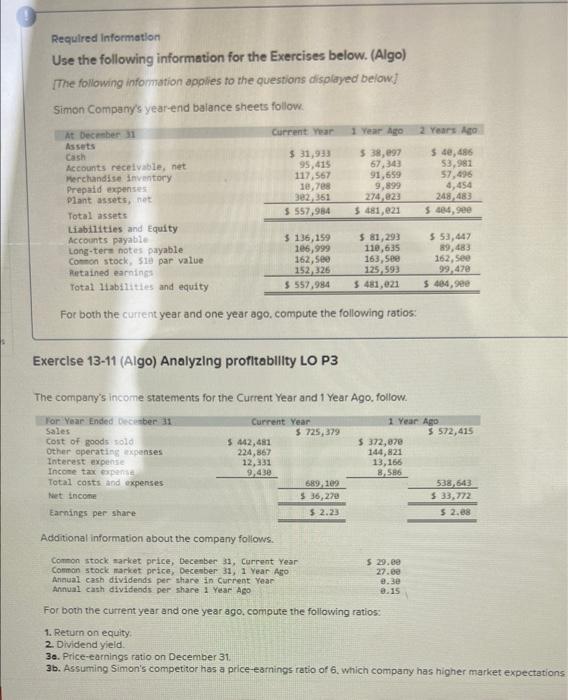

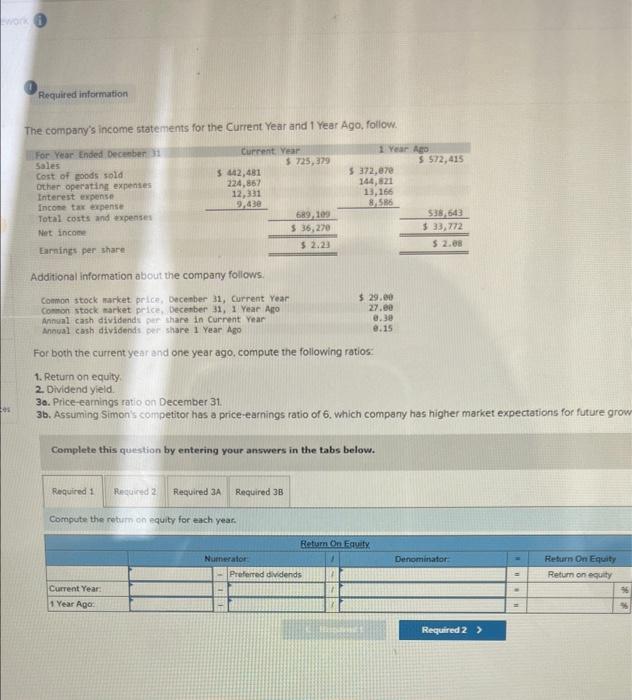

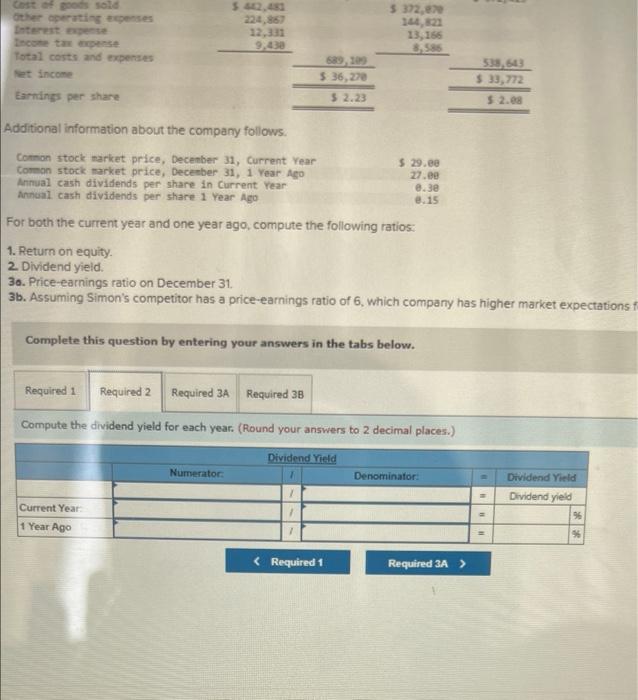

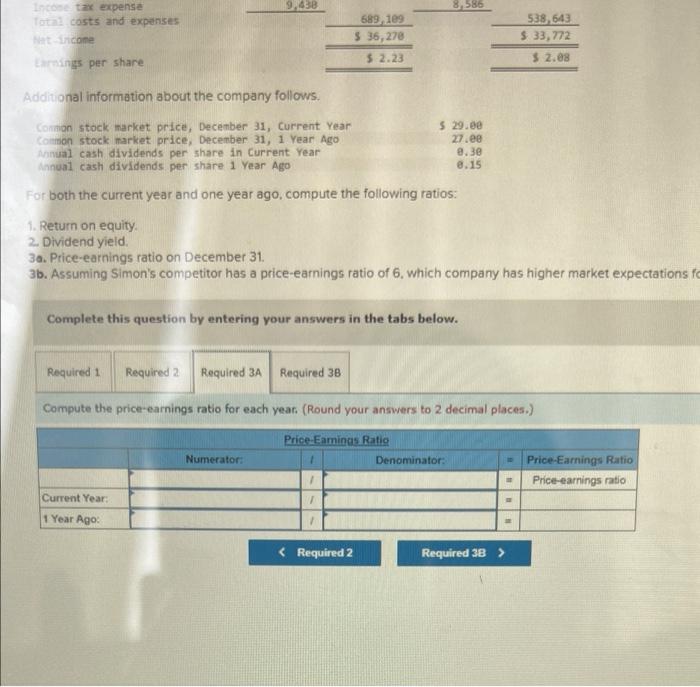

Required Information Use the following information for the Exercises below. (Algo) The following information applies to the questions displayed below) Simon Company's year-end balance sheets follow. Current Year 1 Year Ago 2 Years Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Pant assets net Total assets Liabilities and Equity Accounts payable Long-ters notes payable Common stock, 510 par value Retained earnings Total liabilities and equity $ 31,933 95, 415 117.567 18,788 302,351 $ 557,984 $ 38,097 67,34 91,659 9,899 274.623 5481,621 $ 4,486 53,981 57,496 4,454 248,483 $184, see $ 136,159 106,999 162, see 152,326 $ 557,984 $ 81,293 110,635 163, see 125.593 $ 481,021 553, 447 89,483 162, See 99,470 $44,9ee For both the current year and one year ago, compute the following ratios: Exercise 13-11 (Algo) Analyzing profitablllty LO P3 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales cost of goods sold Other operating expenses Interest expense Income tax pene Total costs and expenses Net income Earnings per share Current Year $ 725,379 $ 442,481 224,867 12,331 9,43 689, 109 $36,272 $ 2.23 1 Year Ago $ 522,415 $ 372,070 144,821 13,166 3,586 538,543 $ 33,772 5 2.08 Additional information about the company follows. Common stock sarket price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago $29.00 27.00 2.3 8.15 For both the current year and one year ago. compute the following ratios: 1. Return on equity. 2. Dividend yield 30. Price-earnings ratio on December 31 3b. Assuming Simon's competitor has a price-earnings ratio of 6, which company has higher market expectations Required information The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Current Year $725, 379 $442,481 224,867 12,331 9.43e 689, 109 5 36,270 $ 2.23 1 Year Ago $ 572,415 $ 372,87 144,821 13,166 8.56 $38,643 $ 33,772 $ 2.88 Earnings per share Additional information about the company follows. Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Apo Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year ago $29.00 27.ee 0.30 0.15 For both the current year and one year ago, compute the following ratios. 1. Return on equity 2. Dividend yield 3a. Price-earnings ratio on December 31 3b. Assuming Simon's competitor has a price-earnings ratio of 6 which company has higher market expectations for future grow- Ees Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Compute the return on equity for each year. Return On Fauty Numerator Preferred dividends Denominator Return On Equity Return on equity Current Year 1 Year Agar Required 2 > Costed sold other operating wenses 52,450 5 372,00 13,155 3,585 Total costs and expenses et income Earnings per share 689, 209 $ 36,270 5 2.23 538, 563 $ 33,772 5 2.08 Additional information about the company follows. Common stock market price, December 31, Current Year Common stock market price, December 31, 1 year ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago $ 29.ee 27.00 8.3e 8.15 For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield 30. Price-earings ratio on December 31 3b. Assuming Simon's competitor has a price-earnings ratio of 6 which company has higher market expectations Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 38 Compute the dividend yield for each year. (Round your answers to 2 decimal places.) Dividend Yield Numerator Denominator Current Year 1 Year Ago Dividend Yield Dividend yield 96 % = 1 9,438 8,586 Income tax expense Total costs and expenses Net-income Earnings per share Additional information about the company follows. $ 29.00 Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year 27.00 0.30 Annual cash dividends per share 1 Year Ago 0.15 For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 6, which company has higher market expectations fo Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 38 Compute the price-earnings ratio for each year. (Round your answers to 2 decimal places.) Price-Earnings Ratio Numerator: Denominator: Price-Earnings Ratio Price-earnings ratio 1 Current Year: 1 Year Ago: 1 538,643 $ 33,772 $ 2.08