Required information [The following information applies to the questions displayed below.] Read the following letter and help Shady Slim with his tax situation. Please assume that his gross income is $172,900 (which consists only of salary) for purposes of this problem. December 31, 2018 To the friendly student tax preparer: Hi, its Shady Slim again. I just got back from my 55th birthday party, and Im told that you need some more information from me in order to complete my tax return. Im an open book! Ill tell you whatever I think you need to know. Let me tell you a few more things about my life. As you may recall, I am divorced from my wife, Alice. I know that it's unusual, but I have custody of my son, Shady, Jr. The judge owed me a few favors and I really love the kid. He lives with me full-time and my wife gets him every other weekend. I pay the vast majority of my son's expenses. I think Alice should have to pay some child support, but she doesn't have to pay a dime. The judge didn't owe me that much, I guess. I had to move this year after getting my job at Roca Cola. We moved on February 3 of this year, and I worked my job at Roca Cola for the rest of the year. I still live in the same state, but I moved 500 miles away from my old house. I hired a moving company to move our stuff at a cost of $2,300, and I drove Junior in my car. Junior and I got a hotel room along the way that cost us $65 (I love Super 8!). Can you believe Im still paying off my student loans, even after 15 years? I paid a total of $900 in interest on my old student loans this year. Remember when I told you about that guy that hit me with his car? I had a bunch of medical expenses that were not reimbursed by the lawsuit or by my insurance. I incurred a total of $20,000 in medical expenses, and I was only reimbursed for $11,000. Good thing I can write off medical expenses, right? I contributed a lot of money to charity this year (and have receipt documentation for all contributions). Im such a nice guy! I gave $1,000 in cash to the March of Dimes. I contributed some of my old furniture to the church. It was some good stuff! I contributed a red velvet couch and my old recliner. The furniture is considered vintage and is worth $5,000 today (the appraiser surprised me!), even though I only paid $1,000 for it back in the day. When I contributed the furniture, the pastor said he didnt like the fabric and was going to sell the furniture to pay for some more pews in the church. Oh well, some people just have no taste, right? Roca Cola had a charity drive for the United Way this year and I contributed $90. Turns out, I dont even miss it, because Roca Cola takes it right off my paycheck every month . . . $15 a month starting in July. My pay stub verifies that I contributed the $90 to the United Way. Oh, one other bit of charity from me this year. An old buddy of mine was down on his luck. He lost his job and his house. I gave him $500 to help him out. I paid a lot of money in interest this year. I paid a total of $950 in personal credit card interest. I also paid $18,000 in interest on my $500,000 home mortgage that helped me buy my dream home. I also paid $2,000 in real estate taxes for my new house. A few other things I want to tell you about this year. Someone broke into my house and stole my kid's brand new bicycle and my set of golf clubs. The total loss from theft was $900. I paid $125 in union dues this year. I had to pay $1,200 for new suits for my job. Roca Cola requires its managers to wear suits every day on the job. I spent a total of $1,300 to pay for gas to commute to my job this year. Oh, this is pretty cool. I've always wanted to be a firefighter. I spent $1,400 in tuition to go to the local firefighter's school. I did this because someone told me that I can deduct the tuition as an itemized deduction, so the money would be coming back to me. That should be all the information you need right now. Please calculate my taxable income and complete pages 1 and 2 of Form 1040 (through taxable income, line 43) and Schedule A. You're still doing this for free, right?

