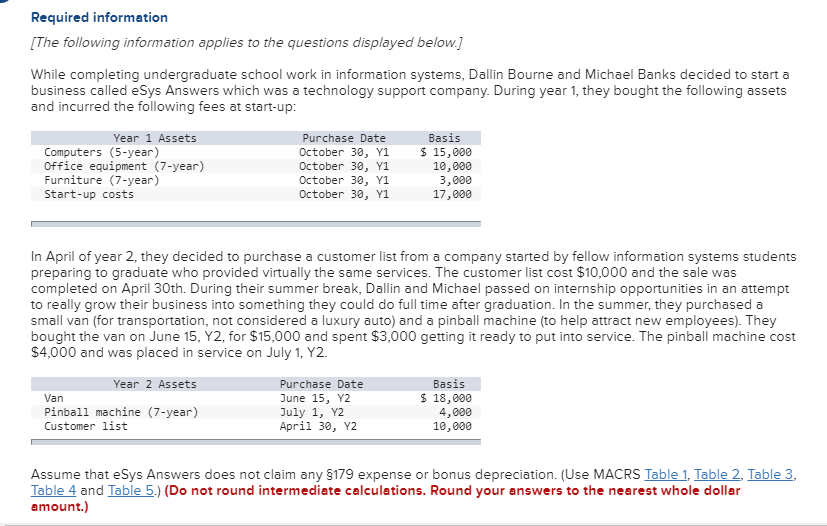

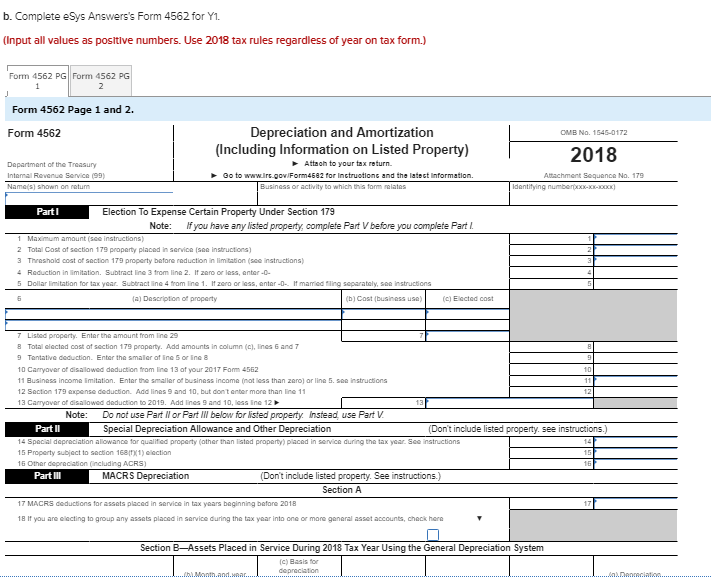

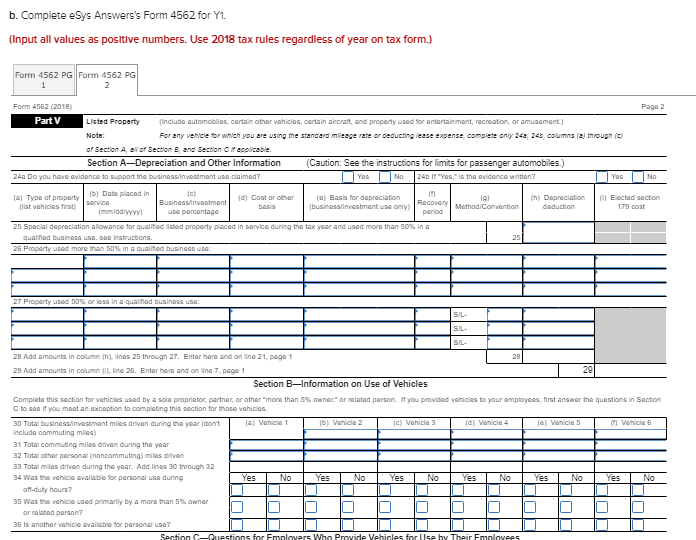

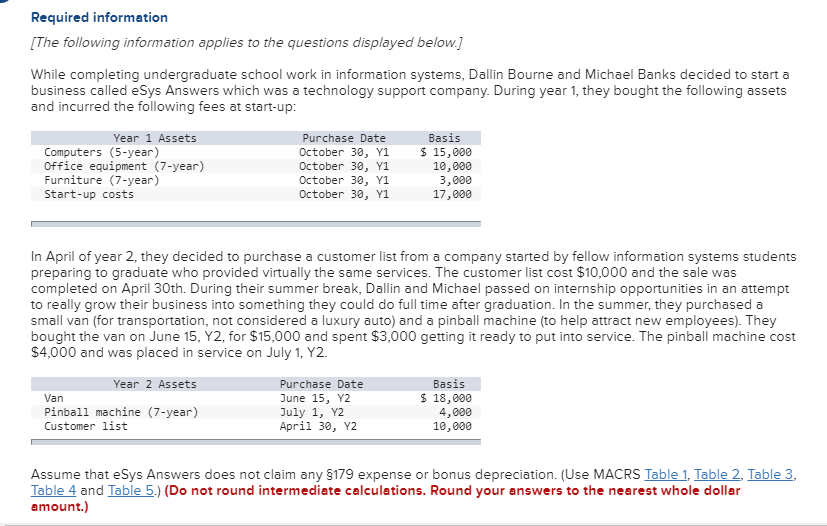

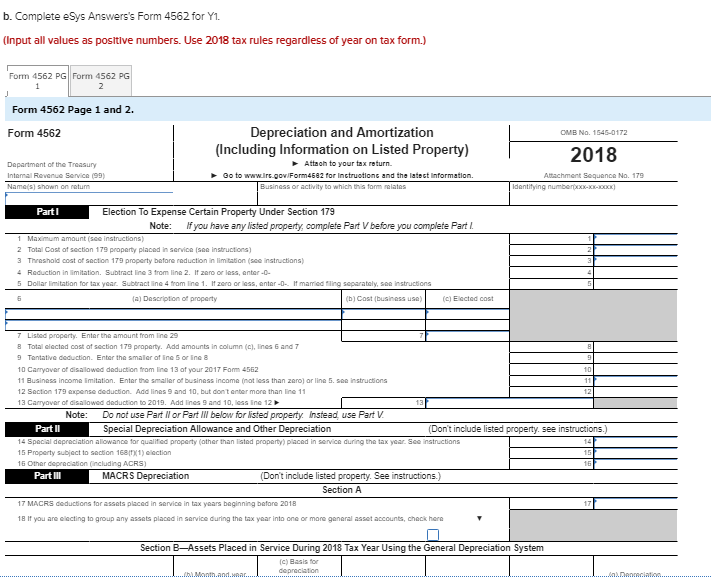

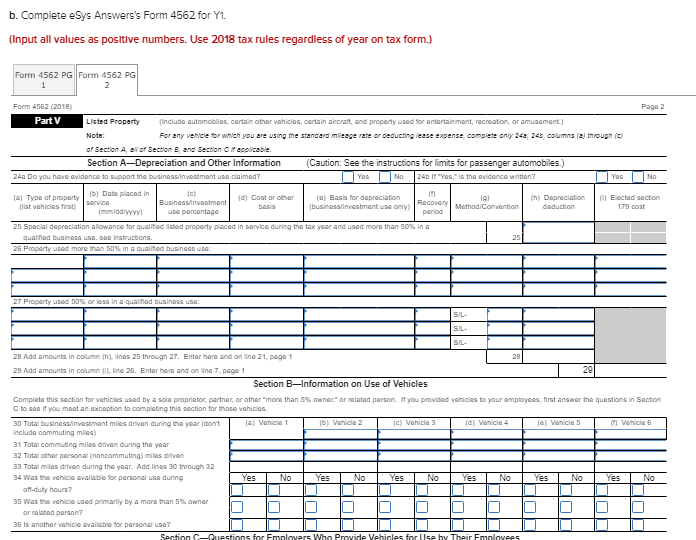

Required information The following information applies to the questions displayed below.] While completing undergraduate school work in information systems, Dallin Bourne and Michael Banks decided to start a business called eSys Answers which was a technology support company. During year 1, they bought the following assets and incurred the following fees at start-up Year 1 Assets Basis Purchase Date October 30, Y1 October 30, Y1 October 30, Y1 October 30, Y1 Computers (5-year) Office equipment (7-year) Furniture (7-year) Start-up costs $ 15,000 10,000 3,000 17,000 In April of year 2, they decided to purchase a customer list from a company started by fellow information systems students preparing to graduate who provided virtually the same services. The customer list cost $10,000 and the sale was completed on April 30th. During their summer break, Dallin and Michael passed on internship opportunities in an attempt to really grow their business into something they could do full time after graduation. In the summer, they purchased a small van (for transportation, not considered a luxury auto) and a pinball machine (to help attract new employees). They bought the van on June 15, Y2, for $15,000 and spent $3,000 getting it ready to put into service. The pinball machine cost $4,000 and was placed in service on July 1, Y2. Year 2 Assets Purchase Date June 15, Y2 July 1, Y2 April 30, Y2 Basis Van $ 18,000 Pinball machine (7-year) Customer list 4,000 10,000 Assume that eSys Answers does not claim any 179 expense or bonus depreciation. (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) b. Complete eSys Answers's Form 4562 for Y1. (Input all values as posltive numbers. Use 2018 tax rules regardless of year on tax form.) Form 4562 PG Form 4562 PG Form 4562 Page 1 and 2. Depreciation and Amortization (Including Information on Listed Property) Form 4562 2018 Attsoh to your tax return Dopartment of the Treasury Go to www.ir.gow Form4682 for Inctruotlons and the latect Information Businss or .ctivity to which this form relates Partl Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part 2 Total Cost of section 179 proparty placed in service (see instructions) 3 Thrashold cost of section 179 property betore reduction in lim tation(see instnuctions) 4 Reduction in limitation. Subtract ine 3 trom line 2. If zero or less, antor- 5 Dollar limitation for tax year. Subtract ine 4 from line 1 " zero or less,Antar-0-- " marred fling separately, see nstructions (a) Description of property (b) Cost (business uSD) (c) Elacted cost