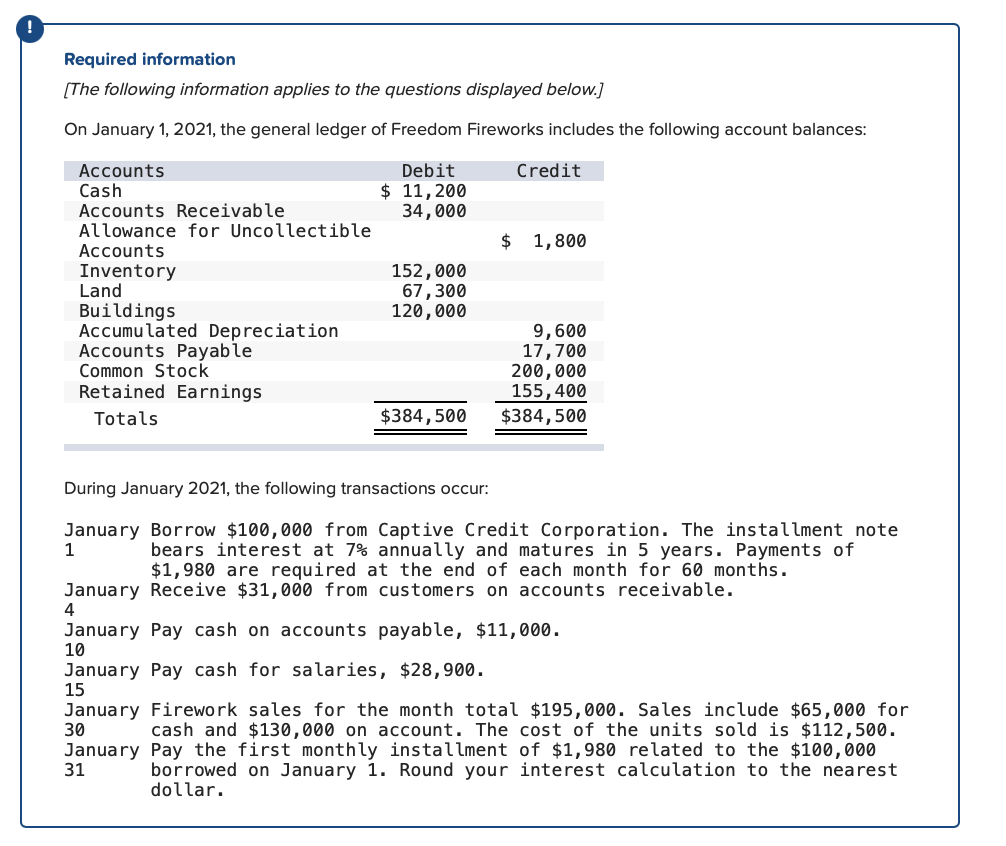

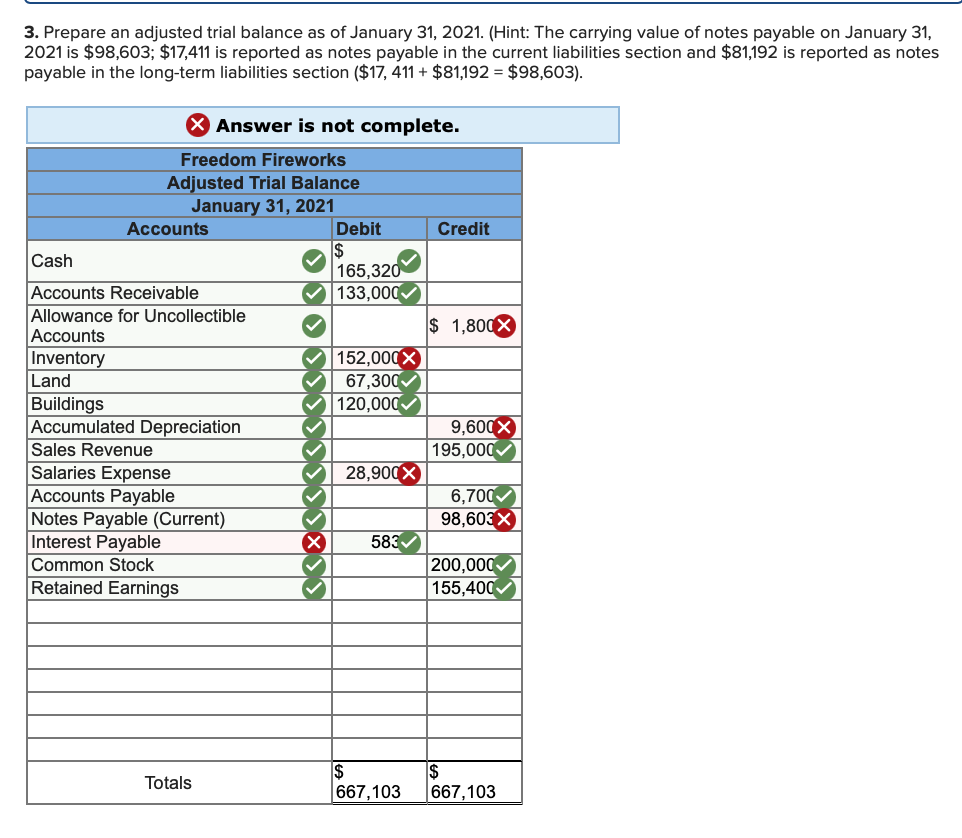

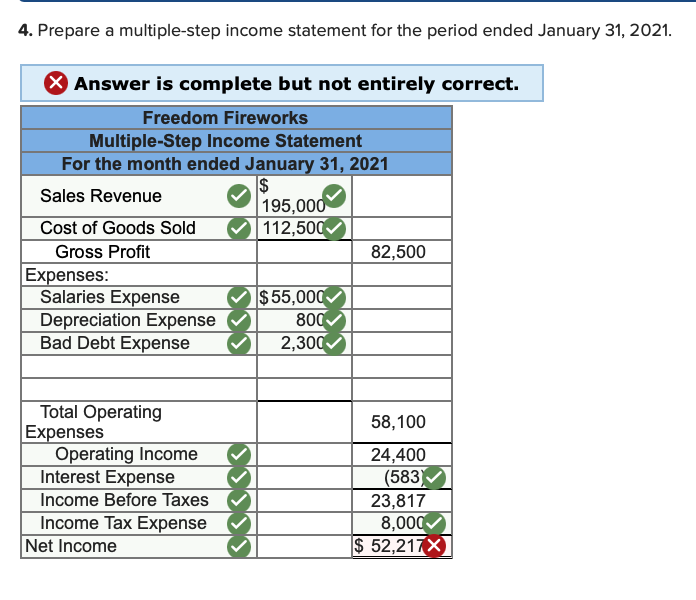

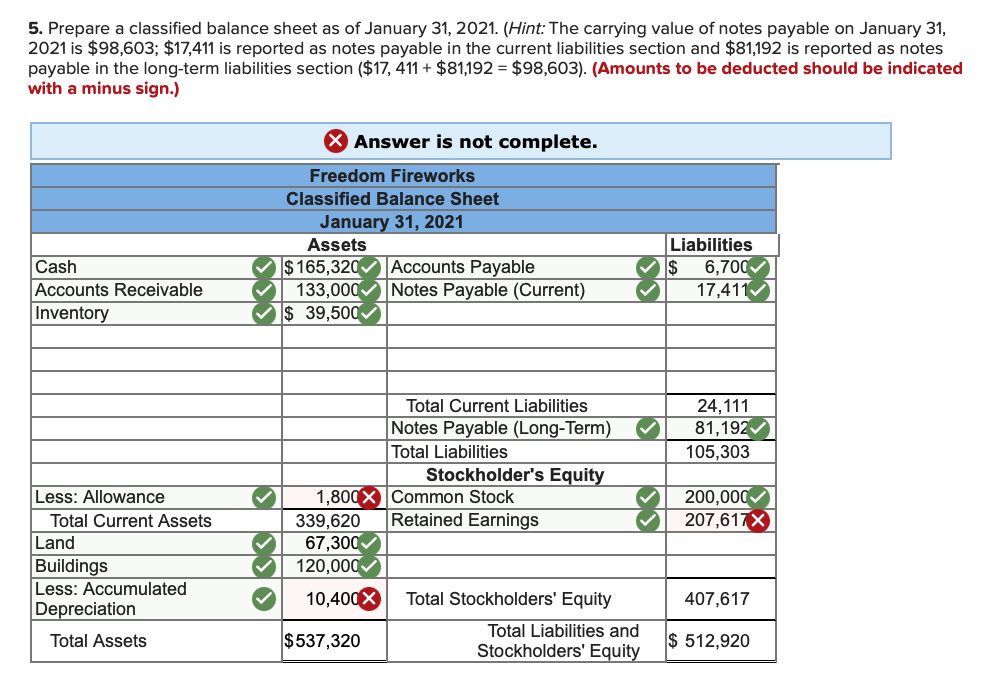

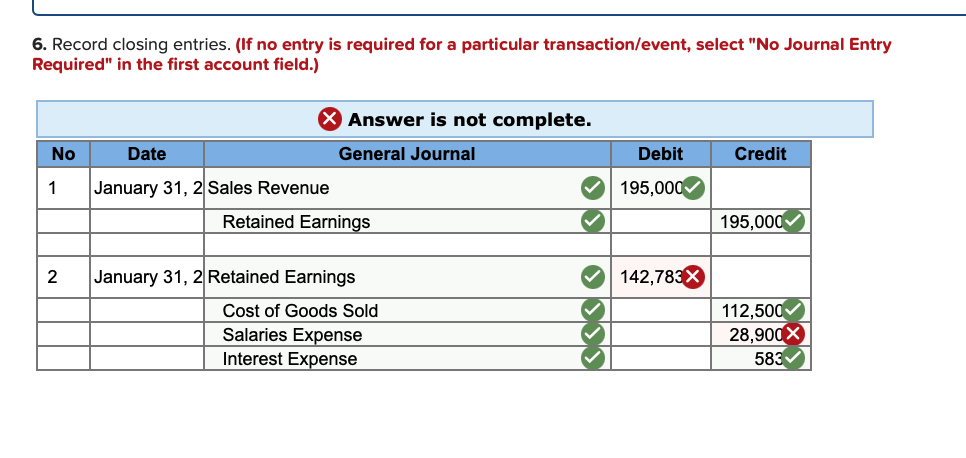

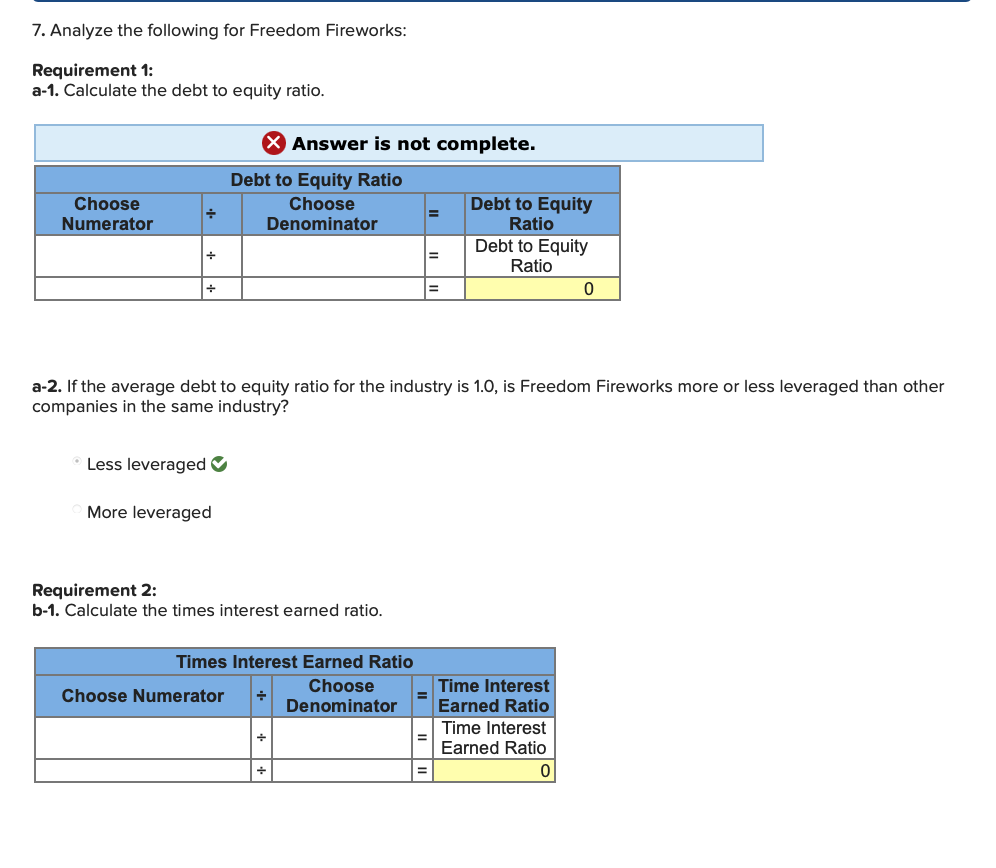

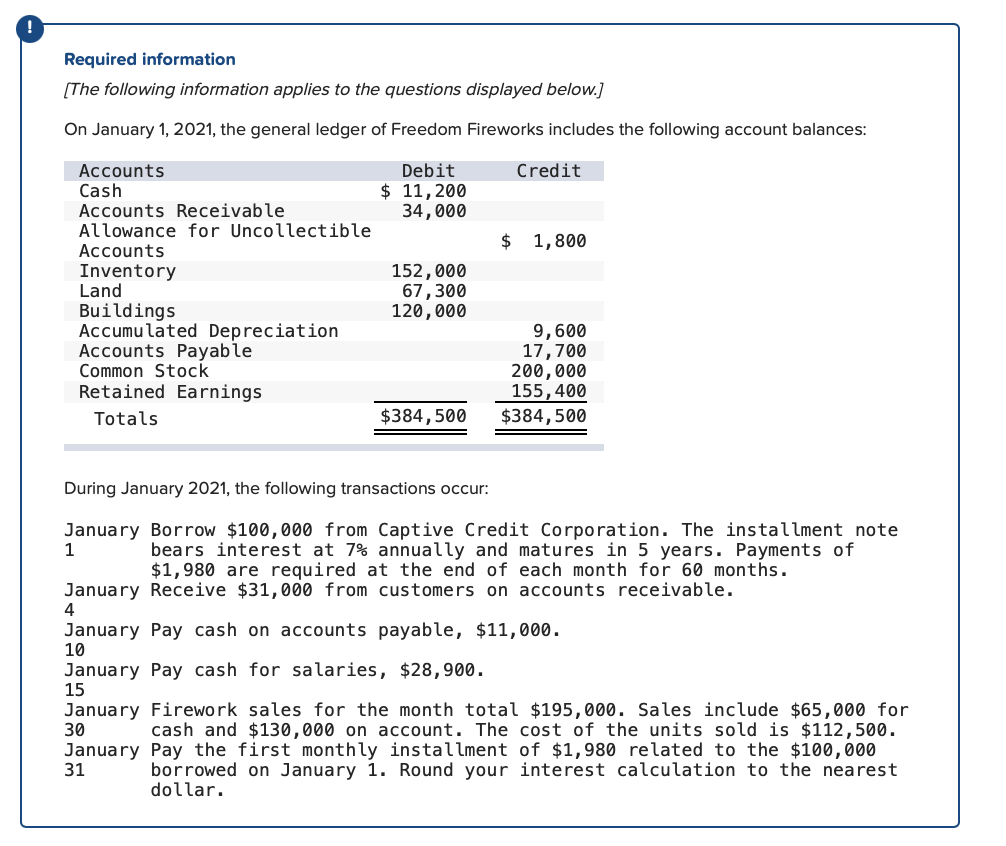

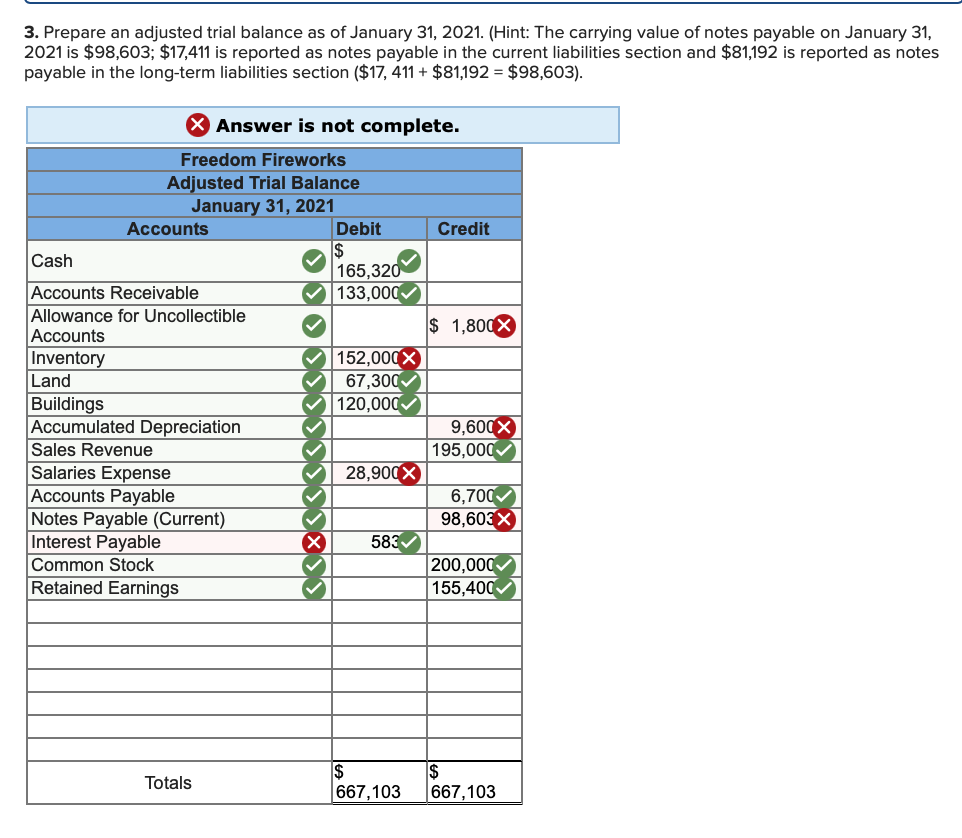

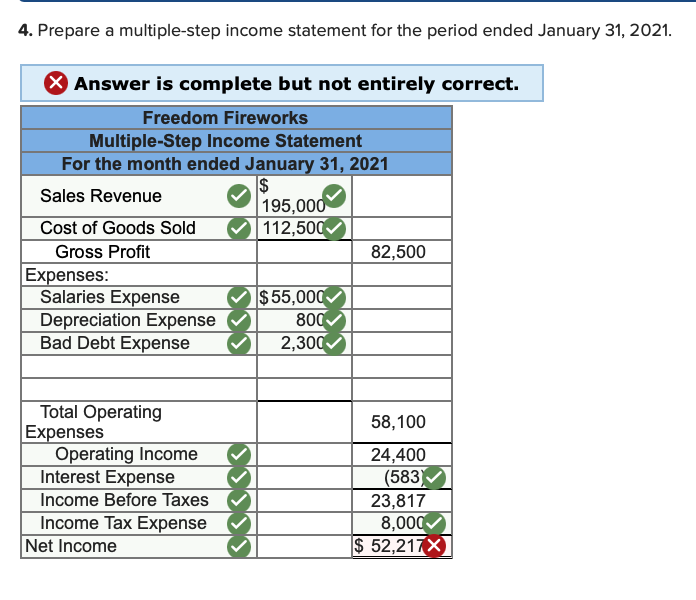

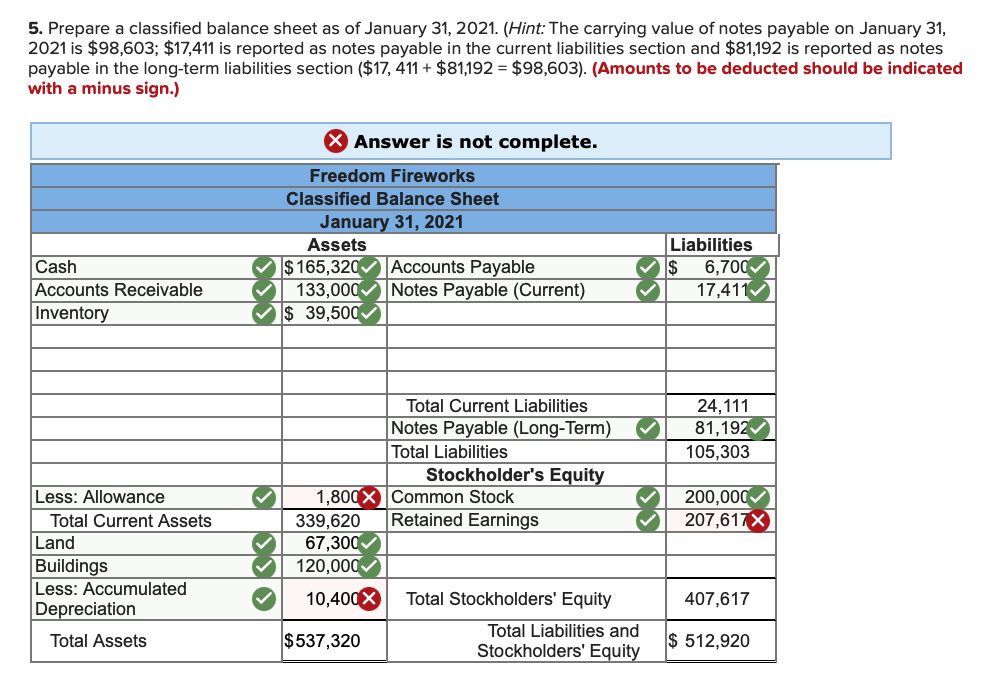

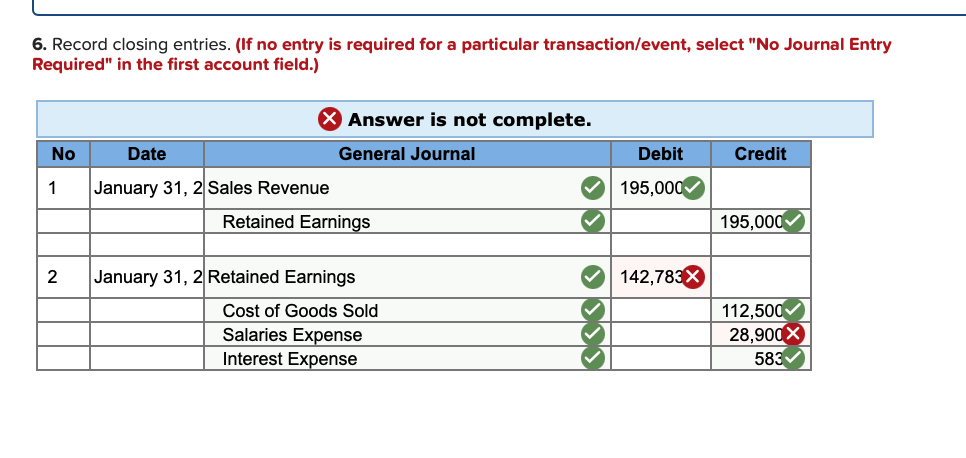

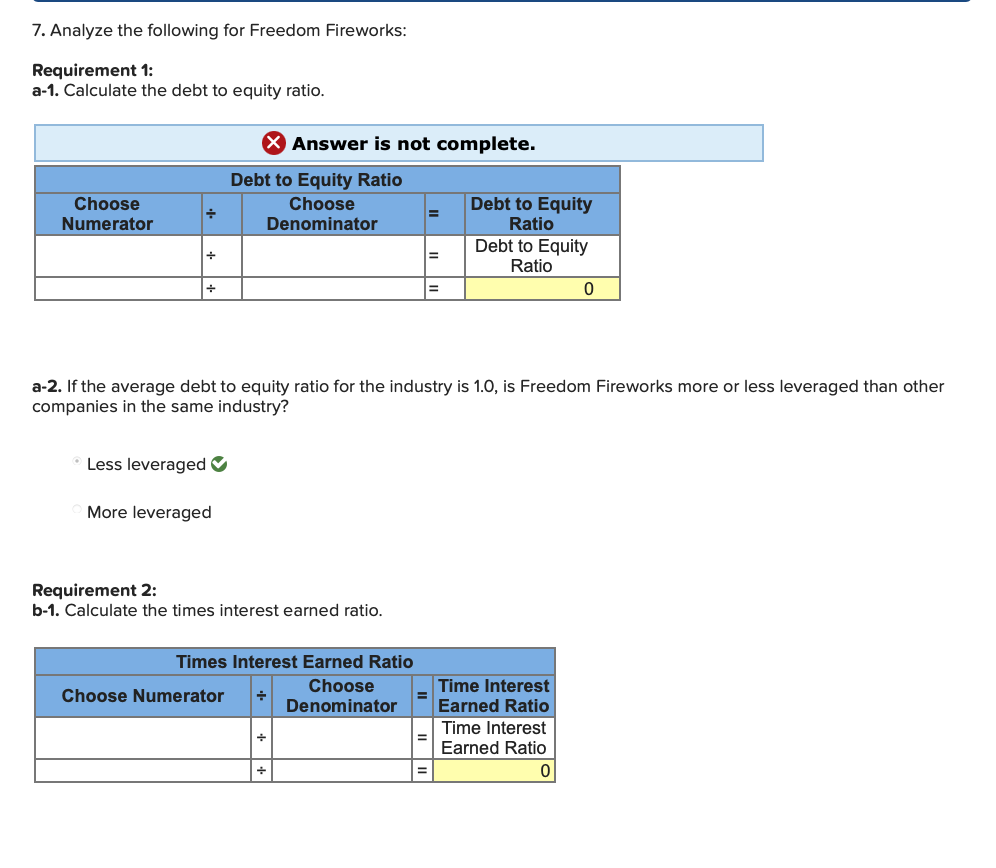

Required information [The following information applies to the questions displayed