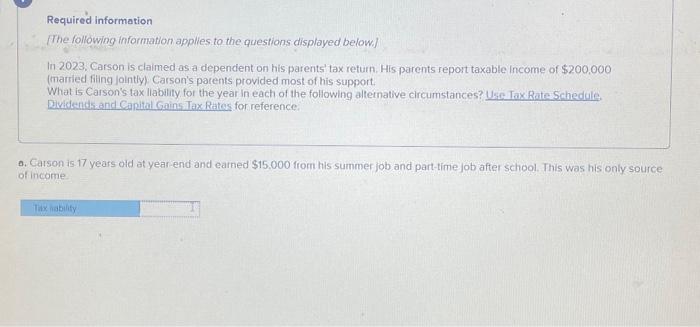

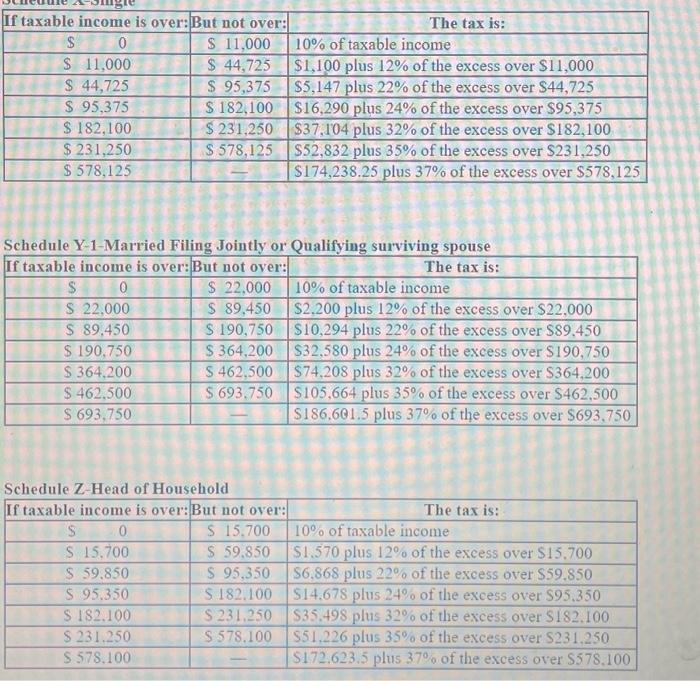

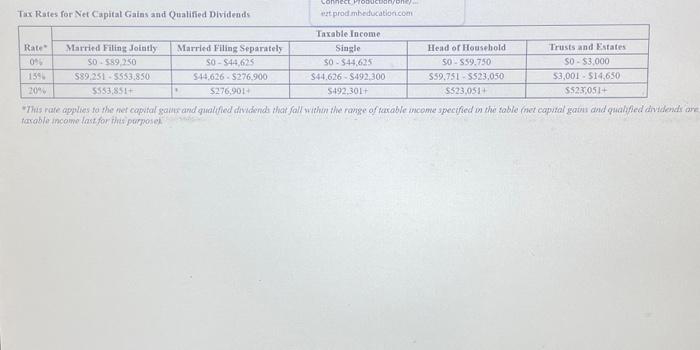

Required information The following intormation applies to the questions displayed below] In 2023. Carson is claimed as a dependent on his parents' tax return. His parents report taxable income of $200,000 (married filing Jointly) Carson's parents provided most of his support. Dividends and Canital Gains Tax Rates for reference: a. Carson is 17 years old at year-end and earned $15,000 from his summer job and part-time job after school. This was his only source of income. \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$0 & $11,000 & 10% of taxable income \\ \hline$11,000 & $44,725 & $1,100 plus 12% of the excess over $11,000 \\ \hline$44,725 & $95,375 & $5,147 plus 22% of the excess over $44,725 \\ \hline$95,375 & $182,100 & $16,290 plus 24% of the excess over $95,375 \\ \hline$182,100 & $231,250 & $37,104 plus 32% of the excess over $182,100 \\ \hline$231,250 & $578,125 & $52,832 plus 35% of the excess over $231,250 \\ \hline$578,125 & - & $174,238,25 plus 37% of the excess over $578,125 \\ \hline \end{tabular} Schedule Y-1-Married Filing Jointly or Qualifying surviving spouse \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$$22,000 & $22,000 & 10% of taxable income \\ \hline$89,450 & $89,450 & $2,200 plus 12% of the excess over $22,000 \\ \hline$190,750 & $364,200 & $32,580 plus 24% of the excess over $190,750 \\ \hline$364,200 & $462,500 & $74,208 plus 32% of the excess over $364,200 \\ \hline$462,500 & $693,750 & $105,664 plus 35% of the excess over $462,500 \\ \hline$693,750 & - & $186,601.5 plus 37% of the excess over $693,750 \\ \hline \end{tabular} Schedule Z-Head of Household \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & The tax is: \\ \hline s & $15,700 & 10% of taxable income \\ \hline \$ 15,700 & $59,850 & $1.570 plus 12% of the excess over $15.700 \\ \hline$59.850 & $95,350 & $6.868 plus 22% of the excess over $59.850 \\ \hline$95,350 & $182.100 & $14.678 plus 24% of the excess over $95.350 \\ \hline$1$2.100 & $231,250 & $35.498 plus 32% of the excess over $182.100 \\ \hline$231,250 & $578.100 & $51,226 plus 35% of the excess over $231,250 \\ \hline$578,100 & - & $172.623.5 plus 37% of the excess over $578,100 \\ \hline \end{tabular} Tax Rates for Net Capital Gaias and Qualiffed Dividends ext prod mibeducationcom farable incoime last for this purnosel