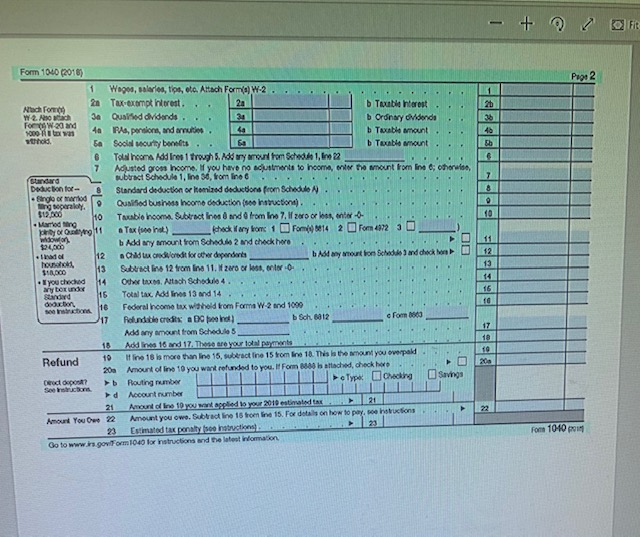

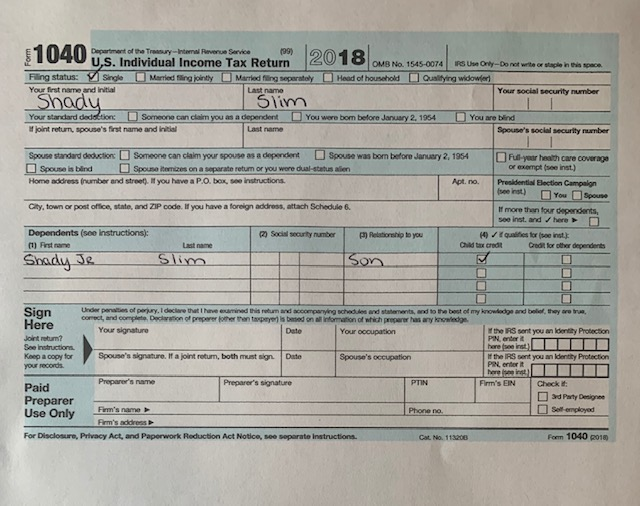

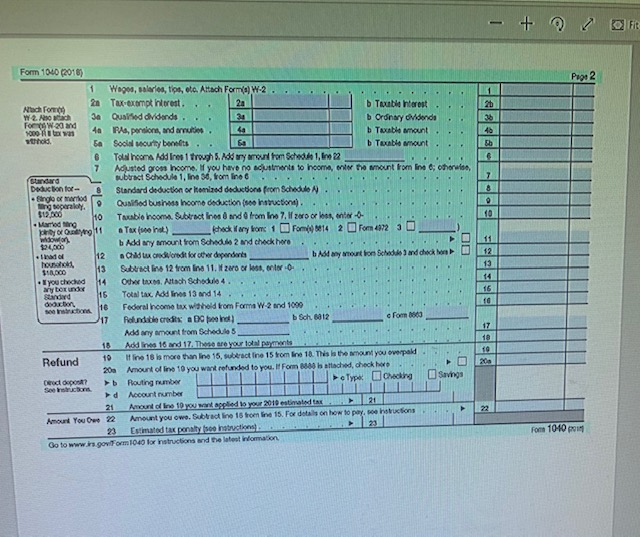

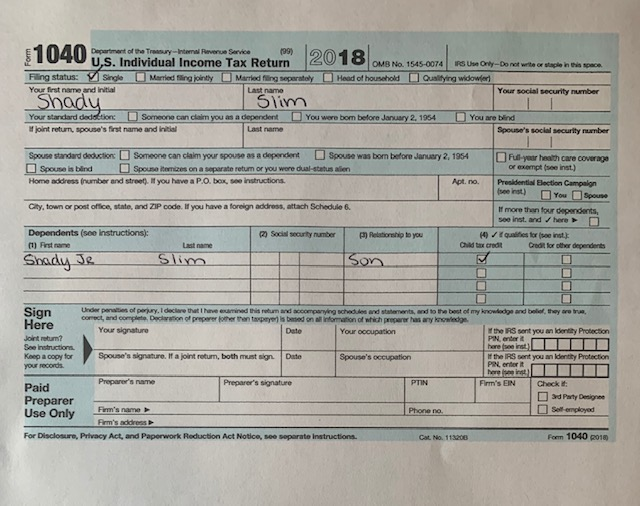

I know correct figures I am just having trouble filling out the tax forms. Can someone help me fill out the tax forms?

