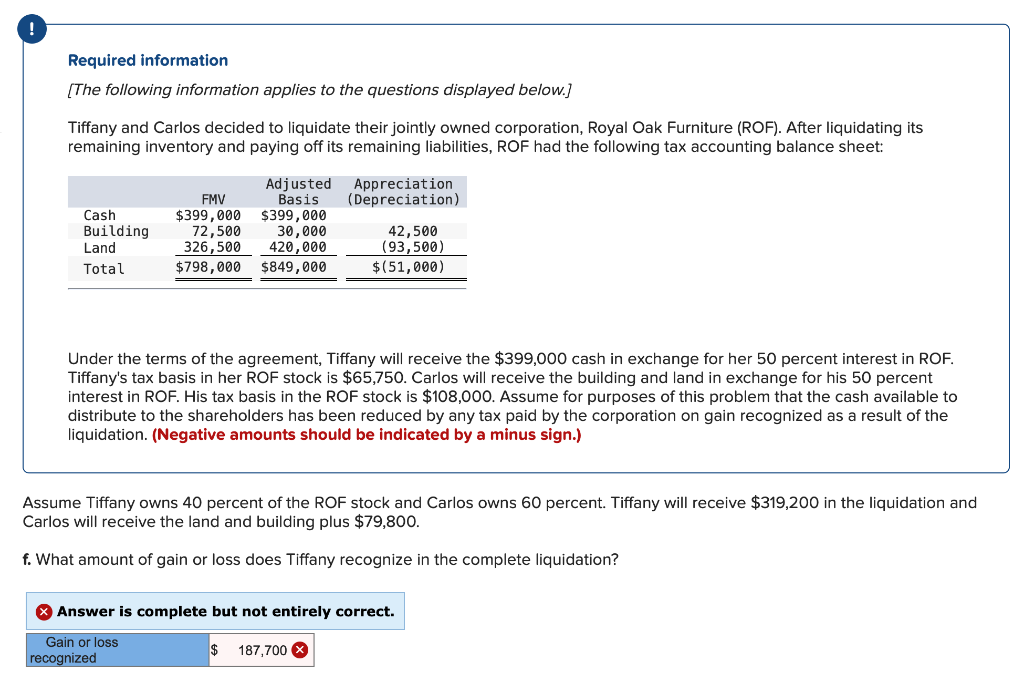

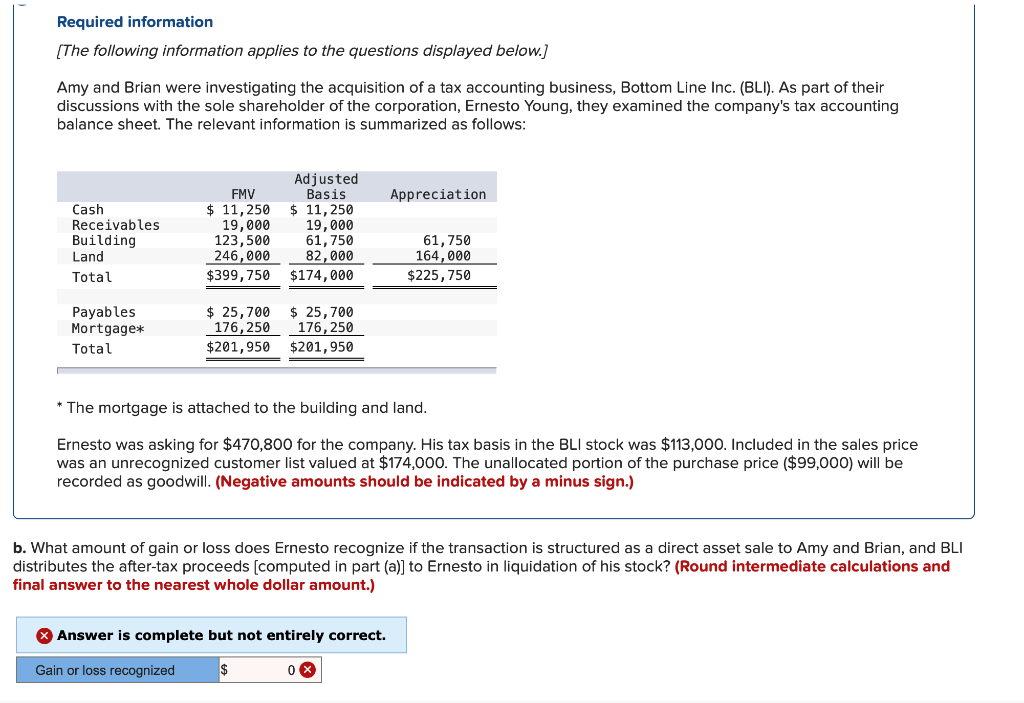

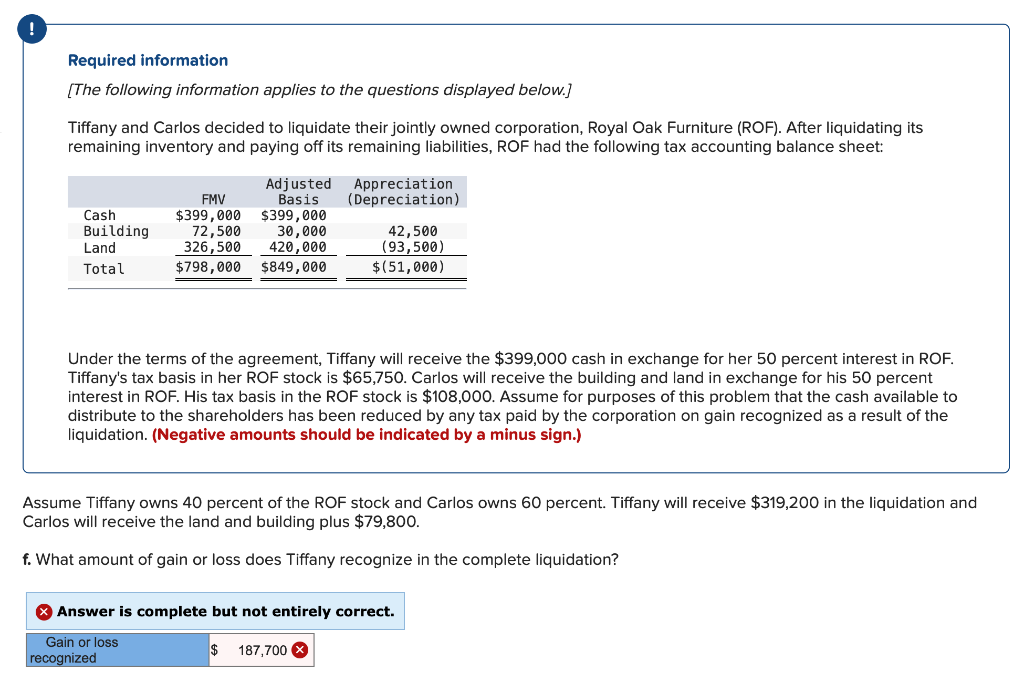

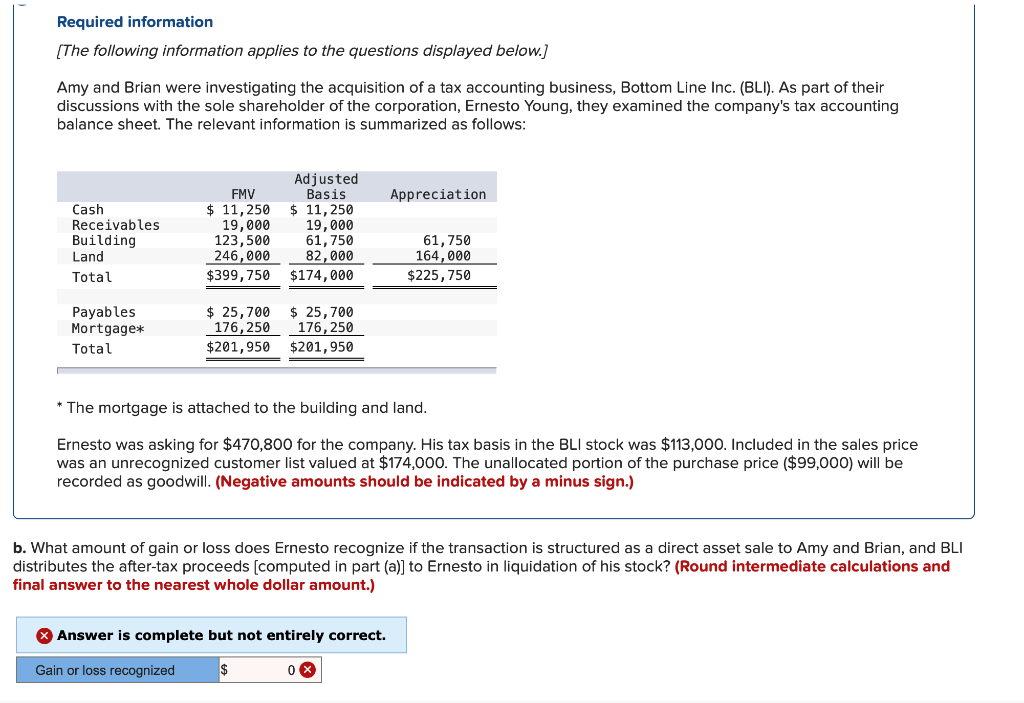

Required information (The following information applies to the questions displayed below. Tiffany and Carlos decided to liquidate their jointly owned corporation, Royal Oak Furniture (ROF). After liquidating its remaining inventory and paying off its remaining liabilities, ROF had the following tax accounting balance sheet: Appreciation (Depreciation) Cash Building Land Total Adjusted FMV Basis $399,000 $399,000 72,500 30,000 326,500 420,000 $798,000 $849,000 42,500 (93,500) $(51,000) Under the terms of the agreement, Tiffany will receive the $399,000 cash in exchange for her 50 percent interest in ROF. Tiffany's tax basis in her ROF stock is $65,750. Carlos will receive the building and land in exchange for his 50 percent interest in ROF. His tax basis in the ROF stock is $108,000. Assume for purposes of this