Listed property. Enter the amount from line 29 B Total elacted cost of section 179 property. Add amounts in column (c), lines and 7 9 Tantative deduction. Entor tha smaler of ina 5 or ine 8 10 Carryovar of disallowed doduction from inc 13 of your 2017 Fomm 4562 11 Business income Emitation. Enter the smaller of business incoma (not less than zaro) or line 5.Se instructions 12 Saction 179 xpense deduction. Add lines 9 and 1D, but dont anter more than ine 11 9 and 10 Add ines s Note: Do not use Part or Part Ill below for listed property Instead use Part V Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property. see instructions.) depraciation allowance for qualified proparty (other than Isted property) placed in service during the tax yoar Se instructions 5 Property subject to section 168x1)action Part lll MACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assots placed in service in tax years baginning batore 2018 18 If you are elacting to group any assets placed in service during the tax yoar into one or mane ganeral asset accounts, check here Section B-Assets Placed in Service During 2018 Tax Year Using the General (C) Basis for n System b. Complete eSys Answers's Form 4562 for Y1. (Input all values as posltive numbers. Use 2018 tax rules regardless of year on tax form.) Form 4562 PG Form 4562 PG Form 4562 (2018) Page 2 Part V Listed Property (Include automobiles. cartan other vehicles, certain aircraft, and property u50d for ntertainment, recreation, oramusement) For any vehce orhich you are using tne standerd mlieage rete or deducting lease expense, complete only 24, 24, columns (aj mouph(c of Section A, avof Section B, and Section C fecpllcable. Section A-Depreciation and Other Information Caution: See the instructions for limits for passenger automobiles.) b) Dabe placed in (a) Type of proparty (d) Cost or othar (a) Bass for dapreciation Ig) h) Dapraciation Elactod saction Racovery at vahicles first) use parcentage 25 Special depreciation allowance lor qualifed sted property placed in service during the tax year and used more than 50% in a qualifiad business S 28 Add amounts in column (h). ines 25 through 27. Enter hane and an ine 21. paga 1 29 Section B-Information on Use of Vehicles complate this section for vehicles used by a sole propriator, partner, or other more than 5% owner,"or r lated person. C to sea if you meat an excaption to complating this section for those vahicles f you prov ded vehicles to your employees first answer the questions in secton t milas drivan during the year (dont ncluda commuting milas) 1 Total commuting miles driven during the year 2 Total othar personal (nancommuting) miles driven 3 Total mlas driven during the year. Add lines 30 through 32 34 Was the vahicle available for personal use during off-duty hours? 