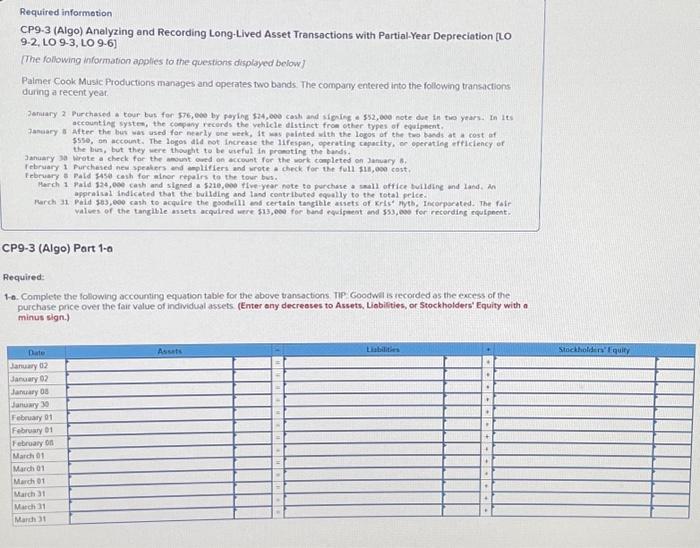

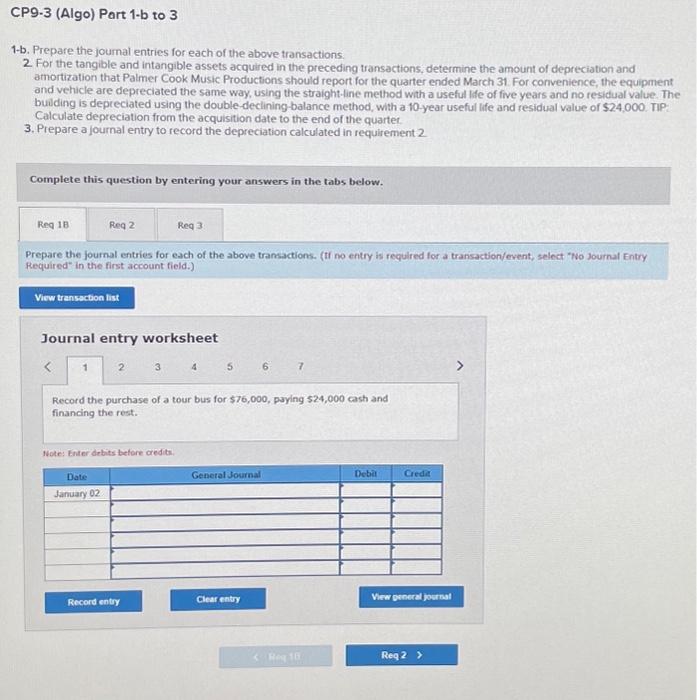

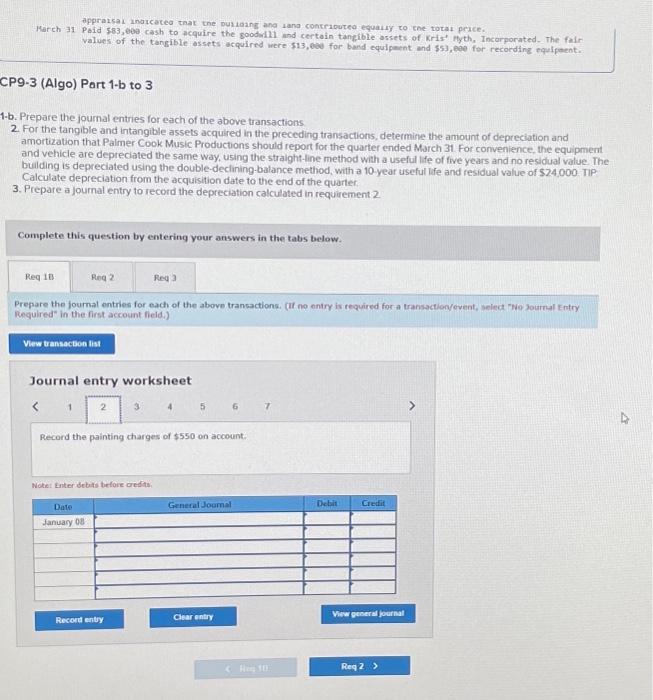

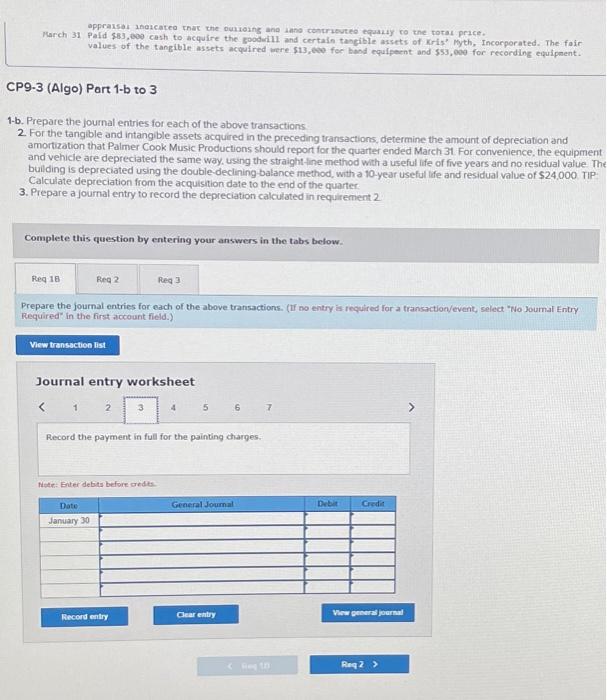

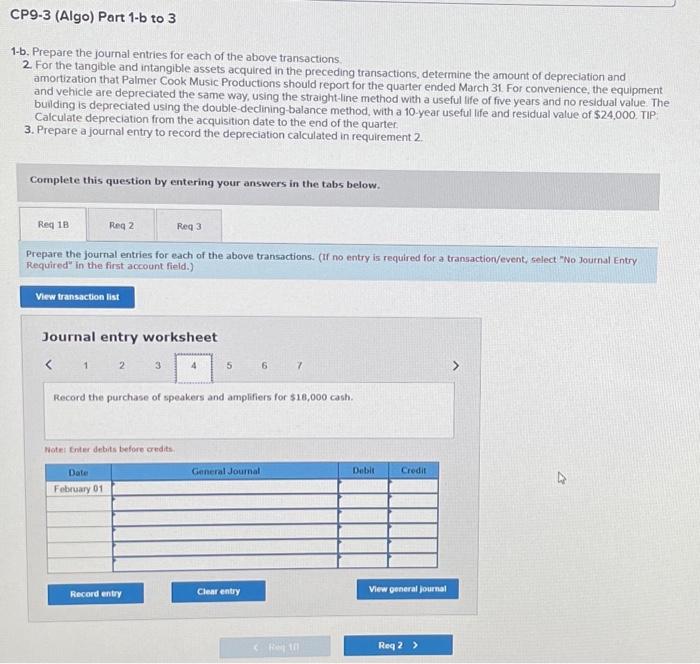

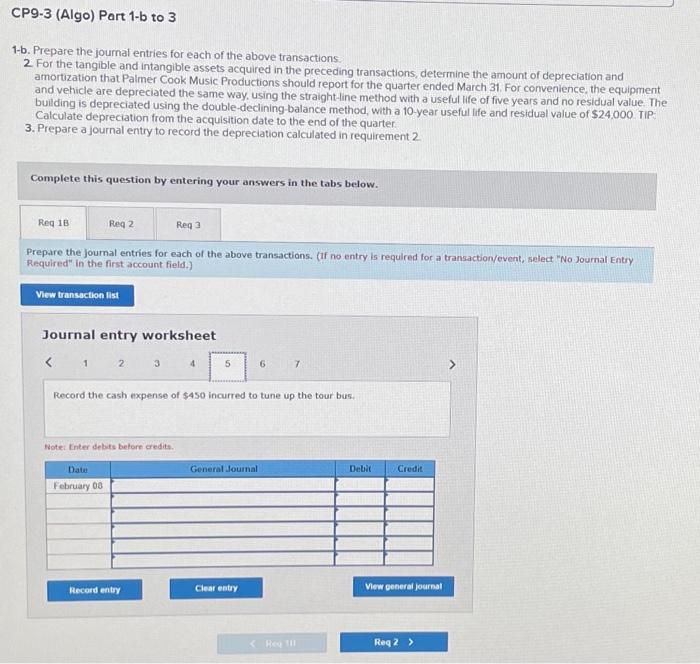

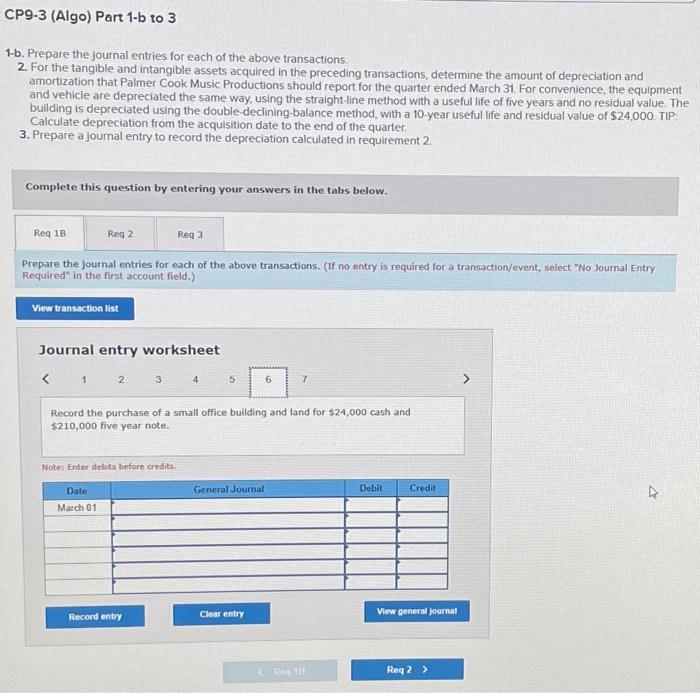

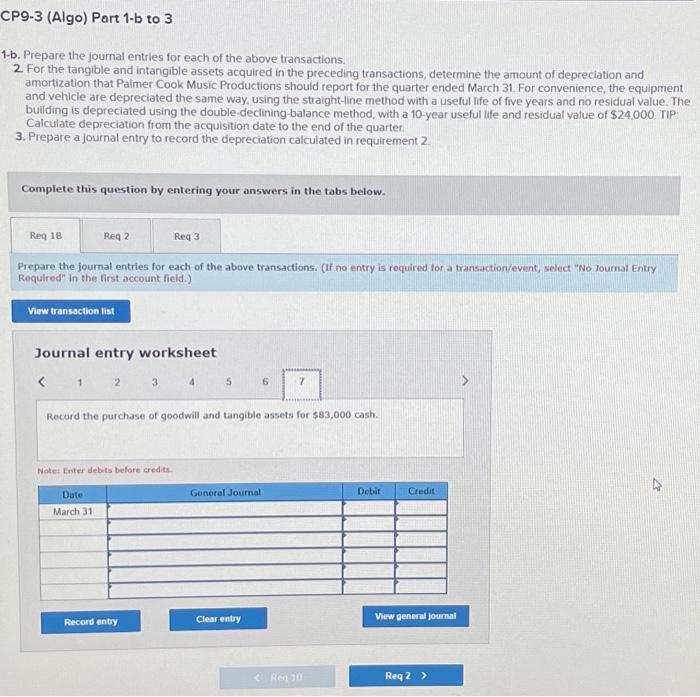

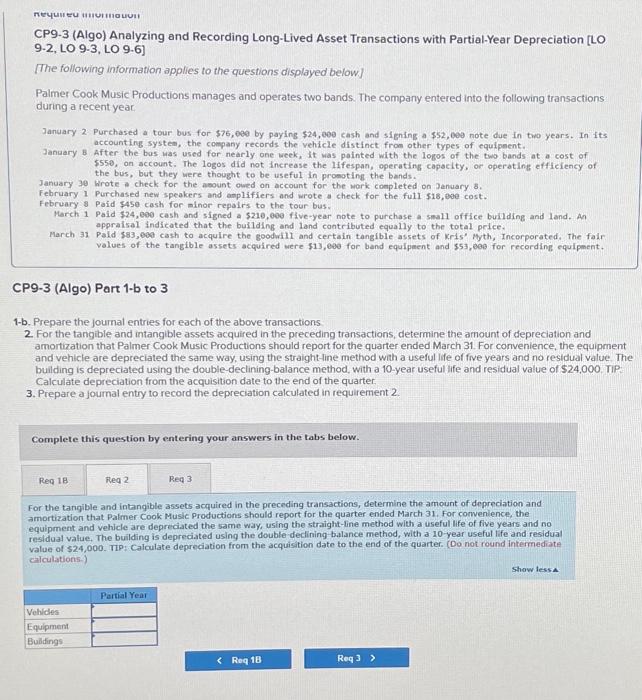

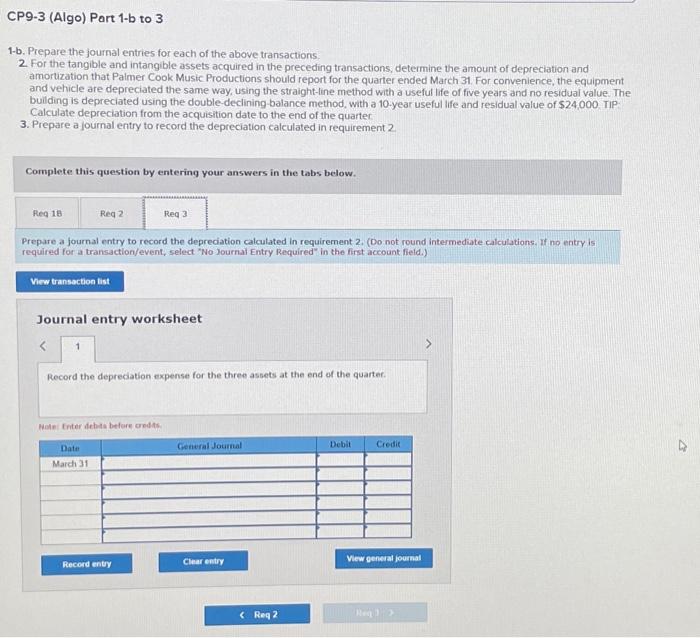

Required informetion CP9-3 (Algo) Analyzing and Recording Long-Lived Asset Transactions with Partial-Year Depreciation [LO 9-2, LO 9-3, LO 9-6] [The following information applies to the questions displayed below] Paimer Cook Music Productions manages and operates two bands. The company entered into the following transactions during a recent year. accounting systew, the company records the wehlcle distinit froe other types of equipecont. the bin, but they were thought to be useful in pronotine the bands. January 39 wrete a Check for the anoust outd on account for the vork completied on january 8. february 1 furchesed new spealers and anplifiers and wrote a check for the full $11, oco cost. february s Fald 345 cash for athor repalis to the tour bus. appraisail indleated that the buliding and land contributed equally to the rotal pelice. CP9-3 (Algo) Port 1-0 Required: 1. Complete the following accouming equation table for the above transactions. InP. Goodwal is recorded as the excess of the purchase price over the fair value of individual assets, (Enter any decreases to Assets, Labilities, or Stockholders' Equity with a minus sign.) 1-b. Prepare the journal entries for each of the above transactions. 2. For the tangible and intangible assets acquired in the preceding transactions, determine the amount of depreciation and amortization that Palmer Cook Music Productions should report for the quarter ended March 31 . For corvenience, the equipment and vehicle are depreciated the same way, using the straight-line method with a useful life of five years and no residual value. The building is depreciated using the double-declining-balance method, with a 10 -year useful life and residual value of $24,000. TIP- Calculate depreciation from the acquisition date to the end of the quartet. 