problem that the cash available to distribute to the shareholders has been reduced by any tax paid by the corporation on gain recognized as a result of the liquidation. (Negative amounts should be indicated by a minus sign.) Assume Tiffany owns 40 percent of the ROF stock and Carlos owns 60 percent. Tiffany will receive $319,200 in the liquidation and Carlos will receive the land and building plus $79,800. f. What amount of gain or loss does Tiffany recognize in the complete liquidation? Answer is complete but not entirely correct. Gain or loss recognized $ 187,700 X Required information (The following information applies to the questions displayed below.) Amy and Brian were investigating the acquisition of a tax accounting business, Bottom Line Inc. (BLI). As part of their discussions with the sole shareholder of the corporation, Ernesto Young, they examined the company's tax accounting balance sheet. The relevant information is summarized as follows: Appreciation Cash Receivables Building FMV $ 11,250 19,000 123,500 246,000 $399,750 Adjusted Basis $ 11,250 19,000 61,750 82,000 $174,000 Land 61,750 164,000 $225,750 Total Payables Mortgage* Total $ 25,700 176,250 $201,950 $ 25, 700 176, 250 $201,950 * The mortgage is attached to the building and land. Ernesto was asking for $470,800 for the company. His tax basis in the BLI stock was $113,000. Included in the sales price was an unrecognized customer list valued at $174,000. The unallocated portion of the purchase price ($99,000) will be recorded as goodwill. (Negative amounts should be indicated by a minus sign.) b. What amount of gain or loss does Ernesto recognize if the transaction is structured as a direct asset sale to Amy and Brian, and BLI distributes the after-tax proceeds (computed in part (a)] to Ernesto in liquidation of his stock? (Round intermediate calculations and final answer to the nearest whole dollar amount.) Answer is complete but not entirely correct. Gain or loss recognized $ 0 X