Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information Use the following information for the Quick Studies below. (Static) [The following information applies to the questions displayed below.] On January 1, the

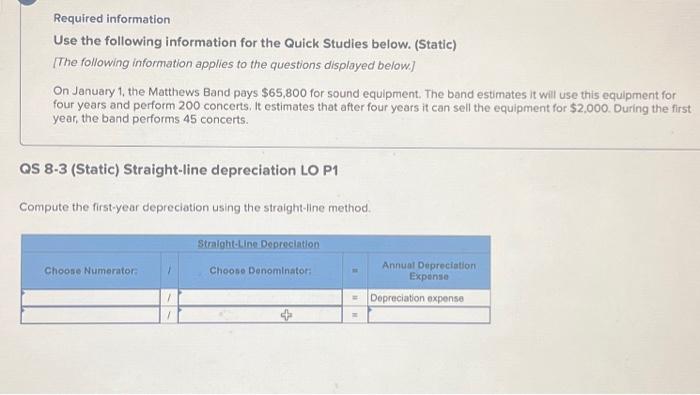

Required information Use the following information for the Quick Studies below. (Static) [The following information applies to the questions displayed below.] On January 1, the Matthews Band pays $65,800 for sound equipment. The band estimates it will use this equipment for four years and perform 200 concerts. It estimates that after four years it can sell the equipment for $2,000. During the first year, the band performs 45 concerts. QS 8-3 (Static) Straight-line depreciation LO P1 Compute the first-year depreciation using the straight-line method. Choose Numerator: 1 1 1 Straight-Line Depreciation Choose Denominator: = Annual Depreciation Expense Depreciation expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started