Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information (The following information applies to the questions displayed below.) On January 1, Boston Company completed the following transactions (use a 7% annual

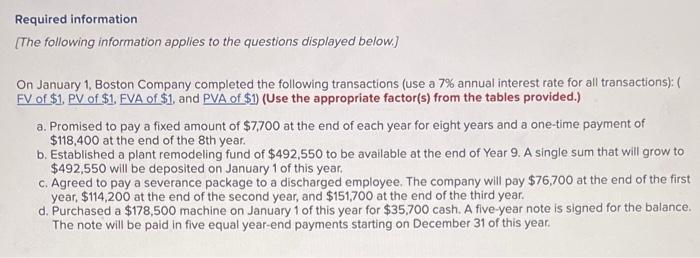

Required information (The following information applies to the questions displayed below.) On January 1, Boston Company completed the following transactions (use a 7% annual interest rate for all transactions): ( FV of $1, PV of $1. EVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.) a. Promised to pay a fixed amount of $7,700 at the end of each year for eight years and a one-time payment of $118,400 at the end of the 8th year. b. Established a plant remodeling fund of $492,550 to be available at the end of Year 9. A single sum that will grow to $492,550 will be deposited on January 1 of this year. C. Agreed to pay a severance package to a discharged employee. The company will pay $76,700 at the end of the first year, $114,200 at the end of the second year, and $151,700 at the end of the third year. d. Purchased a $178,500 machine on January 1 of this year for $35,700 cash. A five-year note is signed for the balance. The note will be paid in five equal year-end payments starting on December 31 of this year. 3. In transaction (c), determine the present value of this obligation. (Round your answer to nearest whole dollar.) Present value

Step by Step Solution

★★★★★

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Annuity payment 7700 X PVA of 1 597130 11078007 Present value of Annuity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started