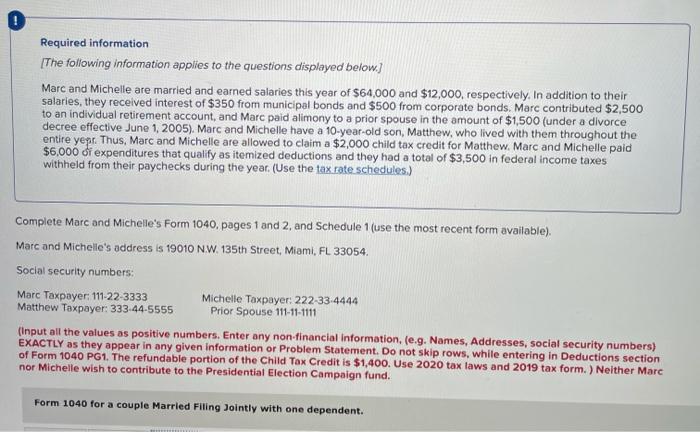

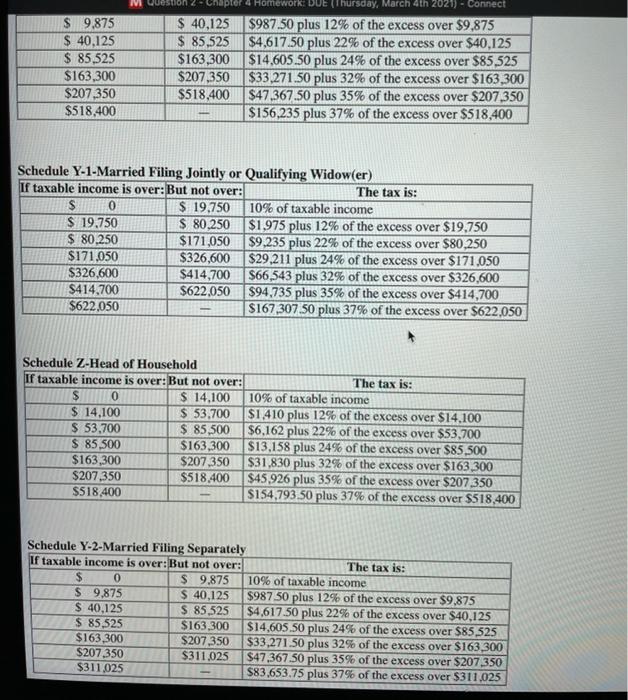

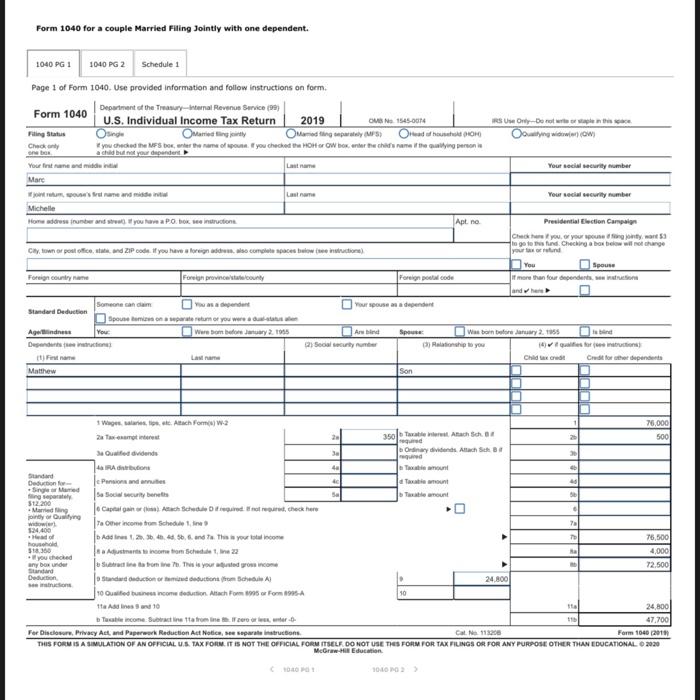

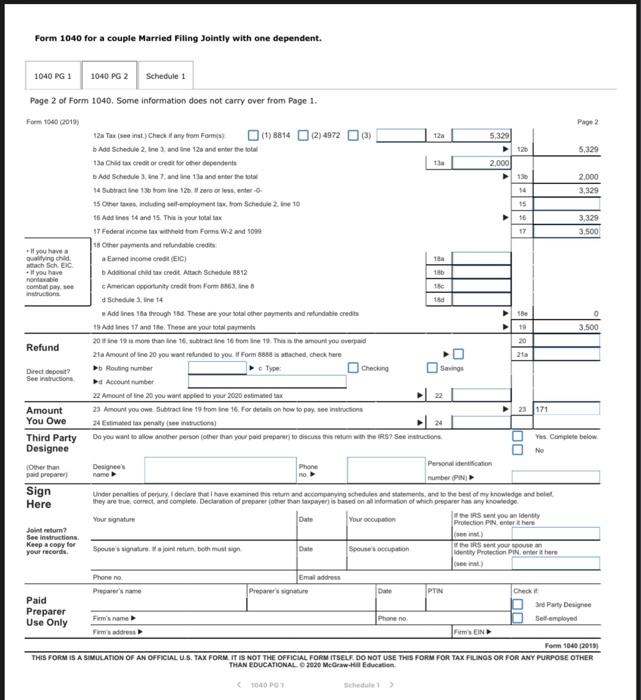

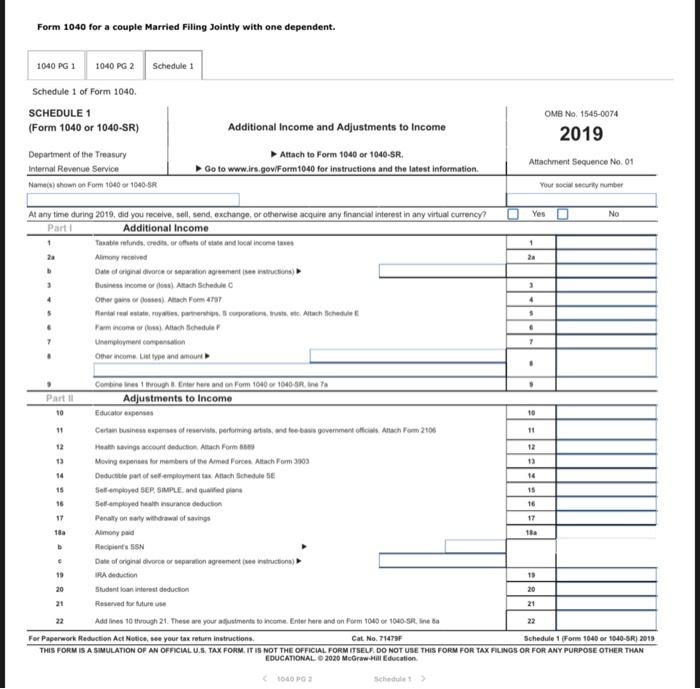

Required information [The following information applies to the questions displayed below) Marc and Michelle are married and earned salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they received interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to an individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2005). Marc and Michelle have a 10-year-old son, Matthew, who lived with them throughout the entire yepr. Thus, Marc and Michelle are allowed to claim a $2,000 child tax credit for Matthew. Marc and Michelle paid $6,000 di expenditures that qualify as itemized deductions and they had a total of $3,500 in federal income taxes withheld from their paychecks during the year. (Use the tax rate schedules.) Complete Marc and Michelle's Form 1040, pages 1 and 2, and Schedule 1 (use the most recent form available) Marc and Michelle's address is 19010 NW. 135th Street, Miami, FL 33054. Social security numbers: Marc Taxpayer: 111-22-3333 Michelle Taxpayer: 222-33.4444 Matthew Taxpayer: 333.44-5555 Prior Spouse 111-11-1111 (Input all the values as positive numbers. Enter any non-financial Information, (e.g. Names, Addresses, social security numbers) EXACTLY as they appear in any given information or Problem Statement. Do not skip rows, while entering in Deductions section of Form 1040 PG1. The refundable portion of the Child Tax Credit is $1,400. Use 2020 tax laws and 2019 tax form. ) Nelther Marc nor Michelle wish to contribute to the Presidential Election Campaign fund. Form 1040 for a couple Married Filling Jointly with one dependent. Question 2 $ 9.875 $ 40,125 $ 85,525 $163,300 $207,350 $518,400 pler & Homework: DUE (Thursday, March 4th 2021) - Connect $ 40,125 $987.50 plus 12% of the excess over $9,875 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $163,300 $14,605.50 plus 24% of the excess over $85,525 $207,350 $33,271.50 plus 32% of the excess over $163,300 $518,400 $47.367.50 plus 35% of the excess over $207 350 $156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,750 10% of taxable income $ 19.750 $ 80,250 $1,975 plus 12% of the excess over $19.750 $ 80,250 $171,050 $9.235 plus 22% of the excess over $80,250 $171.050 $326,600 $29,211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94.735 plus 35% of the excess over $414,700 $622,050 $167,307 50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: $ 0 $ 14,100 10% of taxable income $ 14,100 $ 53,700 $1.410 plus 12% of the excess over $14.100 $ 53,700 $ 85,500 $6,162 plus 22% of the excess over $53.700 $ 85,500 $163,300 $13,158 plus 24% of the excess over $85,500 $163,300 $207,350 $31.830 plus 32% of the excess over $163 300 $207,350 $518.400 $45.926 plus 35% of the excess over $207 350 $518,400 $154,793.50 plus 37% of the excess over $518.400 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: $ 0 $ 9.875 10% of taxable income $ 9,875 $ 40,125 $987 50 plus 12% of the excess over $9.875 $ 40,125 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $ 85.525 $163,300 $14,605.50 plus 24% of the excess over $85 525 $ 163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $311,025 $47,367.50 plus 35% of the excess over $207 350 $311.025 $83.653.75 plus 37% of the excess over $311,025 Form 1040 for a couple Married Filing Jointly with one dependent. 