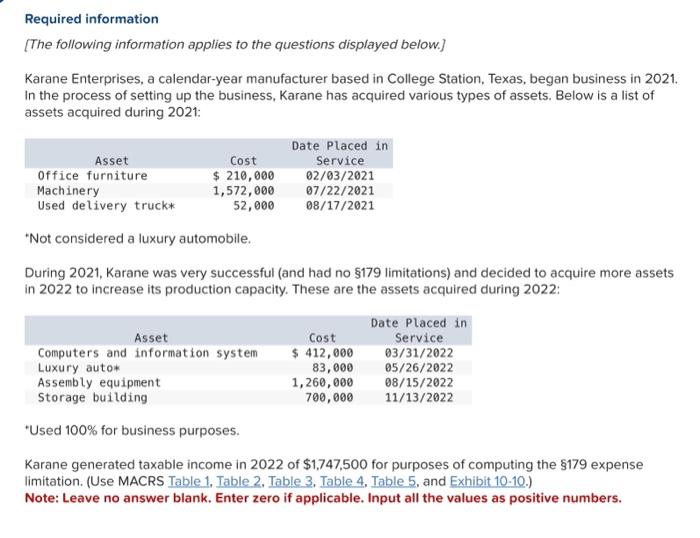

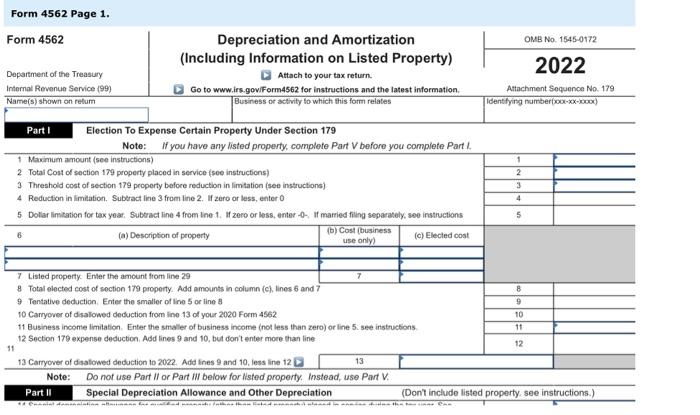

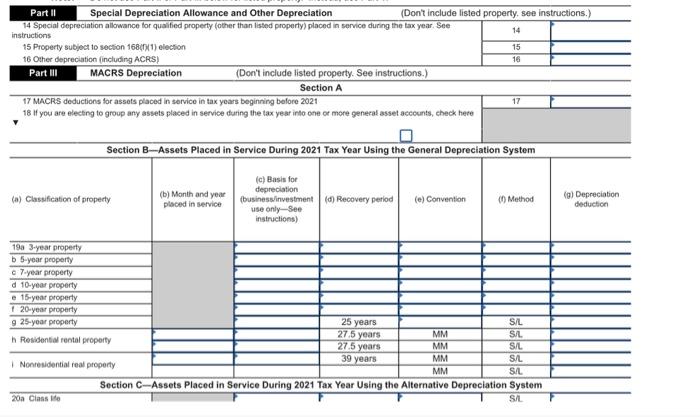

Required information [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2021. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2021: "Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2022 to increase its production capacity. These are the assets acquired during 2022 : "Used 100% for business purposes. Karane generated taxable income in 2022 of $1,747,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1, Table 2, Table 3, Table 4. Table 5, and Exhibit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. Form 4562 Page 1. Part I Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part 1. Note: Do not use Part II or Part in below for isted property. Instead, use Part V. Part II Special Depreciation Allowance and Other Depreciation (Don' include listed property. see instructions.) Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property, see instructions.) 14 Special depreciation allowance for quaified property (other than listed property) placed in service during the tax year. See instructions 15 Property subject to section 168 chindi) election 16 Cther depreciation (including ACPSS) Part III MACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2021 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here 21 Lisled property. Enler amouns from line 28 22. Total. Add amounts from line 12, lines 14 through 17 , lines 19 and 20 in colume ( g ), and line 21. Enser here and on the appropriate lines of your retum. Partnerships and 8 corporations-see instructions 23 For assets shown above and placed in service during the current yeas, enter the portion of the basis attibutabie to section 263A costs For Paperwork Reduction Act Notice, see separate instructions. Cat. No, 12906N \begin{tabular}{|l|} \hline 21 \\ \hline 22 \\ \hline \end{tabular} THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE. THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2022 MeGraw-Hill Education. Form 4562 Page 2. Section B-Information on Use of Vehicles Compiele this section for vehicles used by a sole proprietor, partner, or other "more than 5% owner," or related person. If you provided vehicles to your employees, first answer the questions in Section C to see if you meet an exception to completing this section for those vehicles. Section C-Questions for Employers Who Provide Vehicles for Use by Their Employees Answer these questions to determine if you meet an excoption to completing Section B for vehiclos used by employees who arent more than 5% owners or related persons, seo instructions. 37 Do you maintain a written policy statement that prohibts all personal use of vehicles, including commuting, by your employees? 38 Do you maintain a written policy statement that prohibits personal use of vehicles, except commuting, by your empleyees? See the instructions for vehicles used by corporate otficers, directors, or 1% or more owners. 39 Do you treat at uso of vehicles by employees as personal use? 40 Do you provide more than five vehicles to your employees. obtain information trom your employees about the use of the vehicles. and rotain the information received? 41 Do you moet the requirements concoming qualified automobile domonstration use? See instructions. Note: "I your answer fo 37, 38. 39, 40, or 41 is "Yes," don" complete Section B for the covend vohiches. THES FORM IS A \&IMULATION OF AN OF PICIAL U.S. TAX FOFM. IT IS NOT THE OF FICIAL. FORM ITSLL. DO NOT USE THES FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONA., 2022 MeGrawhai Education. Required information [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2021. