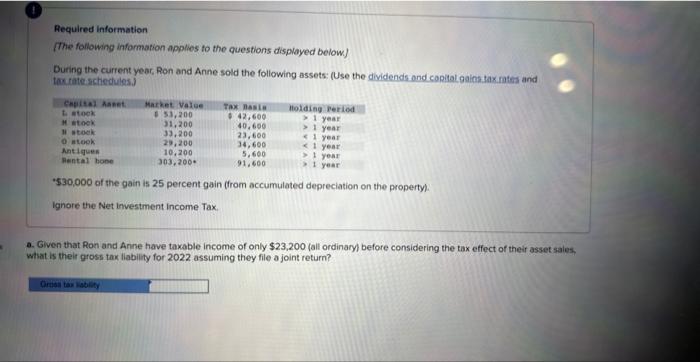

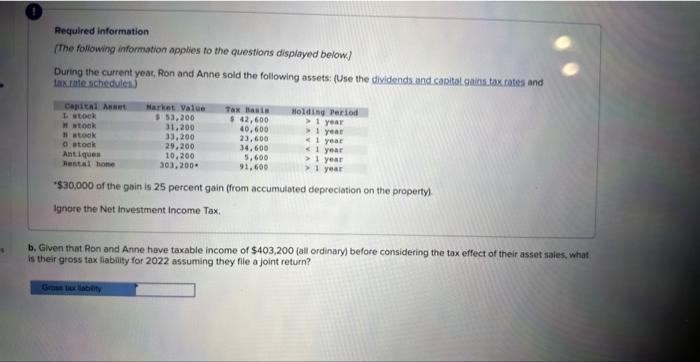

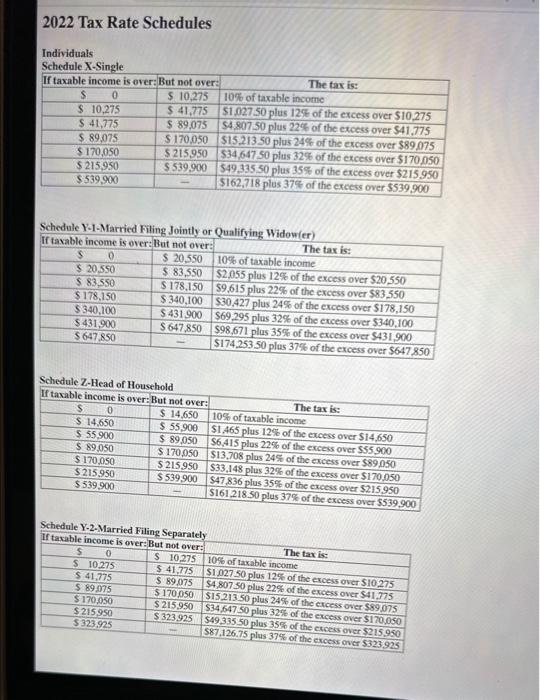

Required information The following information applies to the questions displayed below) Buring the current yeer, Ron and Anne sold the following assets: (Use the dividends and copital gains tax inters and ter rate sichectules.) +\$30,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net livestment income Tax. a. Given that Ron and Anne have taxable income of only $23,200 (all ordinary) before considering the tax effect of their asset saless what is their gross tax liability for 2022 assuming they file a joint return? Required information [The following information applies to the questions displayed below] During the current yeac, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and Laxrute schedulet.) ' $30,000 of the gain is 25 percent gain (from accumuloted depreciation on the property). Ignore the Net investment income Tax; b. Given that Ron and Anne have taxable income of $403,200 (all ordinary) before considering the tax effect of their asset sales. what is their gross tax liability for 2022 assuming they flie a joint return? 2022 Tax Rate Schedules Individuals Schedule Va.1.Marntad Eviliwa t.at.ot- Schedule Y.2.Marnlas now The Itates for Net Capital Crains and Qualified Divitesids Required information [The following information applies to the questions displayed below.] During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax. rateschedules.) - 530,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net investment income Tax. 4iven that Ron and Anne have taxable income of only $23,200 (all ordinary) before considering the tax effect of their asset sales, What is their gross tax liability for 2022 assuming they file a joint return? Required information [The following information applies to the questions displayed bolow.] During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.) '\$30,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net Investment income Tax. Given that Ron and Anne have taxable income of $403,200 (all ordinary) before considering the tax effect of their asset sales, wha. their gross tax liability for 2022 assuming they file a joint return? 2022 Tax Rate Schedules Individuals Thes Rates far Nut Capisal Caloss and Oushified Dividends Required information The following information applies to the questions displayed below) Buring the current yeer, Ron and Anne sold the following assets: (Use the dividends and copital gains tax inters and ter rate sichectules.) +\$30,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net livestment income Tax. a. Given that Ron and Anne have taxable income of only $23,200 (all ordinary) before considering the tax effect of their asset saless what is their gross tax liability for 2022 assuming they file a joint return? Required information [The following information applies to the questions displayed below] During the current yeac, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and Laxrute schedulet.) ' $30,000 of the gain is 25 percent gain (from accumuloted depreciation on the property). Ignore the Net investment income Tax; b. Given that Ron and Anne have taxable income of $403,200 (all ordinary) before considering the tax effect of their asset sales. what is their gross tax liability for 2022 assuming they flie a joint return? 2022 Tax Rate Schedules Individuals Schedule Va.1.Marntad Eviliwa t.at.ot- Schedule Y.2.Marnlas now The Itates for Net Capital Crains and Qualified Divitesids Required information [The following information applies to the questions displayed below.] During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax. rateschedules.) - 530,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net investment income Tax. 4iven that Ron and Anne have taxable income of only $23,200 (all ordinary) before considering the tax effect of their asset sales, What is their gross tax liability for 2022 assuming they file a joint return? Required information [The following information applies to the questions displayed bolow.] During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.) '\$30,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net Investment income Tax. Given that Ron and Anne have taxable income of $403,200 (all ordinary) before considering the tax effect of their asset sales, wha. their gross tax liability for 2022 assuming they file a joint return? 2022 Tax Rate Schedules Individuals Thes Rates far Nut Capisal Caloss and Oushified Dividends