1040 PG 1 1040 PG 2 Schedule 1 Page 1 of Form 1040. Use provided information and follow instructions on form. Form 1040 Department of the Treasury-Internal Revenue Service (9) U.S. Individual Income Tax Return 2019 ON 1545.00 Filing Status Onge Mamading) OOH Check you had the box, whetheme of you checked the HOH GW borbehethsmitheoiling person a child but your dependent Your first and midden RS User-Borowie Ooty www (OW) Your social security number More Last Your social security number re's name and me Michelle Home address founder and strat. you twa Pohokwe instruction |Apt no Chy, town or post office and ZIP code. If you have a foreign complete acestuiwe intruction) Presidential Election Camp Check out your use and to go to the Checking a bow will change you and You Spouse more than four dependent and he Foreign country name Fone Foreign postal code Your spouses and Standard Deduction Someone can dant Spouse more return or you were a You Wer bombon January 2.1955 Agindness Degends Foto And 2 Soal security Was born before a 2.55 Relationship to you Chad credit Cu for the dependent Matthew Son 4 Wagenes Altach For W2 70.000 350 bar Atach sch 500 Qualified dividende 1 Ordinary dividends ArchSB Abon Inwont Sunda Deduction Pension des ant Singer singerly sa Soben 5 312200 Mareng Captainch cherred to part, check here jointly or using Wit Other income from scheine 24.400 Addinsta 3.4.4.5.6 and 7This is your total income 76,500 hold 360 staromom Schedule 1, 22 4,000 you checked any box under 72,500 Standard Deduction | Standard auctor autonom 24.800 10 Qualified business income deduction Altach Form 6 or For A 10 ta Alesson 10 24.800 Talencome. Subtractinetta troine 120 rer 47.700 For Disclosure. Privacy Act, and Paperwork Reduction Act Notice se separate instructions Cal 113000 Form 104012018 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FOR ITSELF DO NOT USE THE FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2020 McGraw-Hill Education 1010 Form 1040 for a couple Married Filing Jointly with one dependent 11 16 17 18 135 1040 PG 1 1040 PG 2 Schedule Page 2 of Form 1040. Some information does not carry over from Page 1 Form 1040 (2010 Page 2 ta (se inst. Check it any from Form) (1)8814 12) 4972 5,320 Ade Schedule 2.trend ne 120 and enter the total 5,329 13 Child tax creditor credit for other dependents 2,000 Add Schedule in 7dine 13e and enter the 2.000 14 Subtractine 136 from ine 12 zero or lessenter 3,329 15 Ohrt, including sel-employment tax from Schedule 2. in 10 15 15 Addnes 14 and 15 This is your totalt 3,329 37 Federal income tax withheld from Forms W2 and 1090 3.500 18 Other payments and refundable cred qiling child Earned income credit (ERC) wachsch. EC + you have Additional Child tax credit. Attach Schedule 3812 montable combat pay.se American opportunity credit tons Form 63. fine 8 instruction Schule in 14 180 Add inesta through These are your total other payments and refundable credits 15e 19 Addines 17 and the There are your total payments 3.500 2015 19 more than in 16 subtractice 16 homine 19. This is