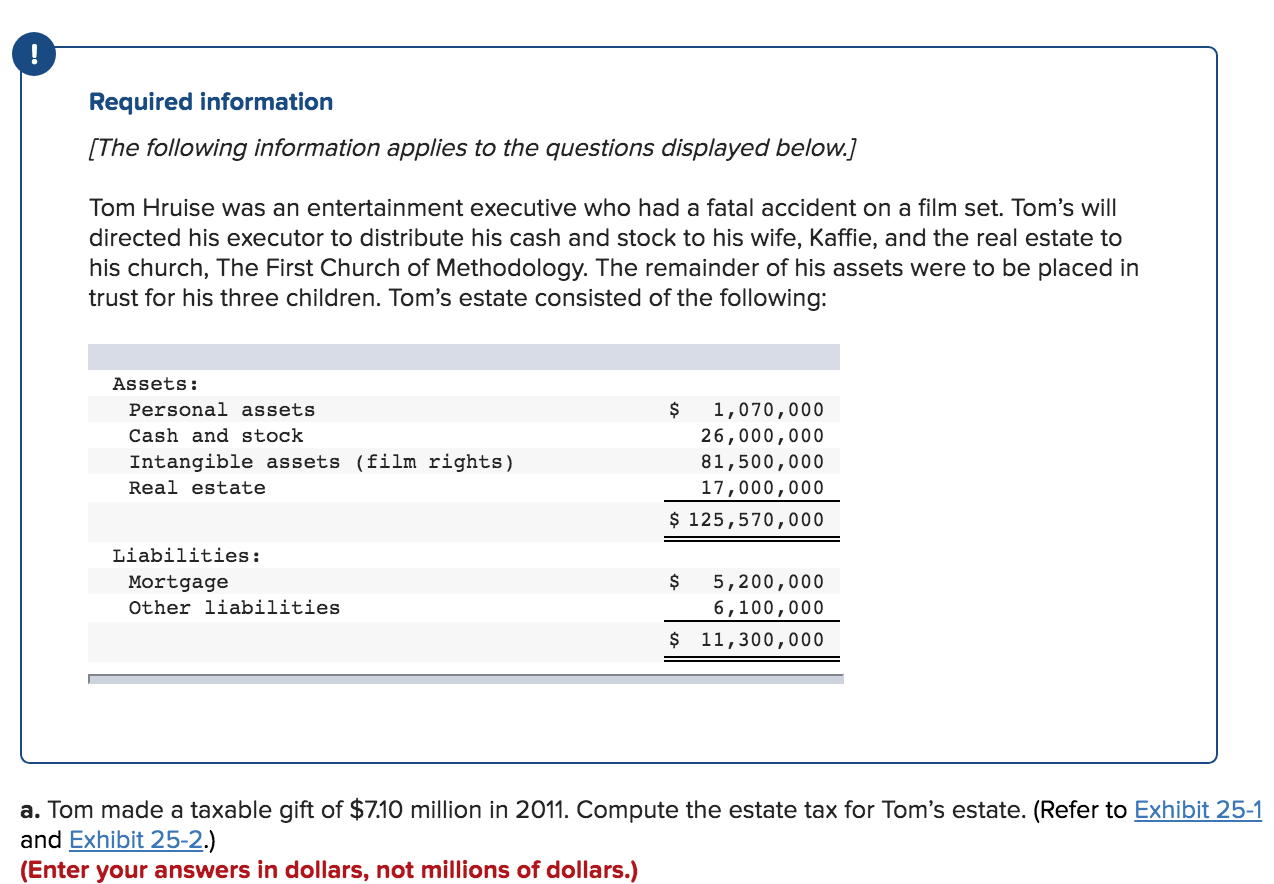

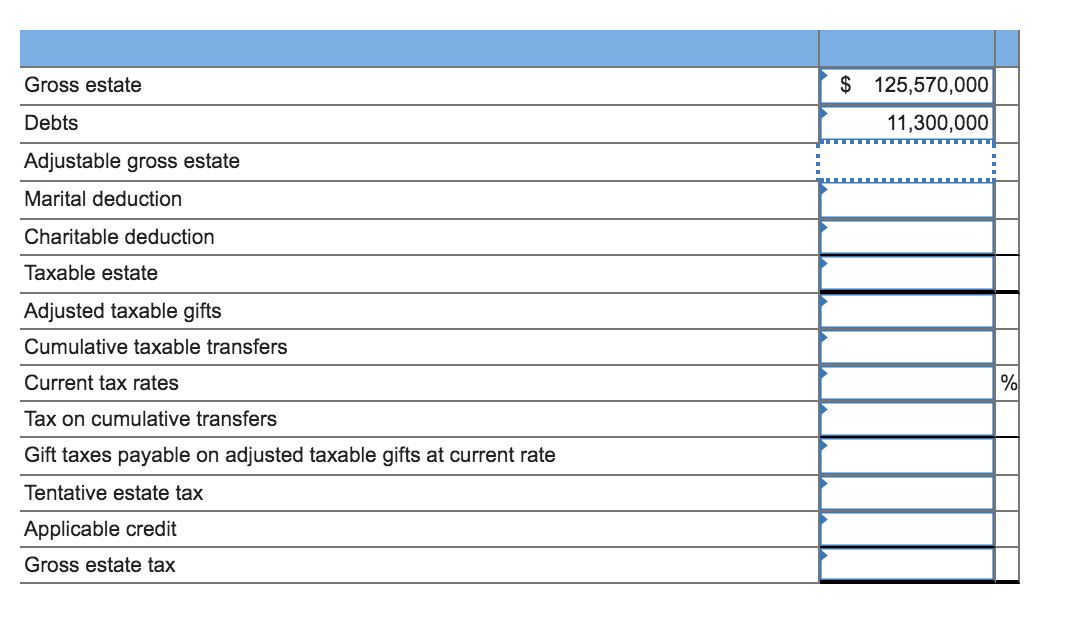

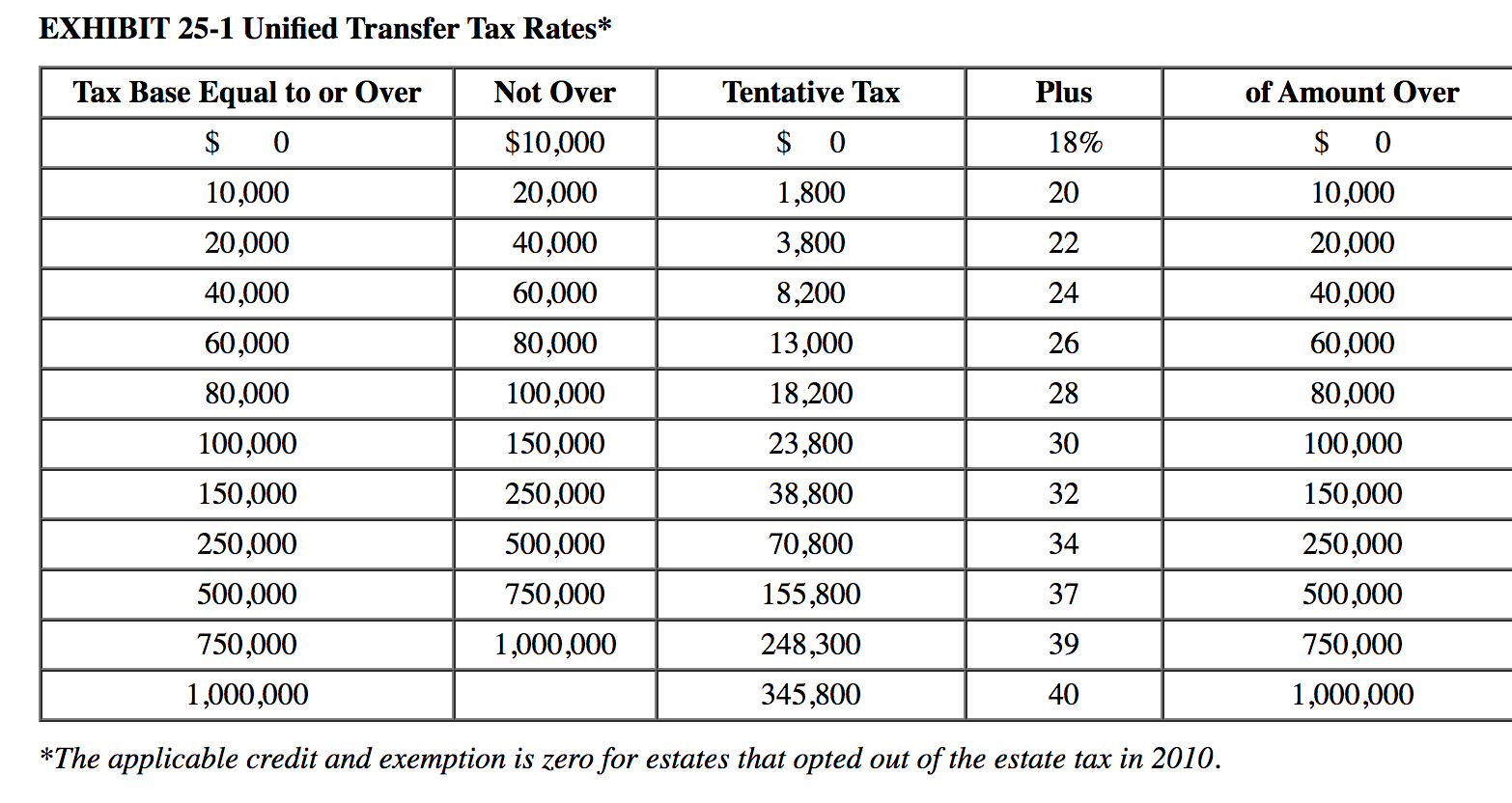

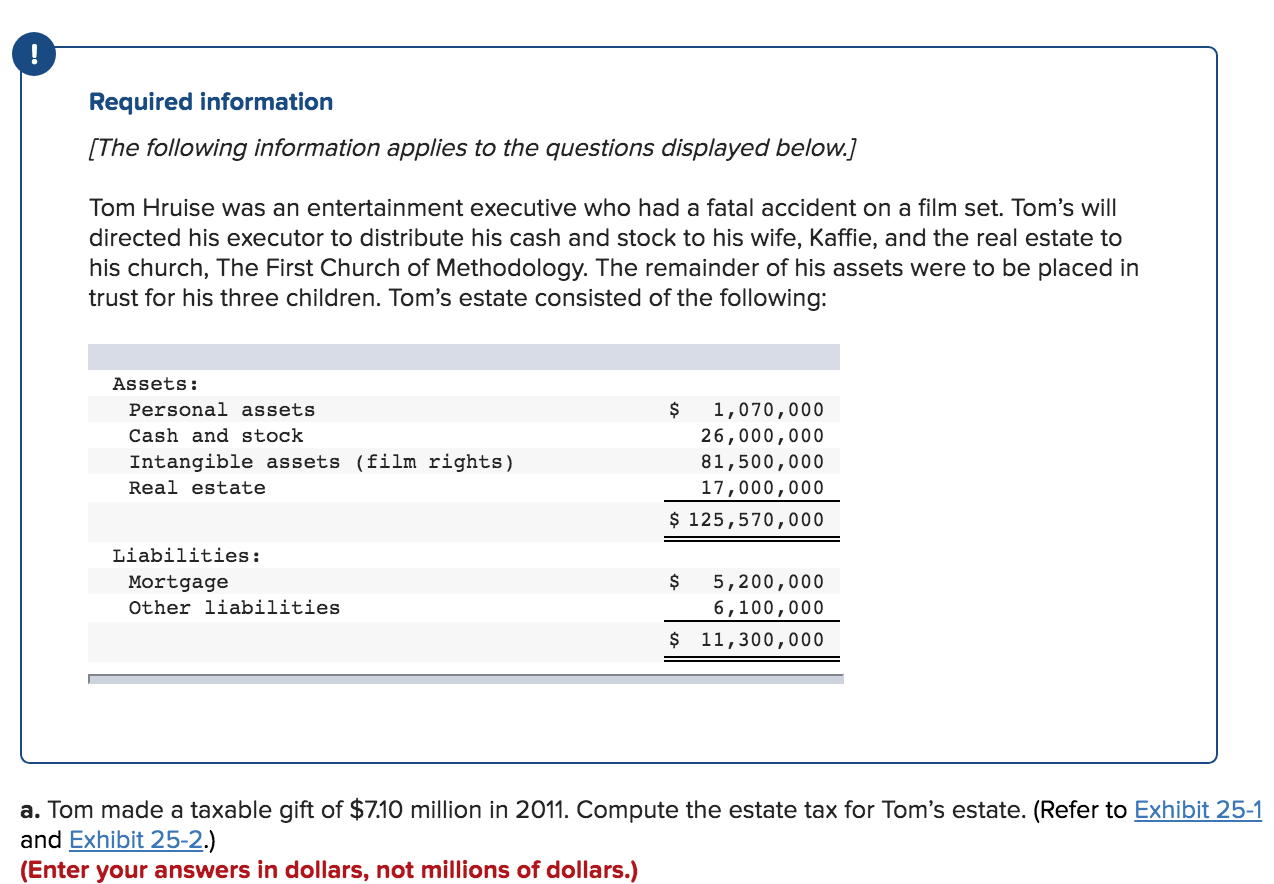

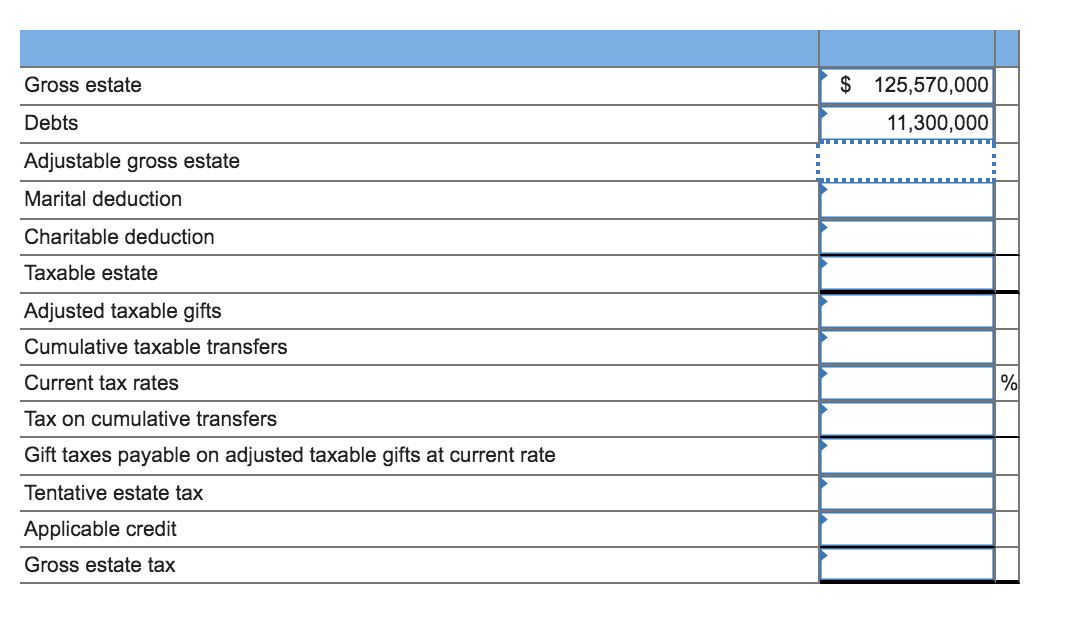

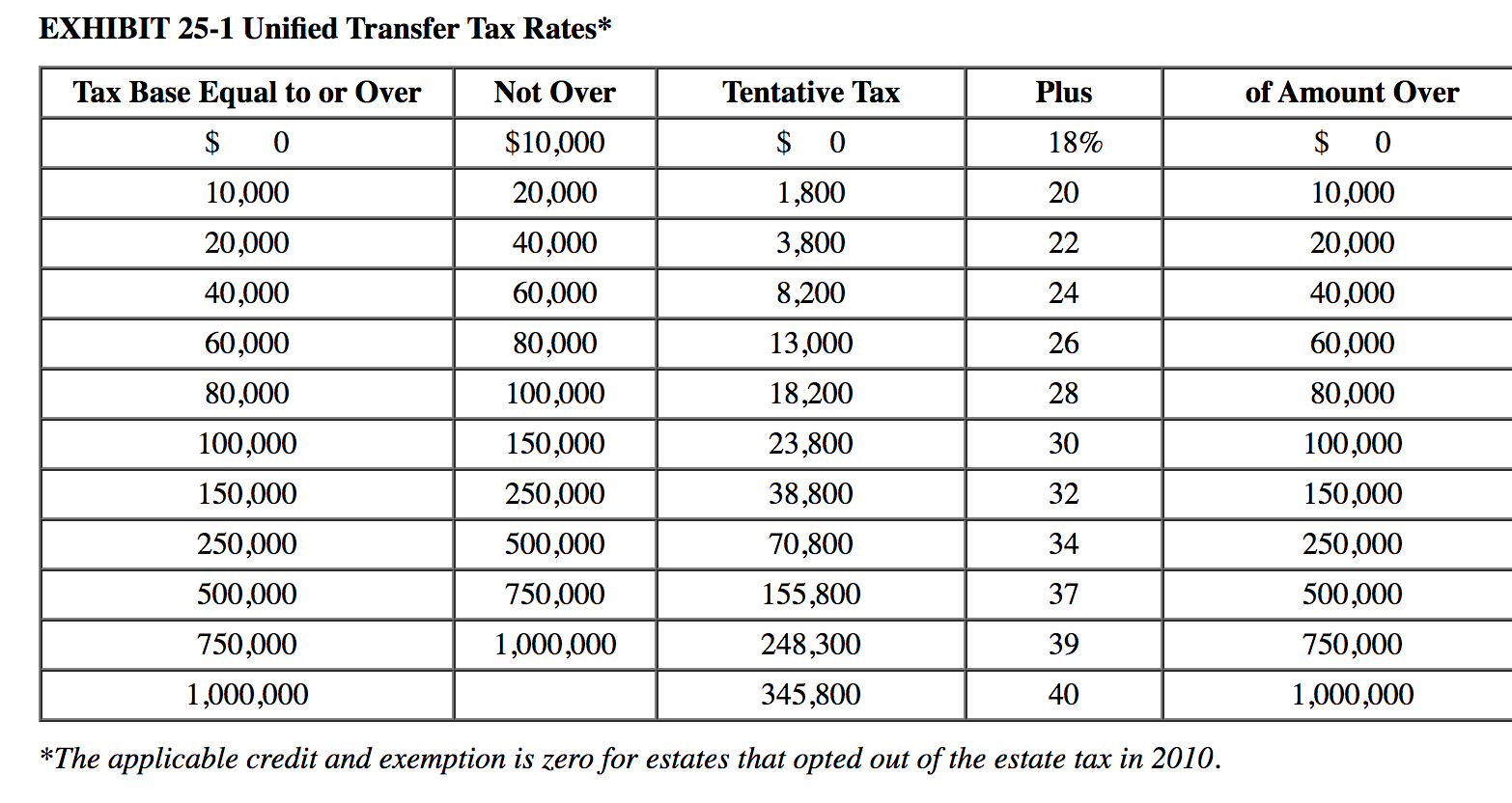

Required information [The following information applies to the questions displayed below.] Tom Hruise was an entertainment executive who had a fatal accident on a film set. Tom's will directed his executor to distribute his cash and stock to his wife, Kaffie, and the real estate