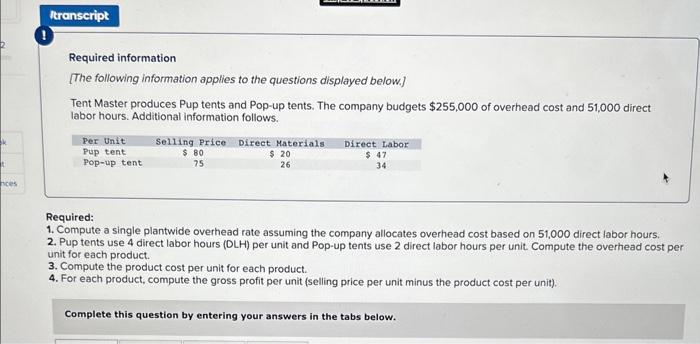

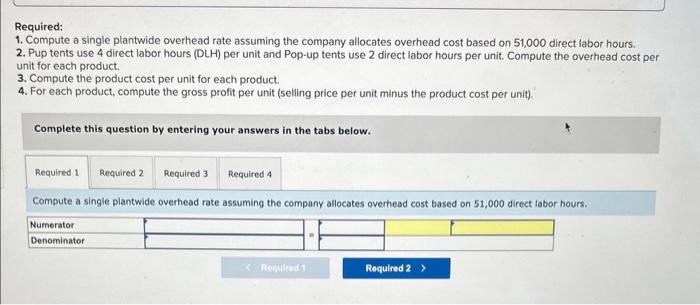

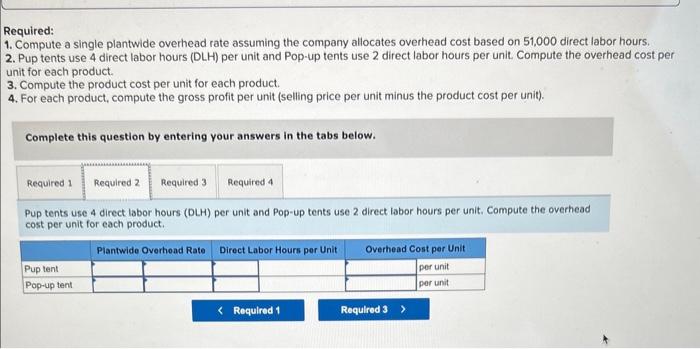

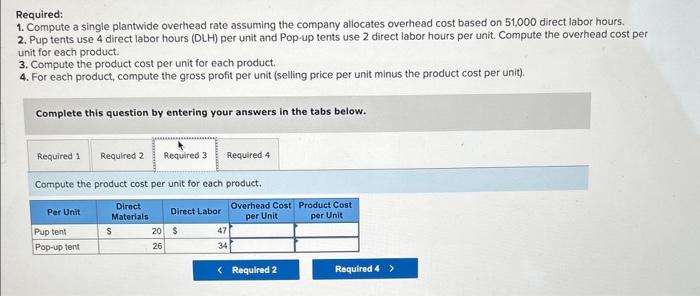

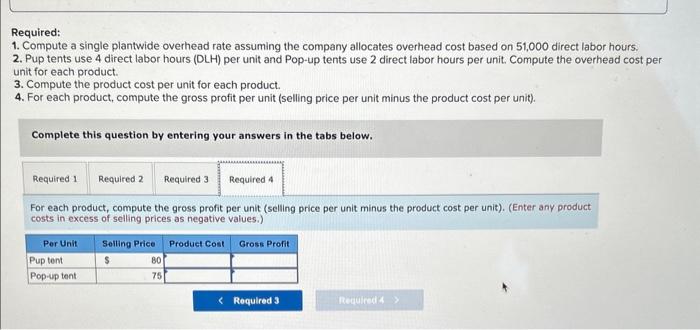

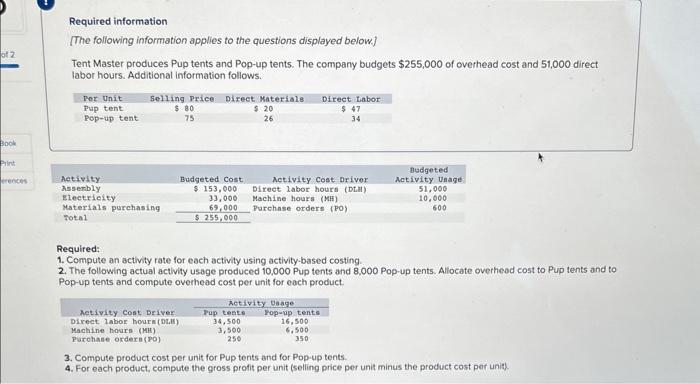

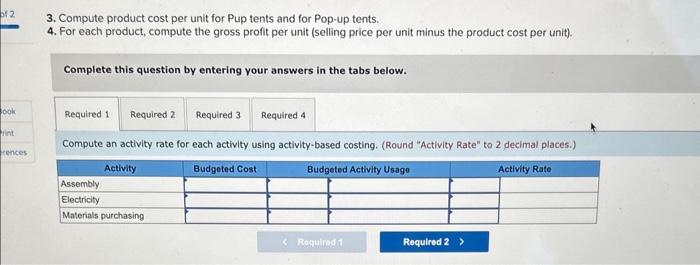

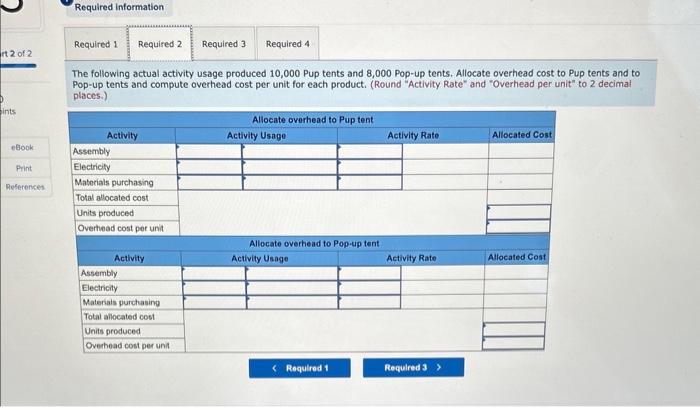

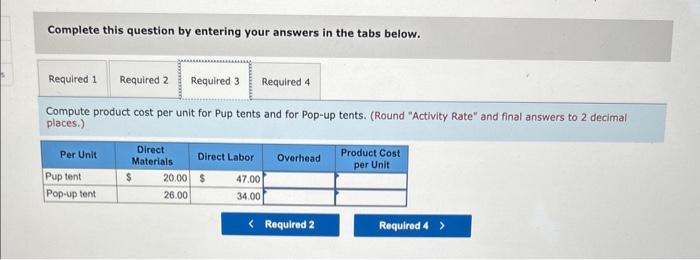

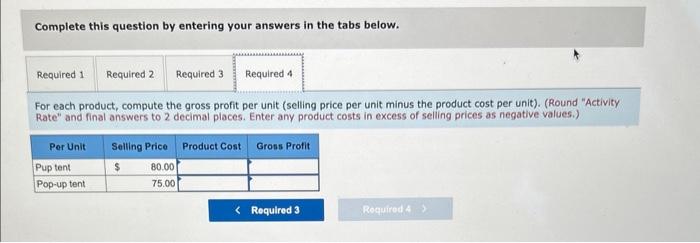

Required information [The following information applies to the questions displayed below.] Tent Master produces Pup tents and Pop-up tents. The company budgets $255,000 of overhead cost and 51,000 direct labor hours. Additional information follows. equired: Compute a single plantwide overhead rate assuming the company allocates overhead cost based on 51,000 direct labor hours. Pup tents use 4 direct labor hours (DLH) per unit and Pop-up tents use 2 direct labor hours per unit. Compute the overhead cost per nit for each product. Compute the product cost per unit for each product. For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit). Complete this question by entering your answers in the tabs below. Required: 1. Compute a single plantwide overhead rate assuming the company allocates overhead cost based on 51,000 direct labor hours. 2. Pup tents use 4 direct labor hours (DLH) per unit and Pop-up tents use 2 direct labor hours per unit. Compute the overhead cost per unit for each product. 3. Compute the product cost per unit for each product. 4. For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit). Complete this question by entering your answers in the tabs below. Compute a single plantwide overhead rate assuming the company allocates overhead cost based on 51,000 direct labor hours. required: - Compute a single plantwide overhead rate assuming the company allocates overhead cost based on 51,000 direct labor hours. 2. Pup tents use 4 direct labor hours (DLH) per unit and Pop-up tents use 2 direct labor hours per unit. Compute the overhead cost per unit for each product. 3. Compute the product cost per unit for each product. 4. For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit). Complete this question by entering your answers in the tabs below. Pup tents use 4 direct labor hours (DLH) per unit and Pop-up tents use 2 direct labor hours per unit. Compute the overhead cost per unit for each product. Required: 1. Compute a single plantwide overhead rate assuming the company allocates overhead cost based on 51,000 direct labor hours. 2. Pup tents use 4 direct labor hours (DLH) per unit and Pop-up tents use 2 direct labor hours per unit. Compute the overhead cost per unit for each product. 