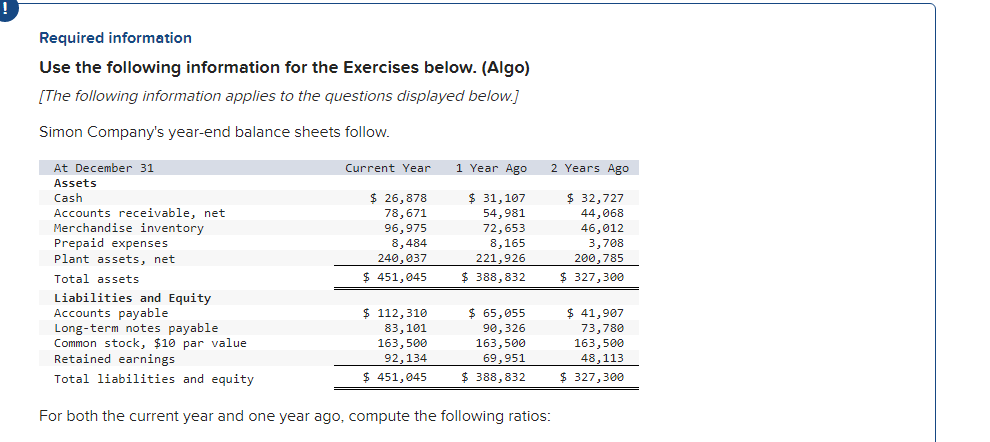

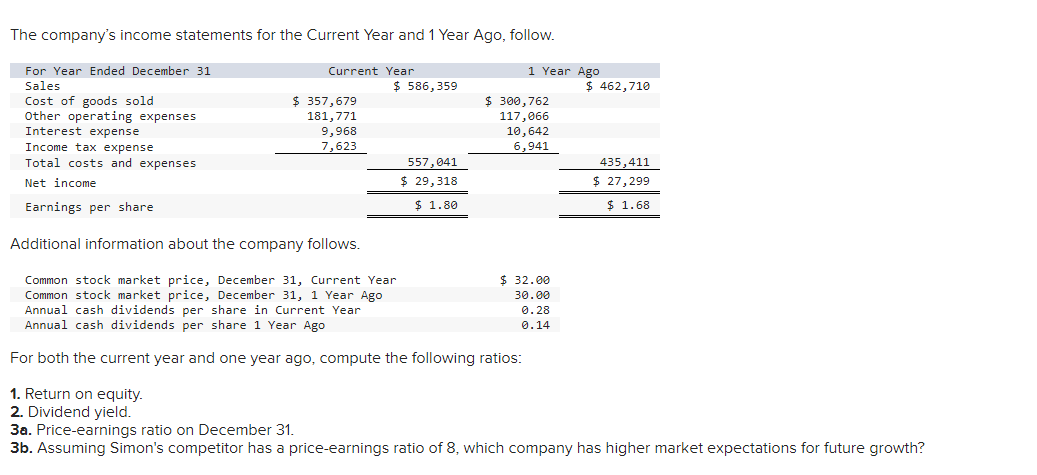

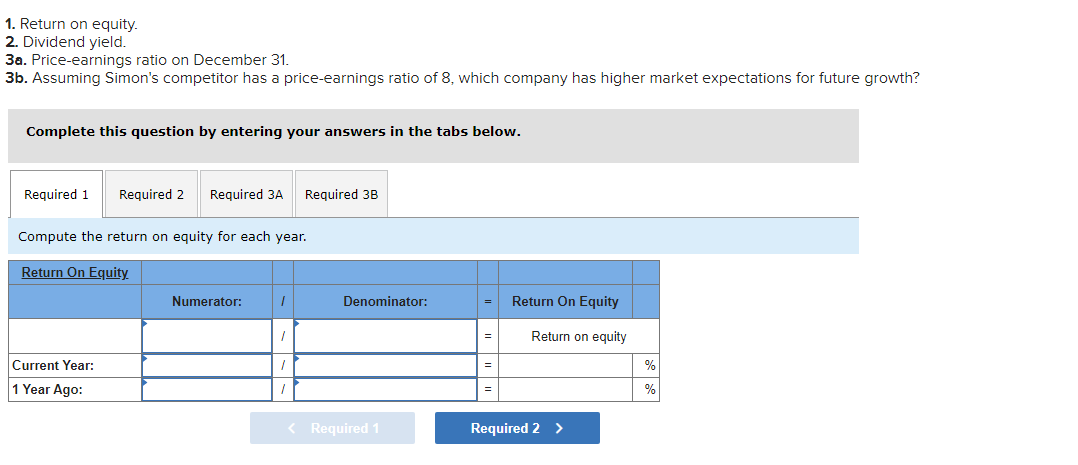

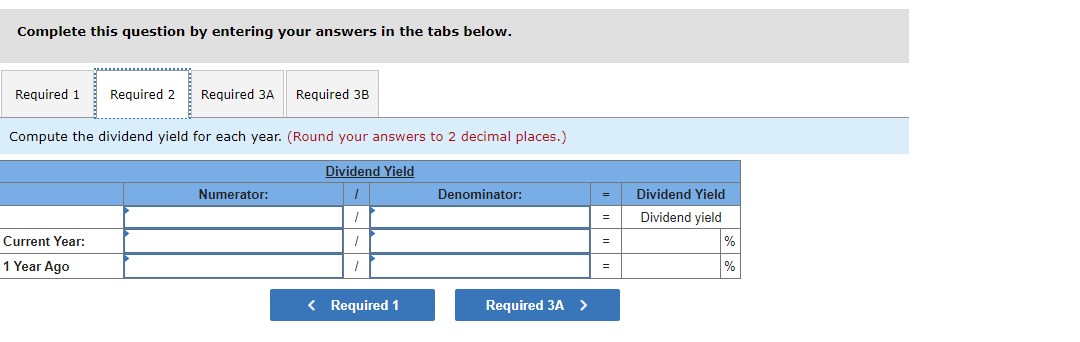

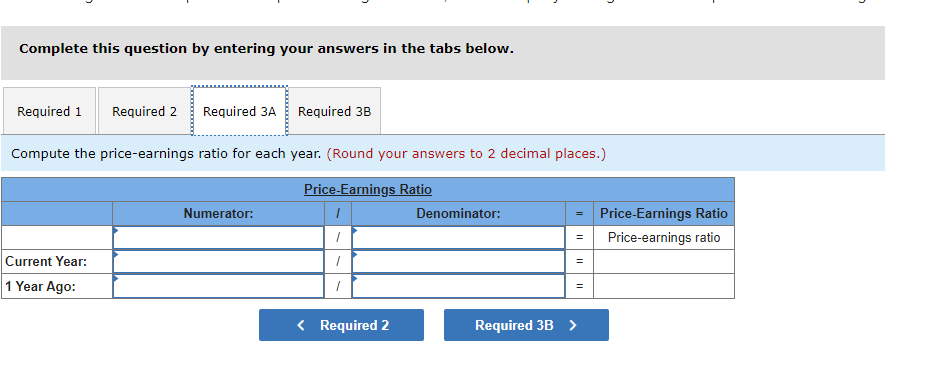

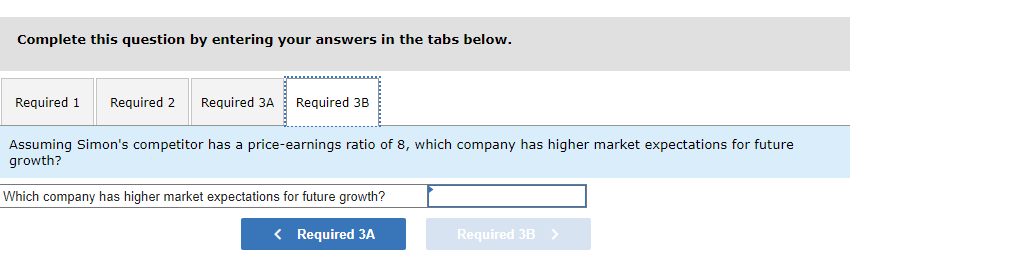

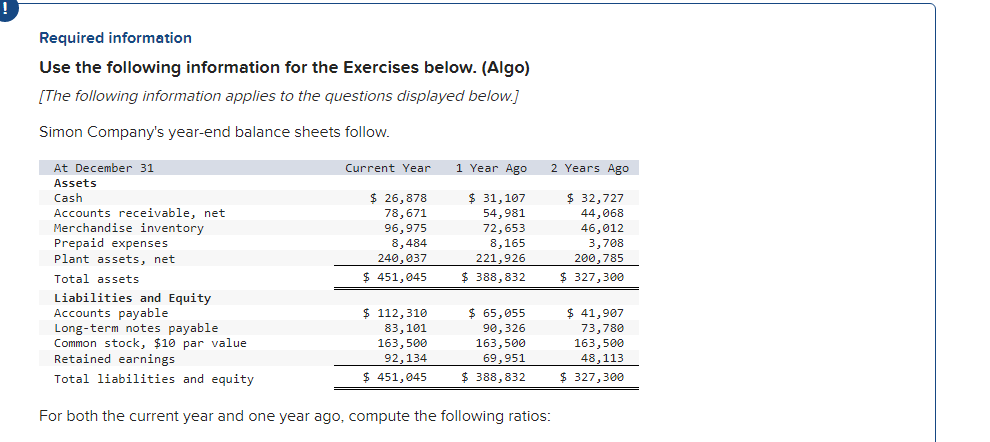

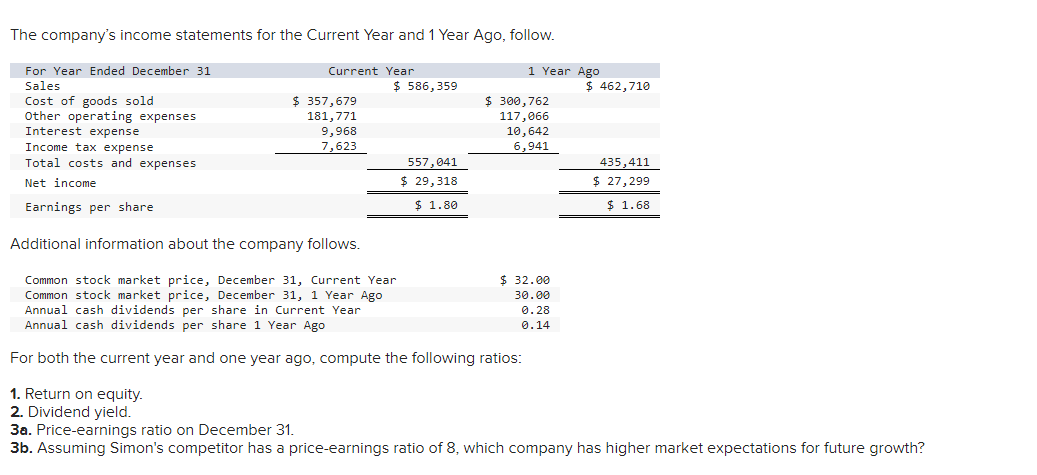

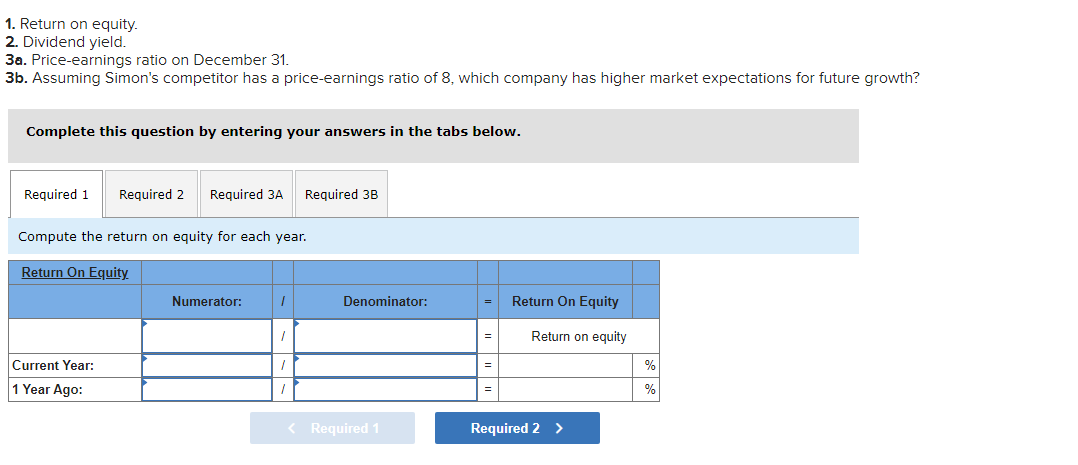

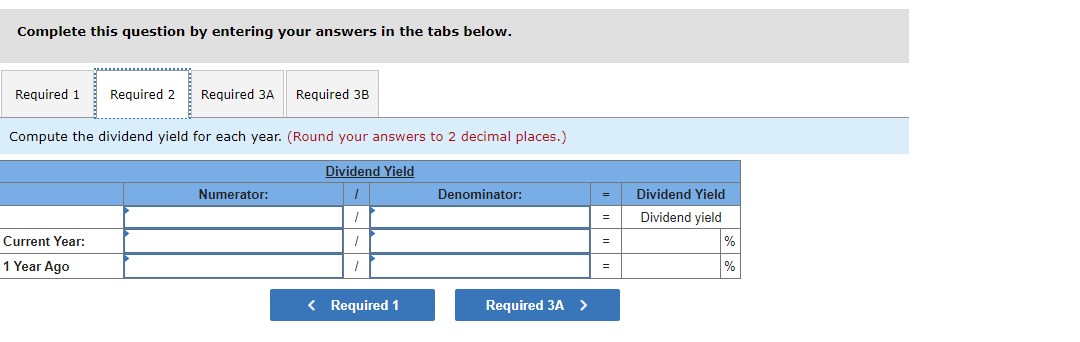

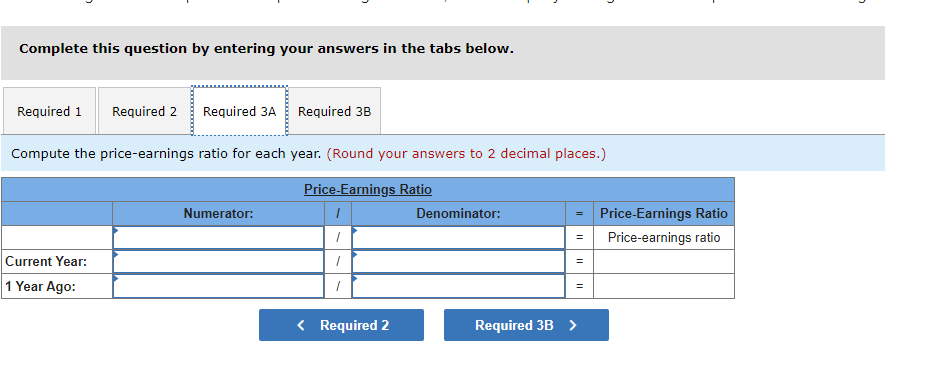

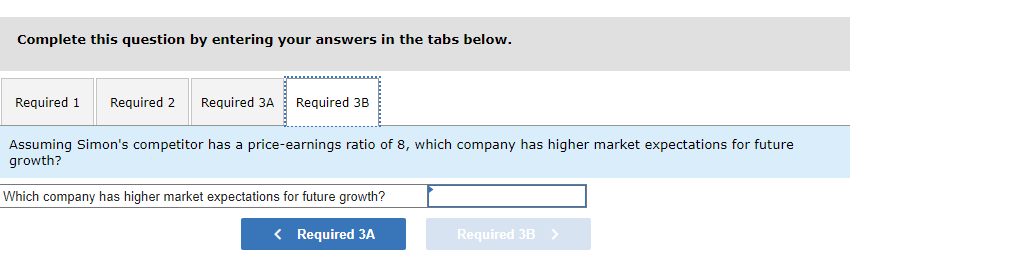

Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. Current Year 1 Year Ago 2 Years Ago $ 26,878 78,671 96,975 8,484 