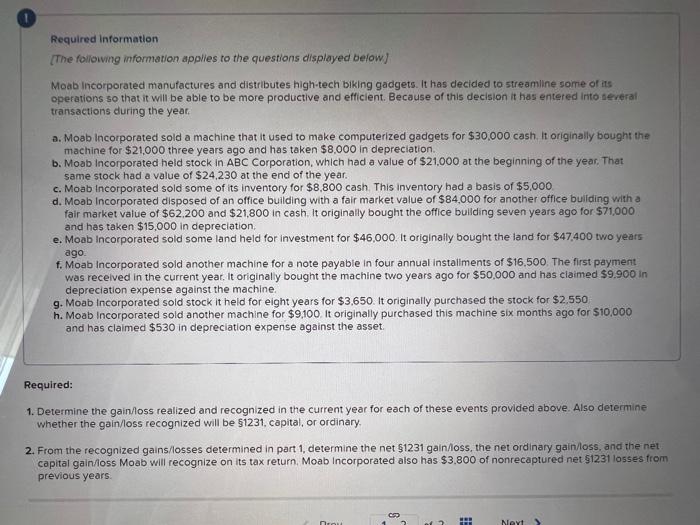

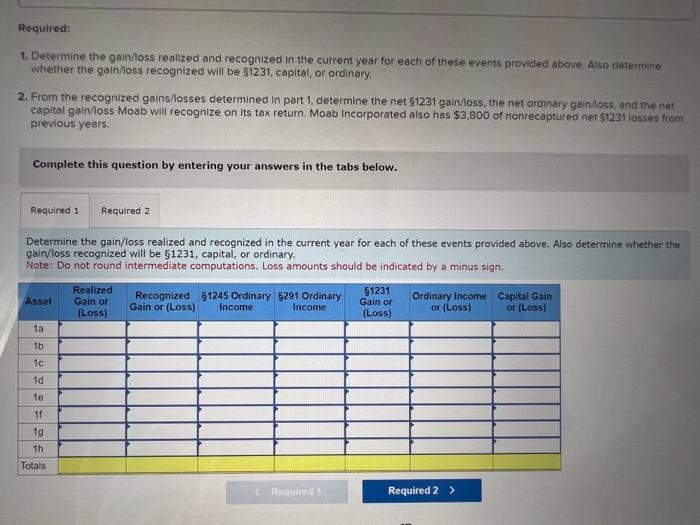

Required information [The followng information applies to the questions displayed below] Moab incorporated manufactures and distributes high-tech biking gadgets. It has decided to streamline some of its operations so that it will be able to be more productive and efficient. Because of this decision it has entered into several transactions during the year. a. Moab Incorporated sold a machine that it used to make computerized gadgets for $30,000 cash. It originaliy bought the machine for $21,000 three years ago and has taken $8,000 in depreciation. b. Moab incorporated held stock in ABC Corporation, which had a value of $21,000 at the beginning of the year. That same stock had a value of $24,230 at the end of the year. c. Moab incorporated sold some of its inventory for $8,800cash. This inventory had a basis of $5,000 d. Moab Incorporated disposed of an office bullding with a fair market value of $84,000 for another office buliding with a fair market value of $62,200 and $21,800 in cash. It originally bought the office bullding seven years ago for $71,000 and has taken $15,000 in depreciation. e. Moab Incorporated sold some land held for investment for $46,000. It originally bought the land for $47,400 two years ago: f. Moab incorporated sold another machine for a note payable in four annual installments of $16.500. The first payment was recelved in the current year, It originaly bought the machine two years ago for $50,000 and has claimed $9,900 in depreciation expense against the machine. 9. Moab incorporated sold stock it heid for eight years for $3,650. It originally purchased the stock for $2,550 h. Moab incorporated sold another machine for $9,100. It originally purchased this machine six months ago for $10,000 and has claimed $530 in depreciation expense against the asset. required: 1. Determine the gain/loss realized and recognized in the current year for each of these events provided above. Also determine whether the gain/loss recognized will be $1231, capital, or ordinary. 2. From the recognized gains/losses determined in part 1 , determine the net $1231 gain/loss, the net ordinary gain/loss, and the net capital gaindoss Moab will recognize on its tax return, Moab Incorporated also has $3.800 of nonrecaptured net $1231 losses from previous years. 1. Determine the gainhoss realized and recognized in the current year for each of these events provided above. Also determine whether the gain/loss recognized will be $1231, capital, or ordinary. 2. From the recognized gains/osses determined in part 1, determine the net 51231 gain/loss, the net ordinary gain/loss, and the net capital gain/loss Moab will recognize on its tax return. Moab incorporated also has $3,800 of nonrecaptured net 51231 losses from previous years. Complete this question by entering your answers in the tabs below. Determine the gain/loss realized and recognized in the current year for each of these events provided above. Also determine whether the gair/loss recognized will be $1231, capital, or ordinary. Note: Do not round intermediate computations. Loss amounts should be indicated by a minus sign. Complete this question by entering your answers in the tabs below. From the recognized gains/losses determined in part 1 , determine the net 51231 gain/loss, the net ordinary gain/loss, and the net capital gain/loss Moab will recognize on its tax return. Moab Incorporated also has $3,800 of nonrecaptured net 51231 losses from previous years. Note: Do not round intermediate computations. Loss amounts should be indicated by a minus sign. 3. Complete Moab incorporated's Form 4797 for the year 2021 Note: input all the values as positive numbers. Use 2022 tax rules regardless of year on tax form. Form 4797 of Moab Incorporated. Form 4797 Page 1. 