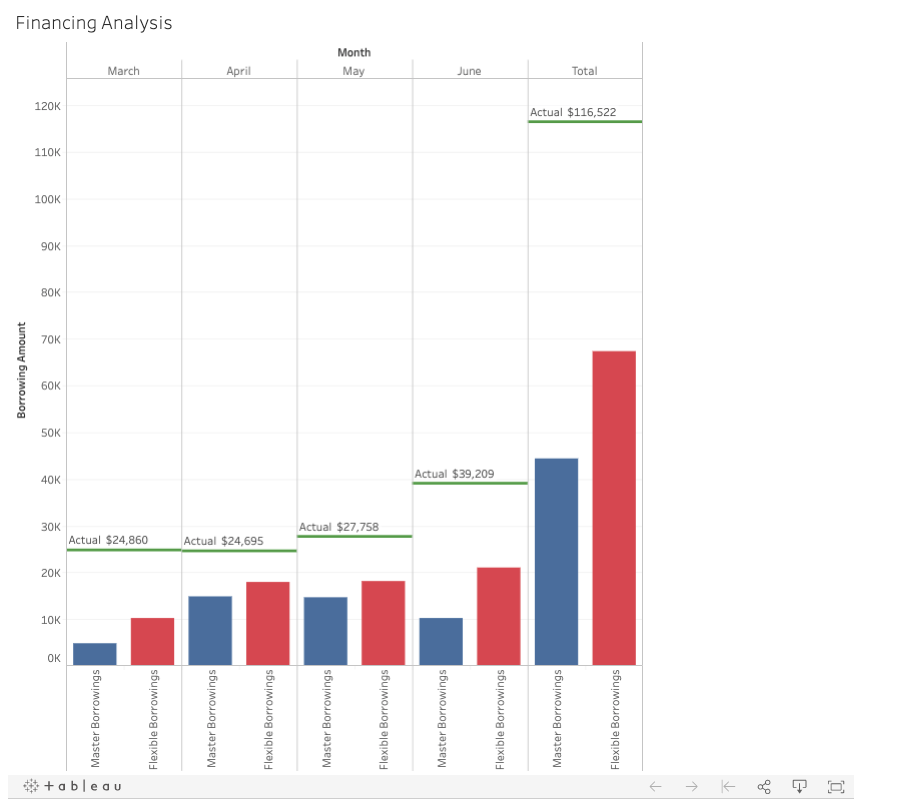

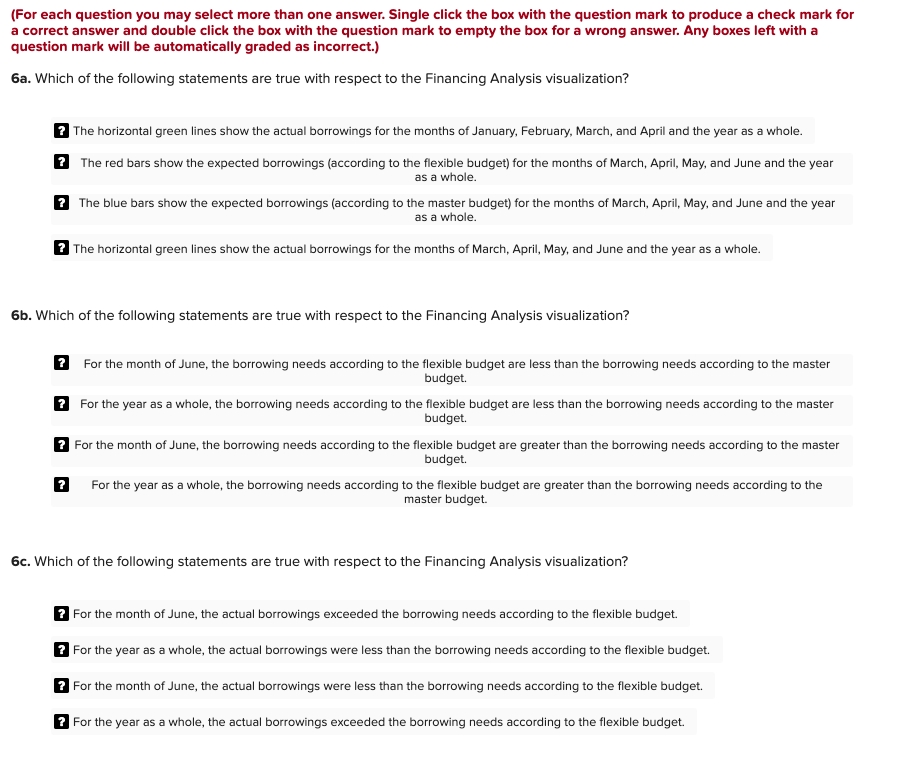

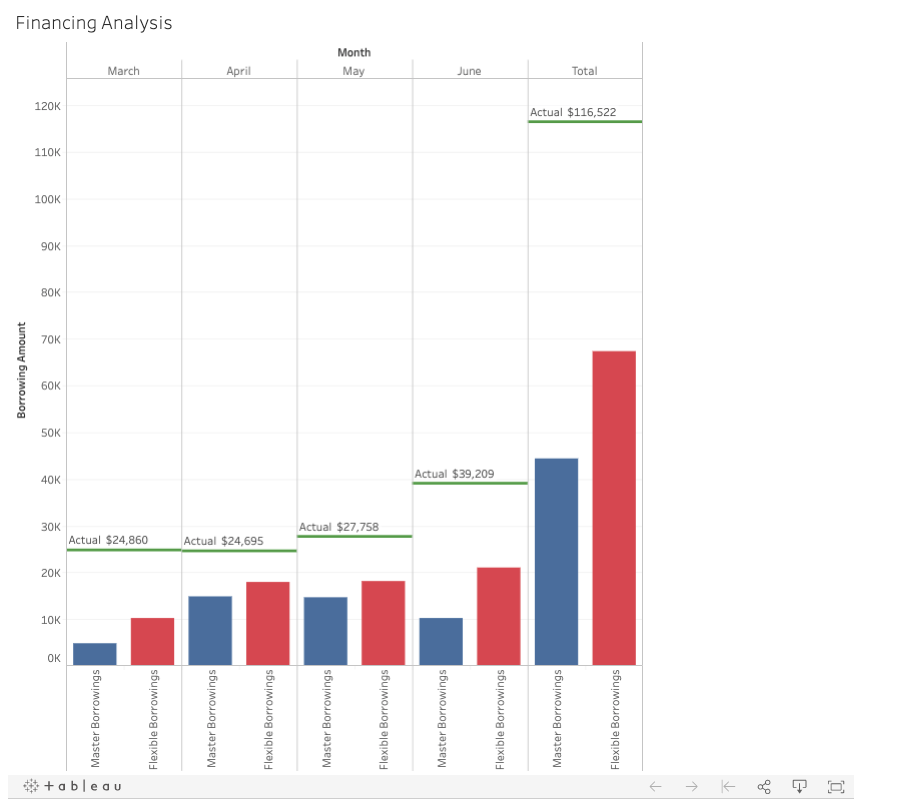

Required information (The following information applies to the questions displayed below.) Williams Company is a merchandiser and its accounting department has finished preparing a flexible budget to better understand the differences between its actual results and the master budget. The chief financial officer (CFO) would like your assistance in interpreting some data visualizations that she will use to explain why the company's actual results differed from its master budget. Required: Review the Tableau dashboards that the CFO has given you and answer the questions that follow. Financing Analysis Month May March April June Total 120K Actual $116,522 110K 100K 90K 70K Borrowing Amount 60K SOK 40K Actual $39,209 Actual $27,758 30K Actual $24,860 Actual $24,695 20K Master Borrowings Flexible Borrowings Master Borrowings Flexible Borrowings Master Borrowings Flexible Borrowings Master Borrowings Flexible Borrowings Master Borrowings Flexible Borrowings ** tableau go t O (For each question you may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) 6a. Which of the following statements are true with respect to the Financing Analysis visualization? The horizontal green lines show the actual borrowings for the months of January, February, March, and April and the year as a whole. ? The red bars show the expected borrowings (according to the flexible budget) for the months of March, April, May, and June and the year as a whole. 2 The blue bars show the expected borrowings (according to the master budget) for the months of March, April, May, and June and the year as a whole. 2 The horizontal green lines show the actual borrowings for the months of March, April, May, and June and the year as a whole. 