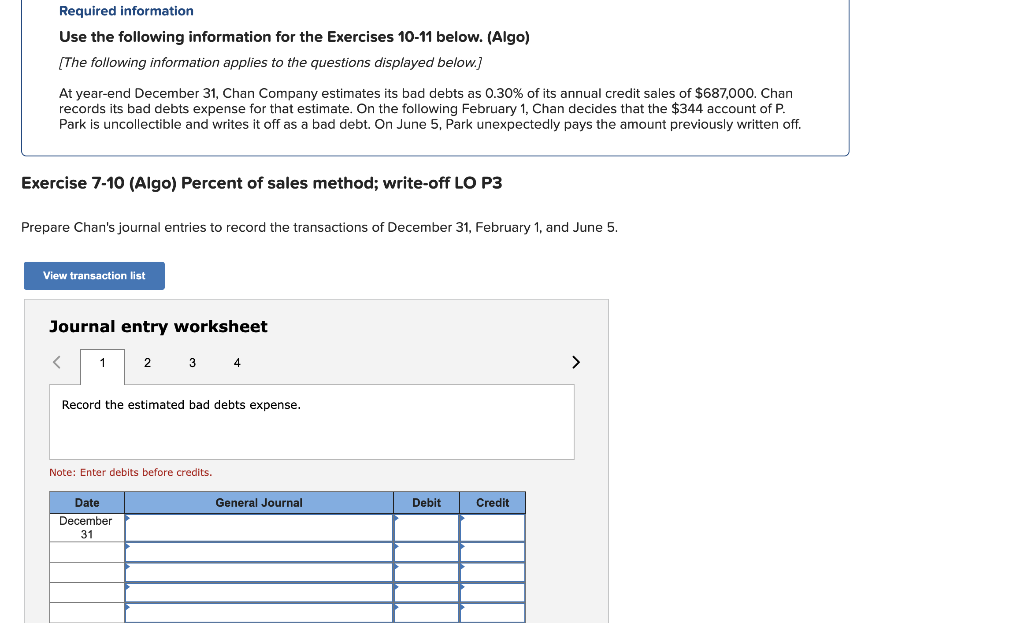

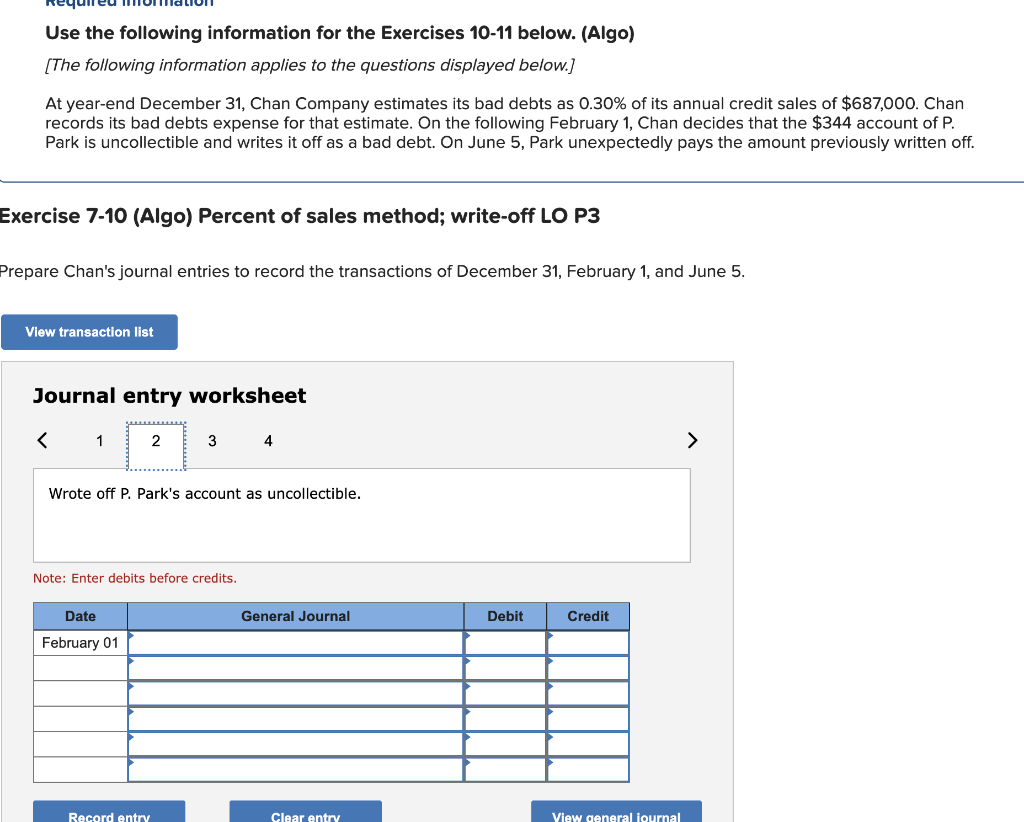

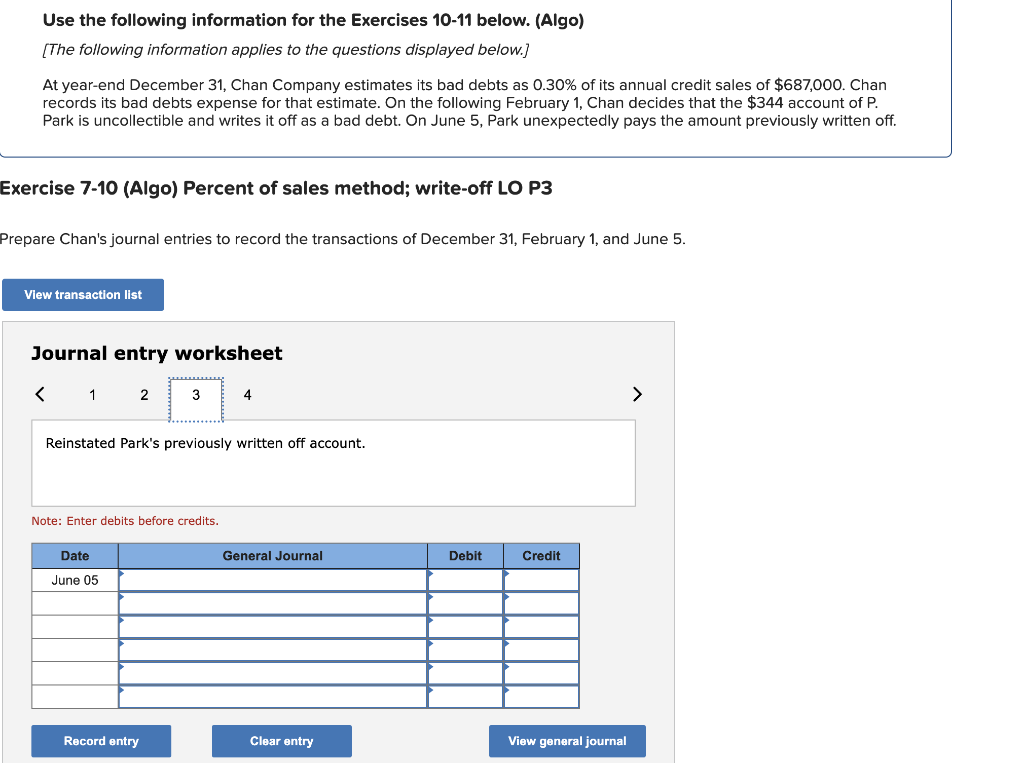

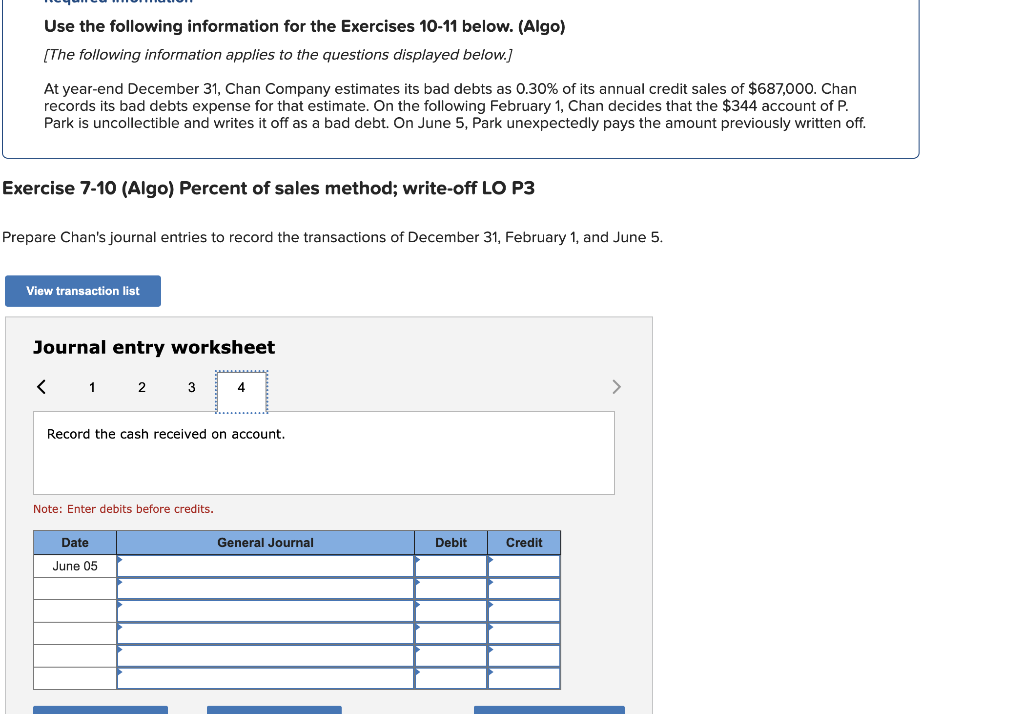

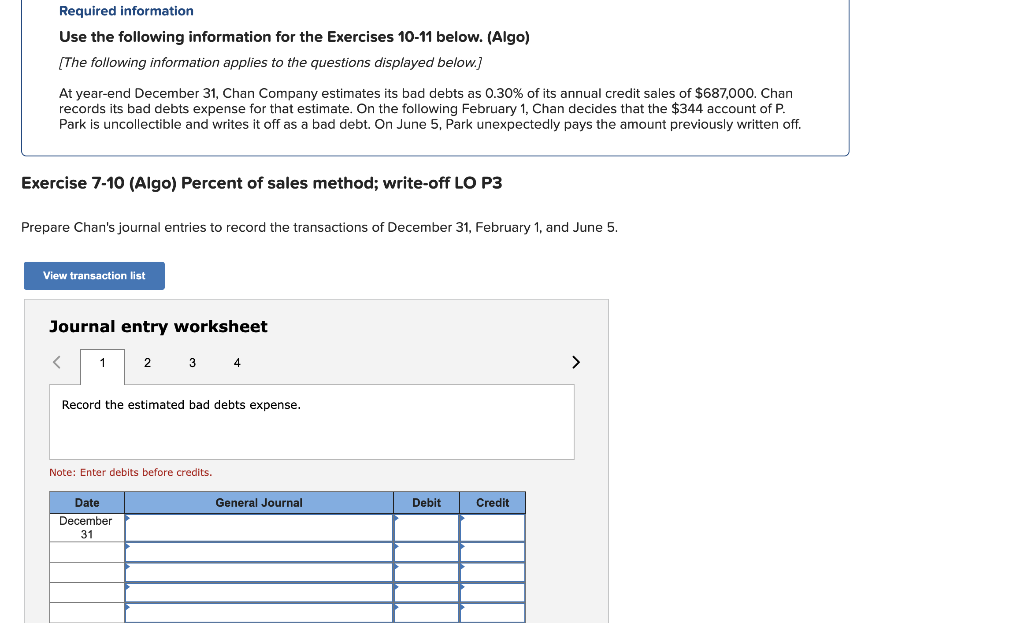

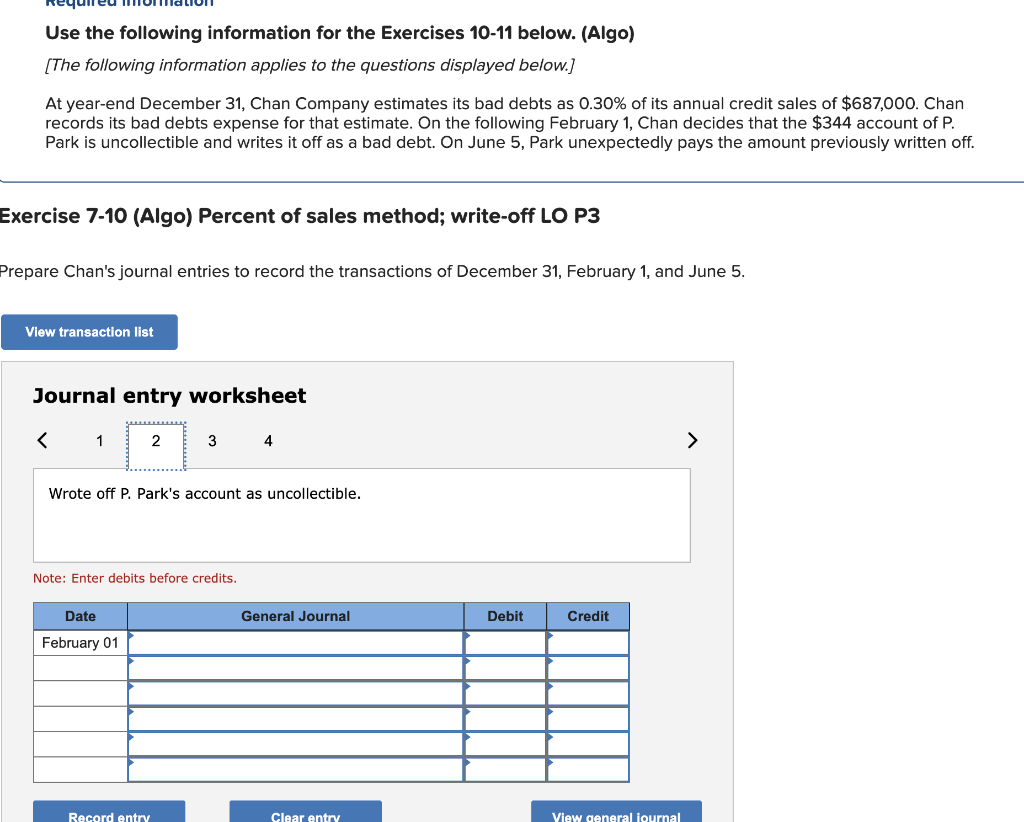

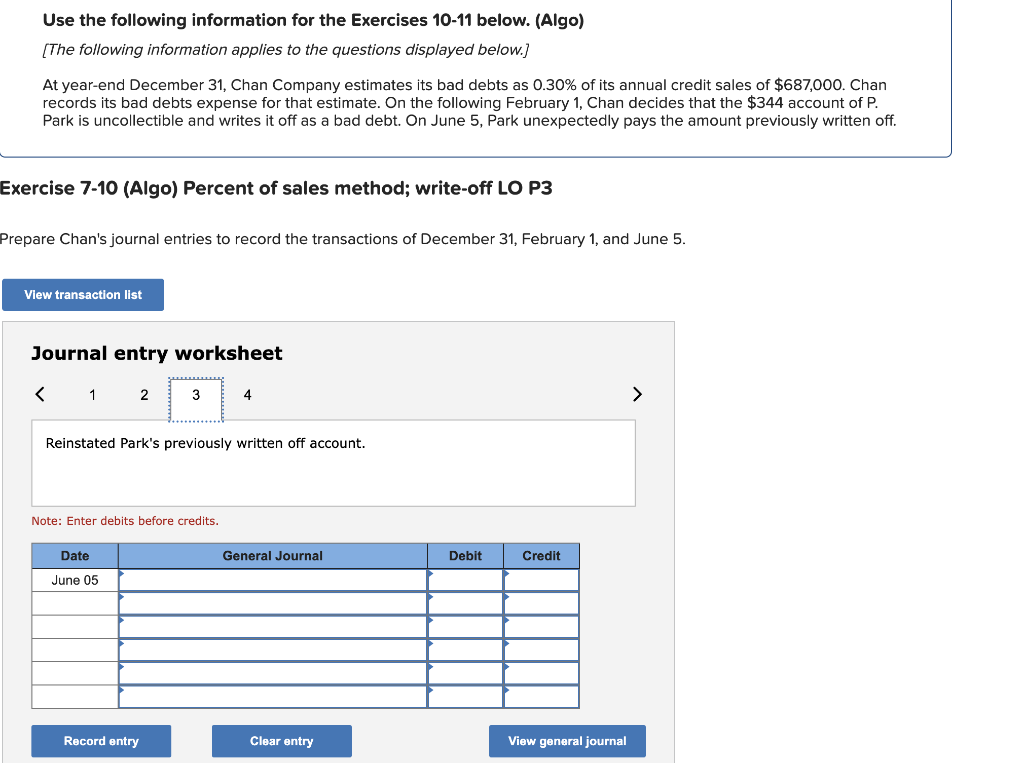

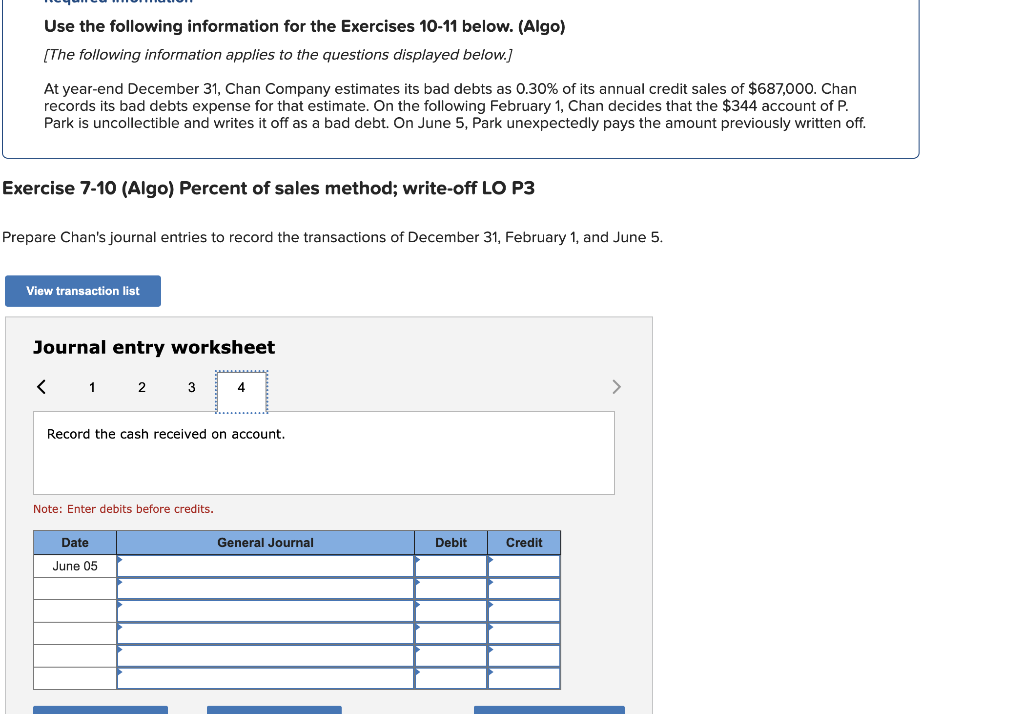

Required information Use the following information for the Exercises 1011 below. (Algo) [The following information applies to the questions displayed below.] At year-end December 31, Chan Company estimates its bad debts as 0.30% of its annual credit sales of $687,000. Chan records its bad debts expense for that