below.) On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: Credit $ 1,800 Accounts Debit Cash $ 11, 200 Accounts Receivable 34,000 Allowance for Uncollectible Accounts Inventory 152,000 Land 67,300 Buildings 120,000 Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Totals $384,500 9,600 17,700 200,000 155,400 $384,500 During January 2021, the following transactions occur: January Borrow $100,000 from Captive Credit Corporation. The installment note 1 bears interest at 7% annually and matures in 5 years. Payments of $1,980 are required at the end of each month for 60 months. January Receive $31,000 from customers on accounts receivable. 4 January Pay cash on accounts payable, $11,000. 10 January Pay cash for salaries, $28,900. 15 January Firework sales for the month total $195,000. Sales include $65,000 for 30 cash and $130,000 on account. The cost of the units sold is $112,500. January Pay the first monthly installment of $1,980 related to the $100,000 31 borrowed on January 1. Round your interest calculation to the nearest dollar. 3. Prepare an adjusted trial balance as of January 31, 2021. (Hint: The carrying value of notes payable on January 31, 2021 is $98,603; $17,411 is reported as notes payable in the current liabilities section and $81,192 is reported as notes payable in the long-term liabilities section ($17, 411 + $81,192 = $98,603). X Answer is not complete. Freedom Fireworks Adjusted Trial Balance January 31, 2021 Accounts Debit Credit $ Cash 165,320 Accounts Receivable 133,000 Allowance for Uncollectible $ 1,800X Accounts Inventory 152,000x Land 67,300 Buildings 120,000 Accumulated Depreciation 9,600X Sales Revenue 195,000 Salaries Expense 28,900X Accounts Payable 6,700 Notes Payable (Current) 98,603 Interest Payable X 583 Common Stock 200,000 Retained Earnings 155,400 8 Totals 667,103 667,103 