35 Was the vehicle used primarly by a more than 5% owner or related parson 36 Is another vehicle availabla for personal uSO? Required information The following information applies to the questions displayed below.] While completing undergraduate school work in information systems, Dallin Bourne and Michael Banks decided to start a business called eSys Answers which was a technology support company. During year 1, they bought the following assets and incurred the following fees at start-up Year 1 Assets Basis Purchase Date October 30, Y1 October 30, Y1 October 30, Y1 October 30, Y1 Computers (5-year) Office equipment (7-year) Furniture (7-year) Start-up costs $ 15,000 10,000 3,000 17,000 In April of year 2, they decided to purchase a customer list from a company started by fellow information systems students preparing to graduate who provided virtually the same services. The customer list cost $10,000 and the sale was completed on April 30th. During their summer break, Dallin and Michael passed on internship opportunities in an attempt to really grow their business into something they could do full time after graduation. In the summer, they purchased a small van (for transportation, not considered a luxury auto) and a pinball machine (to help attract new employees). They bought the van on June 15, Y2, for $15,000 and spent $3,000 getting it ready to put into service. The pinball machine cost $4,000 and was placed in service on July 1, Y2. Year 2 Assets Purchase Date June 15, Y2 July 1, Y2 April 30, Y2 Basis Van $ 18,000 Pinball machine (7-year) Customer list 4,000 10,000 Assume that eSys Answers does not claim any 179 expense or bonus depreciation. (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) b. Complete eSys Answers's Form 4562 for Y1. (Input all values as posltive numbers. Use 2018 tax rules regardless of year on tax form.) Form 4562 PG Form 4562 PG Form 4562 Page 1 and 2. Depreciation and Amortization (Including Information on Listed Property) Form 4562 2018 Attsoh to your tax return Dopartment of the Treasury Go to www.ir.gow Form4682 for Inctruotlons and the latect Information Businss or .ctivity to which this form relates Partl Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part 2 Total Cost of section 179 proparty placed in service (see instructions) 3 Thrashold cost of section 179 property betore reduction in lim tation(see instnuctions) 4 Reduction in limitation. Subtract ine 3 trom line 2. If zero or less, antor- 5 Dollar limitation for tax year. Subtract ine 4 from line 1 " zero or less,Antar-0-- " marred fling separately, see nstructions (a) Description of property (b) Cost (business uSD) (c) Elacted cost Listed property. Enter the amount from line 29 B Total elacted cost of section 179 property. Add amounts in column (c), lines