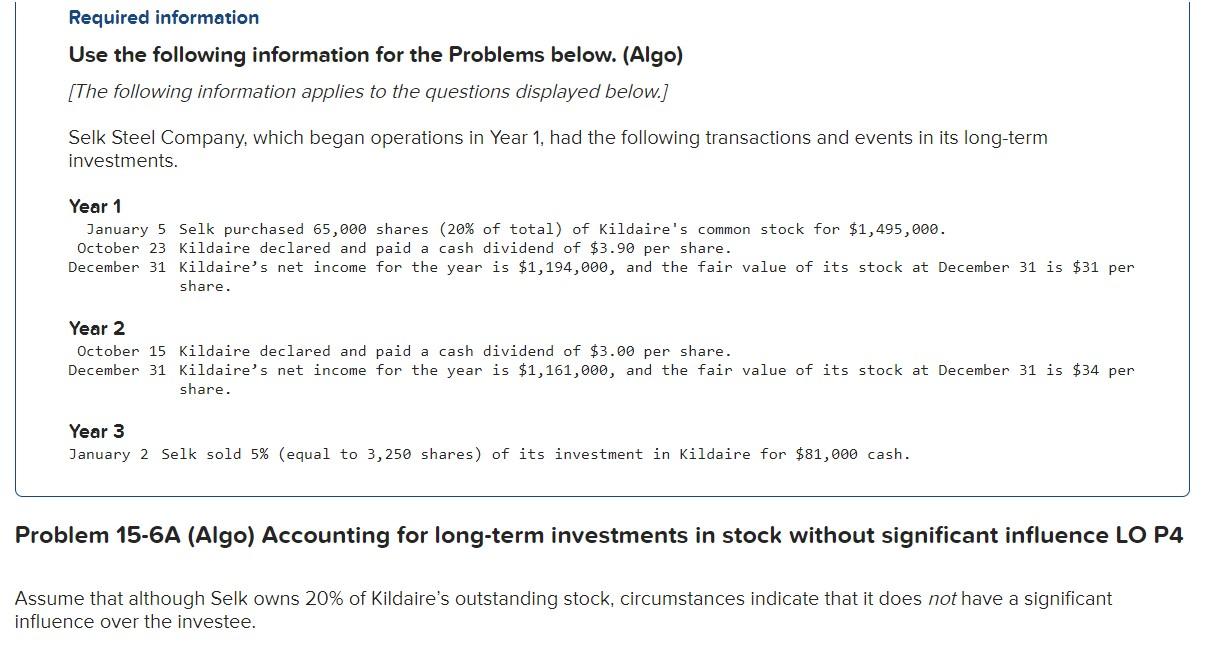

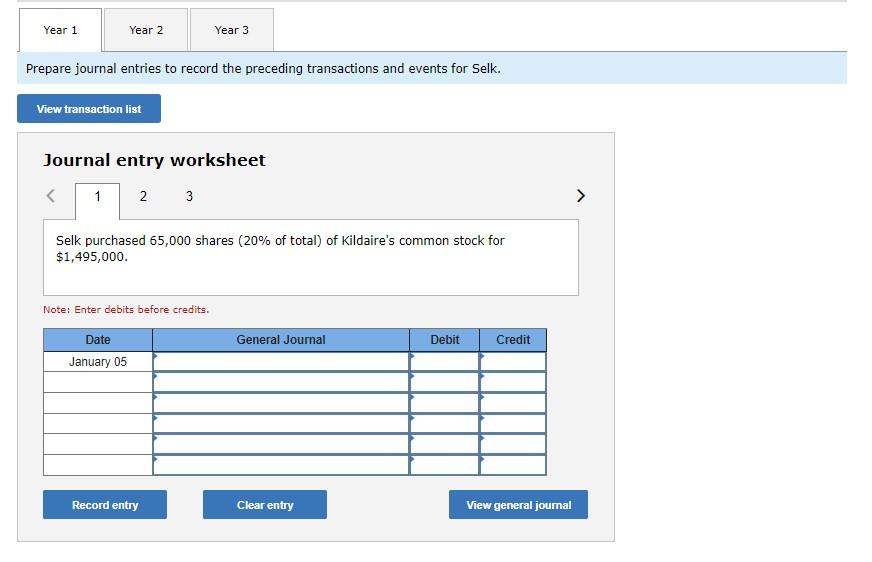

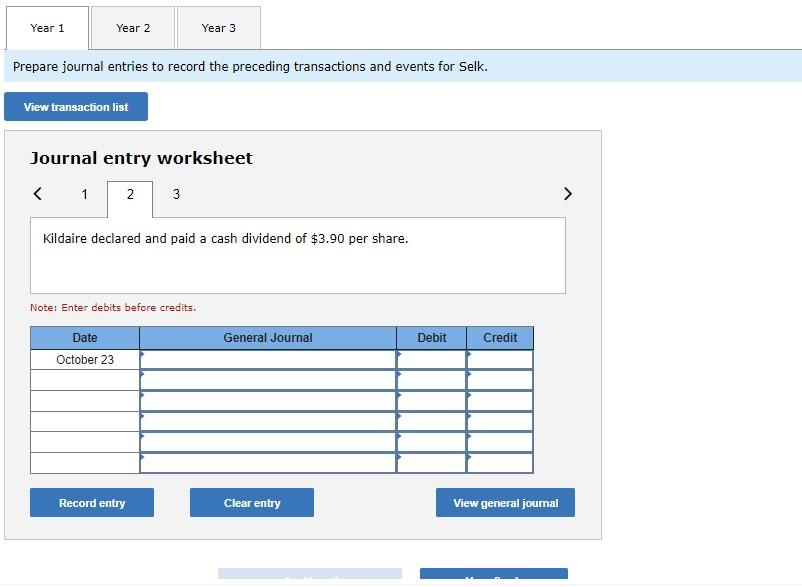

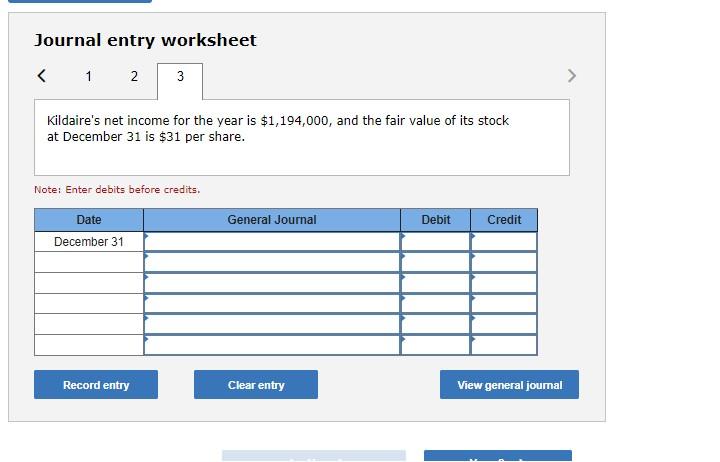

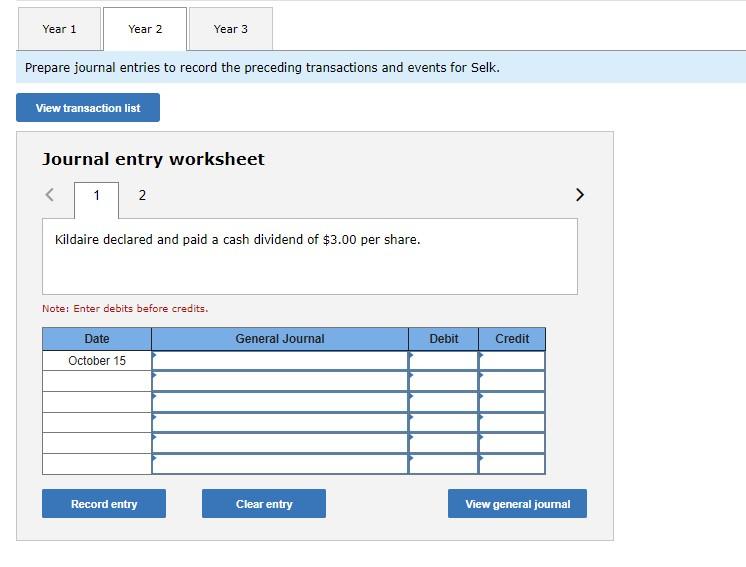

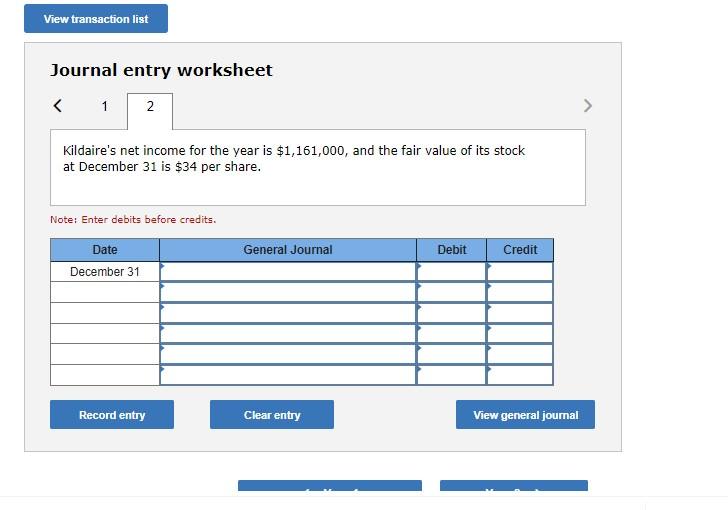

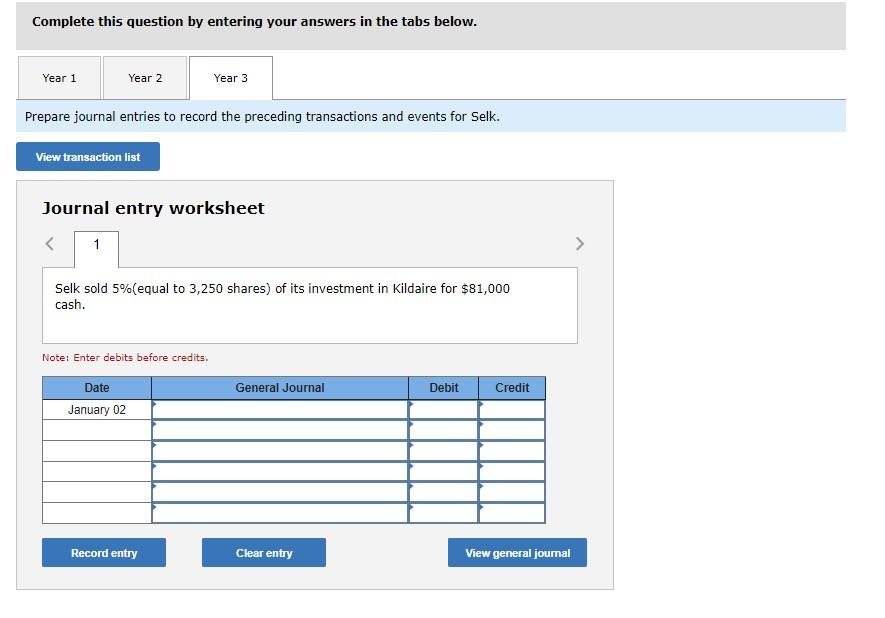

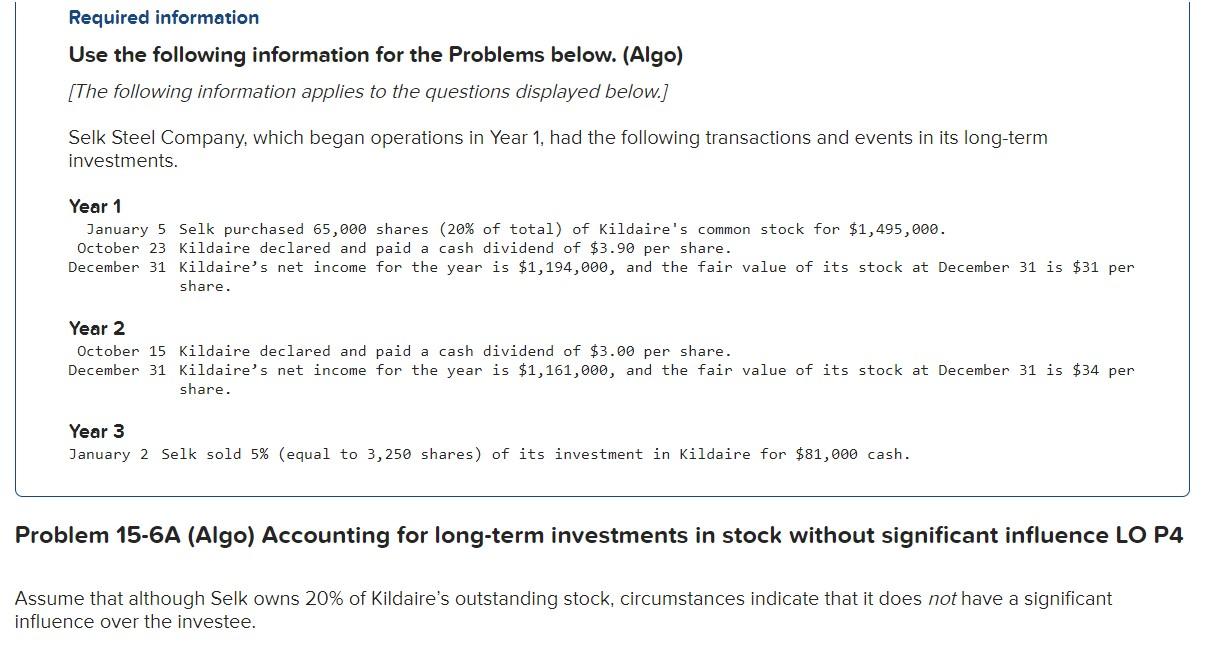

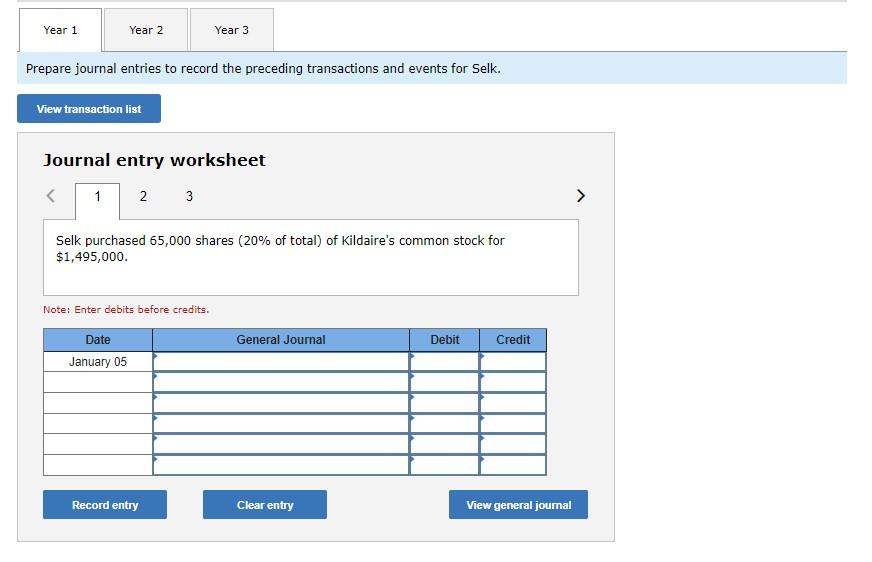

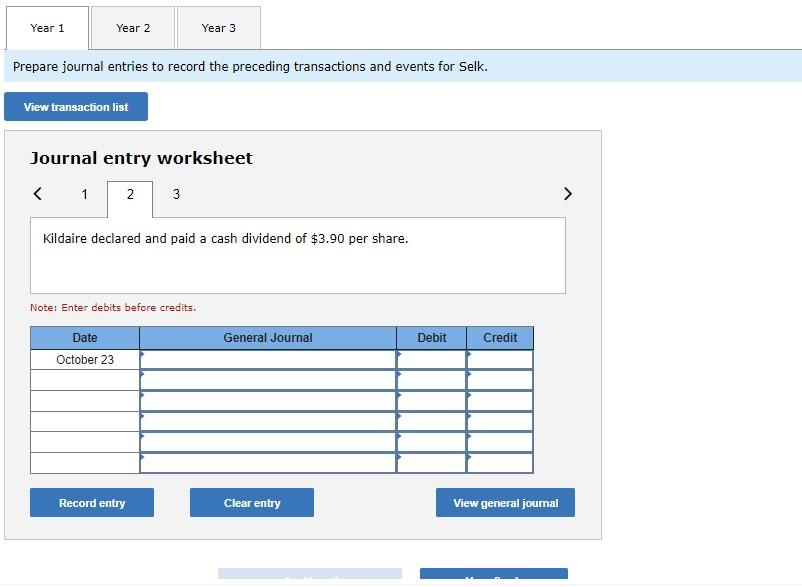

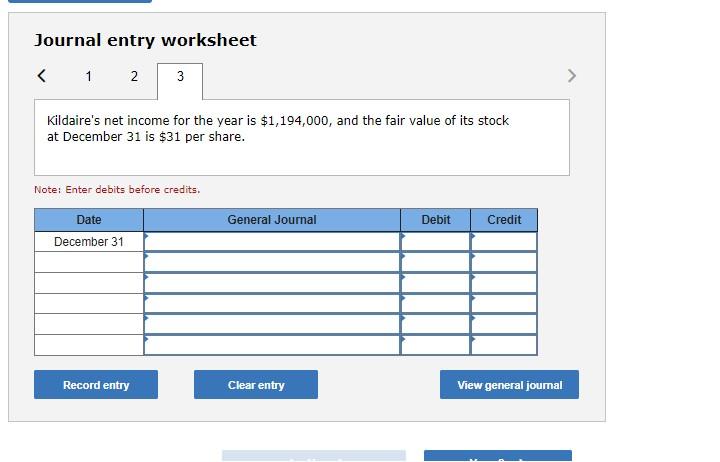

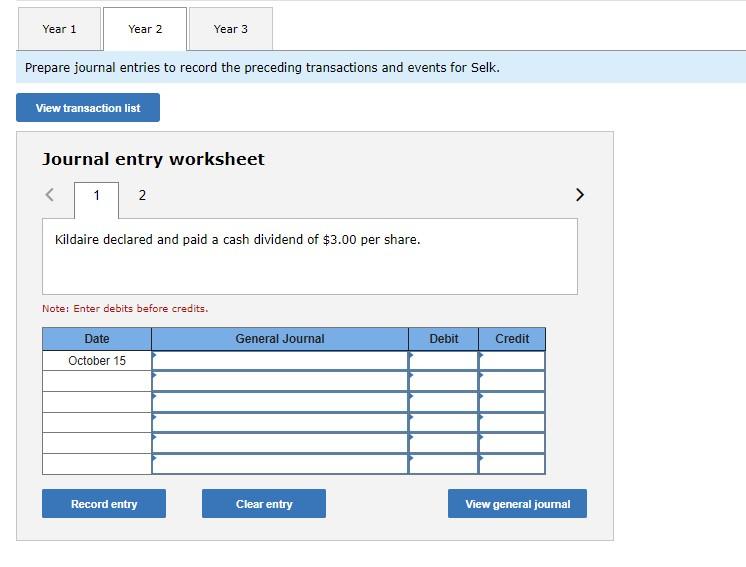

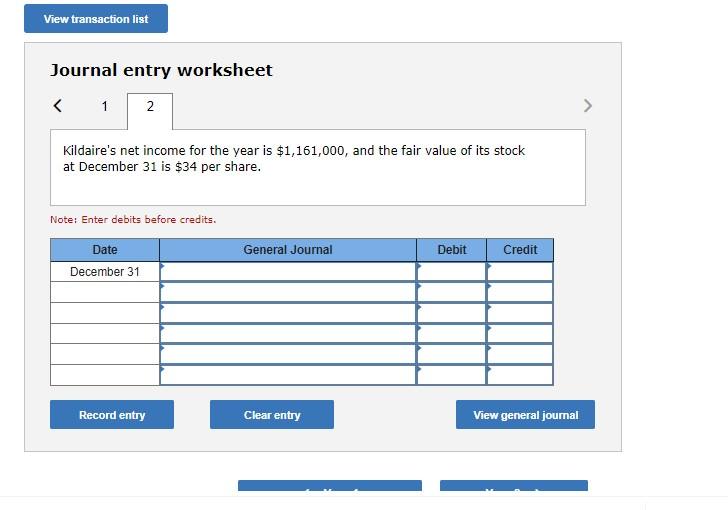

