Question

Required information [The following information applies to the questions displayed below.] L. A. and Paula file as married taxpayers. In August of this year,

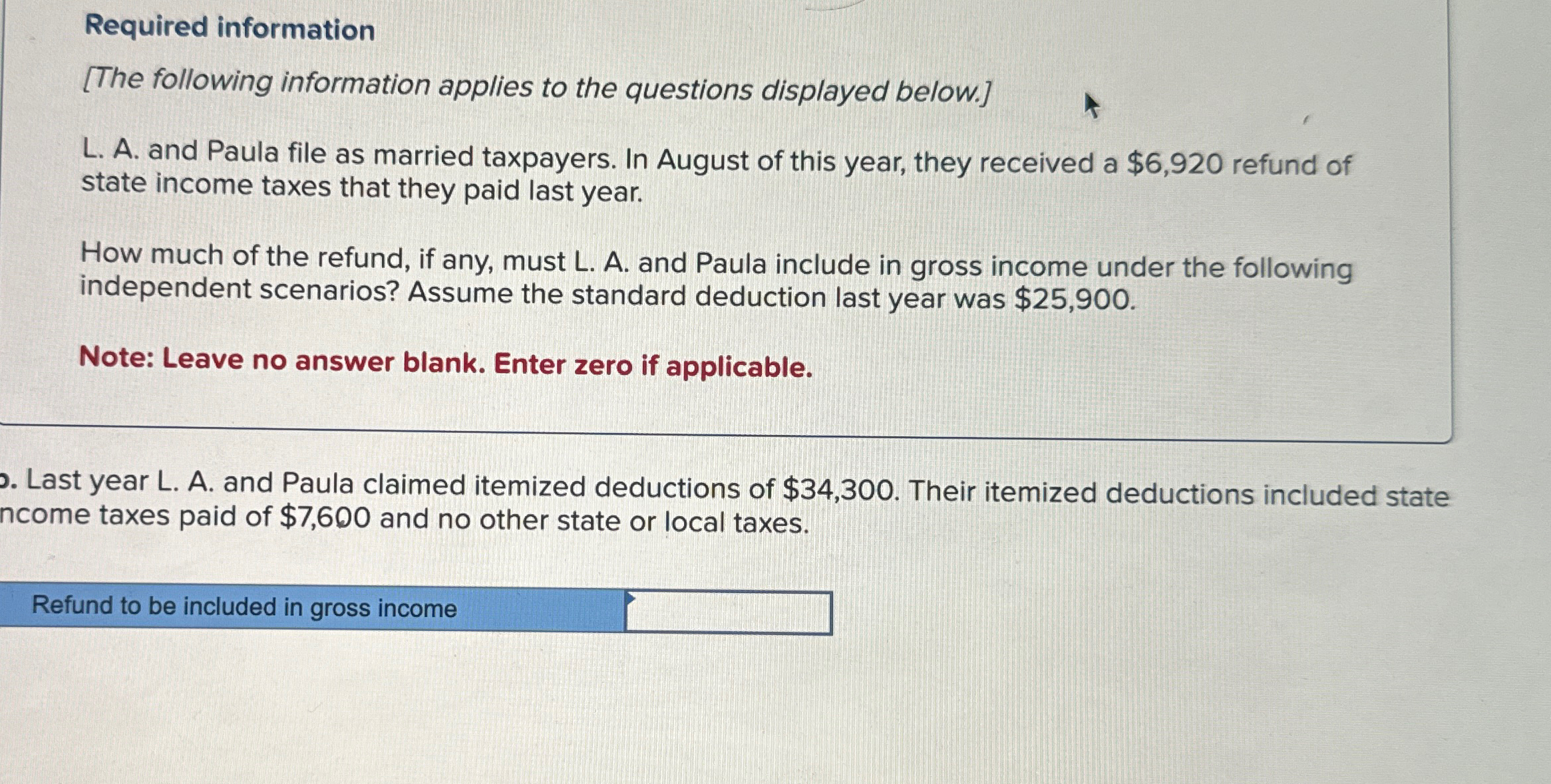

Required information [The following information applies to the questions displayed below.] L. A. and Paula file as married taxpayers. In August of this year, they received a $6,920 refund of state income taxes that they paid last year. How much of the refund, if any, must L. A. and Paula include in gross income under the following independent scenarios? Assume the standard deduction last year was $25,900. Note: Leave no answer blank. Enter zero if applicable. b. Last year L. A. and Paula claimed itemized deductions of $34,300. Their itemized deductions included state ncome taxes paid of $7,600 and no other state or local taxes. Refund to be included in gross income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation Of Individuals And Business Entities 2023 Edition

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham

14th Edition

1265790299, 978-1265790295

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App