3. Prepare a journal entry to record the depreciation calculated in requirement 2 Complete this question by entering your answers in the tabs below. Prepare the journal entries for each of the above transactions. (tf no entry is required for a transaction/event, select "No sournat Entry Required in the first account field.) Journal entry worksheet \begin{tabular}{llllll} 3 & 4 & 5 & 6 & 7 & > \end{tabular} Record the purchase of a tour bus for $76,000, paying $24,000 cash and financing the rest. Note: Enter debits betore credita. Warch 31 Poid 583 , eea cash to acquire the goodslil and certain tangible assets of Kris" Hyth, Incarporated. The falir values of the tangible assets acquired were $13,600 for band equipment and $53, epe for recording equlpent. P9-3 (Algo) Part 1-b to 3 -b. Prepare the journal entries for each of the above transactions. 2. For the tangible and intangible assets acquired in the preceding transactions, determine the amiount of depreciation and amortization that Paimer Cook Music Productions should report for the quarter ended March 31 . For convenience, the equipment. and vehicle are depreciated the same way, using the straight-line method with a useful life of five years and no residual value. The bulding is depreciated using the double-declining-balance method, with a 10 -year useful life and residual value of $24,000 TIP Calculate depreciation from the acquisition date to the end of the quarter. 3. Prepare a journal entry to record the depreciation calculated in requirement 2 Complete this question by entering your answers in the tabs below. Prepare the foumal entries for each of the above trancactions. (II no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 4567 Record the painting charges of $550 on account: Notel Enter debats teflore credits. Narch 31 Pald $83, ooe cash to acquire the goodulil and certain tangible assets of Kris' Myth, Incerporated. The foir CP9-3 (Algo) Port 1-b to 3 