and 7 9 Tantative deduction. Entor tha smaler of ina 5 or ine 8 10 Carryovar of disallowed doduction from inc 13 of your 2017 Fomm 4562 11 Business income Emitation. Enter the smaller of business incoma (not less than zaro) or line 5.Se instructions 12 Saction 179 xpense deduction. Add lines 9 and 1D, but dont anter more than ine 11 9 and 10 Add ines s Note: Do not use Part or Part Ill below for listed property Instead use Part V Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property. see instructions.) depraciation allowance for qualified proparty (other than Isted property) placed in service during the tax yoar Se instructions 5 Property subject to section 168x1)action Part lll MACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assots placed in service in tax years baginning batore 2018 18 If you are elacting to group any assets placed in service during the tax yoar into one or mane ganeral asset accounts, check here Section B-Assets Placed in Service During 2018 Tax Year Using the General (C) Basis for n System b. Complete eSys Answers's Form 4562 for Y1. (Input all values as posltive numbers. Use 2018 tax rules regardless of year on tax form.) Form 4562 PG Form 4562 PG Form 4562 (2018) Page 2 Part V Listed Property (Include automobiles. cartan other vehicles, certain aircraft, and property u50d for ntertainment, recreation, oramusement) For any vehce orhich you are using tne standerd mlieage rete or deducting lease expense, complete only 24, 24, columns (aj mouph(c of Section A, avof Section B, and Section C fecpllcable. Section A-Depreciation and Other Information Caution: See the instructions for limits for passenger automobiles.) b) Dabe placed in (a) Type of proparty (d) Cost or othar (a) Bass for dapreciation Ig) h) Dapraciation Elactod saction Racovery at vahicles first) use parcentage 25 Special depreciation allowance lor qualifed sted property placed in service during the tax year and used more than 50% in a qualifiad business S 28 Add amounts in column (h). ines 25 through 27. Enter hane and an ine 21. paga 1 29 Section B-Information on Use of Vehicles complate this section for vehicles used by a sole propriator, partner, or other more than 5% owner,"or r lated person. C to sea if you meat an excaption to complating this section for those vahicles f you prov ded vehicles to your employees first answer the questions in secton t milas drivan during the year (dont ncluda commuting milas) 1 Total commuting miles driven during the year 2 Total othar personal (nancommuting) miles driven 3 Total mlas driven during the year. Add lines 30 through 32 34 Was the vahicle available for personal use during off-duty hours? 35 Was the vehicle used primarly by a more than 5% owner or related parson 36 Is another vehicle availabla for personal uSO