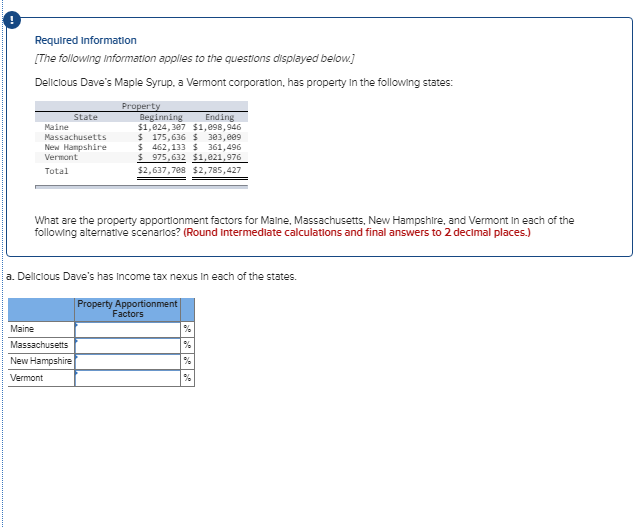

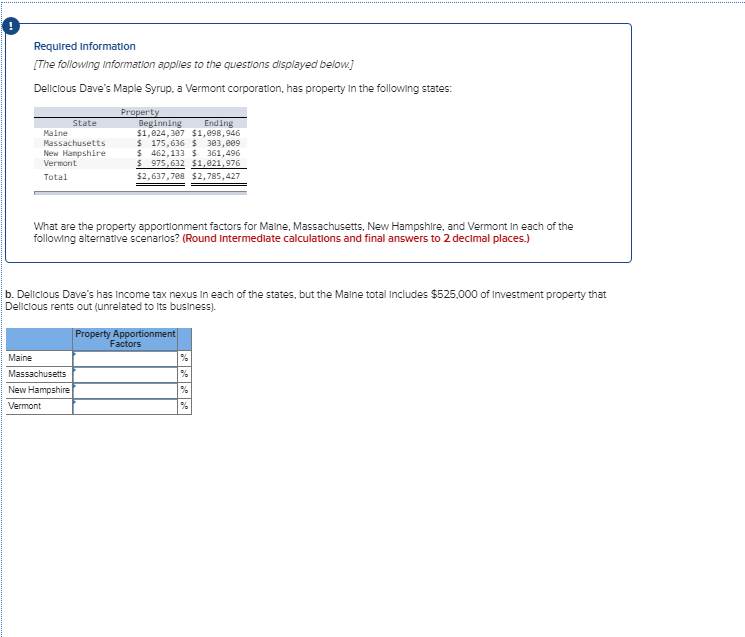

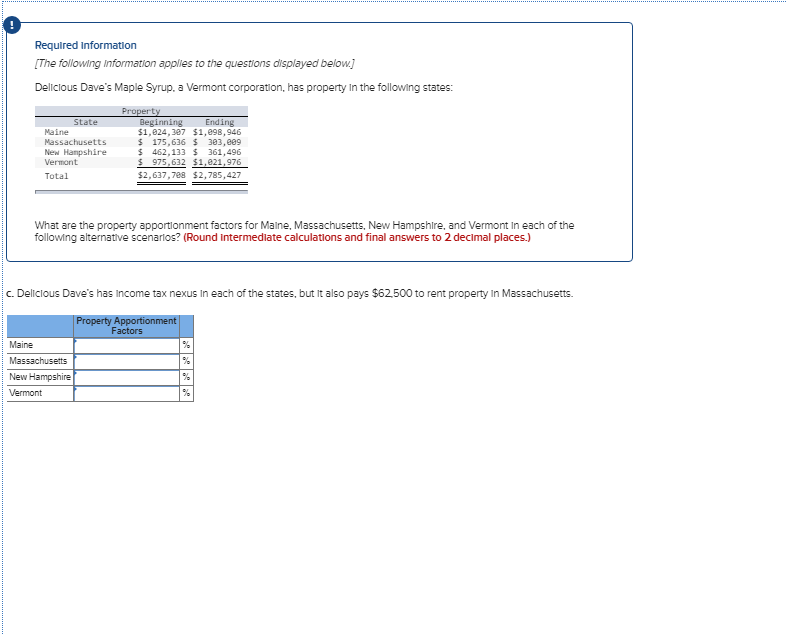

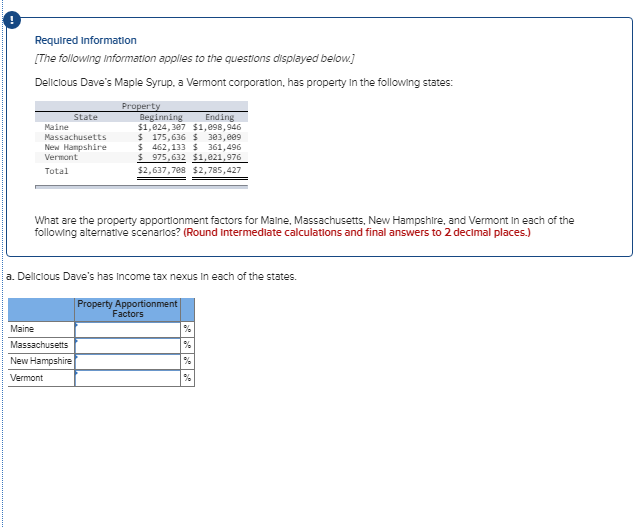

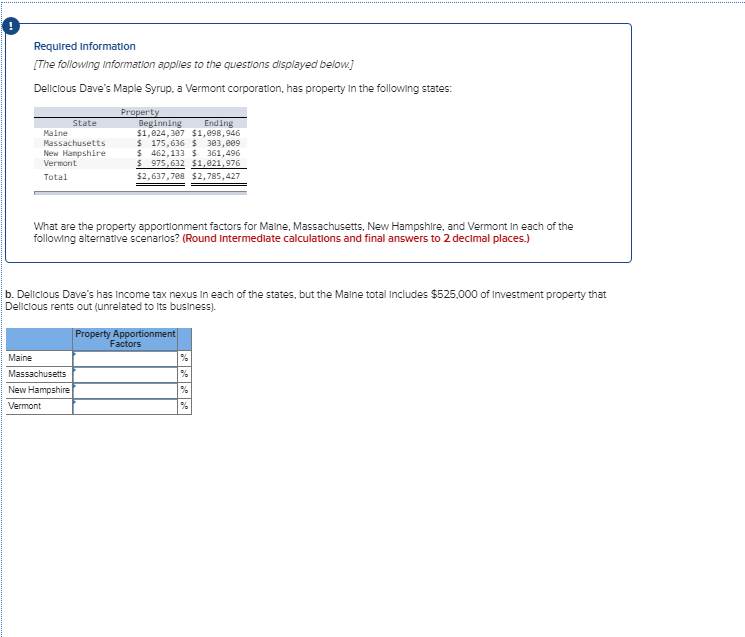

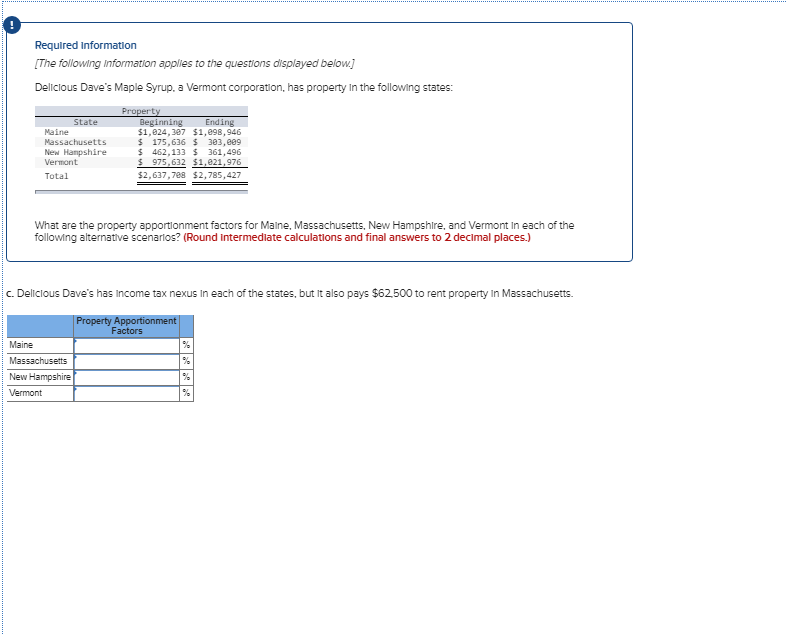

Required Information [The following information applies to the questions displayed below) Delicious Dave's Maple Syrup. a Vermont corporation, has property In the following states: State Maine Massachusetts New Hampshire Vermont Total Property Beginning Ending $1,024,307 $1,698,946 $ 175.636 $ 383.889 $ 462.133 3 61.496 $ 975,632 $1,e21,976 $2,637,708 52.785.427 What are the property apportionment factors for Maine, Massachusetts, New Hampshire, and Vermont In each of the following alternative scenarios? (Round Intermediate calculations and final answers to 2 decimal places.) a. Delicious Dave's has income tax nexus in each of the states. Property Apportionment Factors Maine Massachusetts New Hampshire Vermont Required Information The following information applies to the questions displayed below) Delicious Dave's Maple Syrup. a Vermont corporation, has property in the following states: State Maine Massachusetts New Hampshire Vermont Total Property Beginning Ending $1,024, 307 $1.098.946 $ 175.636 $ 303,609 $ 462. 133 S 361.496 $ 975,632 $1,621,976 $2,637,798 $2,785,427 What are the property apportionment factors for Maine, Massachusetts, New Hampshire, and Vermont In each of the following alternative scenarios? (Round Intermediate calculations and final answers to 2 decimal places.) b. Delicious Dave's has income tax nexus In each of the states, but the Maine total Includes $525.000 of Investment property that Delicious rents out (unrelated to its business). Property Apportionment Factors Maine Massachusetts New Hampshire Vermont Required Information [The following information applies to the questions displayed below.] Delicious Dave's Maple Syrup. a Vermont corporation, has property in the following states: State Maine Massachusetts New Hampshire Vermont Total Property Beginning Ending $1,624,387 $1,098,946 $ 175,636 $ 383,689 $ 462.133 $ 361,496 $ 975,632 $1,621,976 $2,637,798 $2,785,427 What are the property apportionment factors for Maine, Massachusetts, New Hampshire, and Vermont In each of the following alternative scenarios? (Round Intermediate calculations and final answers to 2 decimal places.) c. Delicious Dave's has income tax nexus in each of the states, but it also pays $62,500 to rent property In Massachusetts Property Apportionment Factors Maine % Massachusetts New Hampshire Vermont %