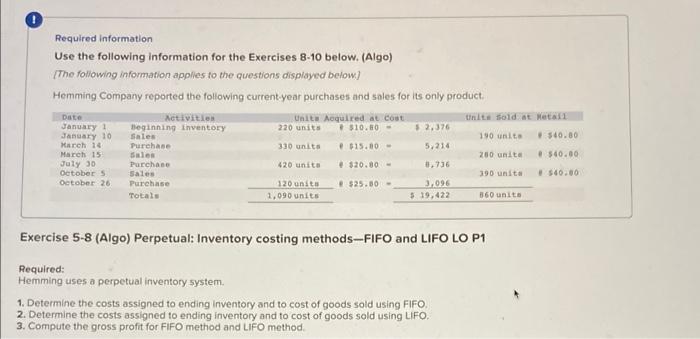

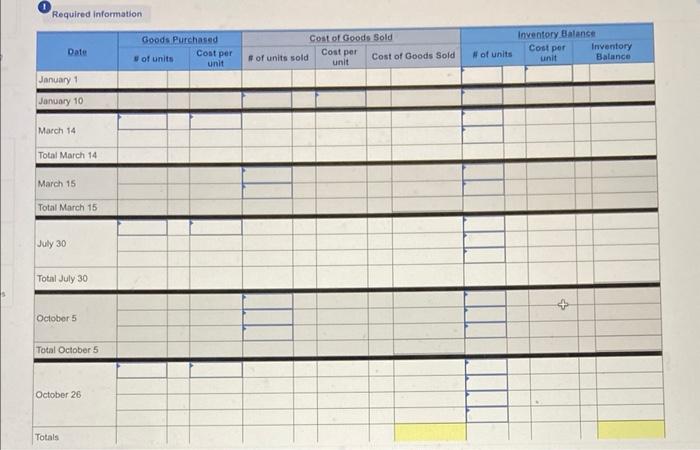

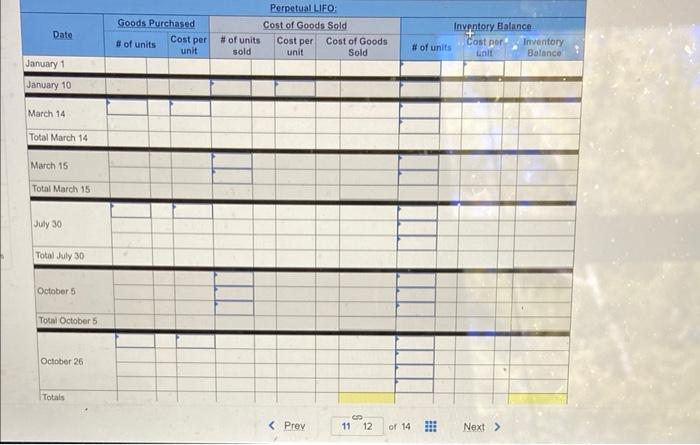

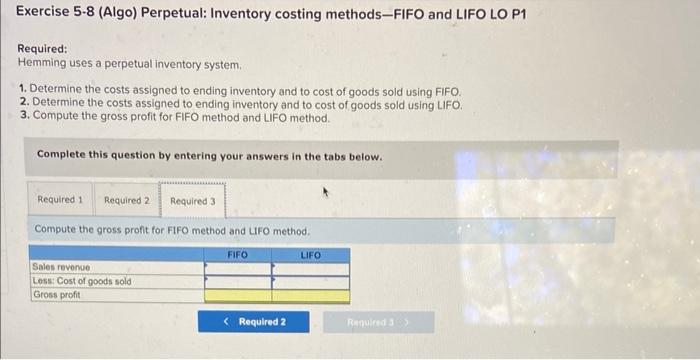

Required information Use the following information for the Exercises 8-10 below, (Algo) [The following information applies to the questions displayed below] Hemming Company reported the following current-year purchases and sales for its only product. Exercise 5-8 (Algo) Perpetual: Inventory costing methods-FIFO and LIFO LO P1 Required: Hemming uses a perpetual inventory system. 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross profit for FIFO method and LIFO method. (1) Required information Perpetual LIFO: 1112 or 14W. Next > Exercise 5-8 (Algo) Perpetual: Inventory costing methods-FIFO and LIFO LO P1 Required: Hemming uses a perpetual inventory system. 1. Determine the costs assigned to ending inventory and to cost of goods sold using FFFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross profit for FIFO method and LIFO method. Complete this question by entering your answers in the tabs below. Compute the gross profit for FIFO method and UFO method. Required information Use the following information for the Exercises 8-10 below, (Algo) [The following information applies to the questions displayed below] Hemming Company reported the following current-year purchases and sales for its only product. Exercise 5-8 (Algo) Perpetual: Inventory costing methods-FIFO and LIFO LO P1 Required: Hemming uses a perpetual inventory system. 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross profit for FIFO method and LIFO method. (1) Required information Perpetual LIFO: 1112 or 14W. Next > Exercise 5-8 (Algo) Perpetual: Inventory costing methods-FIFO and LIFO LO P1 Required: Hemming uses a perpetual inventory system. 1. Determine the costs assigned to ending inventory and to cost of goods sold using FFFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross profit for FIFO method and LIFO method. Complete this question by entering your answers in the tabs below. Compute the gross profit for FIFO method and UFO method