| |

| | | | | Gross income | | $172,900 | | AGI | | $172,900 | | Itemized Deductions: | | | | Charitable Contributions | 2,090 | | | | | | | Mortgage Interest | 18,000 | | | Real Estate Taxes | 2,000 | (22,090) | | Taxable income | | $150,810 | |

| |

| |

|

- 4 & OR Peon 2 Form 1040 (2016) 1 Wagon, salarios, tips, etc. Attach Form() W-2. . .. . . . . . Ahad 20 Tax-exempt hlorest. . om 21 Touble Interest. W 2. osach 3a Quared Vidonds... b Ordinary Odenda .. F W -20 and 9000 Allan 40 PAs, pensions, and armu . b Table Mount whold Sa Social security benefits . . b Toute unt 6 To home Addresi troughs. Add try out from Sched 1, lim 22 - 7 Adjusted gross Income. If you have no adul ts to hoom, with the mount from In otherwise, Standard Bubtract Schedule 1, line 30, from line . . . . . . . . . Dodation for 8 Standard deduction or omized deductions from Schedulo .... .. ting operatoy, 10 Qualified Business Incomo deduction ( Instruction). .. . .. . $12.00 10 Table room. Subtraction and from Ino 7.200 or besonder Married thing Ono 11 a Tox ( sh) shock Vary from 1 Fom 14 2 Pom 4972 3 Wido $24,00 b Add any amount from Schedule and check here. . 12 Cx creditoret for dependen t your lo Sched and check on tou S1CD 13 Subtract in 12 from line 11. 200 0 . you checked 414 Other tex. Artach Schedulo 4. . . .. . 15 Total tax. Add Ines 13 and 14. 16 Federal income tax withold from Forma W-2 and 1099 17 Roundable credits a B e t_ bach 1912 Add any amount from Schedule 18 Adines 16 and 17. These are your ton payants Refund 10 ne 18 is more than line 15, wbtract line 15 from ine 18. This is the mount you ovepald. 200 Amount of live 10 you want refunded to you. If Form 500 b attached, check p y Savings checking Dec Routing number ? b d Account number ULULLLLLLLLLLL 21 21 Amount of line 10 you want applied to your 2010 estinada ons Amount You Owe 22 Amount you owo Subred line 16 from line 15. For details on how to pay, so ho 23 23 Estimated tax paysco instructions Go to www.ingolForm 1040 for instructions and the latest Woman Form 10-10 2011 A Department of the Treasury Internal Revenue Service 19 8 PIUTU U.S. Individual Income Tax Return GUIO OMB No 1545-0074 S O -Dore writer acle in this one Filing status: Single Married in Married fing separately Head of household Qualifying widowie Your first name and initial a rea Your social security number Shady Your standard dedektion O Someone can claim you as a dependent You were born before January 2, 1954 You are blind joint return, spouse's first name and initial Last name Spouse's social security number Spouse standard deduction Someone can claim your spouse as a dependent Spouse was born before January 2, 1954 Spouse is bind Spouse itemizes on a separate return or you were dual-status alien Home address number and street). If you have a P.O. box, se instructions. Apt. no. Full your health care coverage or exempt ( Inst.) Presidential Election Campaign sent) You Spouse City, town or post office, state, and ZIP code. If you have a foreign address, attach Schedule 6. more than four dependents, soe Instand / heren Social security number Relationship to you Ch e Dependents (see Instructions): First name Shady Je 14 / credit forse inst Credit for other dependents Slim Son Sian Here Joint retur? See Instructions Keep a copy for Under penales of perjury. I declare that I have mined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true correct, and complete Declino prepare the tantoyer is bed on information of which preparehas any knowledge Your signature Date Your occupation the RS sont you an identity Protection here seeinst Spouse's signature. If a joint return, both must sign Date Spouse's occupation the IRS ant you an identity Protection PNenterit Firm's EIN Preparer's name Preparer's signature Paid Preparer Firm's name Use Only Firm's address For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, se