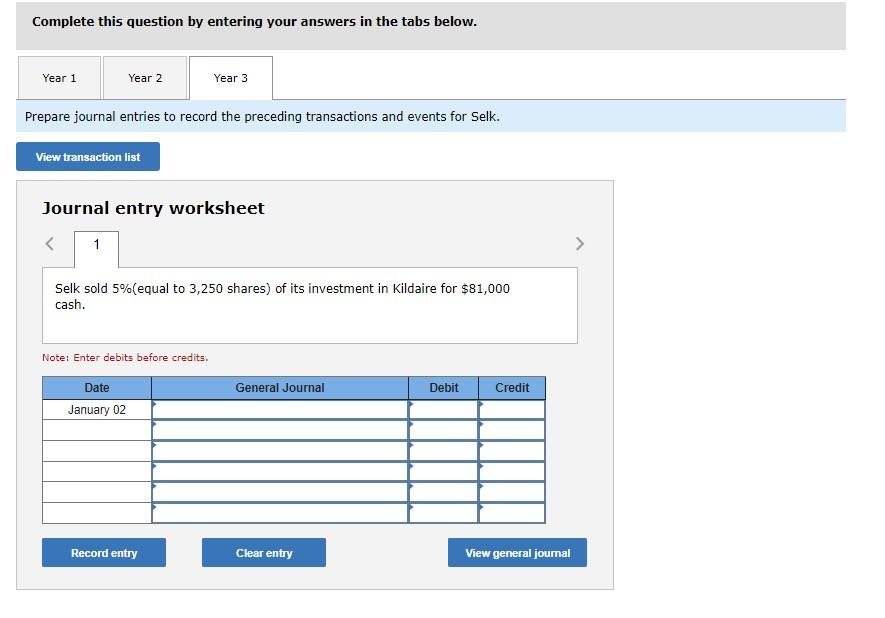

Required information Use the following information for the Problems below. (Algo) [The following information applies to the questions displayed below.) Selk Steel Company, which began operations in Year 1, had the following transactions and events in its long-term investments. Year 1 January 5 Selk purchased 65,000 shares (20% of total of Kildaire's common stock for $1,495,000. October 23 Kildaire declared and paid a cash dividend of $3.90 per share. December 