Answered step by step

Verified Expert Solution

Question

1 Approved Answer

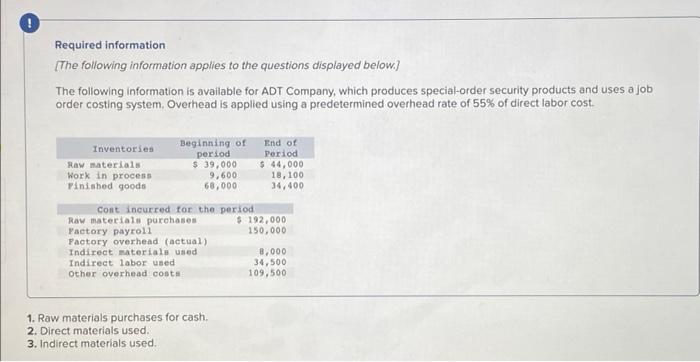

Required information [The following information applies to the questions displayed below.) The following information is available for ADT Company, which produces special-order security products

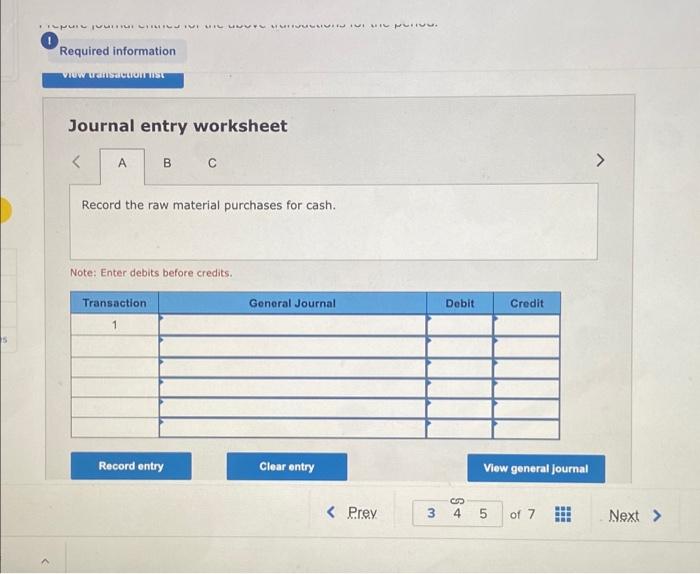

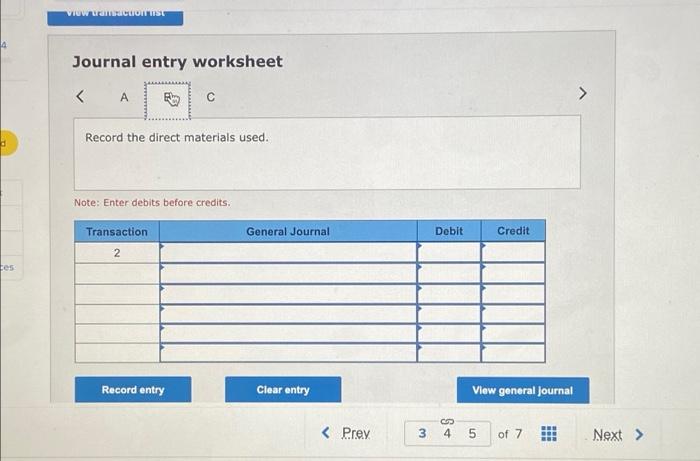

Required information [The following information applies to the questions displayed below.) The following information is available for ADT Company, which produces special-order security products and uses a job order costing system. Overhead is applied using a predetermined overhead rate of 55% of direct labor cost. Beginning of period $ 39,000 9,600 68,000 End of Period Inventories Raw materials Work in process Pinished goods $ 44,000 18,100 34, 400 Cont incurred for the period $ 192,000 150,000 Raw materialn purchases Factory payroll Factory overhead (actual) Indirect materials used Indirect labor uned Other overhead costs 8,000 34,500 109,500 1. Raw materials purchases for cash. 2. Direct materials used. 3. Indirect materials used. Required information VIUw uansacIoIT IST Journal entry worksheet A B C Record the raw material purchases for cash. Note: Enter debits before credits. Transaction General Journal Debit Credit 1. Record entry Clear entry View general journal < Prev 4 5 of 7 Next > VIow uamacuonst Journal entry worksheet A Record the direct materials used. Note: Enter debits before credits. Transaction General Journal Debit Credit tes Record entry Clear entry View general journal < Prev 3 4 5 of 7 Next > Journal entry worksheet A B Record the indirect materials used. Note: Enter debits before credits. Transaction General Journal Debit Credit 3 ces Record entry Clear entry View general journal < Prev 3 4 5 of 7 Next >

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Part1 34 5 TAccounts Raw Materials Inventory Work in Process Inventory 42000 171000 I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started