separate Instructions. Check it 3rd Party Design In seamployed Phone no Cat No. 112200 Form 1040 2018 - 4 & OR Peon 2 Form 1040 (2016) 1 Wagon, salarios, tips, etc. Attach Form() W-2. . .. . . . . . Ahad 20 Tax-exempt hlorest. . om 21 Touble Interest. W 2. osach 3a Quared Vidonds... b Ordinary Odenda .. F W -20 and 9000 Allan 40 PAs, pensions, and armu . b Table Mount whold Sa Social security benefits . . b Toute unt 6 To home Addresi troughs. Add try out from Sched 1, lim 22 - 7 Adjusted gross Income. If you have no adul ts to hoom, with the mount from In otherwise, Standard Bubtract Schedule 1, line 30, from line . . . . . . . . . Dodation for 8 Standard deduction or omized deductions from Schedulo .... .. ting operatoy, 10 Qualified Business Incomo deduction ( Instruction). .. . .. . $12.00 10 Table room. Subtraction and from Ino 7.200 or besonder Married thing Ono 11 a Tox ( sh) shock Vary from 1 Fom 14 2 Pom 4972 3 Wido $24,00 b Add any amount from Schedule and check here. . 12 Cx creditoret for dependen t your lo Sched and check on tou S1CD 13 Subtract in 12 from line 11. 200 0 . you checked 414 Other tex. Artach Schedulo 4. . . .. . 15 Total tax. Add Ines 13 and 14. 16 Federal income tax withold from Forma W-2 and 1099 17 Roundable credits a B e t_ bach 1912 Add any amount from Schedule 18 Adines 16 and 17. These are your ton payants Refund 10 ne 18 is more than line 15, wbtract line 15 from ine 18. This is the mount you ovepald. 200 Amount of live 10 you want refunded to you. If Form 500 b attached, check p y Savings checking Dec Routing number ? b d Account number ULULLLLLLLLLLL 21 21 Amount of line 10 you want applied to your 2010 estinada ons Amount You Owe 22 Amount you owo Subred line 16 from line 15. For details on how to pay, so ho 23 23 Estimated tax paysco instructions Go to www.ingolForm 1040 for instructions and the latest Woman Form 10-10 2011 A Department of the Treasury Internal Revenue Service 19 8 PIUTU U.S. Individual Income Tax Return GUIO OMB No 1545-0074 S O -Dore writer acle in this one Filing status: Single Married in Married fing separately Head of household Qualifying widowie Your first name and initial a rea Your social security number Shady Your standard dedektion O Someone can claim you as a dependent You were born before January 2, 1954 You are blind joint return, spouse's first name and initial Last name Spouse's social security number Spouse standard deduction Someone can claim your spouse as a dependent Spouse was born before January 2, 1954 Spouse is bind Spouse itemizes on a separate return or you were dual-status alien Home address number and street). If you have a P.O. box, se instructions. Apt. no. Full your health care coverage or exempt ( Inst.) Presidential Election Campaign sent) You Spouse City, town or post office, state, and ZIP code. If you have a foreign address, attach Schedule 6. more than four dependents, soe Instand / heren Social security number Relationship to you Ch e Dependents (see Instructions): First name Shady Je 14 / credit forse inst Credit for other dependents Slim Son Sian Here Joint retur? See Instructions Keep a copy for Under penales of perjury. I declare that I have mined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true correct, and complete Declino prepare the tantoyer is bed on information of which preparehas any knowledge Your signature Date Your occupation the RS sont you an identity Protection here seeinst Spouse's signature. If a joint return, both must sign Date Spouse's occupation the IRS ant you an identity Protection PNenterit Firm's EIN Preparer's name Preparer's signature Paid Preparer Firm's name Use Only Firm's address For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, se separate Instructions. Check it 3rd Party Design In seamployed Phone no Cat No. 112200 Form 1040 2018