Answered step by step

Verified Expert Solution

Question

1 Approved Answer

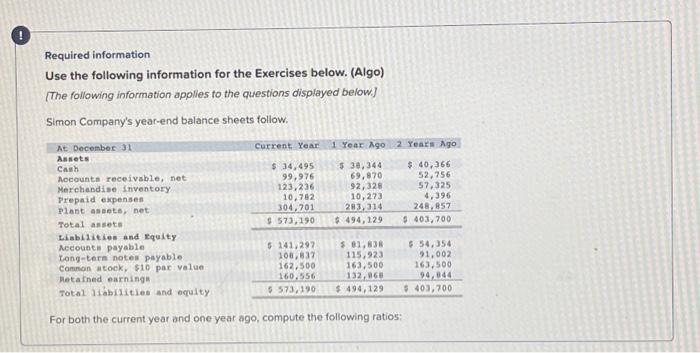

Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Simon Company's year-end balance

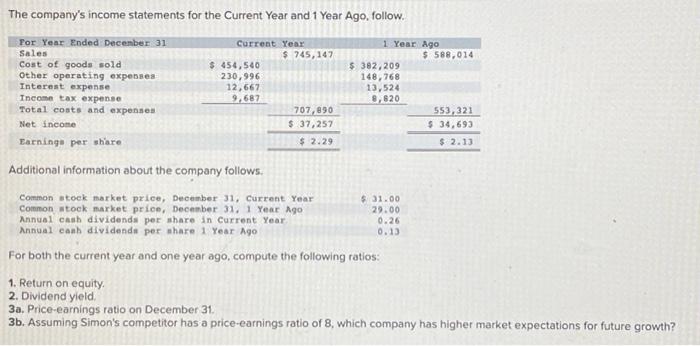

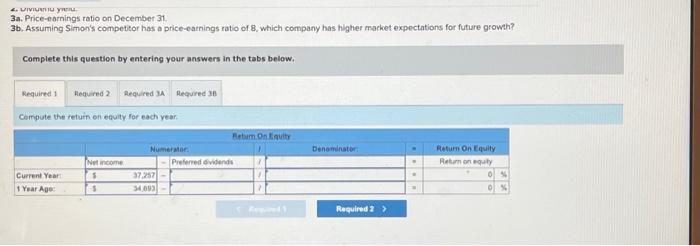

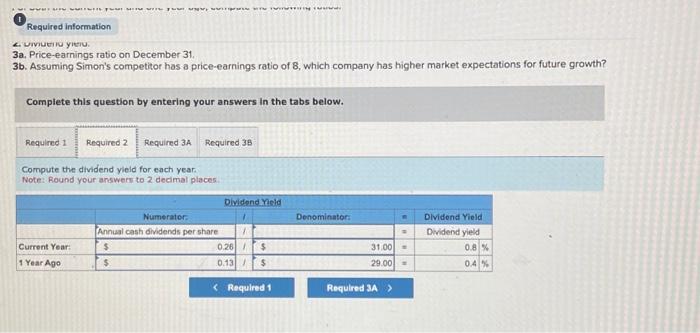

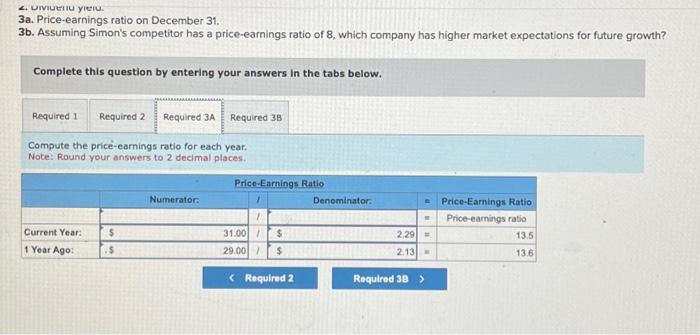

Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net. Merchandise inventory. Prepaid expenses Plant assets, net Total assets Current Year 1 Year Ago 2 Years Ago $ 34,495 99,976 123,236 10,782 $ 38,344 $ 40,366 69,870 92,328 10,273 304,701 283,314 $573,190 $494,129 Liabilities and Equity Accounts payable $141,297 $81,838 Long-term notes payable 108,837 115,923 Common stock, $10 par value 162,500 163,500 Retained earnings 160,556 132,960 Total liabilities and equity $573,190 $494,129 For both the current year and one year ago, compute the following ratios: 52,756 57,325 4,396 248,857 $ 403,700 $ 54,354 91,002 163,500 94,844 $ 403,700 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Current Year $454,540 230,996 12,667 Income tax expense 9,687 Total costs and expenses Net income Earnings per share. $ 745,147 707,890 $ 37,257 $2.29 1 Year Ago $ 588,014 $ 382,209 148,768 13,524 8,820 553,321 $ 34,693 $ 2.13 Additional information about the company follows. Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago $31.00 29.00 For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 0.26 0.13 3b. Assuming Simon's competitor has a price-earnings ratio of 8, which company has higher market expectations for future growth? 4. DIVIU yu 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 8, which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 38 Compute the return on equity for each year. Bebum On Equity Numerator Denominator Preferred dividends Return On Equity Return on equity 0% 0% Net income Current Year $ 37,257 1 Year Age: S 34,093 Required 2> Required information 4. Dividend yie 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 8, which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 38 Compute the dividend yield for each year. Note: Round your answers to 2 decimal places. Numerator Annual cash dividends per share Current Year: $ 1 Year Ago $ Dividend Yield Denominator: Dividend Yield Dividend yield 0.26 / $ 0.13/ $ 31.00 NO 29.00- 0.8 % 0.4 % 2. Dividend yieru. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 8, which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 38 Compute the price-earnings ratio for each year. Note: Round your answers to 2 decimal places. Price-Earnings Ratio Current Year: $ 1 Year Ago: $ Numerator: 1 31.00/ $ 29.00 / $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started