1-b. Prepare the joumal entries for each of the above transactions: 2. For the tangible and intangble assets acquired in the preceding transactions, determine the amount of depreciation and amortization that Palmer Cook Music Productions should repont for the quarter ended March 31 For convenience, the equipment and vehicle are depreciated the same way, using the straight fine method with a useful iffe of five years and no residual value Th bulding is depreciated using the double-decining-balance method, with a 10-year useful life and residual value of $24,000 TIP. Calculate depreciation from the acquisition date to the end of the quarter 3. Prepare a journal entry to record the depreciation calculated in requirement 2 Complete this question by entering your answers in the tabs below. Prepare the journal entries for each of the above transactions. (If no entry is required for a fransaction/event, select "No Joumal Entry Required" in the first account field.) Journal entry worksheet 1 4 5 6 7 > Record the payment in full for the painting charges: Noter: Enter debits before oredits. 1-b. Prepare the journal entries for each of the above transactions 2. For the tangible and intangible assets acquired in the preceding transactions, determine the amount of depreciation and amortization that Palmer Cook Music Productions should report for the quarter ended March 31 . For convenience, the equipment and vehicle are depreciated the same way, using the straight-line method with a useful life of five years and no residual value. The building is depreciated using the double-declining-balance method, with a 10 -year useful life and residual value of $24,000. TIP. Calculate depreciation from the acquisition date to the end of the quarter. 3. Prepare a journal entry to record the depreciation calculated in requirement 2. Complete this question by entering your answers in the tabs below. Prepare the journal entries for each of the above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet \begin{tabular}{|c|cc|ccc|} \hline Record the cash expense of $450 incurred to tune up the tour bus. Wotet Inter debts betore credits. 