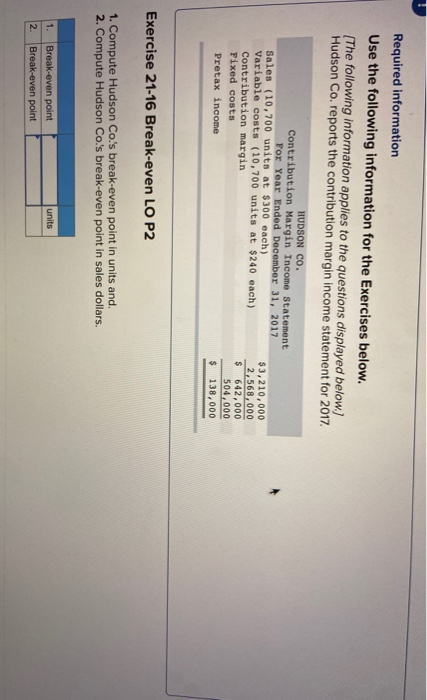

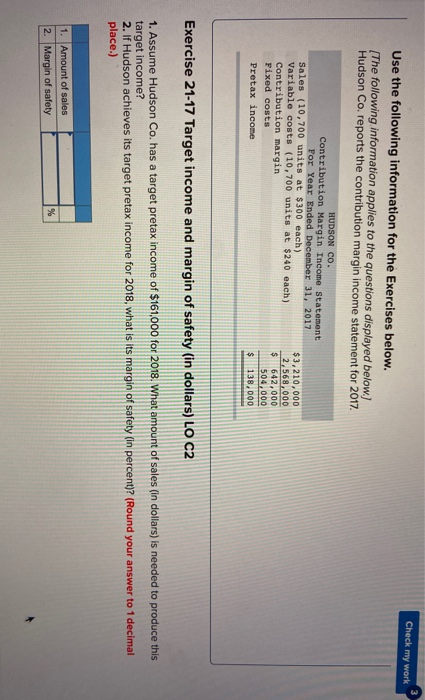

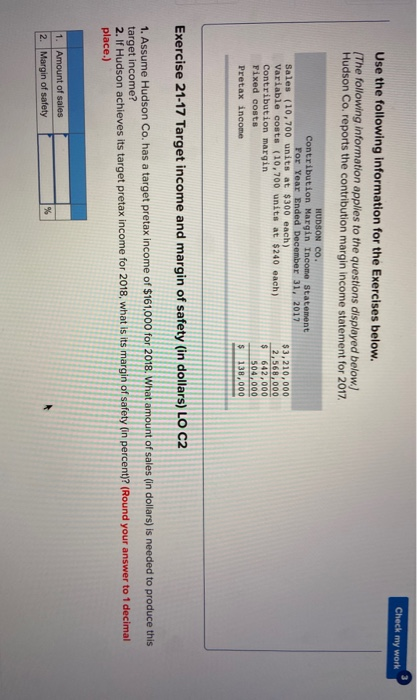

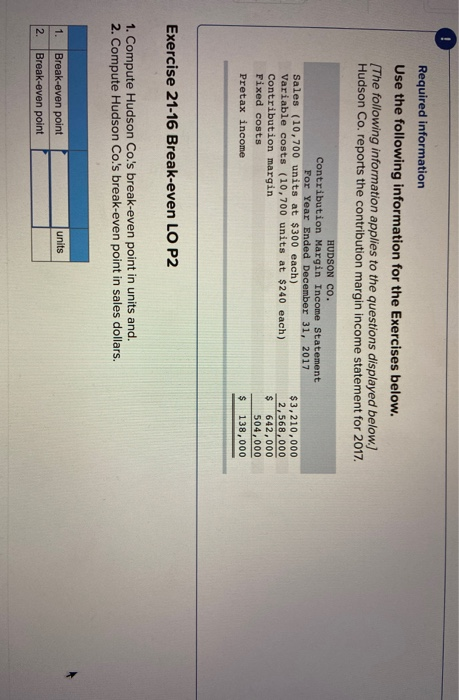

Required information Use the following information for the Exercises below. The following information applies to the questions displayed below.] Hudson Co. reports the contribution margin income statement for 2017 HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2017 Sales (10,700 units at $300 each) Variable costs (10,700 units at $240 each) Contribution margin Fixed costs Pretax income $3,210,000 2,568,000 $ 642,000 504,000 $ 138,000 Exercise 21-16 Break-even LO P2 1. Compute Hudson Co.'s break-even point in units and. 2. Compute Hudson Co.'s break-even point in sales dollars. units Break-even point Break-even point units Check my work Use the following information for the Exercises below. [The following information applies to the questions displayed below.) Hudson Co. reports the contribution margin income statement for 2017 HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2017 Sales (10,700 units at $300 each) Variable costs (10,700 units at $240 each) Contribution margin Fixed costs Pretax income $3,210,000 2,568,000 $ 642,000 504,000 $ 138,000 Exercise 21-17 Target income and margin of safety (in dollars) LO C2 1. Assume Hudson Co. has a target pretax income of $161,000 for 2018. What amount of sales (In dollars) is needed to produce this target income? 2. If Hudson achieves its target pretax income for 2018, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.) 1. Amount of sales 2. Margin of safety Check my work Use the following information for the Exercises below. (The following information applies to the questions displayed below.) Hudson Co. reports the contribution margin income statement for 2017 HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2017 Sales (10,700 units at $300 each) Variable costs (10,700 units at $240 each) Contribution margin Fixed costs Pretax income $3,210,000 2,568,000 $ 642,000 504,000 $ 138,000 Exercise 21-17 Target income and margin of safety (in dollars) LO C2 1. Assume Hudson Co. has a target pretax income of $161,000 for 2018. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target pretax income for 2018, what is its margin of safety in percent)? (Round your answer to 1 decimal place.) 1. Amount of sales 2. Margin of safety Required information Use the following information for the Exercises below. The following information applies to the questions displayed below.) Hudson Co. reports the contribution margin income statement for 2017 HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2017 Sales (10,700 units at $300 each) Variable costs (10,700 units at $240 each) Contribution margin Fixed costs Pretax income $3,210,000 2,568,000 $ 642,000 504,000 $ 138,000 Exercise 21-16 Break-even LO P2 1. Compute Hudson Co.'s break-even point in units and. 2. Compute Hudson Co.'s break-even point in sales dollars units Break-even point Break-even point 2