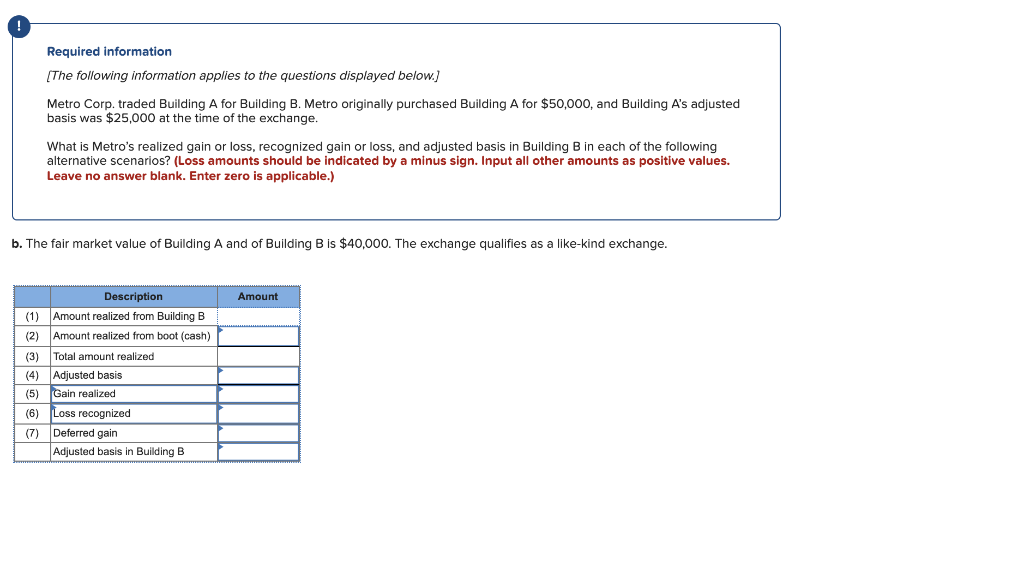

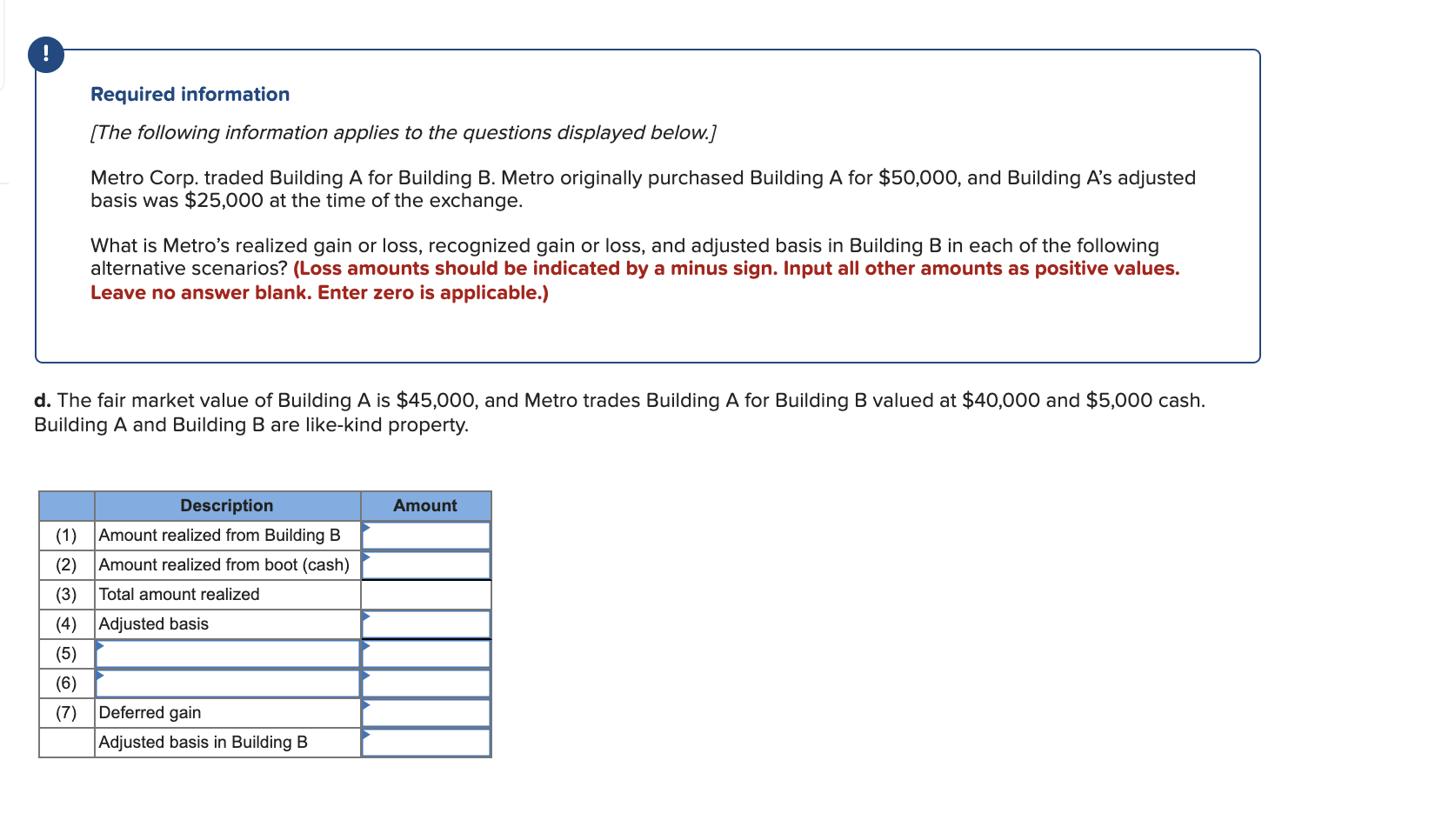

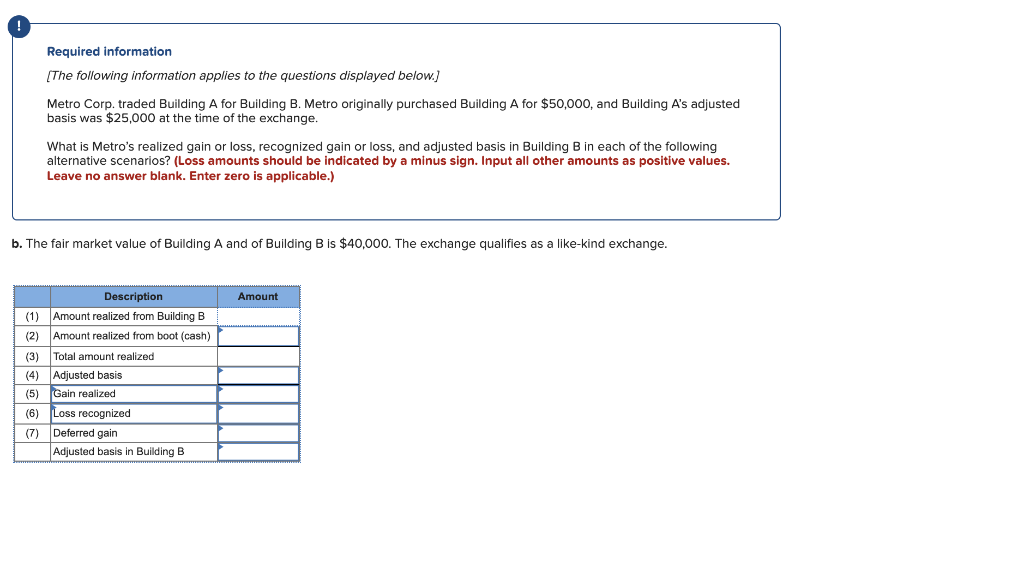

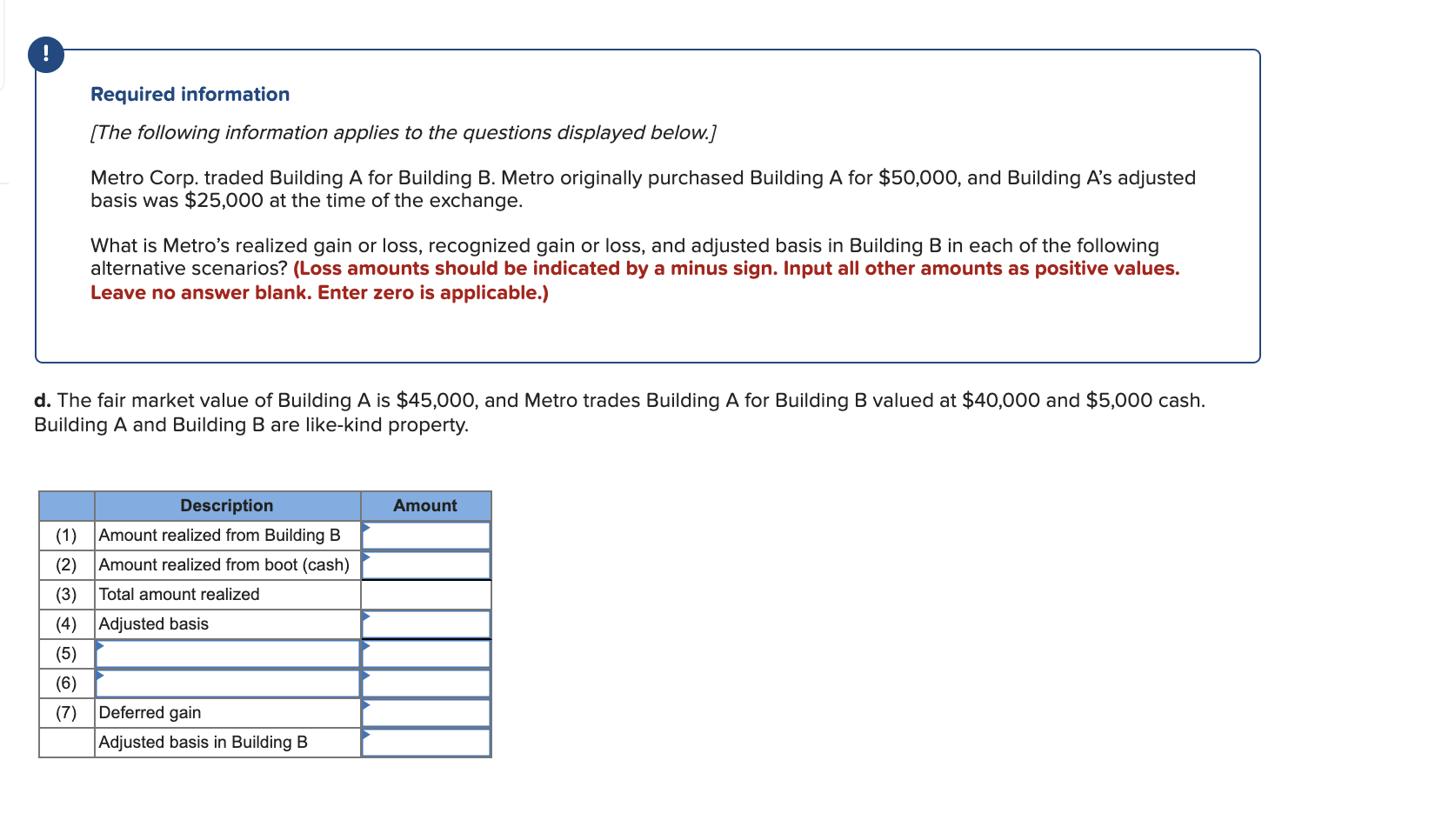

Required information The following information applies to the questions displayed below.) Metro Corp. traded Building A for Building B. Metro originally purchased Building A for $50,000, and Building A's adjusted basis was $25,000 at the time of the exchange. What is Metro's realized gain or loss, recognized gain or loss, and adjusted basis in Building B in each of the following alternative scenarios? (Loss amounts should be indicated by a minus sign. Input all other amounts as positive values. Leave no answer blank. Enter zero is applicable.) b. The fair market value of Building A and of Building B is $40,000. The exchange qualifies as a like-kind exchange. Amount Description (1) Amount realized from Building B (2) Amount realized from boot (cash) Total amount realized (4) Adjusted basis (5) Gain realized (6) Loss recognized (7) Deferred gain Adjusted basis in Building B ! Required information (The following information applies to the questions displayed below.) Metro Corp. traded Building A for Building B. Metro originally purchased Building A for $50,000, and Building A's