the amount you overed Refund 21 Amount of sine 20 you want refunded to you. For 8888 is tached, check here Direct deposit Routing number Checking Sections Account number 22 Amount of line 20 you want applied to your 2020 estimated tax Amount 21 Amount you owe Subtractie te from line 16. For details on how to pay scenuructions 23 171 You Owe 24 Estimated tax penalty (inctions) Third Party Do you want to allow another person other than your paid preparar todos this return with the RS? See instructions Yes. Complete below Designee No Designers Phone Personal con paid prepare name number PINI Sign Under peties of perjury, I declare that I have examined this and accompany schedules and statements, and to the best of my knowledge and beliet Here they are true correct and complete. Declaration of prepare the man payer is based on a normation of which preparer has any knowledge Your signature Die You can then you dently Protection PIN enter there Join return? See instructions Keep a copy for your records Spouse's signature a joint ratum both multig Date the RS sert your spouse an Spouses on idently Protection Planter there 24 DO Phone no Email address Dane Check Paid Srd Party Design Preparer Firm's name Phone no Selemployed Use Only Firms address FEIN Form 1040 (2010) THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF, DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2020 McGraw-Hill Education 1040 PO Form 1040 for a couple Married Filing Jointly with one dependent. 1040 PG 1 1040 PG 2 Schedule 1 Schedule 1 of Form 1040 SCHEDULE 1 (Form 1040 or 1040-SR) Department of the Treasury Internal Revenue Service Name(s) own en Form 1040 or 1040-R OMB No 1545-0074 2019 Additional Income and Adjustments to Income Attach to Form 1040 or 1040-SR. Go to www.irs.govi Form 1040 for instructions and the latest information, Attachment Sequence No. 01 Your occurlymber Yes No + 1 20 2 At any time during 2018, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency Parti Additional Income Toate refunds, creditor ofte and local income Alimony received Date of original divorce or separation agreement sections Business income or ons. Attach Schedule Other gains of Anachom 4797 Plantat real estate mes, parentes, corporater, he Altach Schedule am income) Altach the Unangloyment compensation Other income List type and amount 3 3 4 4 $ 6 . 7 7 . 3 10 11 14 15 Combine through inter here and on From 1640 1640 SR. In a Partit Adjustments to Income 10 Educator 11 Certain businesses of servis performing artists and fous government officials. Attachom 2100 12 Heath savings account deduction Attach Form 12 Moving expenses for members of the Armed Forces Attach Form 2003 Deductible part of semployment to Attach Schedule SE 15 Sof-employed SER SIMPLE. and qualified plane 16 5e employed heat surance deduction 16 17 Penalty on a wirawal of savings 17 Alimony paid 18 Recipient's SN Date of original divorce or paration agreement weersuctions 19 RA deduction 15 20 Student loan interest deduction 21 Reserved for free 21 Addines to through 21. These we your adjustments to come. Enter here and on Form 1640 or 1040-SR nebo For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 71473F Schedule 1 (Form 1040 or 1040-SR) 2017 