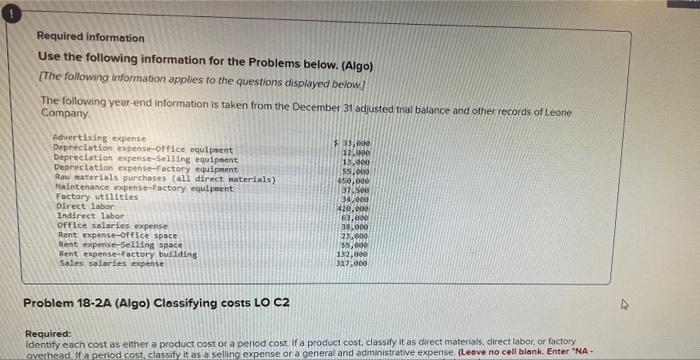

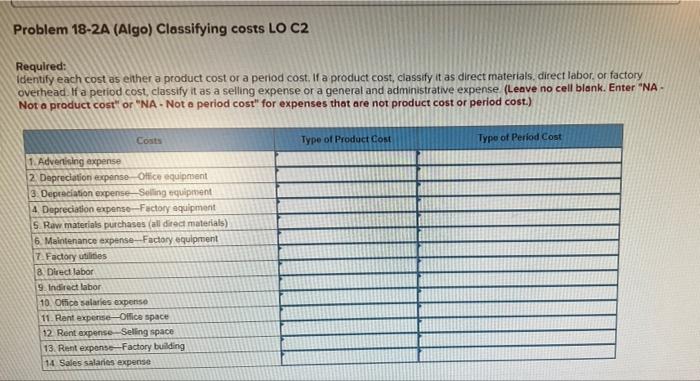

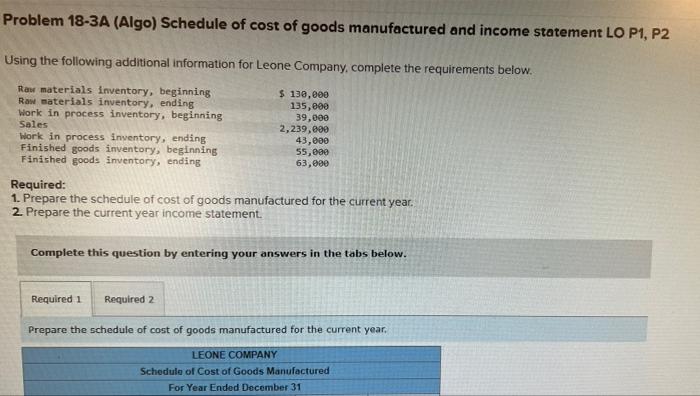

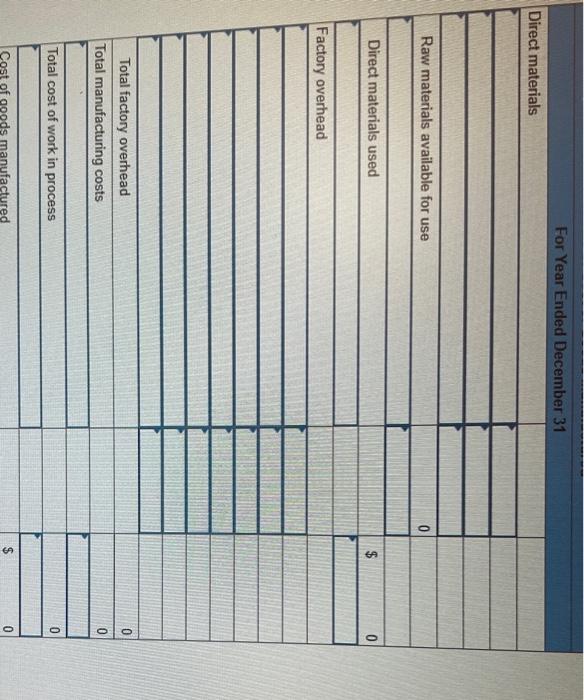

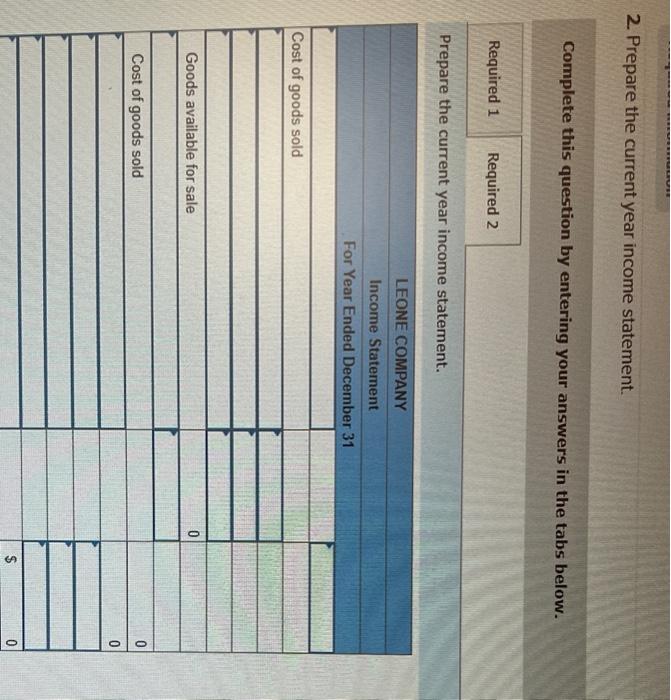

Required information Use the following information for the Problems below. (Algo) [The following information applies to the questions displayed below! The following year-end information is taken from the December 31 adjusted trial balance and other records of Leone Company Advertising expense Depreciation expense-office equipment Depreciation expense-Selling equipment Depreciation expense-factory equipment Raw materials purchases (all direct materials) Maintenance expense-Factory equipment Factory utilities Direct labor Indirect labor Office salaries expense Rent expense-office space Rent expense-Selling space Rent expense-Factory building Sales salaries expense $123 12.00 11. SS. 650,000 37.500 34,00 420,00 63.000 38.000 23.00 55,00 132,000 327.000 Problem 18-2A (Algo) Classifying costs LO C2 Required: Identify each cost as either a product cost or a period cost. If a product cost classify it as direct materials, direct labor or factory overhead If a period cost classify it as a selling expense or a general and administrative expense (Leave no cell blank. Enter "NA- Problem 18-2A (Algo) Classifying costs LO C2 Required: Identify each cost as either a product cost or a period cost. If a product cost, classify it as direct materials, direct labor, or factory overhead. If a period cost, classify it as a selling expense or a general and administrative expense (Leave no cell blank. Enter "NA. Not a product cost" or "NA. Not a period cost" for expenses that are not product cost or period cost.) Costs Type of Product