Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [The following information applies to the questions displayed below.] At the beginning of Year 2, Oak Consulting had the following normal balances

![Required information [The following information applies to the questions displayed below.] At the beginning](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/01/65af706a0a272_39365af70699dcab.jpg)

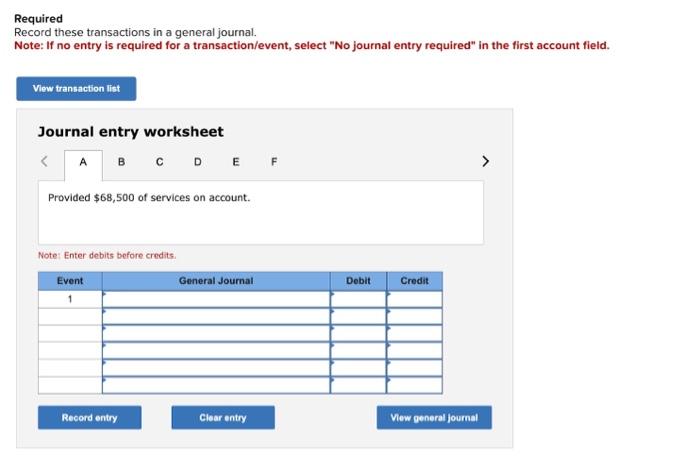

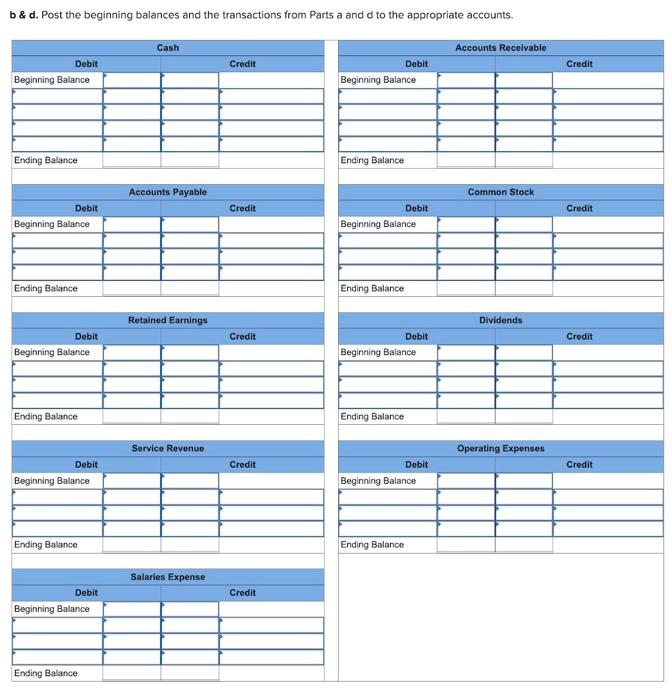

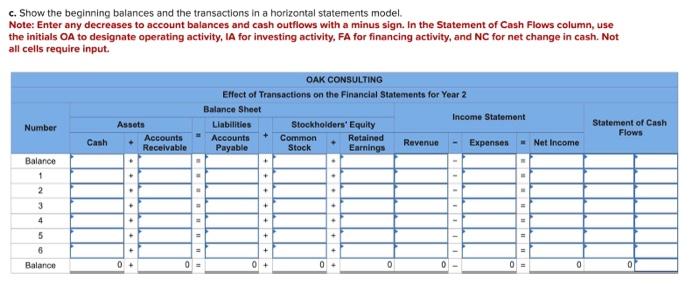

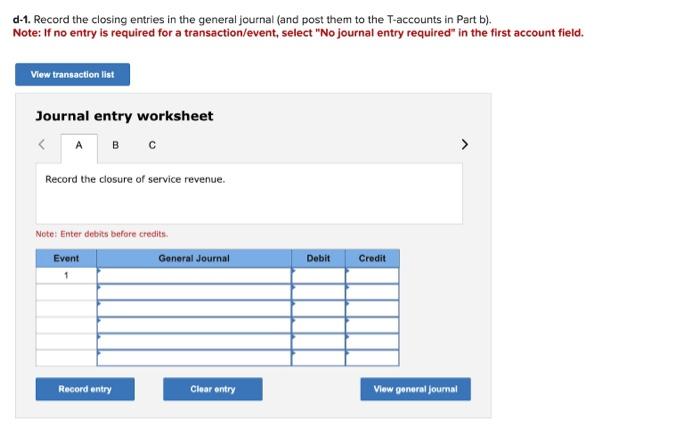

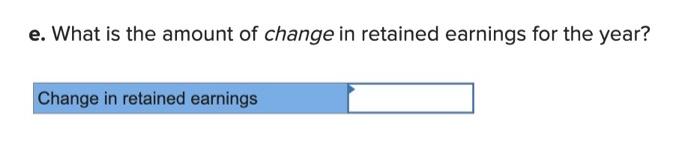

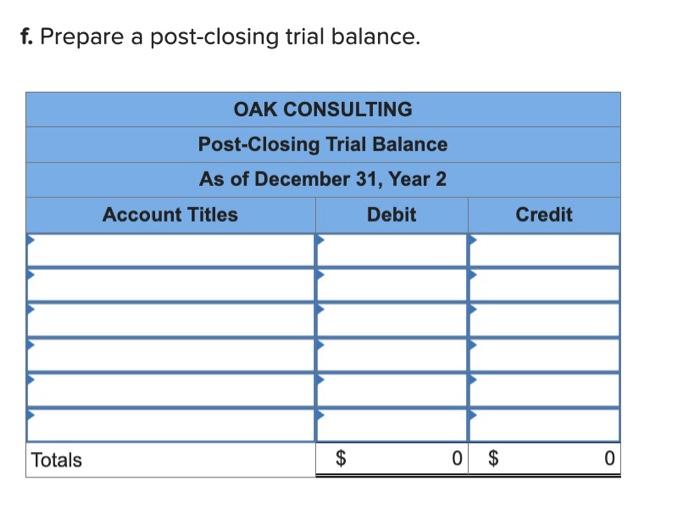

Required information [The following information applies to the questions displayed below.] At the beginning of Year 2, Oak Consulting had the following normal balances in its accounts: Account Cash Balance $ 34,300 Accounts receivable Accounts payable Common stock Retained earnings The following events apply to Oak Consulting for Year 2: 1. Provided $68,500 of services on account. 2. Incurred $2,700 of operating expenses on account. 3. Collected $47,300 of accounts receivable. 4. Paid $37,000 cash for salaries expense. 5. Paid $11,880 cash as a partial payment on accounts payable. 6. Paid a $9,000 cash dividend to the stockholders. 16,100 10,500 28,300 11,600 Required Record these transactions in a general journal. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < A B C D E F Provided $68,500 of services on account. Note: Enter debits before credits. Event 1 Record entry General Journal Clear entry Debit Credit View general journal b & d. Post the beginning balances and the transactions from Parts a and d to the appropriate accounts. Debit Beginning Balance Ending Balance Debit Beginning Balance Ending Balance Debit Beginning Balance Ending Balance Debit Beginning Balance Ending Balance Debit Beginning Balance