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM, IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2020 McGraw-Hill Education 20 22 1060 PO Required information [The following information applies to the questions displayed below) Marc and Michelle are married and earned salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they received interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to an individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2005). Marc and Michelle have a 10-year-old son, Matthew, who lived with them throughout the entire yepr. Thus, Marc and Michelle are allowed to claim a $2,000 child tax credit for Matthew. Marc and Michelle paid $6,000 di expenditures that qualify as itemized deductions and they had a total of $3,500 in federal income taxes withheld from their paychecks during the year. (Use the tax rate schedules.) Complete Marc and Michelle's Form 1040, pages 1 and 2, and Schedule 1 (use the most recent form available) Marc and Michelle's address is 19010 NW. 135th Street, Miami, FL 33054. Social security numbers: Marc Taxpayer: 111-22-3333 Michelle Taxpayer: 222-33.4444 Matthew Taxpayer: 333.44-5555 Prior Spouse 111-11-1111 (Input all the values as positive numbers. Enter any non-financial Information, (e.g. Names, Addresses, social security numbers) EXACTLY as they appear in any given information or Problem Statement. Do not skip rows, while entering in Deductions section of Form 1040 PG1. The refundable portion of the Child Tax Credit is $1,400. Use 2020 tax laws and 2019 tax form. ) Nelther Marc nor Michelle wish to contribute to the Presidential Election Campaign fund. Form 1040 for a couple Married Filling Jointly with one dependent. Question 2 $ 9.875 $ 40,125 $ 85,525 $163,300 $207,350 $518,400 pler & Homework: DUE (Thursday, March 4th 2021) - Connect $ 40,125 $987.50 plus 12% of the excess over $9,875 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $163,300 $14,605.50 plus 24% of the excess over $85,525 $207,350 $33,271.50 plus 32% of the excess over $163,300 $518,400 $47.367.50 plus 35% of the excess over $207 350 $156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,750 10% of taxable income $ 19.750 $ 80,250 $1,975 plus 12% of the excess over $19.750 $ 80,250 $171,050 $9.235 plus 22% of the excess over $80,250 $171.050 $326,600 $29,211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94.735 plus 35% of the excess over $414,700 $622,050 $167,307 50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: $ 0 $ 14,100 10% of taxable income $ 14,100 $ 53,700 $1.410 plus 12% of the excess over $14.100 $ 53,700 $ 85,500 $6,162 plus 22% of the excess over $53.700 $ 85,500 $163,300 $13,158 plus 24% of the excess over $85,500 $163,300 $207,350 $31.830 plus 32% of the excess over $163 300 $207,350 $518.400 $45.926 plus 35% of the excess over $207 350 $518,400 $154,793.50 plus 37% of the excess over $518.400 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: $ 0 $ 9.875 10% of taxable income $ 9,875 $ 40,125 $987 50 plus 12% of the excess over $9.875 $ 40,125 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $ 85.525 $163,300 $14,605.50 plus 24% of the excess over $85 525 $ 163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $311,025 $47,367.50 plus 35% of the excess over $207 350 $311.025 $83.653.75 plus 37% of the excess over $311,025 Form 1040 for a couple Married Filing Jointly with one dependent. 