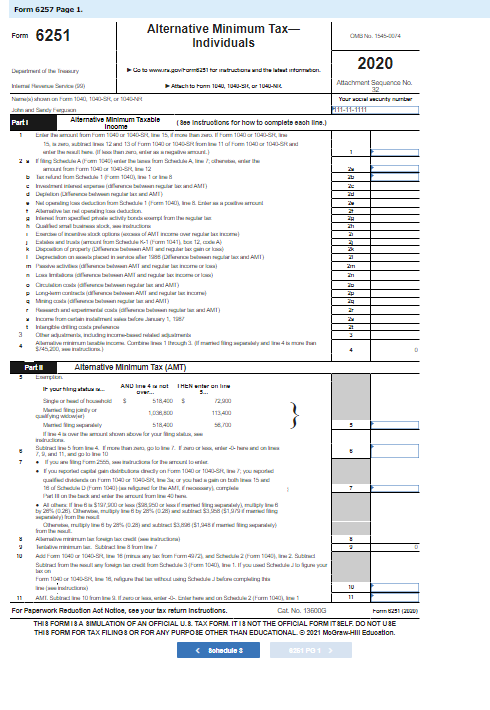

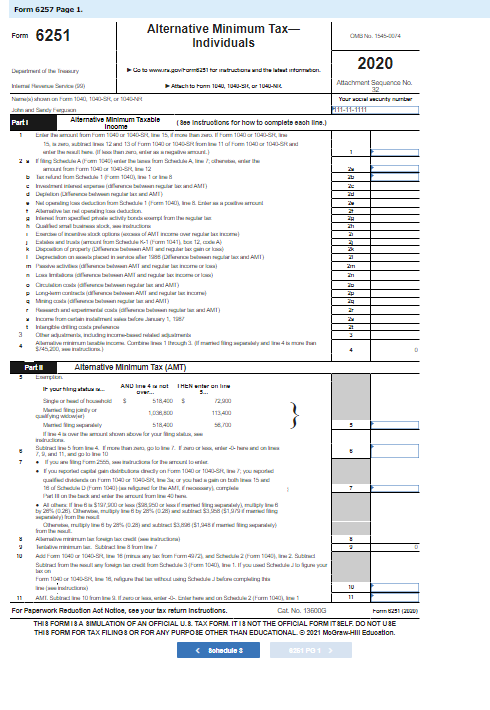

Required information [The following information applies to the questions displayed below. John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2021, John worked as a computer technician at a local university earning a salary of $152,000, and Sandy worked part time as a receptionist for a law firm earning a salary of $29,000. John also does some Web design work on the side and reported revenues of $4,000 and associated expenses of $750. The Fergusons received $800 in qualified dividends and a $200 refund of their state income taxes. The Fergusons always itemize their deductions, and their itemized deductions were well over the standard deduction amount last year. Assume the Fergusons did not receive an advance payment for the 2021 individual recovery credit because they are not eligible for the credit. Use Exhibit 8-10, Tax Rate Schedule, Dividends and Capital Gains Tax Rates, 2021 AMT exemption for reference. The Fergusons reported making the following payments during the year: State income taxes of $4,400. Federal tax withholding of $21,000. Alimony payments to John's former wife of $10,000 (divorced 12/31/2014). Child support payments for John's child with his former wife of $4,100. $12,200 of real property taxes. Sandy was reimbursed $600 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer. $3,600 to Kid Care day care center for Samantha's care while John and Sandy worked. $14,000 interest on their home mortgage ($400,000 acquisition debt). $3,000 interest on a $40,000 home-equity loan. They used the loan to pay for a family vacation and new car. $15,000 cash charitable contributions to qualified charities. Donation of used furniture to Goodwill. The furniture had a fair market value of $400 and cost $2,000. Complete pages 1 and 2, Schedule 1, Schedule 2, and Schedule 3 of Form 1040 and Form 6251 for John and Sandy. John and Sandy Ferguson's address is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: John (DOB 11/07/1970): 111-11-1111 Sandy (DOB 6/24/1972): 222-22-2222 Samantha (DOB 9/30/2016): 333-33-3333 Alimony recipient: 555-55-5555 Your security 2 2H ah 2p Form 6257 Page 1 Form 6251 Alternative Minimum Tax- CM 1545-0014 Individuals 2020 Deanit Try Co to www.ra.govtmc21 terratruction and the stationen and HD Ach to tonn 1043, 104-84 210- Attachment Sequence No. Namen noem 100, 100-1040 Icha Sayang 11.11.11 Parti Alternative Minimum Taxable (800 instructions for how to completo schline. Income Erbreceno 1040 1040-8. i 15. me. I rem 10421093-8, bine 12 to form for 10408x11o Fem 100cm 1000 Sk ll hara a laa ltar 2 incheon 1040 Thuan Ali Tolbos, som om 100 x 1000-12 la 10,1 ore 2 deprechend AMI Depildinfo AMI) Nel cochonneum, respect Abidden Horari diverse compromise Obed small bow Endrup (Albarin 1 Einaren om de K-1 om 1041) bor 12. Decalon parapety Db AMI dar bericol 4 Decodinou a bubar se AVI) mladiva (balan Allah 2 - Limitada bilang bercommer) Celine furre la AMI) Locaba Avenger Ming. WAMI) Mechand paid aber AVI ar honcurrently 17 Harringsplan Abdul income taltechifmated field is more $145.200, Part Alternative Minimum Tax (AMT) Em If your hair AND I THEN antar online Singer had hoolds 514.400 Murrectly or MO 113.400 Maria Madely 58.400 If we were turister your lists, Subredere regolare -- 1,911, do 10 . If you wag om het .yol ile pentru ca inclyn Fem 100 100 Skype dhed onto 1040 you again on the Schedule Difum 100AMT, cride will be secundair 40 . Alles i les 7.300cr la cele mai mulply in by 200 ha, mulplyn by2002) sara 19 mars Charter multiply lined by 20:24) und bract 51.925 mm apuestasy) Ahead lauguet (pass naturn) lub in Streami! AddFcm 1040 1040, lire 18 e renome 2) Studi (1046), 2. und Stined from souligned from Sadecem 10), in 11 your below your Foam 13 or 1040-82, Ingrid Jul cardiga reduce AMI. Sadre Tornio br. En dan Sadu 2 Form Tour For Paperwork Reduction Act Notice, ceo your tax return Intruotions. Cat No. 13800G Form 231/2009 THIS FORMI8A SIMULATION OF AN OFFICIAL U. & TAX FORM. IT IS NOT THE OFFICIAL FORMIT BELF. DO NOT USE THIS FORM FOR TAX FILING OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2021 MoGraw-Hill Education.