estimate. On the following February 1 , Chan decides that the $344 account of P. Park is uncollectible and writes it off as a bad debt. On June 5. Park unexpectedly pays the amount previously written off. Exercise 7-10 (Algo) Percent of sales method; write-off LO P3 Prepare Chan's journal entries to record the transactions of December 31 , February 1, and June 5. Use the following information for the Exercises 1011 below. (Algo) [The following information applies to the questions displayed below.] At year-end December 31, Chan Company estimates its bad debts as 0.30% of its annual credit sales of $687,000. Chan records its bad debts expense for that estimate. On the following February 1 , Chan decides that the $344 account of P. Park is uncollectible and writes it off as a bad debt. On June 5 , Park unexpectedly pays the amount previously written off. Exercise 7-10 (Algo) Percent of sales method; write-off LO P3 repare Chan's journal entries to record the transactions of December 31 , February 1 , and June 5. Journal entry worksheet Note: Enter debits before credits. Use the following information for the Exercises 1011 below. (Algo) [The following information applies to the questions displayed below.] At year-end December 31, Chan Company estimates its bad debts as 0.30% of its annual credit sales of $687,000. Chan records its bad debts expense for that estimate. On the following February 1 , Chan decides that the $344 account of P. Park is uncollectible and writes it off as a bad debt. On June 5, Park unexpectedly pays the amount previously written off. Exercise 7-10 (Algo) Percent of sales method; write-off LO P3 Prepare Chan's journal entries to record the transactions of December 31, February 1 , and June 5. Journal entry worksheet Reinstated Park's previously written off account. Note: Enter debits before credits. Use the following information for the Exercises 1011 below. (Algo) [The following information applies to the questions displayed below.] At year-end December 31, Chan Company estimates its bad debts as 0.30% of its annual credit sales of $687,000. Chan records its bad debts expense for that estimate. On the following February 1 , Chan decides that the $344 account of P. Park is uncollectible and writes it off as a bad debt. On June 5, Park unexpectedly pays the amount previously written off. Exercise 7-10 (Algo) Percent of sales method; write-off LO P3 Prepare Chan's journal entries to record the transactions of December 31 , February 1 , and June 5. Journal entry worksheet Record the cash received on account. Note: Enter debits before credits