3. Compute the product cost per unit for each product. 4. For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit). Complete this question by entering your answers in the tabs below. Compute the product cost per unit for each product. Required: 1. Compute a single plantwide overhead rate assuming the company allocates overhead cost based on 51,000 direct labor hours. 2. Pup tents use 4 direct labor hours (DLH) per unit and Pop-up tents use 2 direct labor hours per unit. Compute the overhead cost per unit for each product. 3. Compute the product cost per unit for each product. 4. For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit). Complete this question by entering your answers in the tabs below. For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit). (Enter any product costs in excess of selling prices as negative values.) Required information [The following information applies to the questions displayed below] Tent Master produces Pup tents and Pop-up tents. The company budgets $255,000 of overhead cost and 51,000 direct labor hours. Additional information follows. Required: 1. Compute an activity rate for each activity using activity-based costing. 2. The following actual activity usage produced 10,000 Pup tents and 8,000 Pop-up tents. Allocate overheod cost to Pup tents and to Pop-up tents and compute overhead cost per unit for each product. 3. Compute product cost per unit for Pup tents and for Pop-up tents 4. For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit). Compute product cost per unit for Pup tents and for Pop-up tents. For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit). Complete this question by entering your answers in the tabs below. Compute an activity rate for each activity using activity-based costing. (Round "Activity Rate" to 2 decimal places.) The following actual activity usage produced 10,000 Pup tents and 8,000 Pop-up tents. Allocate overhead cost to Pup tents and to Pop-up tents and compute overhead cost per unit for each product. (Round "Activity Rate" and "Overhead per unit" to 2 decimal places.) Complete this question by entering your answers in the tabs below. Compute product cost per unit for Pup tents and for Pop-up tents. (Round "Activity Rate" and final answers to 2 decimal places.) Complete this question by entering your answers in the tabs below. For each product, compute the gross profit per unit (selling price per unit minus the product cost per unit). (Round "Activity Rate" and final answers to 2 decimal places. Enter any product costs in excess of selling prices as negative values.)