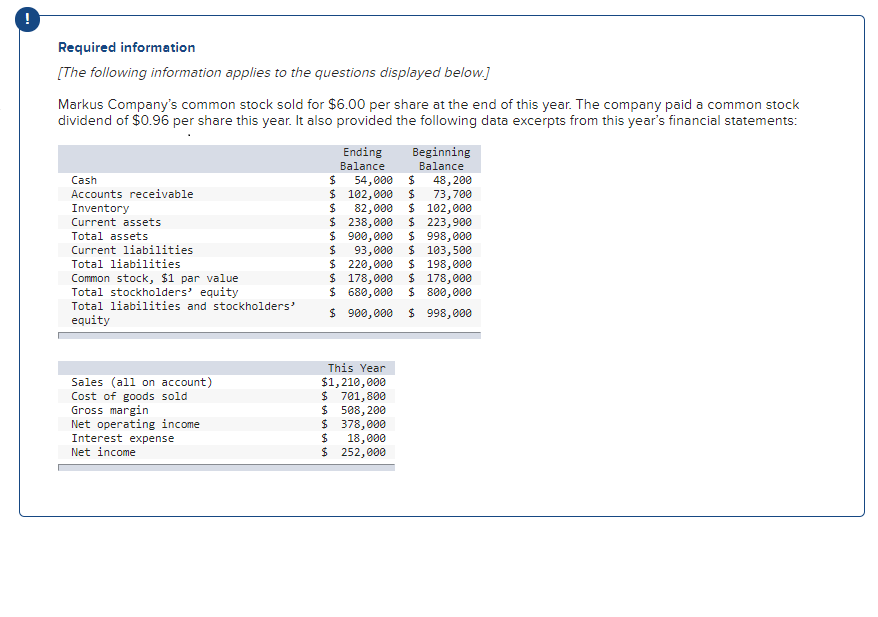

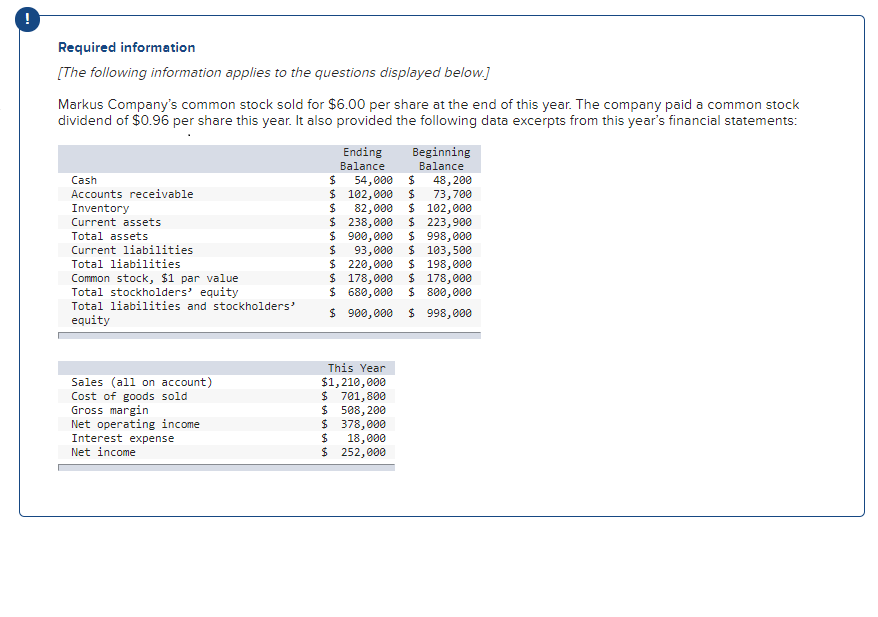

Required information [The following information applies to the questions displayed below.] Markus Company's common stock sold for $6.00 per share at the end of this year. The company paid a common stock dividend of $0.96 per share this year. It also provided the following data excerpts from this year's financial statements: Cash Accounts receivable Inventory Current assets Total assets Current liabilities Total liabilities Common stock, $1 par value Total stockholders' equity Total liabilities and stockholders' equity Ending Beginning Balance Balance $ 54,000 $ 48,200 $ 102,000 $ 73,700 $ 82,000 $ 102,000 $ 238,000 $ 223,900 $ 900,000 $ 998,000 $ 93,000 $ 103,500 $ 220,000 $ 198,000 $ 178,000 $ 178,000 $ 680,000 $ 800,000 $ 900,000 $ 998,000 Sales (all on account) Cost of goods sold Gross margin Net operating income Interest expense Net income This Year $1,210,000 $ 701,800 $ 508, 200 $ 378,000 $ 18,000 $ 252,000 5. What is the return on equity? (Round your answer to the nearest whole percentage place. i.e., 0.1234 should be considered as 12%.) Return on equity % 6. What is the book value per share at the end of this year? (Round your answer to 2 decimal places.) Book value per share 7. What is the amount of working capital and the current ratio at the end of this year? (Round "Current ratio" to 2 decimal places.) Working capital Current ratio 8. What is the acid-test ratio at the end of this year? (Round your answer to 2 decimal places.) Acid-test ratio 9. What is the accounts receivable turnover and the average collection period? (Use 365 days in a year. Round your intermediate and final answers to 2 decimal places.) Accounts receivable turnover Average collection period days 10. What is the inventory turnover and the average sale period? (Use 365 days in a year. Round your intermediate and final answers to 2 decimal places.) Inventory turnover Average sale period days 13. What is the times interest earned ratio? (Round your answer to 2 decimal place.) Times interest earned ratio 14. What is the debt-to-equity ratio at the end of this year? (Round your answer to 2 decimal places.) Debt-to-equity ratio 15. What is the equity multiplier? (Round your answer to 2 decimal places.) Equity multiplier