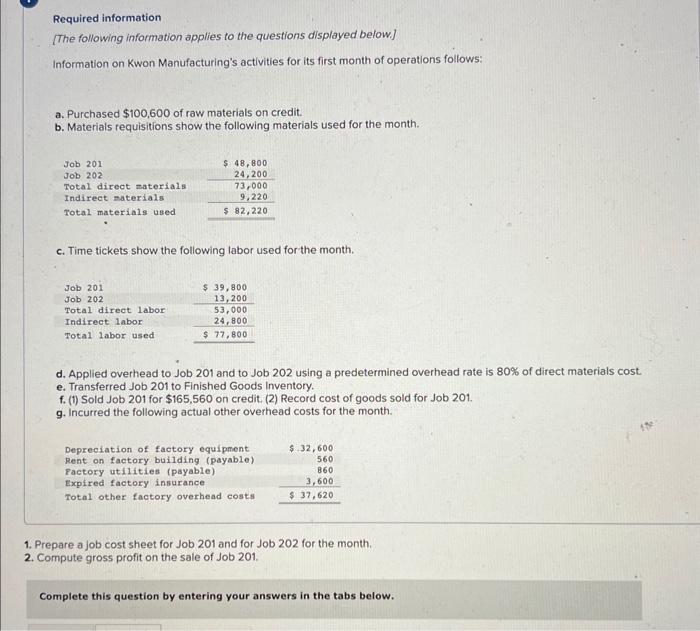

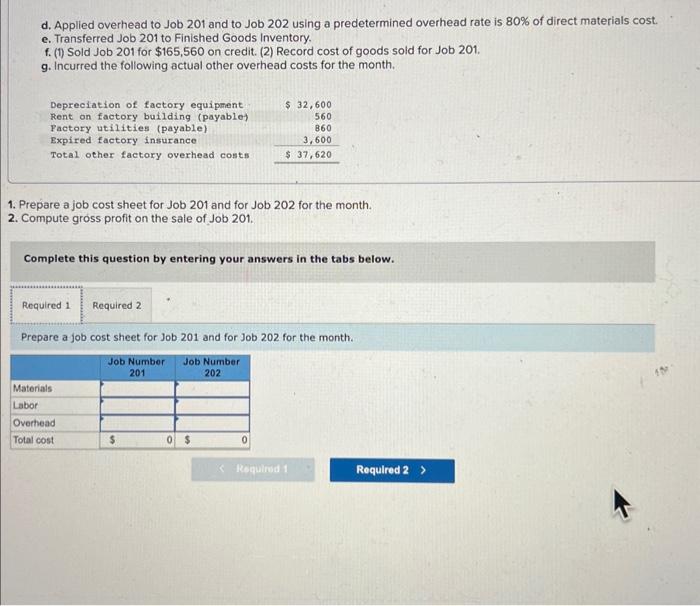

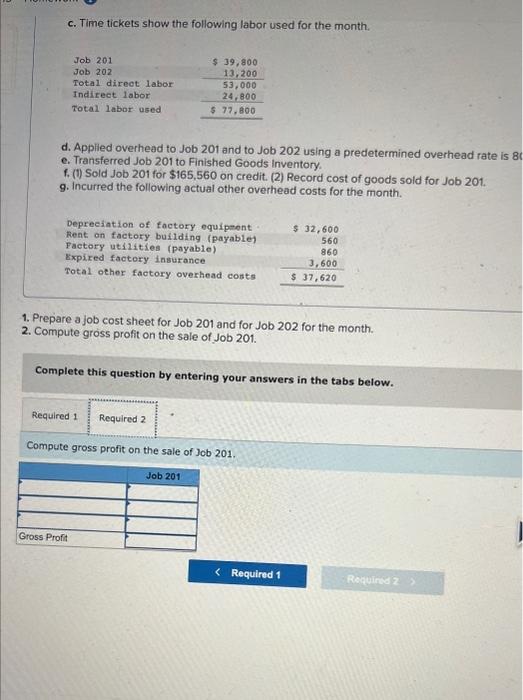

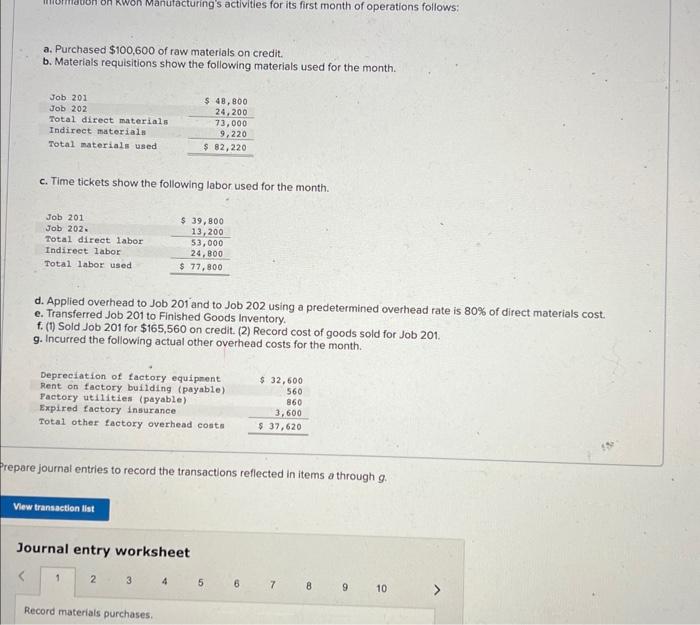

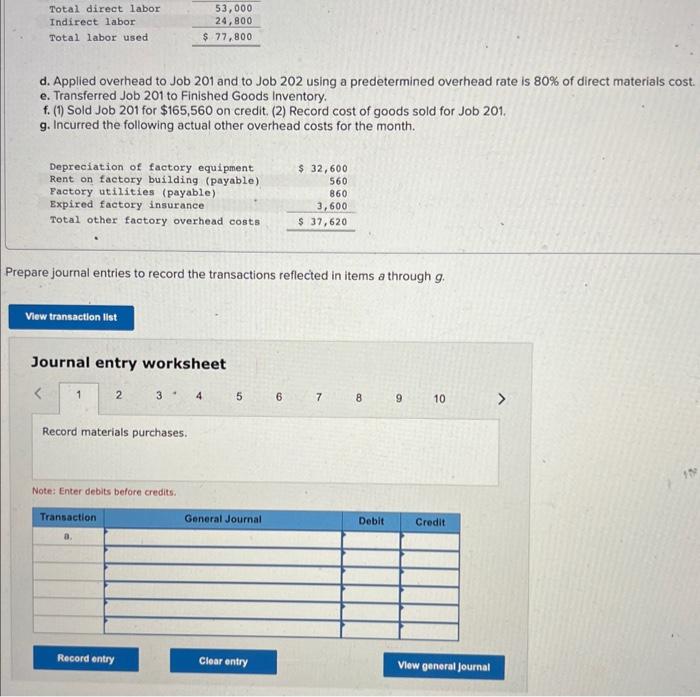

Required information [The following information applies to the questions displayed below.] Information on Kwon Manufacturing's activities for its first month of operations follows: a. Purchased $100,600 of raw materials on credit. b. Materials requisitions show the following materials used for the month. c. Time tickets show the following labor used for the month. d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate is 80% of direct materials cost. e. Transferred Job 201 to Finished Goods Inventory. f. (1) Sold Job 201 for $165,560 on credit. (2) Record cost of goods sold for Job 201. g. Incurred the following actual other overhead costs for the month. 1. Prepare a job cost sheet for Job 201 and for Job 202 for the month. 2. Compute gross profit on the sale of Job 201. Complete this question by entering your answers in the tabs below. d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate is 80% of direct materials cost. e. Transferred Job 201 to Finished Goods Inventory. f. (1) Sold Job 201 for $165,560 on credit. (2) Record cost of goods sold for Job 201. g. Incurred the following actual other overhead costs for the month. 1. Prepare a job cost sheet for Job 201 and for Job 202 for the month. 