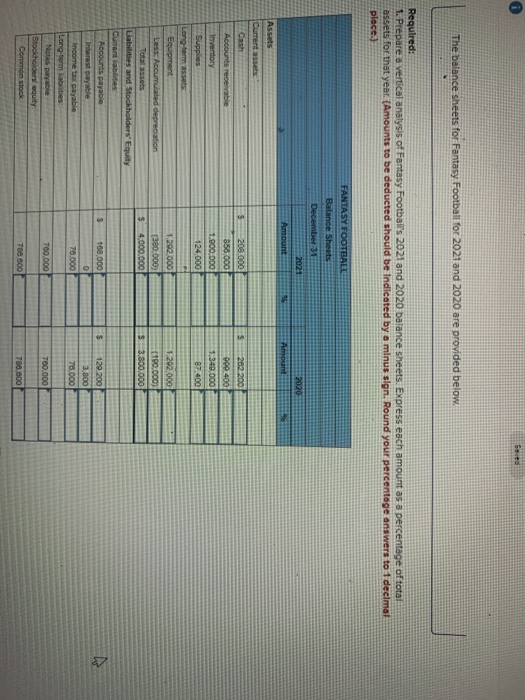

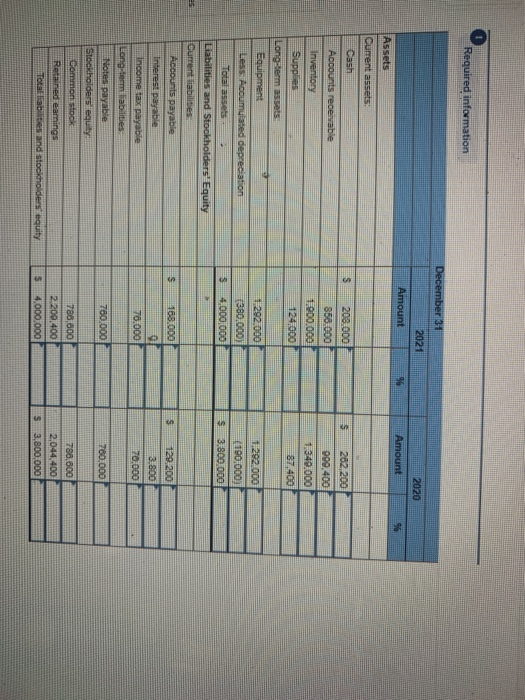

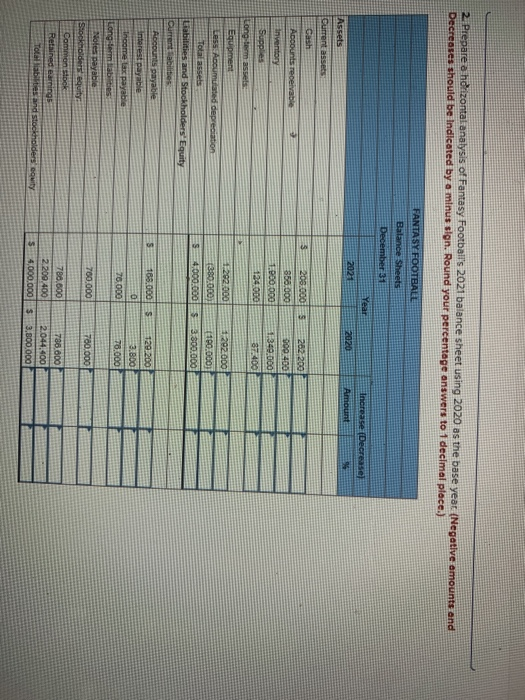

Required Information The following information applies to the questions displayed below.) The balance sheets for Fantasy Football for 2021 and 2020 are provided below. Required: 1. Prepare a vertical analysis of Fantasy Football's 2021 and 2020 balance sheets. Express each amount as a percentage of total assets for that year (Amounts to be deducted should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) FANTASY FOOTBALL Balance Sheets December 31 2021 Amount 2020 Amount 5 Assets $ 4.05 208.000 858.000 1.000.000 124,000 282 200 000,400 1.340.000 87.400 Current assets Cash Accounts receivable Inventory Supplies Long-term assets Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabides: Accounts payable Interest payable Income tax payable 1.292.000 (380,000) S 4.000.000 1.292.000 (100,000) $ 3.800.000 $ S 108,000 0 70,000 129 200 3.800 70,000 B 0 Required information of 4 FANTASY FOOTBALL Balance Sheets December 31 2021 Amount 2020 Amount 9 -Book s s 208.000 850,000 282,200 999.400 1.340.000 87.400 ASK 1.900.000 124.000 ferences 1.292.000 (380,000) 4,000,000 1,202,000 (190,000) $3,800,000 $ Assets Current assets Cash Accounts receivable Inventory Supplies Long-term assets Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities Notes payable Stockholders' equity Common stock Retained earnings Total liabilities and stockholders' equity + $ 168,000 0 78,000 129,200 3,800 78.000 700.000 700,000 780,000 2.200,400 $4,000,000 788,600 2,044,400 $3,800.000 K 06 i ne balance sheets for Fantasy root for 2021 and 2020 are provided below. 2. Prepare a horizontal analysis of Fantasy Footballs 2021 balance sheet using 2020 as the bose year (Negative amounts and Decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) FANTASY FOOTBALL Balance Sheets December 31 Year Increase (Decrease) Amount 56 2021 2020 $ 208,000 5 350.000 1.000.000 124.000 202 200 090.400 1.340,000 87,400 1.292.000 1 292.000 (38.000) (190,000) $ 4,000,000 3 3.800.000 Assets Current assets Cash Accounts receivable Inventory Supplies Long-term assets Equipment Less Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders equity Common stock Retained earnings Total abilities and stockholders' equity 5 168,000 $ 0 129.200 3.800 78.000 70.000 700.000 700.000 780.000 2,200,400 $4,000,000 $ 