31 Kildaire's net income for the year is $1,194,000, and the fair value of its stock at December 31 is $31 per share. Year 2 October 15 Kildaire declared and paid a cash dividend of $3.00 per share. December 31 Kildaire's net income for the year is $1,161,000, and the fair value of its stock at December 31 is $34 per share. Year 3 January 2 Selk sold 5% (equal to 3,250 shares) of its investment in Kildaire for $81,000 cash. Problem 15-6A (Algo) Accounting for long-term investments in stock without significant influence LO P4 Assume that although Selk owns 20% of Kildaire's outstanding stock, circumstances indicate that it does not have a significant influence over the investee. Year 1 Year 2 Year 3 Prepare journal entries to record the preceding transactions and events for Selk. View transaction list Journal entry worksheet 1 2 3 Selk purchased 65,000 shares (20% of total) of Kildaire's common stock for $1,495,000. Note: Enter debits before credits. General Journal Debit Credit Date January 05 Record entry Clear entry View general joumal Year 1 Year 2 Year 3 Prepare journal entries to record the preceding transactions and events for Selk. View transaction list Journal entry worksheet Kildaire declared and paid a cash dividend of $3.90 per share. Note: Enter debits before credits. General Journal Debit Credit Date October 23 Record entry Clear entry View general journal Journal entry worksheet Kildaire declared and paid a cash dividend of $3.00 per share. Note: Enter debits before credits. General Journal Debit Credit Date October 15 Record entry Clear entry View general journal View transaction list Journal entry worksheet Kildaire's net income for the year is $1,161,000, and the fair value of its stock at December 31 is $34 per share. Note: Enter debits before credits. General Journal Debit Credit Date December 31 Record entry Clear entry View general journal Complete this question by entering your answers in the tabs below. Year 1 Year 2 Year 3 Prepare journal entries to record the preceding transactions and events for Selk. View transaction list Journal entry worksheet