to his church, The First Church of Methodology. The remainder of his assets were to be placed in trust for his three children. Tom's estate consisted of the following: Assets: Personal assets Cash and stock Intangible assets (film rights) Real estate $ 1,070,000 26,000,000 81,500,000 17,000,000 $ 125,570,000 Liabilities: Mortgage Other liabilities $ 5,200,000 6,100,000 $ 11,300,000 a. Tom made a taxable gift of $7.10 million in 2011. Compute the estate tax for Tom's estate. (Refer to Exhibit 25-1 and Exhibit 25-2.) (Enter your answers in dollars, not millions of dollars.) | $ 125,570,000 Gross estate Debts 11,300,000 Adjustable gross estate Marital deduction Charitable deduction Taxable estate Adjusted taxable gifts Cumulative taxable transfers Current tax rates Tax on cumulative transfers Gift taxes payable on adjusted taxable gifts at current rate Tentative estate tax Applicable credit Gross estate tax EXHIBIT 25-1 Unified Transfer Tax Rates* Not Over $10,000 20,000 of Amount Over $ 0 10,000 20,000 | 40,000 60,000 80,000 40,000 Tax Base Equal to or Over $ 0 10,000 20,000 40,000 60,000 80,000 100,000 150,000 250,000 500,000 750,000 1,000,000 Plus 18% 20 22 24 26 28 30 32 60,000 T entative Tax $ 0 1,800 3,800 8,200 13,000 18,200 23,800 38,800 70,800 155,800 248,300 345,800 100,000 80,000 150,000 100,000 250,000 150,000 500,000 750,000 37 250,000 500,000 750,000 1,000,000 1,000,000 40 *The applicable credit and exemption is zero for estates that opted out of the estate tax in 2010. EXHIBIT 25-2 The Exemption Equivalent Year of Transfer Gift Tax 1986 19871997 Estate Tax $500,000 600,000 625,000 650.000 1998 675,000 1999 20002001 20022003 20042005 20062008 20092010* 2011 2012 2013 2014 2015 2016 $500,000 600,000 625,000 650,000 675,000 1,000,000 1,000,000 1,000,000 1,000,000 5,000,000 5,120,000 5,250,000 5,340,000 5,430,000 5,450,000 1,000,000 1,500,000 2,000,000 3,500,000 5,000,000 5,120,000 5,250,000 5,340,000 5,430,000 5,450,000 2017 2018 2019 5,490,000 11,180,000 11,400,000 5,490,000 11,180,000 11,400,000 *The applicable credit and exemption is zero for taxpayers who opt out of the e