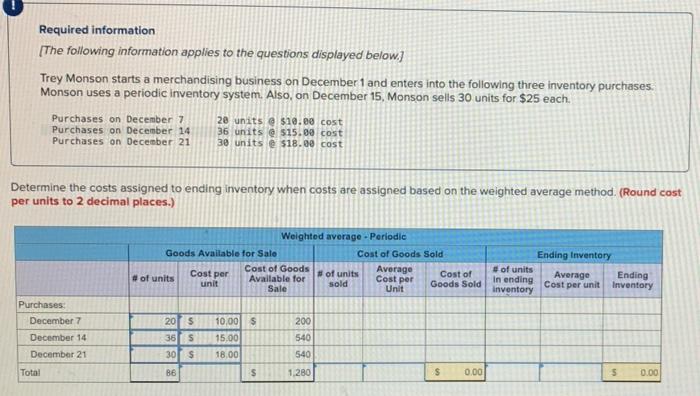

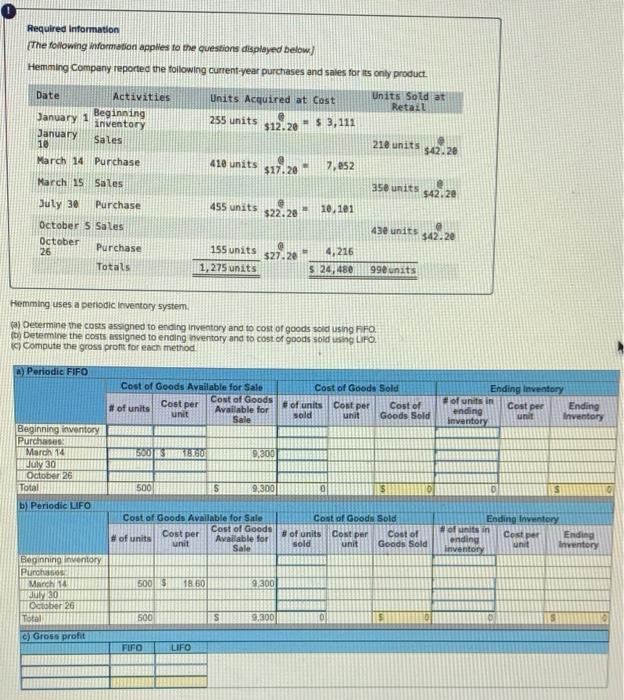

Required information [The following information applies to the questions displayed below.) Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Monson uses a periodic inventory system. Also, on December 15, Monson sells 30 units for $25 each. Purchases on December 7 20 units @ $10.00 cost Purchases on December 14 36 units @ $15.00 cost Purchases on December 21 30 units $18.00 cost Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round cost per units to 2 decimal places.) Weighted average . Periodic Goods Available for Salo Cost of Goods Sold Cost of Goods Average # of units Cost per #of units Cost of Available for Cost per unit sold Sale Unit Goods Sold Ending Inventory # of units Average In ending Ending Cost per unit Inventory Inventory 200 Purchases December 7 December 14 December 21 Total 2015 36 s 30 s 10.00 $ 15,00 18.00 540 540 86 $ 1.280 0.00 5 0.00 Required Information The following information applies to the questions displayed below) Hemming Company reported the following current-year purchases and sales for its only product. Units Acquired at Cost Units Sold at Retail 255 units Date Activities Beginning January 1 inventory January Sales 10 March 14 Purchase $12.20 - $ 3,111 218 units $42.28 410 units $17.20 7, 252 March 15 Sales 350 units $42.20 July 30 Purchase 455 units $22.20 10.101 43e units $42.20 October s Sales October Purchase 26 Totals 155 units 1,275 units $27.20 4,216 5 24,480 990 units Hemming uses a periodic Inventory system a) Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Di Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 1) Compute the gross profit for each method a) Periodic FIFO Cost of Goods Sold Cost of Goods Available for Sale Cost per Cost of Goods # of units Available for unit Sale # of units Cost per sold unit Cost of Goods Sold Ending Inventory of units in Cost per Ending ending unit Inventory Inventory Beginning inventory Purchase March 14 Luly 30 October 26 Total 3300 13180 9300 500 S 9,300 0 IS D S b) Periodic LIFO Cost of Goods Available for Sale Cost of Goods Cost per of units Available for unit Sale Cost of Goods Sold of units Cost per Cost of sold unit Goods Sold Ending Inventory #of units in Cost per Ending ending unit Inventory 500$ 18 60 9300 Beginning inventory Purchases March July 30 October 26 Total c) Gross profit 500 IS 91300 0 FIFO LIFO