786,600 2.044.400 3.800.000 Swed The balance sheets for Fantasy Football for 2021 and 2020 are provided below. Required: 1. Prepare a vertical analysis of Fantasy Football's 2021 and 2020 balance sheets. Express each amount as a percentage of total assets for that year. (Amounts to be deducted should be Indicated by a minus sign. Round your percentage answers to 1 decimal plece.) FANTASY FOOTBALL Balance Sheets December 31 2021 Amount 2020 Amount 55 s 200.000 856,000 1.900.000 124.000 202 200 999 400 1,340.000 87 400 Assets Current assets Cash Accounts receivable Inventory Supplies Long-term assets Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabides Accounts payable Interest payable Income tax payable Long-term labities: Notes payable Stockholders equity Common stock 1,202,000 (380,000) $ 4.000.000 1,202,000 (190.000) $ 3.800.000 5 168,000 $ 0 129.200 3.800 78,000 76.000 700.000 700.000 786,600 780,000 Required information December 31 2021 Amount 2020 96 Amount Assets Current assets 262,200 208.000 858.000 1.900.000 124 000 999,400 13349,000 87,400 1.292.000 380.000) 4,000,000 1292.000 (190,000) $ 3.800.000 Cash Accounts receivable Inventory Supplies Long-term assets Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Interest payable Income tax payable Long-term liabilities Notes payable Stockholders equity Common stock Retained earnings Total liabilities and stockholders equity S 168.000 s 129.200 3.800 70,000 70.000 780,000 700.000 788,000 2.200,400 4.000.000 786,600 2,044,400 $3,800,000 S 2. Prepare a horizontal analysis of Fantasy Football's 2021 balance sheet using 2020 as the base year (Negative amounts and Decreases should be Indicated by a minus sign. Round your percentage answers to 1 decimal place.) FANTASY FOOTBALL Balance Sheets December 31 Year 2021 Increase Decrease! Amount 2020 Assets Current assets 3 205.000 5 850,000 1.900.000 124.000 282 200 300 400 1349.000 87.400 292.000 1 292.000 1380.000) 180.0001 s 4,000,000 $3,800.000 Accounts receivable Inventory Supplies Long-term assets Equipment Les Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current abilities Accounts payable Interest payable Income tax payable Long-term liabilities Noles payable Stockholders gut Common stock Retained earrings Totallibilities and stockholders wity s 168.000 0 76000 129.200 3 BDO 75.000 700.000 780.000 780.600 2.209.400 4,000,000 786.000 2044.400 53.800.000 s