Cost Type of Period Cost 1. Advertising expense 2 Depreciation expense Office equipment 3 Depreciation expense Selling equipment A Depreciation expense-Factory equipment 5. Raw materials purchases (all direct materials) 6. Maintenance expense-Factory equipment 7. Factory utilities 8. Direct labor 9. Indirect labor 10. Office salaries expense 11. Rent expense-Office space 12 Rent expense-Selling space 13. Rent expense Factory building 14 Sales salaries expense Problem 18-3A (Algo) Schedule of cost of goods manufactured and income statement LO P1, P2 Using the following additional information for Leone Company, complete the requirements below. Raw materials inventory, beginning $ 130,000 Raw materials inventory, ending 135,000 Work in process inventory, beginning 39,000 Sales 2,239,000 Work in process inventory, ending 43,000 Finished goods inventory, beginning 55,000 Finished goods inventory, ending 63,880 Required: 1. Prepare the schedule of cost of goods manufactured for the current year. 2. Prepare the current year income statement. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the schedule of cost of goods manufactured for the current year. LEONE COMPANY Schedule of Cost of Goods Manufactured For Year Ended December 31 For Year Ended December 31 Direct materials Raw materials available for use 0 Direct materials used $ 0 Factory overhead 0 Total factory overhead Total manufacturing costs 0 Total cost of work in process 0 Cost of goods manufactured $ 2. Prepare the current year income statement Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the current year income statement. LEONE COMPANY Income Statement For Year Ended December 31 Cost of goods sold Goods available for sale 0 Cost of goods sold 0 0 GA $