1-b. Prepare the journal entries for each of the above transactions. 2. For the tangible and intangible assets acquired in the preceding transactions, determine the amount of depreciation and amortization that Palmer Cook Music Productions should report for the quarter ended March 31 . For convenience, the equipment and vehicle are depreclated the same way, using the straight-line method with a useful life of five years and no residual value. The building is depreciated using the double-declining-balance method, with a 10 -year useful life and residual value of $24,000. TIP. Calculate depreciation from the acquisition date to the end of the quarter. 3. Prepare a journal entry to record the depreciation calculated in requirement 2 Complete this question by entering your answers in the tabs below. Prepare the journal entries for each of the above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 1 2 3 4 7 > Record the purchase of a small office building and land for $24,000 cash and $210,000 five year note. Notel Enter debils before credits. 1-b. Prepare the journal entries for each of the above transactions. 2. For the tangible and intangible assets acquired in the preceding transactions, determine the amount of depreciation and amortization that Palmer Cook Music Productions should report for the quarter ended March 31 . For convenience, the equipment and vehicle are depreciated the same way, using the straight-line method with a useful life of five years and no residual value. The building is depreciated using the double-declining-balance method, with a 10 -year useful life and residual value of $24,000. TIP. Calculate depreciation from the acquisition date to the end of the quarter 3. Prepare a journal entry to record the depreciation calculated in requirement 2 Complete this question by entering your answers in the tabs below. Prepare the journal entries for each of the above transactions. (If no entry is required for a transaction/event, select "No Joumal Entry Required" in the first account field.) Journal