Ending Balance Cash Accounts Payable Retained Earnings Service Revenue Salaries Expense Credit Credit Credit Credit Credit Beginning Balance Ending Balance Ending Balance Debit Beginning Balance Ending Balance Debit Beginning Balance Ending Balance Debit Debit Beginning Balance Accounts Receivable Common Stock Dividends Operating Expenses Credit Credit Credit Credit c. Show the beginning balances and the transactions in a horizontal statements model. Note: Enter any decreases to account balances and cash outflows with a minus sign. In the Statement of Cash Flows column, use the initials OA to designate operating activity, IA for investing activity, FA for financing activity, and NC for net change in cash. Not all cells require input. Number Balance 1 2 3 4 5 6 Balance Cash Assets 0 Accounts Receivable 0 " OAK CONSULTING Effect of Transactions on the Financial Statements for Year 2 Balance Sheet Liabilities Accounts Payable + Stockholders' Equity Common Stock 0 . + Retained Earnings 0 Revenue Income Statement Expenses 0 = Net Income 0 Statement of Cash Flows d-1. Record the closing entries in the general journal (and post them to the T-accounts in Part b). Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < A Record the closure of service revenue. Note: Enter debits before credits. Event 1 Record entry General Journal Clear entry Debit Credit View general journal e. What is the amount of change in retained earnings for the year? Change in retained earnings f. Prepare a post-closing trial balance. Totals OAK CONSULTING Post-Closing Trial Balance As of December 31, Year 2 Debit Account Titles $ 0 $ Credit 0

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Oak Consulting Accounting Transactions and Financial Statements a General Journal Entries Transaction 1 Debit Accounts Receivable 68500 Credit Service ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started