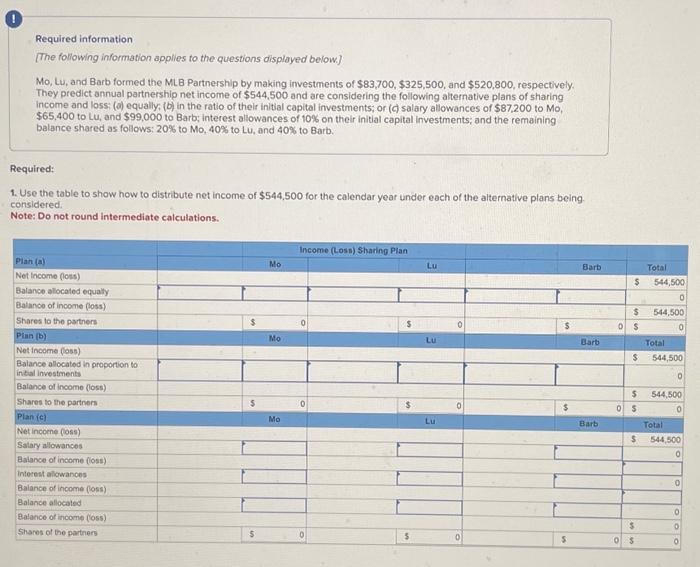

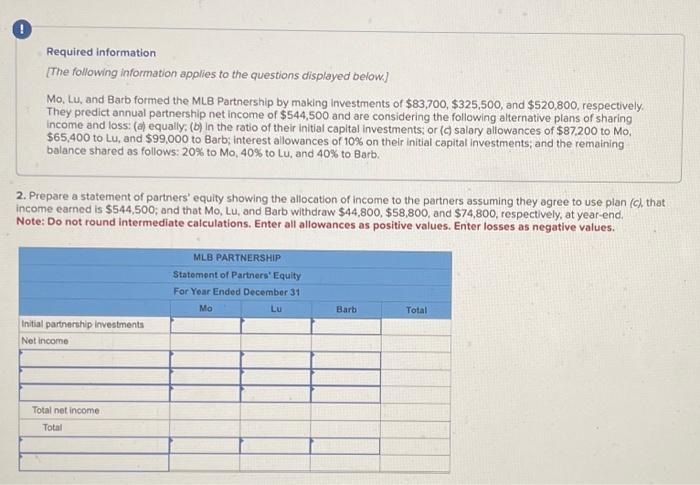

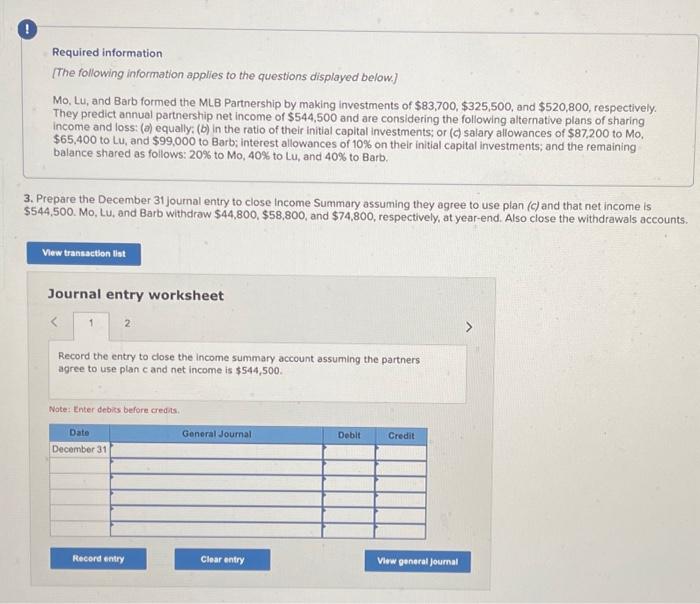

Required information [The following information applies to the questions displayed below] Mo, Lu, and Barb formed the MLB Partnership by making investments of $83,700,$325,500, and $520,800, respectively. They predict annual partnership net income of $544,500 and are considering the following alternative plans of sharing income and loss; (o) equally; (b) in the ratio of their initial capital investments; or (C) salary allowances of $87,200 to Mo, $65,400 to Lu, and $99,000 to Barb; interest allowances of 10% on their initial capital investments; and the remaining balance shared as follows: 20% to Mo, 40% to LU, and 40% to Barb. Required: 1. Use the table to show how to distribute net income of $544,500 for the calendar year under each of the alternative plans being considered. Note: Do not round intermediate calculations. Required information [The following information applies to the questions displayed below] Mo, Lu, and Barb formed the MLB Partnership by making investments of $83,700,$325,500, and $520,800, respectively. They predict annual partnership net income of $544,500 and are considering the following alternative plans of sharing income and loss: (d) equally, (b) in the ratio of their initial capital investments; or (c) salary allowances of $87.200 to Mo, $65,400 to Lu, and $99,000 to Barb; interest allowances of 10% on their initial capital investments; and the remaining balance shared as follows: 20% to Mo,40% to Lu, and 40% to Barb. 2. Prepare a statement of partners' equity showing the allocation of income to the partners assuming they agree to use plan (c) that income earned is $544,500; and that Mo, Lu, and Barb withdraw $44,800,$58,800, and $74,800, respectively, at year-end. Note: Do not round intermediate calculations. Enter all allowances as positive values. Enter losses as negative values. Required information [The following information applies to the questions displayed below.] Mo, Lu, and Barb formed the MLB Partnership by making investments of $83,700,$325,500, and $520,800, respectively. They predict annual partnership net income of $544,500 and are considering the following alternative plans of sharing income and loss: (a) equally; (b) in the ratio of their initial capital investments; or (c) salary allowances of $87,200 to Mo. $65,400 to Lu, and $99,000 to Barb; interest allowances of 10% on their initial capital investments; and the remaining balance shared as follows: 20% to Mo, 40% to Lu, and 40% to Barb. 3. Prepare the December 31 journal entry to close income Summary assuming they agree to use plan (c) and that net income is $544,500. Mo, Lu, and Barb withdraw $44,800,$58,800, and $74,800, respectively, at year-end. Also close the withdrawals accounts. Journal entry worksheet 2 Record the entry to close the income summary account assuming the partners agree to use plan c and net income is $544,500. Note: Enter debits before cred/s. Required information [The following information applies to the questions displayed below.] Mo, Lu, and Barb formed the MLB Partnership by making investments of $83,700,$325,500, and $520,800, respectively They predict annual partnership net income of $544,500 and are considering the following alternative plans of sharing income and loss: (a) equally; (b) in the ratio of their initial capital investments; or (c) salary allowances of $87,200 to Mo, $65,400 to Lu, and $99,000 to Barb; interest allowances of 10% on their initial capital investments; and the remaining balance shared as follows: 20% to Mo,40% to Lu, and 40% to Barb. Prepare the December 31 journal entry to close income Summary assuming they agree to use plan (c) and that net income is 544,500 . Mo, Lu, and Barb withdraw $44,800,$58,800, and $74,800, respectively, at year-end. Also close the withdrawals accounts. Journal entry worksheet Record the entry to close the partners' withdrawats accounts. (Mo, Lu, and Barb withdraw $44,800,$58,800, and $74,800, respectively, at year-end.) Notet Enter alebits before crediss