entry worksheet 1 2 3 4 5 6 > Record the purchase of goodwill and tangible assets for $83,000 cash. Note: Enter debits before credits. CP9-3 (Algo) Analyzing and Recording Long-Lived Asset Transactions with Partial-Year Depreciation [LO 9-2, LO 9-3, LO 9-6] [The following information applies to the questions displayed below] Palmer Cook Music Productions manages and operates two bands. The company entered into the following transactions during a recent year. January 2 Purchased a tour bus for $76, 000 by paying $24,000 cash and $1 gning a $52, 009 note due in two years. In its accounting system, the company records the vehicle distinct from other types of equipment. January B After the bus was used for nearly one week, it was painted with the logos of the two bands at a cost of $550, on account. The logos did not increase the lifespan, operating capacity, or operating efficiency of the bus, but they were thought to be useful in pronoting the bands. January 30 Wrote a check for the asount oured on account for the work completed on January 8. February 1 Purchased new speakers and anplifiers and wrote a check for the full $18, eae cost. February 8 Paid $450 cash for minor repalrs to the tour bus. March 1 Paid $24,000cash and signed a $210,000 five-year note to purchase a small office building and land. An appraisal indicated that the building and land contributed equally to the total peice. March 31 Pald \$83, 009 cash to acquire the goodwill and certain tangible assets of Kris' Myth, Incorporated. The fair velues of the tangible assets acquired were $13,000 for band equipment and $3,009 for recording equipment. CP9-3 (Algo) Part 1-b to 3 1-b. Prepare the journal entries for each of the above transactions. 2. For the tangible and intangible assets acquired in the preceding transactions, determine the amount of depreciation and amortization that Palmer Cook Music Productions should report for the quarter ended March 31 . For convenience, the equipment and vehicle are depreciated the same way, using the straight-line method with a useful life of five years and no residual value. The building is depreciated using the double-declining-balance method, with a 10-year useful ife and residual value of $24,000. MP. Calculate depreciation from the acquisition date to the end of the quarter. 