240,037 $ 451,045 $ 31, 107 54,981 72,653 8,165 At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity $ 32,727 44,068 46,012 3,708 200,785 $ 327,300 221,926 $ 388,832 $ 112,310 83,101 163,500 92,134 $ 451, 045 $ 65,055 90,326 163,500 69,951 $ 388, 832 $ 41,907 73,780 163,500 48,113 $ 327,300 For both the current year and one year ago, compute the following ratios: The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Current Year $ 586, 359 $ 357,679 181,771 9,968 7,623 557,041 $ 29, 318 1 Year Ago $ 462,710 $ 300,762 117,066 10,642 6,941 435,411 $ 27,299 Earnings per share $ 1.80 $ 1.68 Additional information about the company follows. Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago $ 32.00 30.00 0.28 0.14 For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 8, which company has higher market expectations for future growth? 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 8, which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Compute the return on equity for each year. Return On Equity Numerator: Denominator: = Return On Equity = Return on equity 1 = % Current Year: 1 Year Ago: % Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Compute the dividend yield for each year. (Round your answers to 2 decimal places.) Dividend Yield 1 Numerator: Denominator: Dividend Yield Dividend yield % Current Year: 1 Year Ago 1 % Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Compute the price-earnings ratio for each year. (Round your answers to 2 decimal places.) Price-Earnings Ratio Denominator: Numerator: = Price-Earnings Ratio Price-earnings ratio 11 Current Year: 1 Year Ago: = Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Assuming Simon's competitor has a price-earnings ratio of 8, which company has higher market expectations for future growth? Which company has higher market expectations for future growth?