1 Required information 4. Section 1291 gan birn kotadinent soles fiom Fonis e2s2, ine 20 ar at S. Sechoh 1231 gan or (kns) trixt 1a0-kind exchanpos frort fomn 18e24 6. Oom if any, from line 32 , from olher eun casuedy of thet 7. Contwwi ines 2 through 6 . Ether the gan or (oows) here and on the appropnate ine as follows Paruientips and S corporations. Repot the gain or (loss) following the iratructions for Fomn toes schubhide K. bne to, or Fom 1120. S, schodile K lane 9. Skep in05 0.9, 11, and 12 below. Indviduals, parthers. Scorpoenion shareholders and all othors. If line 7 is zero or a loss, enter the ameunt from tue 7 on Ino 11 betow and skes lees 6 and 9 If line 7 is a gain and you didnthave ory pror yoer soction 1231 fosses, or they wore ske lines 8:9.11, and 12 below 8. Nontecaphured net section-1231 losses from proor yeas Seo instructions Subtrad tee 8 from ine 7 . If zero or less, enter-0- If line 9 is zero, enter the gain from line 7 on lne 12 below If ine 9 is more than zero otsor the amourn from line 8 on line 12 below and enter the gain from ine 9 as a lang term capital gen on the Schodule 0 tied with your roturn. See instructions Part II Ordinary Gains and Losses (see instructions) 10 Ordinery gains and losses not included on lines 11 through t6 (incluge property held 1 year or less): 12. Gan if any, from line 7 or ancent from line 8 , if applcable 13 Gain it any trom line 31 14 Net gain or (boss) from Form 4684 , thes 31 and 38 a 15 Ordnary gain trom instaiment sules from Form 6252 , ine 25 or 36 16 Ordnary gain or (loss) from like-kind oxchanges trom Form 8824 17 combine hnes 10 though 16 16 For al except indivdual rotums, ecter the emount from tine 17 on the appropriale ine of your return and skp thes a and b below For indidual setums, complete lines a and b below: a. If Eue less on line 11 includes a loss from Form 4684 , ine 35 , column (bke), enter that part of the loss here. Enter the loss from income-groduang property on Schedule A (FCem 1040 or Fom 1040 SR), line 16 (Do not include any loss on property. ised as an employoe ) ldently as from Form 4797 , line 18a "See instructions 6. Pedefiermine the gan or (loss) on Ine 17 cocliding the loss, if any on ine 18a Einter here and on Schedule 1 (Form 1040 or Fom 1040-SR). Part, line 4 For Paperwork Reduction Act Notice, see stparate inetrietinne Cat No 13088 Form 4797(2021) Fotn 4797 page 2. hom atrut (2021) Pinge 2 \begin{tabular}{l} Part BIIl Gain From Dispo \\ te (a) Descripton of section 1245, 1250, 1252, \\ \hline A \\ \hline C \\ \hline C \\ \hline These colamnts relate to the properties on \end{tabular} \begin{tabular}{|l|l|} \hline(my) & (iwin) \\ \hline & \\ \hline & \\ \hline & \\ \hline \end{tabular} 20 Cross sBles price (Note See line 1 before cornpleting) 21 Cost of other basis plus expense of sale 22 Depiecistion ( depletion) allowed or allowable 23 Adusted basis subtract line 22 from line 21 24 Total gain Subtract bne 23 from lne 20 a Desreciation allowed of allowable from ine 22 \begin{tabular}{|c|c|c|c|c|} \hline 20 & & & & \\ \hline 21 & & & \\ \hline 22 & & & \\ \hline 23 & 0 & & \\ \hline 24 & 0 & & \\ \hline & & & \\ \hline 259 & & & \\ \hline \end{tabular} b Enier the smaller of tine 24 or 25 a 26 if section 1250 propecty: If straght ine deprociaton was used 291 a Agational depreciajon atter 1975 see instructions b Applicatile percentoge mulatied by the smaler of Ine 24 of line 26 . Sse instucions c Subtract line 76 a from line 24 If residential rentai propeity of line 24 isnt more than line 264 skp thes 26d and 26e a Addtional depreciatioe anter 1969 and belore 1976 e Enter the smaller of line 26 or 26d 1 Section 201 amount (corporations onty) 27Ifsection1252propertySlopthissectionifyoudidriy9Addbres260,260,and26t drspose of farmiand of it the form is bong completed for. \begin{tabular}{|c|c|} \hline 26a & \\ \hline 260 & \\ \hline & \\ \hline 26c \\ \hline 260 & \\ \hline 260 & \\ \hline 261 & \\ \hline 269 & \\ \hline & \\ \hline \end{tabular} Prev 2 of 2 in Next 24 on vas thi goe intilis tori o cinter the fmatlos of limm z00 ar 25 d 1 gecteon 291 anouin (corporations only) 0 Actslrurs 200.200 and 2 i 27. Ei sedine 1252 propuity, Skip itves sectwan if you din't desposs of inmwand or if this form is being compleded for a purtiorshia a Soul wobor, and lard ciearing expenses b. Litn 27 imuitplipd by apphcable percentage: Soe instrucbons c Ented the sxnallor of line 24 or 27b a latangible dilling and devolopment costs, expendtures for tervetopment of menes and other natural deposits, muring exploration costs, and depletion See instructions 30 Totat gains tor all properties Add property cokumns A tincough D, line 24 . 31 Add property colurns A through D, Ines 25b 269. 27c, 28b, and 290 . Enler hore and on line 13 32 Subtract ine 31 from line 30 Enter the portion from casuatty or thefl on Form 4684 , Ire 33 Emer the portion from other than casually or then on Form 4797 , line 6 THIS FORM IS A SMULATION OF AN OFFICIAL U,S. TAX FORM. ITIS NOT THE OFFICIAL. FORM ITSELF. DO