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2021: "Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2022 to increase its production capacity. These are the assets acquired during 2022 : "Used 100% for business purposes. Karane generated taxable income in 2022 of $1,747,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1, Table 2, Table 3, Table 4. Table 5, and Exhibit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers. Form 4562 Page 1. Part I Election To Expense Certain Property Under Section 179 Note: If you have any listed property, complete Part V before you complete Part 1. Note: Do not use Part II or Part in below for isted property. Instead, use Part V. Part II Special Depreciation Allowance and Other Depreciation (Don' include listed property. see instructions.) Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property, see instructions.) 14 Special depreciation allowance for quaified property (other than listed property) placed in service during the tax year. See instructions 15 Property subject to section 168 chindi) election 16 Cther depreciation (including ACPSS) Part III MACRS Depreciation (Don't include listed property. See instructions.) Section A 17 MACRS deductions for assets placed in service in tax years beginning before 2021 18 If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here 21 Lisled property. Enler amouns from line 28 22. Total. Add amounts from line 12, lines 14 through 17 , lines 19 and 20 in colume ( g ), and line 21. Enser here and on the appropriate lines of your retum. Partnerships and 8 corporations-see instructions 23 For assets shown above and placed in service during the current yeas, enter the portion of the basis attibutabie to section 263A costs For Paperwork Reduction Act Notice, see separate instructions. Cat. No, 12906N \begin{tabular}{|l|} \hline 21 \\ \hline 22 \\ \hline \end{tabular} THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE. THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2022 MeGraw-Hill Education. Form 4562 Page 2. Section B-Information on Use of Vehicles Compiele this section for vehicles used by a sole proprietor, partner, or other "more than 5% owner," or related person. If you provided vehicles to your employees, first answer the questions in Section C to see if you meet an exception to completing this section for those vehicles. Section C-Questions for Employers Who Provide Vehicles for Use by Their Employees Answer these questions to determine if you meet an excoption to completing Section B for vehiclos used by employees who arent more than 5% owners or related persons, seo instructions. 37 Do you maintain a written policy statement that prohibts all personal use of vehicles, including commuting, by your employees? 38 Do you maintain a written policy statement that prohibits personal use of vehicles, except commuting, by your empleyees? See the instructions for vehicles used by corporate otficers, directors, or 1% or more owners. 39 Do you treat at uso of vehicles by employees as personal use? 40 Do you provide more than five vehicles to your employees. obtain information trom your employees about the use of the vehicles. and rotain the information received? 41 Do you moet the requirements concoming qualified automobile domonstration use? See instructions. Note: "I your answer fo 37, 38. 39, 40, or 41 is "Yes," don" complete Section B for the covend vohiches. THES FORM IS A \&IMULATION OF AN OF PICIAL U.S. TAX FOFM. IT IS NOT THE OF FICIAL. FORM ITSLL. DO NOT USE THES FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONA., 2022 MeGrawhai Education