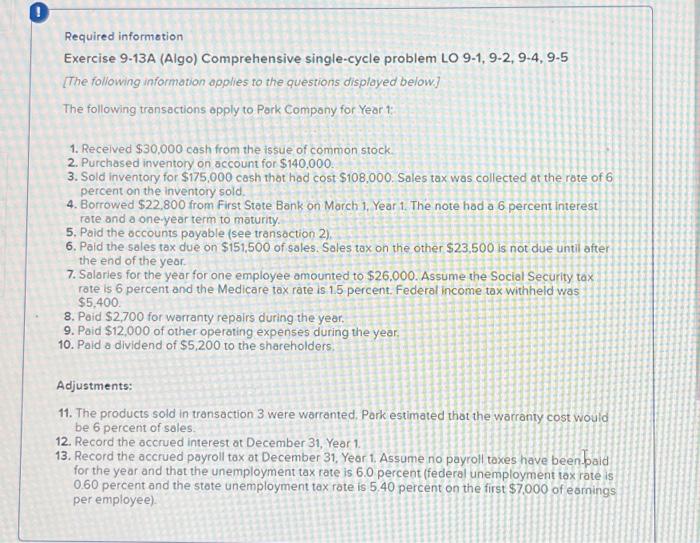

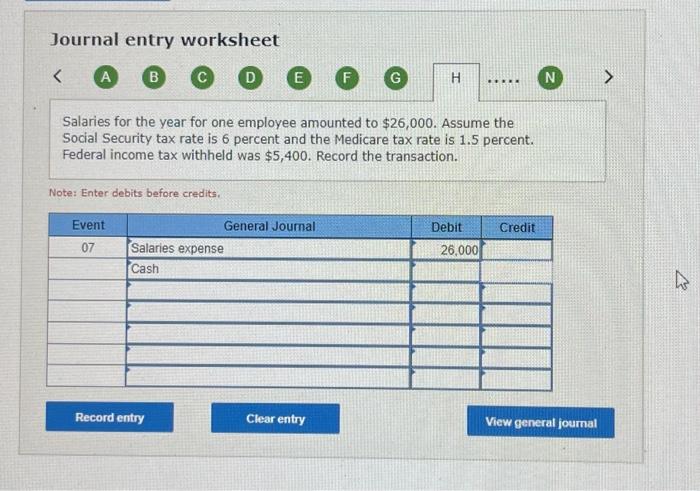

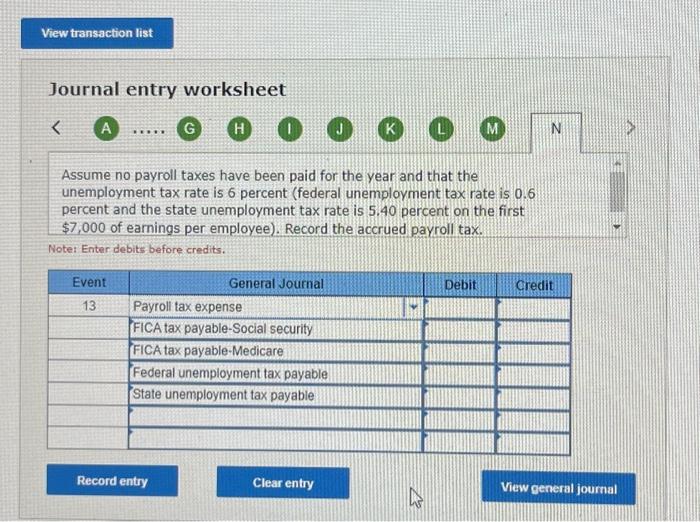

Required informetion Exercise 9-13A (Algo) Comprehensive single-cycle problem LO 9-1, 9-2, 9-4, 9-5 [The following information opplies to the questions displayed below] The following transactions opply to Park Company for Year 1 : 1. Received $30,000 cash from the issue of common stock. 2. Purchased inventory on account for $140,000. 3. Sold inventory for $175,000 cash that had cost $108,000. Sales tax was collected of the rate of 6 percent on the inventory sold. 4. Borrowed $22,800 from First State Bank on March 1, Year 1. The note had a 6 percent interest rote and a one-year term to maturity. 5. Paid the occounts payable (see transaction 2), 6. Paid the sales tax due on $151,500 of sales. Sales tax on the other $23,500 is not due until after the end of the year 7. Solaries for the year for one employee amounted to $26,000. Assume the Social Security tax rote is 6 percent and the Medicare tax rate is 15 percent. Federal income tax withheld was $5.400 8. Paid $2,700 for warranty repairs during the year. 9. Paid $12,000 of other operating expenses during the year. 10. Paid a dividend of $5,200 to the shareholders. Adjustments: 11. The products sold in transaction 3 were warranted. Park estimated that the warranty cost would be 6 percent of sales. 12. Record the accrued interest at December 31, Year 1. 13. Record the accrued payroll tax at December 31, Year 1 . Assume no payroll toxes have been.paid for the year and that the unemployment tax rate is 6.0 percent (federal unemployment tax rate is 0.60 percent and the stote unemployment tax rote is 5.40 percent on the first $7.000 of eomings per employee). Journal entry worksheet Salaries for the year for one employee amounted to $26,000. Assume the Social Security tax rate is 6 percent and the Medicare tax rate is 1.5 percent. Federal income tax withheld was $5,400. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Assume no payroll taxes have been paid for the year and that the unemployment tax rate is 6 percent (federal unemployment tax rate is 0.6 percent and the state unemployment tax rate is 5.40 percent on the first $7,000 of earnings per employee). Record the accrued payroll tax. Note: Enter debits before credits. Required informetion Exercise 9-13A (Algo) Comprehensive single-cycle problem LO 9-1, 9-2, 9-4, 9-5 [The following information opplies to the questions displayed below] The following transactions opply to Park Company for Year 1 : 1. Received $30,000 cash from the issue of common stock. 2. Purchased inventory on account for $140,000. 3. Sold inventory for $175,000 cash that had cost $108,000. Sales tax was collected of the rate of 6 percent on the inventory sold. 4. Borrowed $22,800 from First State Bank on March 1, Year 1. The note had a 6 percent interest rote and a one-year term to maturity. 5. Paid the occounts payable (see transaction 2), 6. Paid the sales tax due on $151,500 of sales. Sales tax on the other $23,500 is not due until after the end of the year 7. Solaries for the year for one employee amounted to $26,000. Assume the Social Security tax rote is 6 percent and the Medicare tax rate is 15 percent. Federal income tax withheld was $5.400 8. Paid $2,700 for warranty repairs during the year. 9. Paid $12,000 of other operating expenses during the year. 10. Paid a dividend of $5,200 to the shareholders. Adjustments: 11. The products sold in transaction 3 were warranted. Park estimated that the warranty cost would be 6 percent of sales. 12. Record the accrued interest at December 31, Year 1. 13. Record the accrued payroll tax at December 31, Year 1 . Assume no payroll toxes have been.paid for the year and that the unemployment tax rate is 6.0 percent (federal unemployment tax rate is 0.60 percent and the stote unemployment tax rote is 5.40 percent on the first $7.000 of eomings per employee). Journal entry worksheet Salaries for the year for one employee amounted to $26,000. Assume the Social Security tax rate is 6 percent and the Medicare tax rate is 1.5 percent. Federal income tax withheld was $5,400. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Assume no payroll taxes have been paid for the year and that the unemployment tax rate is 6 percent (federal unemployment tax rate is 0.6 percent and the state unemployment tax rate is 5.40 percent on the first $7,000 of earnings per employee). Record the accrued payroll tax. Note: Enter debits before credits