1040 PG 1 1040 PG 2 Schedule 1 Page 1 of Form 1040. Use provided information and follow instructions on form. Form 1040 Department of the Treasury-Internal Revenue Service (9) U.S. Individual Income Tax Return 2019 ON 1545.00 Filing Status Onge Mamading) OOH Check you had the box, whetheme of you checked the HOH GW borbehethsmitheoiling person a child but your dependent Your first and midden RS User-Borowie Ooty www (OW) Your social security number More Last Your social security number re's name and me Michelle Home address founder and strat. you twa Pohokwe instruction |Apt no Chy, town or post office and ZIP code. If you have a foreign complete acestuiwe intruction) Presidential Election Camp Check out your use and to go to the Checking a bow will change you and You Spouse more than four dependent and he Foreign country name Fone Foreign postal code Your spouses and Standard Deduction Someone can dant Spouse more return or you were a You Wer bombon January 2.1955 Agindness Degends Foto And 2 Soal security Was born before a 2.55 Relationship to you Chad credit Cu for the dependent Matthew Son 4 Wagenes Altach For W2 70.000 350 bar Atach sch 500 Qualified dividende 1 Ordinary dividends ArchSB Abon Inwont Sunda Deduction Pension des ant Singer singerly sa Soben 5 312200 Mareng Captainch cherred to part, check here jointly or using Wit Other income from scheine 24.400 Addinsta 3.4.4.5.6 and 7This is your total income 76,500 hold 360 staromom Schedule 1, 22 4,000 you checked any box under 72,500 Standard Deduction | Standard auctor autonom 24.800 10 Qualified business income deduction Altach Form 6 or For A 10 ta Alesson 10 24.800 Talencome. Subtractinetta troine 120 rer 47.700 For Disclosure. Privacy Act, and Paperwork Reduction Act Notice se separate instructions Cal 113000 Form 104012018 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FOR ITSELF DO NOT USE THE FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2020 McGraw-Hill Education 1010 Form 1040 for a couple Married Filing Jointly with one dependent 11 16 17 18 135 1040 PG 1 1040 PG 2 Schedule Page 2 of Form 1040. Some information does not carry over from Page 1 Form 1040 (2010 Page 2 ta (se inst. Check it any from Form) (1)8814 12) 4972 5,320 Ade Schedule 2.trend ne 120 and enter the total 5,329 13 Child tax creditor credit for other dependents 2,000 Add Schedule in 7dine 13e and enter the 2.000 14 Subtractine 136 from ine 12 zero or lessenter 3,329 15 Ohrt, including sel-employment tax from Schedule 2. in 10 15 15 Addnes 14 and 15 This is your totalt 3,329 37 Federal income tax withheld from Forms W2 and 1090 3.500 18 Other payments and refundable cred qiling child Earned income credit (ERC) wachsch. EC + you have Additional Child tax credit. Attach Schedule 3812 montable combat pay.se American opportunity credit tons Form 63. fine 8 instruction Schule in 14 180 Add inesta through These are your total other payments and refundable credits 15e 19 Addines 17 and the There are your total payments 3.500 2015 19 more than in 16 subtractice 16 homine 19. This is the amount you overed Refund 21 Amount of sine 20 you want refunded to you. For 8888 is tached, check here