3. Prepare a joumal entry to record the depreciation calculated in requirement 2. Complete this question by entering your answers in the tabs below. For the tangible and intangible assets acquired in the preceding transactions, determine the amount of depreciation and amortization that Palmer Cook Music Productions should report for the quarter ended March 31 . For corvenience, the equipment and vehicle are depreciated the same way, using the straight-line method with a useful life of five years and no residual value, The building is depreciated using the double declining balance method, with a 10 -year useful life and residual value of $24,000. TIP: Calculate depreciation from the acquisition date to the end of the quarter. (Do not round intermediate caculations.) 1-b. Prepare the journal entries for each of the above transactions. 2. For the tangible and intangible assets acquired in the preceding transactions, determine the amount of depreciation and amortization that Palmer Cook Music Productions should report for the quarter ended March 31 . For convenience, the equipment and vehicle are depreciated the same way, using the straight-line method with a useful life of five years and no residual value. The building is depreciated using the double-declining-balance method, with a 10 -year useful life and residual value of $24,000. TIP. Calculate depreciation from the acquisition date to the end of the quarter 3. Prepare a journal entry to record the depreciation calculated in requirement? Complete this question by entering your answers in the tabs below. Prepare a fournal entry to record the depreciation calculated in requirement 2. (Do not round intermediate calculations, If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the depredation expense for the three assets at the end of the quarter. Nolei Enter deba before condas