2. Compute gross profit on the sale of Job 201. Complete this question by entering your answers in the tabs below. Prepare a job cost sheet for Job 201 and for Job 202 for the month. c. Time tickets show the following labor used for the month. d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate is 8 e. Transferred Job 201 to Finished Goods inventory. f. (1) Sold Job 201 for $165,560 on credit. (2) Record cost of goods sold for Job 201. 9. Incurred the following actual other overhead costs for the month. 1. Prepare a job cost sheet for Job 201 and for Job 202 for the month. 2. Compute gross profit on the sale of Job 201. Complete this question by entering your answers in the tabs below. Compute gross profit on the sale of Job 201. a. Purchased $100,600 of raw materials on credit. b. Materials requisitions show the following materials used for the month. c. Time tickets show the following labor used for the month. d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate is 80% of direct materials cost. e. Transferred Job 201 to Finished Goods Inventory. f. (1) Sold Job 201 for $165,560 on credit. (2) Record cost of goods sold for Job 201. g. Incurred the following actual other overhead costs for the month. repare journal entries to record the transactions reflected in items a through g. d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate is 80% of direct materials cost. e. Transferred Job 201 to Finished Goods Inventory. f. (1) Sold Job 201 for $165,560 on credit. (2) Record cost of goods sold for Job 201. g. Incurred the following actual other overhead costs for the month. Prepare journal entries to record the transactions reflected in items a through g. Journal entry worksheet