Direct deposit Routing number Checking Sections Account number 22 Amount of line 20 you want applied to your 2020 estimated tax Amount 21 Amount you owe Subtractie te from line 16. For details on how to pay scenuructions 23 171 You Owe 24 Estimated tax penalty (inctions) Third Party Do you want to allow another person other than your paid preparar todos this return with the RS? See instructions Yes. Complete below Designee No Designers Phone Personal con paid prepare name number PINI Sign Under peties of perjury, I declare that I have examined this and accompany schedules and statements, and to the best of my knowledge and beliet Here they are true correct and complete. Declaration of prepare the man payer is based on a normation of which preparer has any knowledge Your signature Die You can then you dently Protection PIN enter there Join return? See instructions Keep a copy for your records Spouse's signature a joint ratum both multig Date the RS sert your spouse an Spouses on idently Protection Planter there 24 DO Phone no Email address Dane Check Paid Srd Party Design Preparer Firm's name Phone no Selemployed Use Only Firms address FEIN Form 1040 (2010) THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF, DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2020 McGraw-Hill Education 1040 PO Form 1040 for a couple Married Filing Jointly with one dependent. 1040 PG 1 1040 PG 2 Schedule 1 Schedule 1 of Form 1040 SCHEDULE 1 (Form 1040 or 1040-SR) Department of the Treasury Internal Revenue Service Name(s) own en Form 1040 or 1040-R OMB No 1545-0074 2019 Additional Income and Adjustments to Income Attach to Form 1040 or 1040-SR. Go to www.irs.govi Form 1040 for instructions and the latest information, Attachment Sequence No. 01 Your occurlymber Yes No + 1 20 2 At any time during 2018, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency Parti Additional Income Toate refunds, creditor ofte and local income Alimony received Date of original divorce or separation agreement sections Business income or ons. Attach Schedule Other gains of Anachom 4797 Plantat real estate mes, parentes, corporater, he Altach Schedule am income) Altach the Unangloyment compensation Other income List type and amount 3 3 4 4 $ 6 . 7 7 . 3 10 11 14 15 Combine through inter here and on From 1640 1640 SR. In a Partit Adjustments to Income 10 Educator 11 Certain businesses of servis performing artists and fous government officials. Attachom 2100 12 Heath savings account deduction Attach Form 12 Moving expenses for members of the Armed Forces Attach Form 2003 Deductible part of semployment to Attach Schedule SE 15 Sof-employed SER SIMPLE. and qualified plane 16 5e employed heat surance deduction 16 17 Penalty on a wirawal of savings 17 Alimony paid 18 Recipient's SN Date of original divorce or paration agreement weersuctions 19 RA deduction 15 20 Student loan interest deduction 21 Reserved for free 21 Addines to through 21. These we your adjustments to come. Enter here and on Form 1640 or 1040-SR nebo For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 71473F Schedule 1 (Form 1040 or 1040-SR) 2017 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM, IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2020 McGraw-Hill Education 20 22 1060 PO