6b. Which of the following statements are true with respect to the Financing Analysis visualization? ? For the month of June, the borrowing needs according to the flexible budget are less than the borrowing needs according to the master budget 2 For the year as a whole, the borrowing needs according to the flexible budget are less than the borrowing needs according to the master budget 7 For the month of June, the borrowing needs according to the flexible budget are greater than the borrowing needs according to the master budget. For the year as a whole, the borrowing needs according to the flexible budget are greater than the borrowing needs according to the master budget. 6c. Which of the following statements are true with respect to the Financing Analysis visualization? 2 For the month of June, the actual borrowings exceeded the borrowing needs according to the flexible budget. For the year as a whole, the actual borrowings were less than the borrowing needs according to the flexible budget. For the month of June, the actual borrowings were less than the borrowing needs according to the flexible budget. For the year as a whole, the actual borrowings exceeded the borrowing needs according to the flexible budget. 6d. Which of the following insights are revealed by the Financing Analysis visualization? 2 The company expected to borrow money during five months of the year; however, its actual borrowings were greater than expectations in all five of those months. 2 The company expected to borrow money during five months of the year; however, its actual borrowings were less than expectations in all five of those months. 2 The company expected to borrow money during four months of the year; however, its actual borrowings were less than expectations in all four of those months. 2 The company expected to borrow money during four months of the year; however, its actual borrowings were greater than expectations in all four of those months