4. Prepare a multiple-step income statement for the period ended January 31, 2021. X Answer is complete but not entirely correct. Freedom Fireworks Multiple-Step Income Statement For the month ended January 31, 2021 $ Sales Revenue 195,000 Cost of Goods Sold 112,500 Gross Profit 82,500 Expenses: Salaries Expense $ 55,000 Depreciation Expense 800 Bad Debt Expense 2,300 3 58,100 Total Operating Expenses Operating Income Interest Expense Income Before Taxes Income Tax Expense Net Income 24,400 (583 23,817 8,000 $ 52,217X 5. Prepare a classified balance sheet as of January 31, 2021. (Hint: The carrying value of notes payable on January 31, 2021 is $98,603; $17,411 is reported as notes payable in the current liabilities section and $81,192 is reported as notes payable in the long-term liabilities section ($17, 411 + $81,192 = $98,603). (Amounts to be deducted should be indicated with a minus sign.) X Answer is not complete. Freedom Fireworks Classified Balance Sheet January 31, 2021 Assets $ 165,320 Accounts Payable 133,000 Notes Payable (Current) $ 39,500 Cash Accounts Receivable Inventory Liabilities $ 6,700 17,411 24,111 81,192 105,303 Total Current Liabilities Notes Payable (Long-Term) Total Liabilities Stockholder's Equity 1,800X Common Stock 339,620 Retained Earnings 67,300 120,000 10,400X Total Stockholders' Equity Total Liabilities and $537,320 Stockholders' Equity Less: Allowance Total Current Assets Land Buildings Less: Accumulated Depreciation Total Assets 200,000 207,617X 407,617 $ 512,920 6. Record closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Answer is not complete. General Journal No Date Debit Credit 1 January 31, 2 Sales Revenue 195,000 Retained Earnings 195,000 2 142,783 January 31, 2 Retained Earnings Cost of Goods Sold Salaries Expense Interest Expense SI 112,500 28,900 X 583 7. Analyze the following for Freedom Fireworks: Requirement 1: a-1. Calculate the debt to equity ratio. X Answer is not complete. Choose Numerator Debt to Equity Ratio Choose Denominator Debt to Equity Ratio Debt to Equity Ratio 0 + a-2. If the average debt to equity ratio for the industry is 1.0, is Freedom Fireworks more or less leveraged than other companies in the same industry? Less leveraged More leveraged Requirement 2: b-1. Calculate the times interest earned ratio. Times Interest Earned Ratio Choose Numerator Choose Denominator Time Interest Earned Ratio Time Interest Earned Ratio