adjusted basis was $25,000 at the time of the exchange. What is Metro's realized gain or loss, recognized gain or loss, and adjusted basis in Building B in each of the following alternative scenarios? (Loss amounts should be indicated by a minus sign. Input all other amounts as positive values. Leave no answer blank. Enter zero is applicable.) d. The fair market value of Building A is $45,000, and Metro trades Building A for Building B valued at $40,000 and $5,000 cash. Building A and Building B are like-kind property. Amount Description (1) Amount realized from Building B (2) Amount realized from boot (cash) (3) Total amount realized (4) Adjusted basis (5) (6) (7) Deferred gain Adjusted basis in Building B Required information The following information applies to the questions displayed below.) Metro Corp. traded Building A for Building B. Metro originally purchased Building A for $50,000, and Building A's adjusted basis was $25,000 at the time of the exchange. What is Metro's realized gain or loss, recognized gain or loss, and adjusted basis in Building B in each of the following alternative scenarios? (Loss amounts should be indicated by a minus sign. Input all other amounts as positive values. Leave no answer blank. Enter zero is applicable.) b. The fair market value of Building A and of Building B is $40,000. The exchange qualifies as a like-kind exchange. Amount Description (1) Amount realized from Building B (2) Amount realized from boot (cash) Total amount realized (4) Adjusted basis (5) Gain realized (6) Loss recognized (7) Deferred gain Adjusted basis in Building B ! Required information (The following information applies to the questions displayed below.) Metro Corp. traded Building A for Building B. Metro originally purchased Building A for $50,000, and Building A's adjusted basis was $25,000 at the time of the exchange. What is Metro's realized gain or loss, recognized gain or loss, and adjusted basis in Building B in each of the following alternative scenarios? (Loss amounts should be indicated by a minus sign. Input all other amounts as positive values. Leave no answer blank. Enter zero is applicable.) d. The fair market value of Building A is $45,000, and Metro trades Building A for Building B valued at $40,000 and $5,000 cash. Building A and Building B are like-kind property. Amount Description (1) Amount realized from Building B (2) Amount realized from boot (cash) (3) Total amount realized (4) Adjusted basis (5) (6) (7) Deferred gain Adjusted basis in Building B